Key Takeaways

These seven AI stocks represent different layers of the artificial intelligence ecosystem, from hardware to applications, offering investors diversified exposure to the AI revolution before 2026.

• Nvidia dominates with 90% market share in AI chips and a $500 billion order backlog, making it the foundational pick for AI infrastructure exposure.

• Microsoft's AI integration across products could add $26 billion in revenue by 2026, with 75% of enterprise customers expected to use AI functionality.

• Salesforce's Agentforce platform achieved 330% ARR growth to $540 million, demonstrating successful AI monetization in enterprise software.

• Vertiv provides critical AI infrastructure with 29% revenue growth, positioning it as the backbone supporting massive data center expansion.

• SoundHound AI offers high-growth potential with 68% revenue growth and exposure to the rapidly expanding voice AI market across automotive and restaurant industries.

The AI investment opportunity extends beyond 2026, with BlackRock projecting $5-8 trillion in AI capital expenditures through 2030. However, investors should balance growth potential against premium valuations, as many AI stocks trade at elevated multiples reflecting high market expectations. Diversifying across multiple AI layers—from chips to applications—may provide the optimal risk-adjusted exposure to this transformative technology trend.

Looking for the best AI stocks to buy 2026? You might be surprised by what Wall Street analysts are forecasting for the industry heavyweights.

The AI investment landscape continues to boom, with BlackRock Investment Institute projecting another $5-8 trillion in AI-related capital expenditures through 2030. Meanwhile, companies like Nvidia and Microsoft are showing remarkable upside potential. Actually, Nvidia has a median target price of $250 per share, suggesting a 31% upside from its current $190 price, while Microsoft sits at a target of $631, indicating a 29% growth potential from its $488 share price.

What makes these artificial intelligence stocks particularly compelling is their impressive growth rates. For instance, Nvidia commands over 90% market share in data center GPUs, a sector projected to grow at 36% annually through 2033. Similarly, companies like SoundHound have more than doubled their revenue in the first nine months of 2025, while Salesforce's Agentforce product saw its annual recurring revenue surge by an astonishing 330% to $540 million last quarter. If you're wondering which ai stocks to invest in before 2026, our expert analysis covers seven top contenders, including the often-overlooked VRT stock, that deserve a place in your portfolio.

Nvidia

Image Source: FourWeekMBA

"We're creating a whole bunch of blueprints that our ecosystem could take advantage of. All of this is completely open source, so you could take it and modify the blueprints." — Jensen Huang, CEO of NVIDIA, leading pioneer in AI hardware and computing platforms

Nvidia stands as the undisputed titan among **artificial intelligence stocks**, commanding a staggering [85-90% share of the AI chip market](https://www.fool.com/investing/2025/11/19/nvidias-grip-on-the-ai-chip-business-is-strong-but/) [[1]](https://docs.snowflake.com/en/user-guide/intro-key-concepts). This semiconductor powerhouse has transformed from a graphics pioneer into the backbone of modern AI infrastructure, with a strategic vision that extends far beyond hardware manufacturing.

Nvidia's AI strategy and full-stack dominance

At the core of Nvidia's success lies its "full-stack co-design" approach – recognizing that accelerated computing requires integrated solutions spanning compute, networking, software, and developer ecosystems. This strategy positions Nvidia not just as a chip supplier but as an AI factory enabler.

The company has expanded its portfolio beyond GPUs to become a provider of vertically-integrated, full-stack systems that include GPUs, CPUs, networking switches (both InfiniBand and Spectrum-X), and comprehensive software tools designed to optimize AI data center performance. Furthermore, this platform approach creates higher switching costs for customers considering alternative solutions, a strategy now being embraced by competitors like AMD.

Nvidia's full-stack dominance extends across the entire AI workflow – from training to inference – allowing organizations to deploy agentic AI systems across clouds, data centers, or at the edge. This approach accelerates time to market and reduces infrastructure costs while ensuring reliable AI operations.

Nvidia's competitive advantage in GPUs and CUDA

What truly separates Nvidia from competitors is not just superior silicon but its proprietary CUDA software platform, which has become the industry standard for AI development. Launched in 2006, CUDA enables researchers to use GPUs for general-purpose computing, creating a developer ecosystem that now encompasses over 4 million developers.

The CUDA advantage creates what analysts call "vendor lock-in" – customers rely on Nvidia's software for AI models, making it exceptionally difficult to switch providers. Additionally, the company's technological lead enables it to command significant price premiums, which it reinvests in R&D to introduce innovative products faster than competitors.

This software-hardware integration gives Nvidia an estimated 2-year lead over even Google's in-house TPU program. As CEO Jensen Huang noted, the goal is to create computing technology where "the programming language is human" – making AI accessible to everyone.

Nvidia's financial performance and growth outlook

Nvidia's financial trajectory demonstrates exceptional momentum:

Q1 FY2026 revenue reached $44.10 billion, up 69% year-over-year

Data center revenue surged to $39.10 billion, representing 73% growth

S&P Global forecasts Nvidia's revenue to increase to $205.00 billion in FY2026 and $272.00 billion in FY2027

Free operating cash flow is projected to rise from $61.00 billion in FY2025 to $96.00 billion in FY2026 and $145.00 billion in FY2027

Consequently, Nvidia's growth potential remains substantial, supported by a massive order backlog. The company has secured over $500 billion worth of orders for its current Blackwell processors and upcoming Rubin GPUs, to be fulfilled through 2026. Moreover, with global data center capital expenditures projected to grow to $3-4 trillion by 2030, Nvidia is positioned to capture a significant portion of this expanding market.

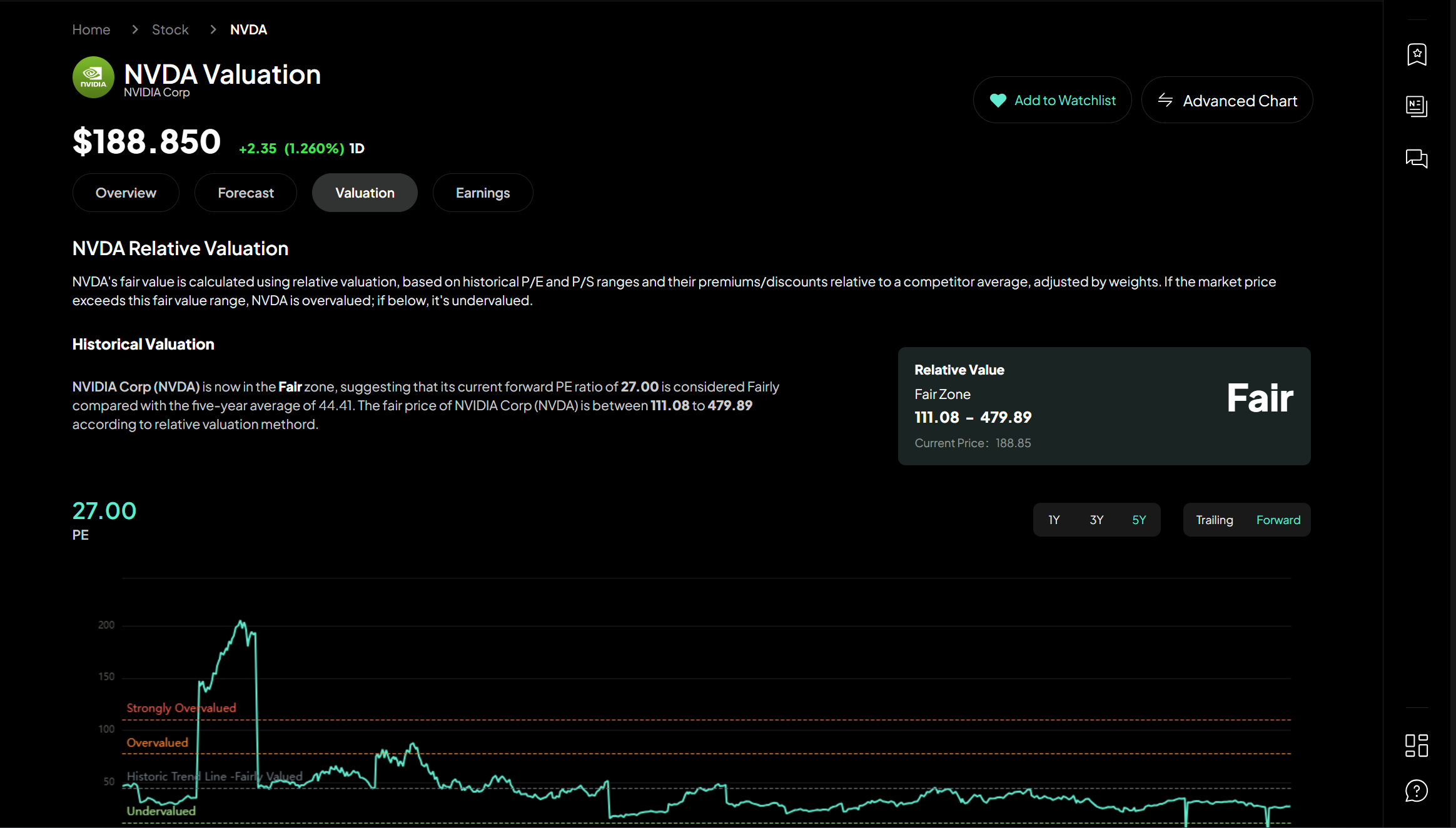

Nvidia stock valuation and analyst sentiment

Wall Street maintains an overwhelmingly positive outlook on Nvidia stock. Among 48 analysts covering the company, 44 advise a "Strong Buy," two suggest a "Moderate Buy," one recommends a "Hold," and only one advises a “Strong Sell”. The average analyst price target stands at $252.49, indicating a 34.15% upside potential.

TipRanks' AI Stock Analysis assigns Nvidia an "Outperform" rating with a score of 76 out of 100, setting a price target of $205. Nevertheless, investors should consider that Nvidia trades at approximately 40 times projected earnings, reflecting high growth expectations.

Despite its premium valuation, many analysts view Nvidia as attractively priced relative to its growth trajectory. Bank of America analyst Vivek Arya maintains a "Buy" rating with a $275 target, noting that Nvidia's P/E multiples of 25x and 19x for 2026 and 2027 earnings respectively imply only a 0.5x PEG ratio – compared to the average of 2x for comparable growth stocks.

Microsoft

Image Source: FourWeekMBA

As one of the best AI stocks to buy 2026, Microsoft has positioned itself at the center of the artificial intelligence revolution. The tech giant isn't merely adding AI features to existing products—it's reimagining its entire ecosystem with AI as the fundamental connective tissue across its product lineup. This strategic approach helps explain why Microsoft has maintained its position among the most valuable companies in the world.

Microsoft's AI integration across products

Microsoft's AI strategy extends far beyond experimental features to become deeply embedded across its entire portfolio. The company's Copilot AI assistant serves as a powerful productivity tool integrated into Microsoft 365 apps including Word, Excel, PowerPoint, Outlook, and Teams. This integration enables users to draft documents, analyze data, create presentations, and manage communications with AI assistance.

Azure, Microsoft's cloud platform, stands at the forefront of the company's AI initiatives. Analysts estimate that AI-driven cloud adoption could add approximately $26 billion to Microsoft's top-line trajectory by fiscal 2026. The company has expanded its AI offerings to include a comprehensive suite of tools called Foundry Tools (formerly Azure AI Services), which provide prebuilt capabilities for vision, speech, language, and document intelligence.

First thing to remember, Microsoft's approach to AI focuses on practical business applications rather than theoretical capabilities. In essence, by 2026, approximately 75% of Microsoft's enterprise installed base is projected to use AI-enabled functionality in some form.

Microsoft's partnership with OpenAI

Central to Microsoft's AI strategy is its strategic partnership with OpenAI, which has evolved significantly since its inception in 2019. Following a recent recapitalization, Microsoft now holds an investment in OpenAI Group PBC valued at approximately $135 billion, representing roughly 27% ownership on an as-converted diluted basis.

The partnership preserves key elements that have fueled success—OpenAI remains Microsoft's frontier model partner with Microsoft maintaining exclusive IP rights and Azure API exclusivity until Artificial General Intelligence (AGI) is achieved. Under the new agreement, OpenAI has contracted to purchase an incremental $250 billion of Azure services.

This partnership has already yielded significant results, as seen in the integration of OpenAI's technology into Microsoft products like Bing, Microsoft 365, and Azure, creating powerful AI-enhanced experiences for users and developers alike.

Microsoft's financial performance and earnings growth

Microsoft's financial results reflect strong momentum driven by AI adoption:

Q1 FY2026 total revenue grew 18% year-over-year to $77.7 billion

Intelligent Cloud segment grew 28% annually to $30.9 billion, accounting for approximately 40% of total revenue

Azure cloud services grew by approximately 40%, reinforcing its position as the primary growth driver

Commercial remaining performance obligation increased more than 50% to nearly $400 billion

This impressive backlog signals long-term customer commitments to Microsoft's cloud and AI platforms, providing exceptional visibility into future revenue streams. Operating income increased $7.4 billion or 24% with growth across all segments.

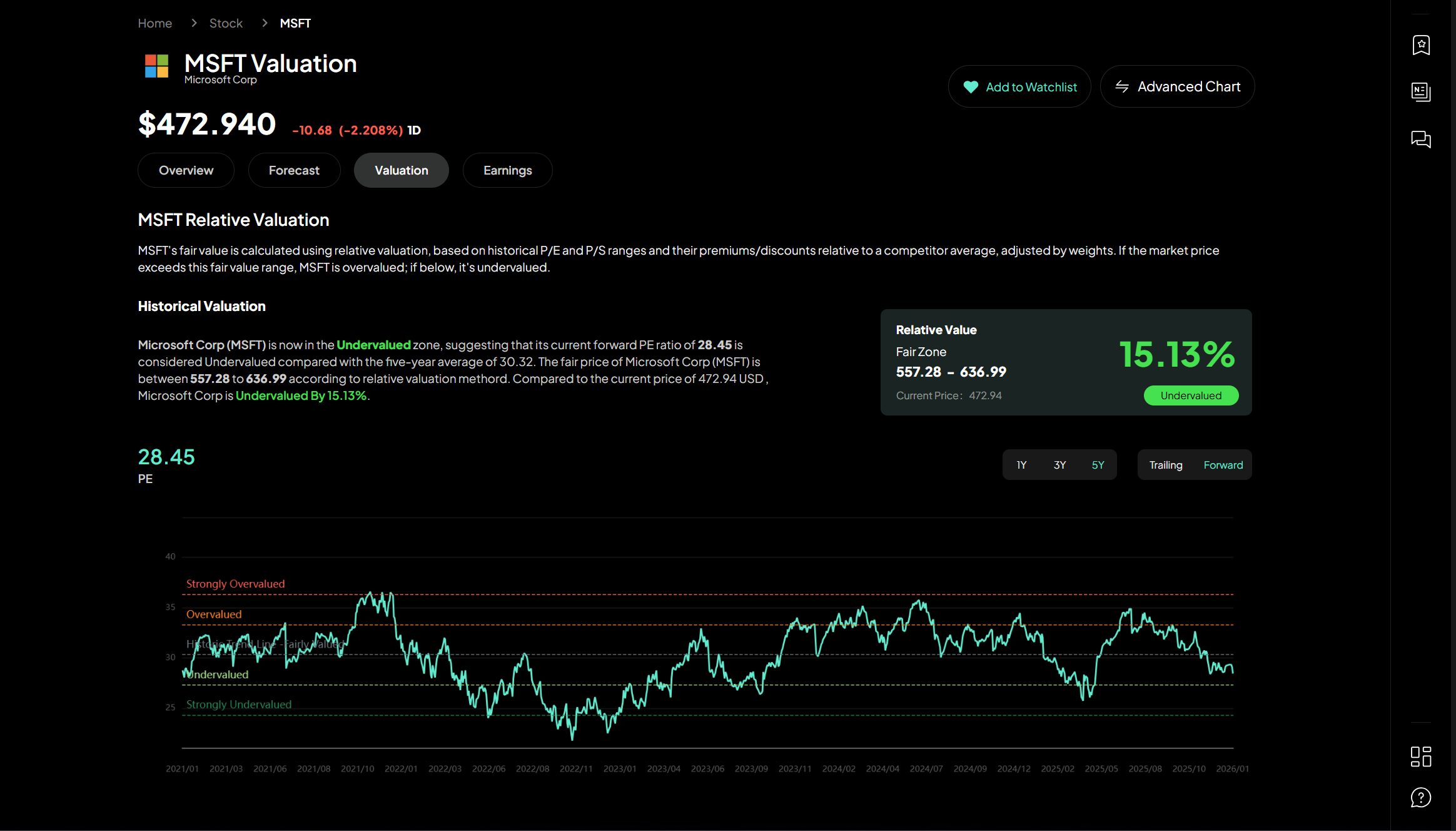

Microsoft stock valuation and future potential

Wall Street maintains an overwhelmingly positive outlook on Microsoft as an artificial intelligence stock. The 33 analysts covering Microsoft have a consensus rating of "Strong Buy" with an average price target of $628.03, forecasting a 28.93% increase over the next year. The lowest target is $500.00 and the highest is $700.00.

Although Microsoft trades at a premium compared to sector peers, with a P/E in the mid-30s, these multiples are slightly below Microsoft's historical averages. Analysts estimate fair value around $530.00 per share based on a combination of valuation approaches.

Looking ahead to 2030, the most bullish forecasts place the stock as high as $1,777.00, while more conservative estimates suggest a range of $850.00 to $1,000.00. These projections are supported by expectations that Microsoft's total revenue will reach between $700.00 billion and $800.00 billion by 2030.

Given Microsoft's strategic AI positioning, diverse revenue streams, and strong financial health, it remains one of the most compelling AI stocks to invest in before 2026.

Salesforce

Image Source: Salesforce

Salesforce has emerged as a powerful contender in the AI investment landscape, transforming from a traditional CRM provider into an AI-driven enterprise platform. The company's strategic shift toward agentic AI positions it among the best AI stocks to buy 2026 with substantial growth potential ahead.

Salesforce's Agentforce AI integration

At the core of Salesforce's AI strategy lies Agentforce, the company's agentic AI platform that brings autonomous, goal-oriented AI agents into enterprise workflows. This platform redefines digital labor by automating complex business processes across sales, service, and operations departments. Agentforce has demonstrated impressive real-world results, including a 15% decrease in average case processing time for Engine and autonomous management of 70% of 1-800Accountant's administrative interactions during peak periods.

Adoption rates highlight Agentforce's momentum:

Over 9,500 paid Agentforce deals, up 50% quarter-over-quarter

70% quarter-over-quarter increase in Agentforce accounts in production

More than 3.2 trillion tokens processed through Salesforce's LLM gateway

This rapid adoption signals that Salesforce's transition to becoming an AI-first company is well underway, with Agentforce serving as the centerpiece of this transformation.

Salesforce's data infrastructure and Informatica acquisition

In light of the AI transition, Salesforce completed its acquisition of Informatica for approximately $8 billion in November 2025, significantly enhancing its data management capabilities. This strategic move brings Informatica's rich data catalog, integration, governance, quality, privacy, metadata management, and Master Data Management services to the Salesforce platform.

The acquisition addresses a critical truth in AI development: "You have to get your data right to get your AI right," as CEO Marc Benioff emphasized. Indeed, by combining Informatica's advanced catalog and metadata capabilities with the Agentforce platform, Salesforce can now deliver a governed and complete data platform that powers more intelligent, contextual, and autonomous experiences.

Salesforce's financial metrics and ARR growth

Salesforce's financial performance validates its AI-focused strategy:

Q3 FY2026 revenue reached $10.3 billion, up 9% year-over-year

Subscription and support revenue grew 10% year-over-year to $9.7 billion

Operating cash flow increased 17% year-over-year to $2.3 billion

Specifically, the company's AI initiatives are driving exceptional growth:

Agentforce and Data 360 annual recurring revenue (ARR) reached nearly $1.4 billion, up 114% year-over-year

Agentforce ARR surpassed half a billion dollars, up 330% year-over-year

50% of Agentforce and Data 360 Q3 bookings came from existing customer expansion

These metrics underscore why Salesforce remains one of the most promising artificial intelligence stocks for investors focused on companies with proven AI monetization strategies.

Salesforce stock valuation and PEG ratio

From a valuation perspective, Salesforce presents an attractive opportunity among AI stocks to invest in. The company trades at a forward P/E ratio of 20.49, substantially lower than many high-growth tech peers. Coupled with its impressive growth trajectory, this creates a favorable valuation profile.

Most notably, Salesforce's PEG ratio (Price/Earnings to Growth) is particularly compelling at 1.24, indicating that investors are getting Salesforce's growth at a reasonable price. For context, a PEG ratio below 1.5 is generally considered attractive, especially for companies with Salesforce's growth profile.

With a 5-Year EBITDA growth rate of 33.50%, Salesforce's current PEG ratio of 0.69 ranks better than 76.89% of 818 companies in the software industry. This metric suggests Salesforce may be undervalued relative to its growth prospects, making it a compelling addition to portfolios focused on best AI stocks.

Snowflake

Image Source: Snowflake

Snowflake distinguishes itself among best AI stocks by serving as the foundation upon which AI systems access, process, and analyze enterprise data. The company's rapid transformation from a cloud data warehouse to an AI-powered platform has positioned it as a critical component in the generative AI ecosystem.

Snowflake's AI agent capabilities

Snowflake Intelligence, the company's enterprise AI agent, has seen the fastest adoption ramp in Snowflake history, with over 1,200 customers already embracing the platform. This agent technology transforms how businesses interact with their data, enabling natural language queries to generate actionable insights. Weekly, more than 7,300 accounts utilize Snowflake's AI capabilities , demonstrating substantial market demand.

At the core of these capabilities lies Snowflake Cortex, a comprehensive AI platform that enables organizations to analyze unstructured data and build conversational agentic applications directly within Snowflake's secure perimeter. The platform orchestrates across both structured and unstructured data sources through specialized tools — Cortex Analyst generates SQL to process structured data, whereas Cortex Search extracts insights from unstructured sources.

Beyond this, Snowflake ML provides a unified environment for developing and deploying machine learning models, offering capabilities for feature engineering, model training, and inference at scale. Subsequently, these models can be deployed to Snowflake's Container Service for inference or brought into production through the Snowflake Model Registry.

Snowflake's data warehousing and cloud flexibility

Primarily, what sets Snowflake apart is its cloud-native architecture that separates storage from compute — a design that simplifies traditional data engineering challenges including infrastructure management and performance tuning. Through this approach, organizations can scale workloads dynamically based on demand and access different types of data (structured, semi-structured, and unstructured) within a single platform.

Even more impressive, the platform's versatility extends across major cloud providers including AWS, Azure, and Google Cloud, offering unprecedented flexibility for enterprises pursuing multi-cloud strategies. This flexibility, combined with Snowflake's elastic architecture, enables organizations to handle fluctuating workloads efficiently while only paying for resources they actually consume.

Snowflake's customer growth and retention

Presently, Snowflake's customer metrics showcase remarkable momentum:

Q3 FY2026 product revenue reached $1.16 billion, representing 29% year-over-year growth

Net revenue retention rate stands at 125%, indicating existing customers continue to expand their usage

The company now has 688 customers with trailing 12-month product revenue exceeding $1 million

Snowflake serves 766 Forbes Global 2000 customers, representing 4% year-over-year growth

The company's consumption-based business model distinguishes it from subscription-based software providers, giving customers flexibility to consume more than their contracted capacity and roll over unused capacity to future periods.

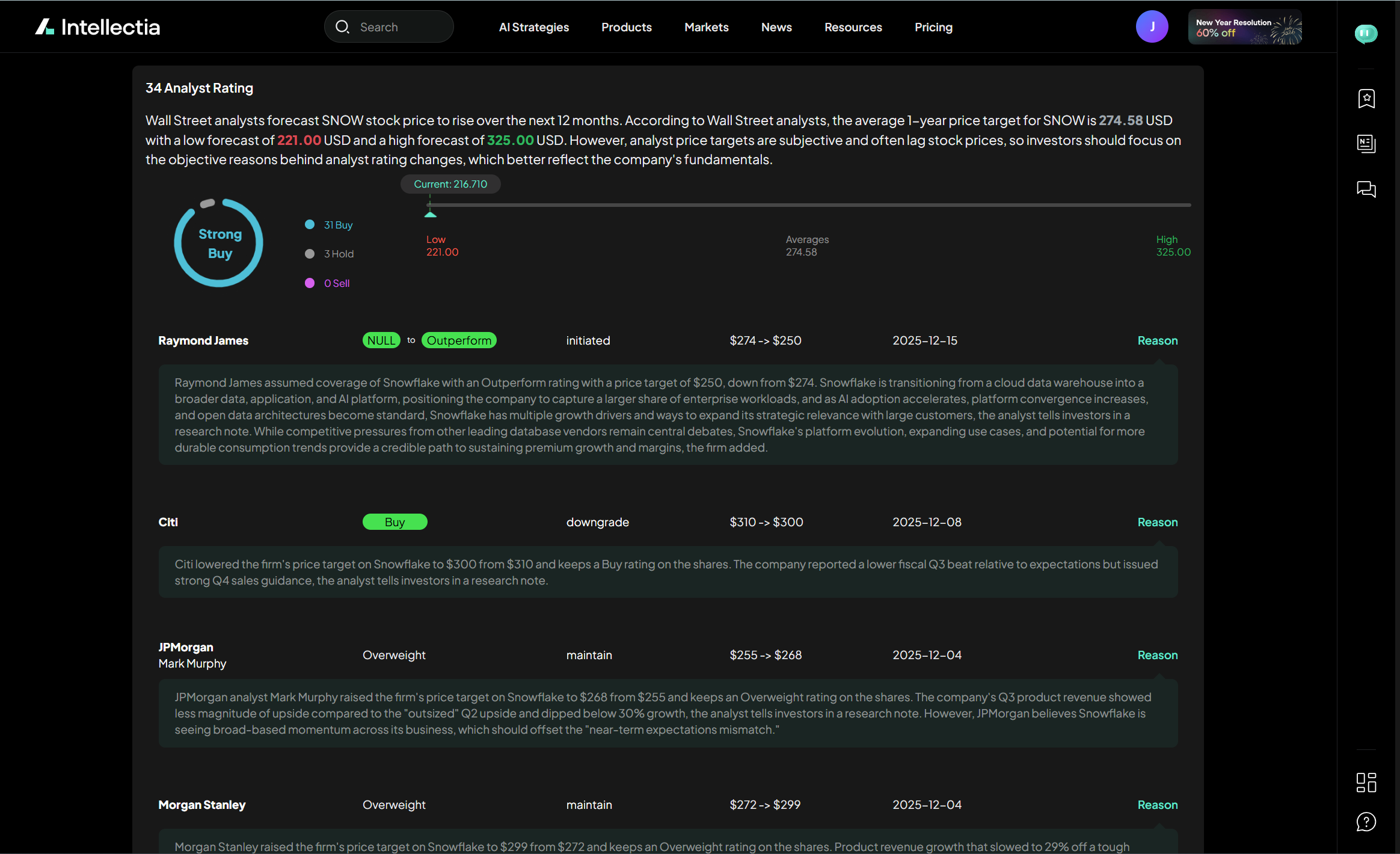

Snowflake stock valuation and market position

In terms of valuation, Snowflake trades at a Price-to-Sales ratio of 17.4x, reflecting high investor expectations for future growth. Compared to the IT industry average of 2.2x, this premium valuation underscores Snowflake's perceived market opportunity.

Wall Street remains optimistic about Snowflake's prospects, with the company raising its revenue guidance for fiscal year 2026 to $4.45 billion, implying 28% annual growth. Much of this optimism centers on Snowflake's AI initiatives reaching $100 million in revenue run rate one quarter ahead of schedule

As AI adoption continues to accelerate, Snowflake's total addressable market has expanded from $170 billion to a projected $355 billion, highlighting why many analysts consider it one of the most promising artificial intelligence stocks for long-term investors seeking exposure to the data infrastructure powering next-generation AI applications.

SoundHound AI

"More's coming, Huang said, describing the growing power of AI to reason and perceive. That leads us to agentic AI — AI able to understand, think and act." — Jensen Huang, CEO of NVIDIA, leading pioneer in AI hardware and computing platforms

Among the up-and-coming **best AI stocks to buy 2026**, SoundHound AI's rapid advancement in voice technology demonstrates why smaller players can offer substantial growth potential in the artificial intelligence sector.

SoundHound's voice AI and agentic platform

At the core of SoundHound's competitive advantage is its Amelia platform, which incorporates proprietary Speech-to-Meaning® technology. This innovation delivers industry-leading latency of just 350 milliseconds, dramatically outpacing the 1.5 second average reported by larger tech companies. The platform's Agentic+ framework uniquely combines generative AI, multi-agent orchestration, and deterministic models for more natural voice experiences

SoundHound processes approximately 10 billion queries annually across more than 40 languages and accents. The company's proprietary ASR model, Polaris, distinguishes itself with contextual understanding capabilities and an exceptionally low word error rate.

SoundHound's industry applications in auto and restaurants

In the automotive sector, SoundHound has secured several major partnerships. The company is working with a globally renowned sports car brand to launch a custom "personality" for its assistant and has expanded with Jeep vehicles across Europe. Additionally, SoundHound has signed agreements with an Italian commercial vehicle company and two prominent two-wheeler brands in India.

Within the restaurant industry, SoundHound has deployed its AI ordering solutions with numerous national chains. Recent franchise wins include Firehouse Subs, Five Guys, and McAllister's Deli, alongside full deployments across all MOD Pizza, Habit Burger, Red Lobster, and Torchy's Tacos locations. Furthermore, Peet's Coffee has expanded SoundHound's Employee Assist technology to all company-owned locations.

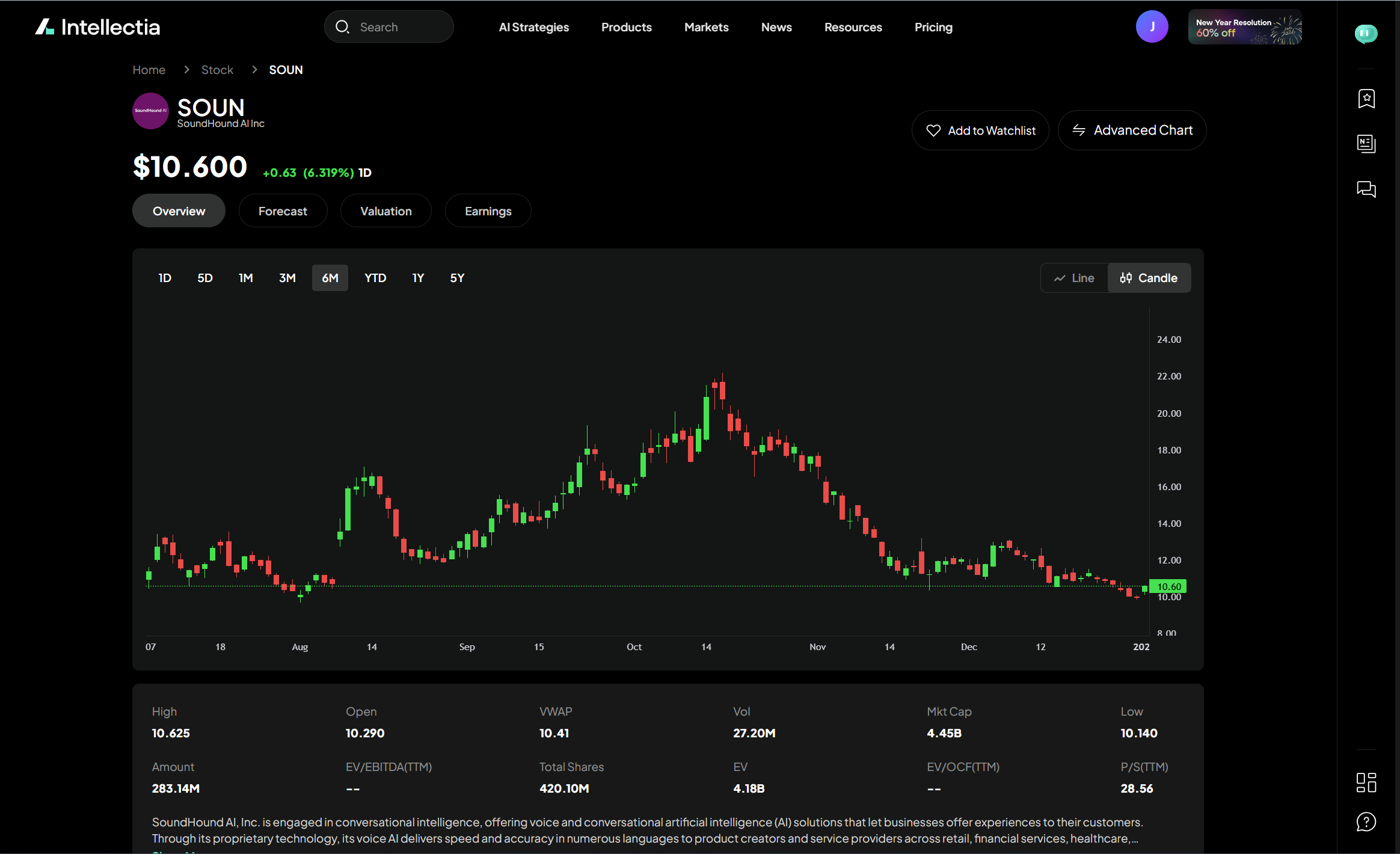

SoundHound's revenue growth and margin improvement

In Q3 2025, SoundHound reported revenue of $42 million, representing a 68% increase year-over-year. Based on this strong performance, the company raised its full-year 2025 revenue outlook to between $165-$180 million.

On the profitability front, SoundHound reported a GAAP gross margin of 42.6% and non-GAAP gross margin of 59.3%. The company's cash position remains strong at $269 million with no debt as of September 2025.

SoundHound stock valuation and future outlook

With a market capitalization of approximately $4.7 billion against projected 2025 revenue of about $173 million, SoundHound trades at a forward price-to-sales ratio of roughly 27. This premium valuation reflects high growth expectations.

The seven analysts covering SoundHound maintain a consensus "Buy" rating with an average price target of $16.14, suggesting a 55.04% potential upside. The most optimistic target stands at $26, while the most conservative is $8.

Looking ahead, analysts project revenue growth of 103.55% in 2025 and 38.38% in 2026. Hence, SoundHound represents an intriguing option among artificial intelligence stocks for investors seeking exposure to the rapidly expanding voice AI market.

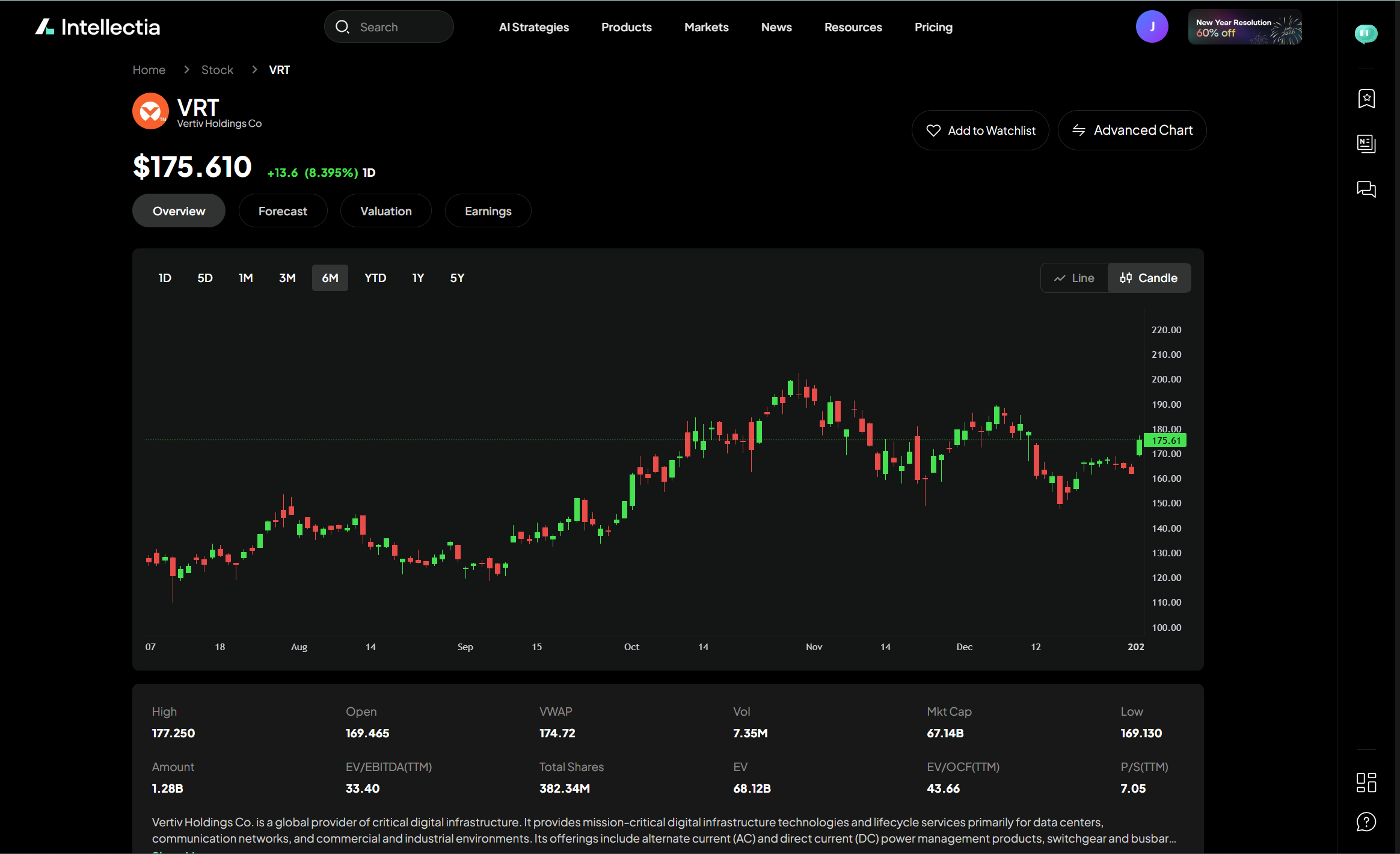

VRT (Vertiv Holdings)

When examining best AI stocks to buy 2026, Vertiv Holdings (VRT) stands out as the physical foundation enabling AI's explosive growth. This infrastructure provider delivers critical power and cooling solutions that keep AI data centers operational—effectively becoming the backbone of artificial intelligence development.

VRT's role in AI infrastructure and data centers

Vertiv specializes in designing, building, and servicing critical digital infrastructure for data centers, communication networks, and commercial environments. The company's AI-focused portfolio is fueling rapid data center growth, serving as a proxy for high-growth AI infrastructure as we approach 2026.

Uniquely positioned across the entire digital infrastructure ecosystem, Vertiv offers end-to-end power and cooling technologies that help customers remain resilient and future-ready. In response to AI's demands, the company has developed comprehensive reference designs supporting rack densities up to 142kW through combined liquid and air cooling approaches.

VRT's competitive edge in thermal and power management

What truly distinguishes Vertiv is its advanced cooling technology portfolio, including rear-door heat exchangers, direct-to-chip liquid cooling, and immersion cooling solutions. As AI chip densities increase dramatically, Vertiv's thermal management capabilities become increasingly vital—typically outperforming traditional air cooling by up to 3,000 times in efficiency.

Concurrently, the company has strengthened its position through strategic partnerships with industry leaders like NVIDIA, joining their Partner Network to develop specialized AI cooling solutions. Vertiv is also preparing for future AI demands through its 800 VDC power architecture, specifically designed to support NVIDIA's next-generation Rubin Ultra platform.

VRT's financial performance and market expansion

Fiscally, Vertiv reported impressive Q3 2025 results with:

Net sales of $2.68 billion, up 29% year-over-year

Organic orders increasing 60% year-over-year

Adjusted operating profit of $596 million, up 43% year-over-year

Backlog growing to $9.5 billion, up 30% from the previous year

VRT stock valuation and analyst projections

According to Wall Street analysts, VRT has a consensus "Strong Buy" rating with an average price target of $196.66, suggesting 19% upside potential [5]. Revenue is projected to grow at a compound annual rate of 19% over the next four years, with operating income and net income expected to grow at impressive 29% and 58% CAGR respectively.

Overall, Vertiv's ability to capitalize on the AI infrastructure boom positions it as one of the artificial intelligence stocks offering both growth potential and exposure to the physical layer of the AI revolution.

Comparison Table

| Company | Primary AI Focus | Recent Revenue Performance | Key Partnerships/Customers | Notable Growth Metrics | Market Position/Analyst Outlook |

| Nvidia | AI chips & CUDA platform | Q1 FY2026: $44.10B (69% YoY) | 4M+ CUDA developers | 90% market share in data center GPUs | 44 of 48 analysts rate "Strong Buy"; PT: $252.49 (34.15% upside) |

| Microsoft | Enterprise AI & Cloud Services | Q1 FY2026: $77.7B (18% YoY) | OpenAI ($250B Azure services deal) | Azure cloud grew 40% | 33 analysts consensus "Strong Buy"; PT: $628.03 (28.93% upside) |

| Salesforce | Agentforce AI platform | Q3 FY2026: $10.3B (9% YoY) | Informatica acquisition ($8B) | Agentforce ARR up 330% to $540M | Forward P/E: 20.49; PEG ratio: 1.24 |

| Snowflake | AI-powered data platform | Q3 FY2026: $1.16B (29% YoY) | AWS, Azure, Google Cloud | 1,200+ AI platform customers | Projected FY2026 revenue: $4.45B (28% growth) |

| SoundHound AI | Voice AI technology | Q3 2025: $42M (68% YoY) | Jeep, Five Guys, Red Lobster | 10B annual queries across 40+ languages | 7 analysts consensus "Buy"; PT: $16.14 (55.04% upside) |

| VRT | AI infrastructure & cooling | Q3 2025: $2.68B (29% YoY) | NVIDIA Partner Network | Backlog: $9.5B (30% YoY growth) | Consensus "Strong Buy"; PT: $196.66 (19% upside) |

Conclusion

The AI investment landscape stands poised for extraordinary growth through 2030, with companies strategically positioning themselves to capture significant market share. Consequently, investing in AI stocks before 2026 offers substantial upside potential as these technologies continue transforming industries worldwide.

Nvidia remains the undisputed market leader with its full-stack approach and CUDA ecosystem creating formidable competitive advantages. Microsoft's deep integration of AI across its product suite and strategic partnership with OpenAI establishes it as a cornerstone investment in this space. Salesforce demonstrates impressive monetization through its Agentforce platform, while Snowflake provides essential data infrastructure powering enterprise AI initiatives.

Though less recognized, SoundHound AI presents compelling growth opportunities in voice technology markets. Vertiv Holdings offers unique exposure to the physical infrastructure supporting AI development, addressing the critical cooling and power management challenges. C3.ai, despite recent struggles, potentially represents a value opportunity for investors willing to accept higher risk.

Before investing, you should consider several factors beyond growth projections. Valuation premiums reflect high expectations, and the rapid evolution of competitive dynamics makes manual analysis increasingly difficult. To navigate this overwhelming amount of data and remove emotional bias, many investors are now leveraging a Financial AI Agent. This powerful tool acts as a dedicated financial advisor, providing precise insights and tailored analysis for stocks, ETFs, and cryptos, ensuring you stay ahead of the competition with faster, smarter decision-making.

Your investment approach might benefit from allocating across multiple AI stocks to balance risk while maintaining significant exposure to this transformative technology trend. While long-term portfolios require stable winners, the high volatility of the AI sector also creates unique opportunities for active traders. To capitalize on these daily price movements without the stress of guesswork, using an AI Stock Picker can be a game-changer. By delivering data-driven stock picks before the market opens, it allows traders to buy in the morning and sell by close, maximizing intraday profits through superior timing and real-time insights.

The AI revolution extends far beyond short-term hype, representing perhaps the most significant technological shift since the internet itself. These seven companies embody different aspects of this transformation, but the most successful investors will be those who recognize both the immediate potential and long-term implications. By combining long-term strategic holdings with AI-powered tools for daily execution and deep analysis, you can fully capture the upside of this historic global economic shift.