Validea's Leading IT Stocks According to Joel Greenblatt - 8/18/2025

Top Rated IT Stocks: Validea's Earnings Yield Investor model highlights HP Inc., Western Digital Corp., MicroStrategy Inc., Cognizant Technology Solutions Corp., and Leidos Holdings Inc. as top-rated stocks based on Joel Greenblatt's investment strategy.

HP Inc. Overview: HP Inc. received a 100% rating, indicating strong interest due to its fundamentals in personal computing and printing solutions across various segments.

Western Digital Corp. Overview: With a 90% rating, Western Digital specializes in data storage devices and solutions, catering to diverse markets including cloud and consumer sectors.

MicroStrategy and Cognizant Ratings: Both MicroStrategy and Cognizant Technology Solutions scored 80%, focusing on software development and technology services, with MicroStrategy notably investing heavily in Bitcoin.

Trade with 70% Backtested Accuracy

Analyst Views on HPQ

About HPQ

About the author

- Stock Surge: Toymaker Funko's shares jumped approximately 25% following Pleasant Lake Partners' urging for the company to explore strategic alternatives, indicating strong market optimism and potential for new growth avenues.

- Strategic Restructuring: Werewolf Therapeutics has hired Piper Sandler to manage a sale process, highlighting the company's proactive approach to cut operating costs by 64% through layoffs, aiming to enhance financial stability amid restructuring efforts.

- Market Dynamics: The surge in Funko's stock price, coupled with strategic recommendations from its investors, may attract further investor interest, potentially boosting its market performance and overall valuation.

- Private Equity Opportunities: In the private equity space, David Altshuler from Cresta Fund Management discussed opportunities in the energy transition market, reflecting investor interest in the potential value of Funko and similar companies.

- Earnings Report Impact: Dell Technologies' stock experienced a surge following the release of its earnings report.

- Investor Sentiment: The company's ability to navigate challenges has generated excitement among investors.

- Memory Cost Pressure: HP has warned that surging memory chip prices will likely push its full-year 2026 earnings toward the low end of its previously forecast range, despite beating recent revenue and profit estimates, indicating a significant impact on profit margins across the tech sector.

- Smartphone Market Strain: According to GF Securities, rising prices for NAND flash and LPDDR have increased memory's share of a smartphone's bill of materials from 10%-20% to 20%-30%, exacerbating cost pressures in a market already facing soft demand.

- AI Demand Driving Tightness: Nvidia, a major buyer of advanced HBM for AI accelerators, is shifting industry capacity toward high-margin enterprise-grade memory, leading to a squeeze on conventional DRAM supply; IDC expects these memory supply challenges to persist into 2027, amplifying market tightness.

- Samsung Price Negotiations: Samsung Electronics has warned that memory shortages will keep prices elevated industry-wide in 2026, with recent reports indicating that it is negotiating prices for its latest AI-focused memory chips at up to 30% above the previous generation, reflecting strong demand for high-end memory.

- Dell's Strong Earnings: Dell Technologies reported a blowout quarter driven by AI buildout, resulting in a 12% stock increase, with AI server revenue expected to double to approximately $50 billion in the new fiscal year, highlighting the company's robust growth potential in the AI sector.

- CoreWeave's Capital Expenditure Surge: CoreWeave plans to invest $30 billion to $35 billion in data center construction for 2026, significantly exceeding the Street's estimate of $26.9 billion, and despite a sharp decline in shares, nearly all new capacity is allocated, indicating strong market demand.

- Block's Workforce Reduction: Jack Dorsey's Block announced a 40% workforce cut, stating that intelligence tools have changed company operations, and despite flat revenues in 2025, Morgan Stanley upgraded its rating from hold to buy, reflecting confidence in its potential growth.

- Zscaler's Underwhelming Performance: Although Zscaler delivered a beat-and-raise quarter, its shares fell 11% in premarket trading, indicating market caution regarding software valuations, as analysts remain skeptical about future profitability in the sector.

- Takeover Rumors Resurface: PayPal's shares fell as takeover chatter resurfaced, with reports indicating that the company has not engaged in sale negotiations with Stripe or any other suitors, highlighting market uncertainty regarding its future.

- Subpar Earnings Report: On February 3, PayPal reported fourth-quarter earnings of $1.23 per share, missing the analyst consensus estimate of $1.28, which may lead to a decline in investor confidence due to unmet profitability expectations.

- Sales Miss Expectations: The company reported quarterly sales of $8.676 billion, falling short of the $8.801 billion analyst consensus estimate, although this represents a 3.71% year-over-year increase, failing to alleviate concerns about its growth prospects.

- Significant Stock Volatility: As of Thursday, PayPal's shares were down 4.80% at $45.05, reflecting heightened investor concerns about the company's future performance, which could impact its market competitiveness and investment appeal.

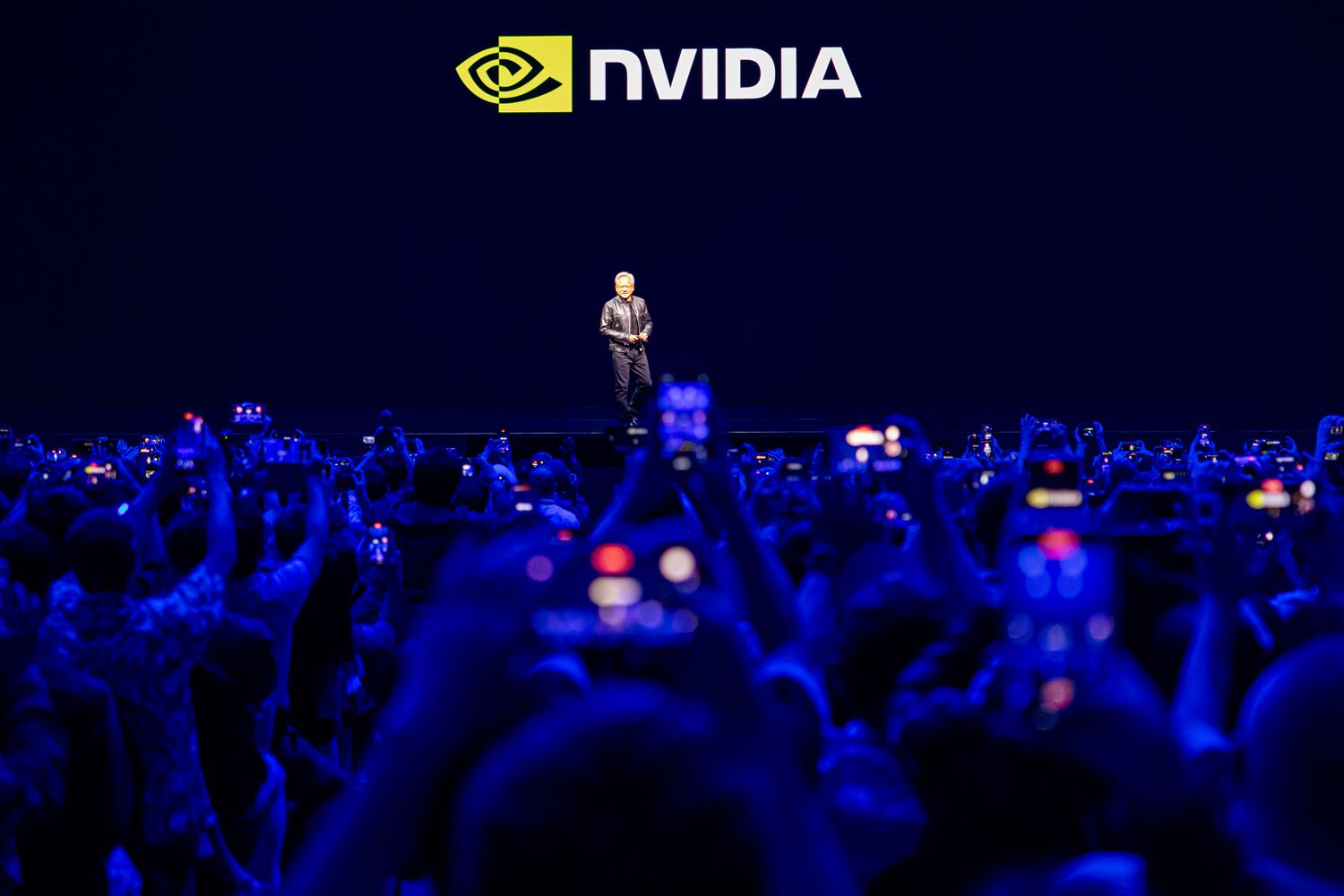

- Market Misjudgment: Nvidia CEO Jensen Huang stated in a CNBC interview that investors overreacted to AI fears, leading to a significant sell-off in software stocks that pushed the sector into bear market territory, indicating an overestimation of AI's impact.

- Industry Transformation: Analyst Neil Shah emphasized that SaaS companies are under pressure to pivot quickly from service-based models to outcome-based models to capture market leadership in the AI era, particularly within the next two years.

- Emerging Investment Opportunities: Siddy Jobe from Econopolis Wealth Management highlighted that AI will enhance the efficiency of software tools, particularly for companies like Salesforce and ServiceNow, which are expected to attract more customers willing to pay for their services.

- Optimistic Industry Outlook: HSBC analysts believe that the software sector will significantly benefit from the mainstream adoption of AI, predicting that substantial value will be generated in this field by 2026, especially as companies have been preparing for AI development over the past two years.