Uranium Prices Surpass $100, Market Reacts Strongly

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Feb 11 2026

0mins

Source: Benzinga

- Uranium Price Surge: Uranium prices have surpassed $100 per pound, reaching a two-year high, reflecting sustained market demand for nuclear fuel, particularly amid increasing policy support and supply risks, which are expected to drive long-term industry growth.

- Enhanced Policy Support: U.S. policy targets aim for a fourfold increase in nuclear capacity by 2050 and the construction of at least 10 large reactors by 2030, necessitating a substantial increase in uranium supply, thereby creating durable demand visibility for the industry.

- Supply Constraints: Kazakhstan, a major source of global uranium supply, has tightened exploration and development controls, making it difficult to increase production levels, which further exacerbates market supply shortages and is likely to push uranium prices higher.

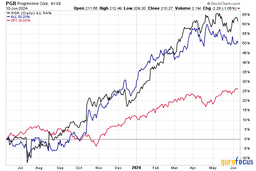

- Strong Equity Performance: The Sprott report indicates that uranium-related equities have significantly outperformed global stocks and broad commodities over the past five years, suggesting that the combination of strategic demand and constrained production may sustain momentum in the sector, attracting more investor interest.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.