Top Value Stocks to Consider Purchasing on December 17

Stock Recommendations: Two stocks, Bread Financial Holdings, Inc. and F&G Annuities & Life, Inc., are highlighted as strong buy options with Zacks Rank #1 and significant earnings growth estimates for the current year.

Value Characteristics: Bread Financial has a P/E ratio of 7.30 and a Value Score of A, while F&G Annuities has a P/E ratio of 8.40 and also a Value Score of A, both outperforming their respective industry averages.

Investment Potential: These stocks are considered under the radar, providing a unique opportunity for investors to potentially gain significant returns, as previous recommendations have seen gains of over 100%.

Further Resources: Investors can access additional stock analysis reports and recommendations from Zacks Investment Research, including a list of top-ranked stocks for potential investment.

Trade with 70% Backtested Accuracy

Analyst Views on FG

About FG

About the author

- Earnings Release Schedule: F&G Annuities & Life, Inc. will release its fourth quarter and full year 2025 earnings after the market closes on February 19, 2026, which is expected to provide investors with critical financial performance data to assess the company's future growth potential.

- Conference Call Timing: Following the earnings release, F&G will host a webcast and conference call at 9:00 a.m. Eastern Time on February 20, 2026, aimed at providing a detailed interpretation of the financial results and addressing investor inquiries, thereby enhancing transparency and investor confidence.

- Investor Relations Information: Additional information regarding the quarterly financial results, including the earnings release, will be available on F&G's Investor Relations website, ensuring that investors can access the latest financial data and company updates in a timely manner, thus improving information accessibility.

- Company Background: F&G is a leading provider of insurance solutions headquartered in Des Moines, Iowa, focusing on retail annuity and life customers as well as institutional clients, committed to helping Americans achieve their financial aspirations, showcasing its market position in the insurance industry.

- Earnings Release Schedule: Fidelity National Financial will release its Q4 and full year 2025 earnings after market close on February 19, 2026, providing critical financial metrics to assess company performance.

- Conference Call Timing: Following the earnings release, Fidelity will hold a conference call on February 20, 2026, at 11:00 a.m. Eastern Time, allowing analysts and investors to discuss financial results and future outlook in depth.

- Investor Relations Information: Additional details regarding the financial results, including the earnings release, will be available on Fidelity's Investor Relations website, ensuring investors can stay updated with the latest developments.

- Market Position: Fidelity National Financial is the largest title insurance company in the U.S., with its subsidiaries collectively issuing more title insurance policies than any other company, highlighting its leadership in the real estate and mortgage industries.

- Earnings Release Schedule: F&G Annuities & Life, Inc. will release its fourth quarter and full year 2025 earnings after market close on February 19, 2026, providing critical financial performance data that will help analysts assess the company's future growth potential.

- Conference Call Timing: Following the earnings release, F&G will hold a conference call at 9:00 a.m. Eastern Time on February 20, 2026, aimed at enhancing communication with investors and increasing transparency and trust.

- Webcast Access Information: Investors can register and access the live webcast through F&G's Investor Relations website, ensuring that all stakeholders can obtain real-time updates on the company's latest financial information, thereby fostering greater investor engagement.

- Replay Availability: A replay of the webcast will be available on F&G's Investor Relations website after the live event, allowing investors who could not participate in real-time to review the meeting content, ensuring widespread dissemination and access to information.

- Risk Aversion Trend: According to F&G's annual survey, 77% of American investors are pulling back on risk investments due to concerns over healthcare, inflation, and AI, indicating heightened economic anxiety.

- Declining Financial Confidence: The survey reveals that increased economic burdens are eroding investors' confidence in their financial situations, which is impacting their retirement planning and investment decisions.

- Rising Demand for Insurance Solutions: As risk aversion rises, F&G, as a provider of insurance solutions, may experience increased demand for annuity and life insurance products, potentially driving business growth.

- Market Impact Analysis: The trend of risk aversion among investors could lead to decreased market liquidity, affecting stock market performance, especially amid growing economic uncertainties.

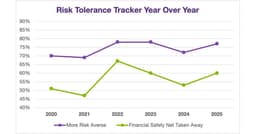

- Rising Risk Aversion: According to F&G's sixth annual Risk Tolerance Tracker, 77% of Americans report becoming more cautious over the past year, a 4 percentage point increase from last year, indicating the ongoing erosion of household financial confidence due to economic pressures.

- Increased Anxiety Among Middle-Aged: Among Americans in their 40s, 81% report becoming more risk averse, highlighting the mounting financial anxiety at a critical stage defined by housing costs and family obligations, which complicates retirement planning.

- Healthcare Cost Concerns Surge: The survey reveals that worries about healthcare and long-term care costs have risen from sixth to second place, now at 31%, indicating that alongside inflation, Americans are increasingly anxious about future medical expenses.

- Lack of Professional Guidance: Despite heightened financial stress, 54% of respondents indicate they do not work with a financial professional, suggesting that many are navigating these challenges without adequate support amid economic uncertainty.

- Insider Buying Activity: United Natural Foods' Director James C. Pappas purchased 17,000 shares at $33.71 each for a total investment of $573,000 on Monday, which resulted in a paper gain of approximately 3.8% at the peak of the trading session, indicating confidence in the company's future performance.

- Stock Performance: Following Pappas's purchase, UNFI's stock rose about 3.5% on Tuesday, reflecting a positive market reaction to insider buying, which may bolster investor confidence in the company's outlook.

- Historical Purchases: This marks Pappas's first buy in the past year, suggesting his recognition of the current valuation, which could attract further investor interest and enhance market liquidity.

- F&G Annuities Update: Concurrently, F&G Annuities & Life CEO Christopher O. Blunt bought 5,000 shares at $29.56 each for a total of $147,800 on Friday, and despite a 0.8% decline in stock price on Tuesday, the current trading price remains below Blunt's purchase price, presenting an opportunity for bargain hunters.