Take-Two Interactive Software Stock Outlook: Is Wall Street Bullish or Bearish?

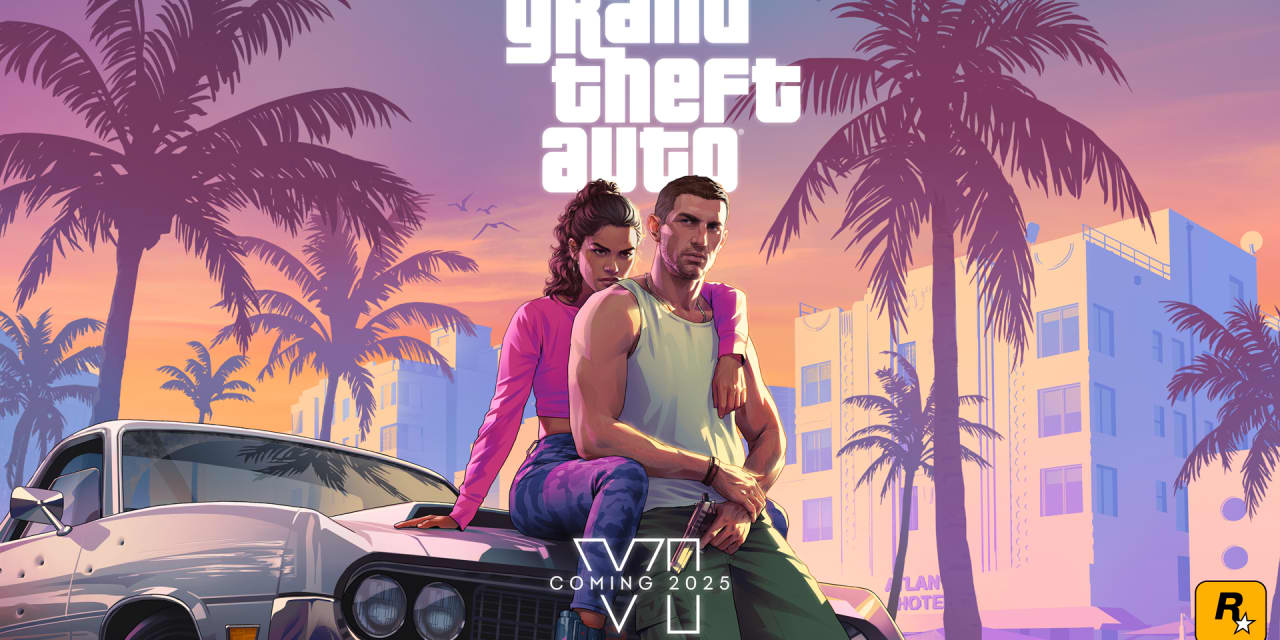

Company Overview and Performance: Take-Two Interactive Software, Inc. is a leading video game publisher with a market cap of $38.2 billion, known for franchises like Grand Theft Auto and NBA 2K. The company has outperformed the broader market, gaining 41.2% over the past year compared to the S&P 500's 22.5%.

Analyst Ratings and Future Outlook: Analysts have a consensus "Strong Buy" rating for TTWO stock, with expectations for EPS growth of 7.7% this fiscal year. Recent ratings suggest a price target of $250, indicating potential upside from current levels.

Trade with 70% Backtested Accuracy

Analyst Views on HERO

About the author

High Trading Volume for ETF: The Global X Video Games & Esports ETF experienced unusually high trading volume on Wednesday, with over 322,000 shares traded compared to a three-month average of about 33,000 shares.

Performance of ETF Components: Among the ETF components, Unity Software saw a decline of 4.9%, while Electronic Arts increased by 0.3%. Playtika Holding performed best with a 2% rise, whereas Douyu International Holdings dropped by 6%.

Company Overview and Performance: Take-Two Interactive Software, Inc. is a leading video game publisher with a market cap of $38.2 billion, known for franchises like Grand Theft Auto and NBA 2K. The company has outperformed the broader market, gaining 41.2% over the past year compared to the S&P 500's 22.5%.

Analyst Ratings and Future Outlook: Analysts have a consensus "Strong Buy" rating for TTWO stock, with expectations for EPS growth of 7.7% this fiscal year. Recent ratings suggest a price target of $250, indicating potential upside from current levels.

Earnings Report: Electronic Arts Inc reported third-quarter revenue of $1.883 billion, exceeding expectations, while net bookings fell short at $2.215 billion. The company anticipates a return to growth in FY26 and has declared a quarterly dividend of $0.19 per share.

Stock Performance and Future Outlook: EA shares rose 2.99% premarket, with plans for an accelerated stock repurchase of $1 billion. For the fourth quarter, the company expects EPS between $0.65 – $1.00 and revenue of $1.682 billion – $1.832 billion, projecting lower net bookings for FY25 compared to previous estimates.

Industry Outlook: The videogame industry, which faced challenges post-Covid-19, is expected to rebound in 2025 with anticipated releases like Grand Theft Auto VI and updates from other major publishers, potentially driving sales and investor interest.

Investment Risks and Opportunities: Analysts recommend investing in the sector despite high production costs and risks associated with new game launches, highlighting the potential for growth through artificial intelligence integration and upcoming game releases.

Quarterly Performance: Electronic Arts reported second-quarter net revenue of $2.025 billion, slightly below expectations, but exceeded EPS estimates with $1.11. The company achieved record net bookings of $2.079 billion and announced a quarterly dividend of $0.19 per share.

Future Outlook: EA raised its full fiscal year EPS guidance to $3.82 – $4.33 and revenue forecast to $7.4 billion – $7.7 billion, while projecting net bookings around $7.500 billion to $7.800 billion.

Invesco Leisure and Entertainment ETF Overview: The Invesco Leisure and Entertainment ETF (PEJ) is a passively managed fund that provides exposure to the Consumer Discretionary - Leisure and Entertainment sector, with assets over $243 million and an expense ratio of 0.58%. It aims to match the performance of the Dynamic Leisure & Entertainment Intellidex Index.

Performance and Holdings: Year-to-date, PEJ has increased by 13.52% and 24.25% over the past year, with a high risk profile indicated by a beta of 1.36. The ETF's top holdings include Sysco Corp, Hilton Worldwide, and Royal Caribbean Cruises, representing about 44.51% of total assets.