South Korea's automotive sector anticipates adverse effects from Trump's agreement with Japan.

Impact on South Korean Automotive Industry: South Korea anticipates a negative effect on its automotive sector due to a new U.S.-Japan trade deal that reduces U.S. tariffs on Japanese auto imports to 15%, while South Korean imports remain at 25%.

Competitive Disadvantage for Korean Automakers: The tariff disparity is expected to hinder the competitiveness of South Korean automakers like Hyundai and Kia in the U.S. market, potentially affecting their pricing strategies and market share.

Trade with 70% Backtested Accuracy

Analyst Views on EWY

About the author

- Market Reaction: South Korea's benchmark stock index experienced its largest one-day decline on Wednesday.

- Causes of Decline: The drop was linked to concerns over oil prices and tensions with Iran.

- Performance Context: This decline marks a significant turnaround for South Korea, which was the world's top-performing market last year.

- Investor Sentiment: The dramatic market response reflects heightened investor anxiety regarding geopolitical issues and their impact on the economy.

Current State of AI Trade: The AI trade is experiencing fluctuations, with some sectors showing growth while others face challenges, leading to debates about its viability.

Market Dynamics: Factors such as technological advancements, regulatory changes, and competition are influencing the AI market, impacting investment and development strategies.

Future Prospects: Experts are divided on the future of AI trade, with some predicting a resurgence driven by innovation, while others caution about potential market saturation.

Investment Trends: There is a noticeable shift in investment patterns, with a focus on sustainable and ethical AI solutions, reflecting changing consumer and regulatory expectations.

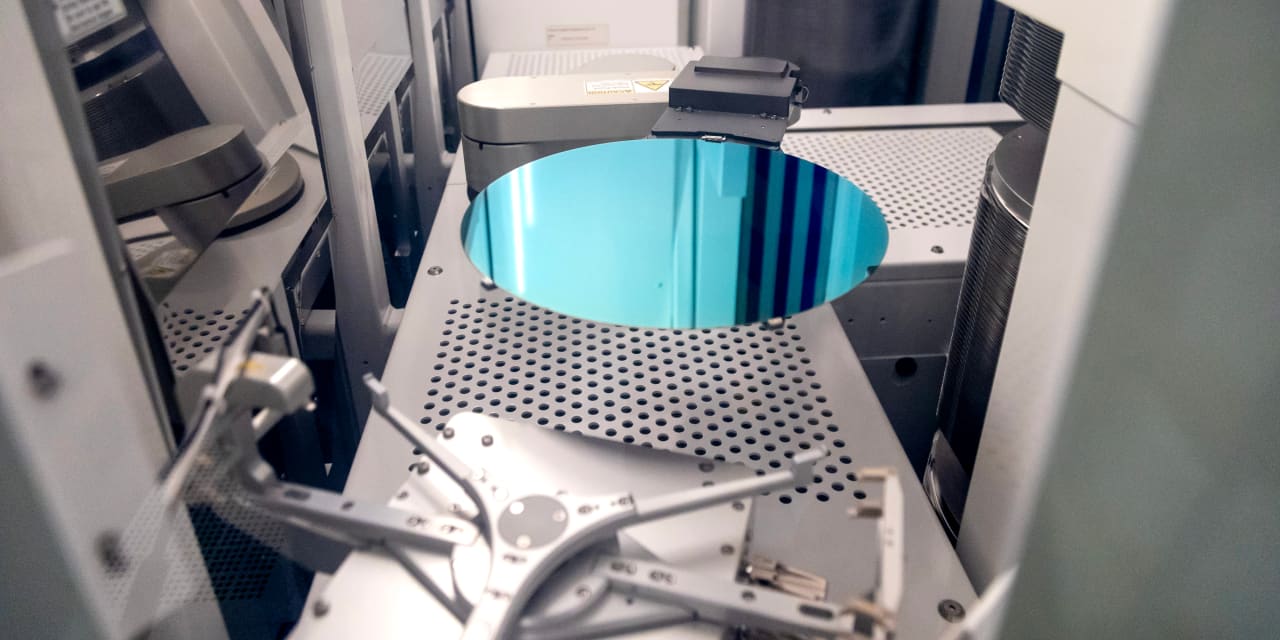

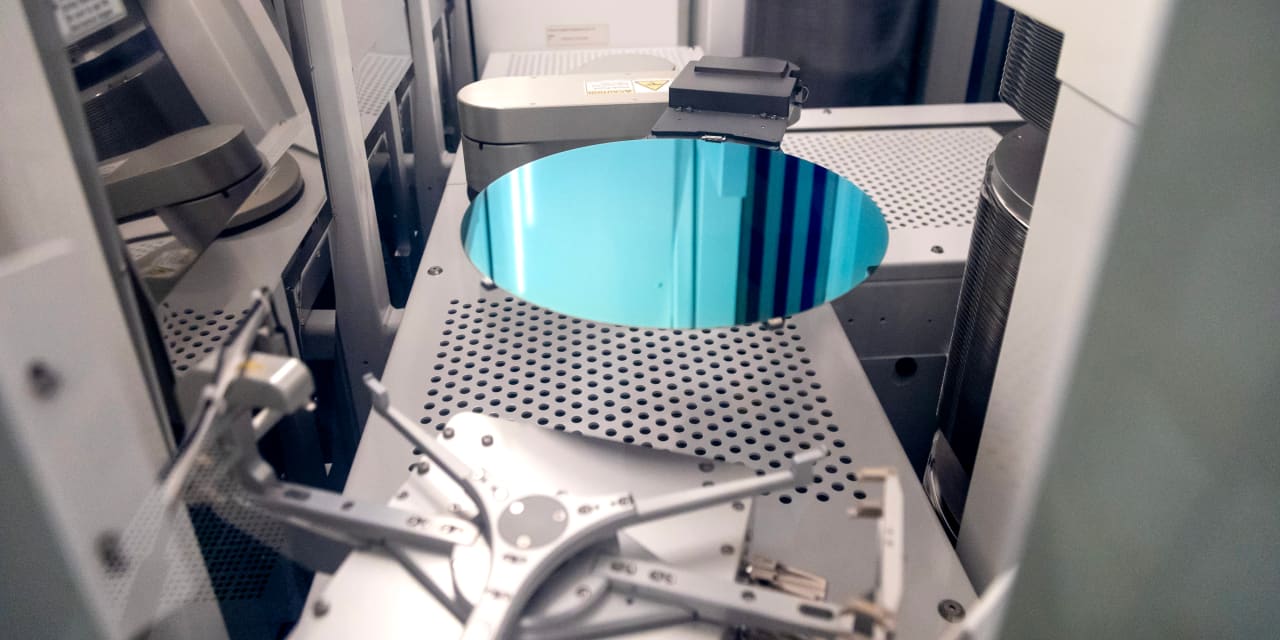

AI Growth Boosts Memory-Chip Makers: Companies like Micron Technology, SK Hynix, and Samsung Electronics are experiencing significant growth due to increased demand for memory chips driven by artificial intelligence advancements.

Risk of Market Overproduction: The history of the memory-chip industry suggests that rapid production increases could lead to an oversupply, potentially resulting in a market crash.

AI Growth Boosts Memory-Chip Makers: Companies like Micron Technology, SK Hynix, and Samsung Electronics are experiencing significant growth due to increased demand for memory chips driven by artificial intelligence advancements.

Risk of Market Overproduction: The history of the memory-chip industry suggests that rapid production increases could lead to an oversupply, potentially resulting in a market crash.

South Korea's Economic Performance: South Korea's economy has shown gains, with a reported increase of 3.2% following a Supreme Court ruling against Trump's global tariffs.

Impact of Supreme Court Ruling: The Supreme Court's decision has positively influenced South Korea's economic outlook, contributing to the recent growth in the country's economic indicators.

- Hedge Fund Activity: Appaloosa, led by billionaire David Tepper, made significant changes to its tech portfolio in Q4 2025.

- Increased Investments: The fund increased its investments in Micron and Alphabet.

- Reduced Holdings: Appaloosa reduced its stakes in AMD, Alibaba, and Uber.

- Market Strategy: These adjustments reflect the fund's strategic approach to navigating the tech sector.