Significant Withdrawals Observed in ETF for NOBL, ALB, CHRW, NUE

NOBL Share Price Analysis: NOBL's current share price is $104.76, situated between its 52-week low of $89.76 and high of $107.12, indicating a stable position within its trading range.

Understanding ETFs: Exchange traded funds (ETFs) function similarly to stocks, where investors buy and sell "units" that can be created or destroyed based on demand, affecting the underlying assets.

Monitoring ETF Flows: Weekly analysis of shares outstanding helps identify ETFs with significant inflows (new units created) or outflows (units destroyed), which can influence the individual components of the ETFs.

Disclaimer on Views: The opinions expressed in the article are solely those of the author and do not necessarily represent the views of Nasdaq, Inc.

Trade with 70% Backtested Accuracy

Analyst Views on CHRW

About CHRW

About the author

- Cloudflare Earnings Highlight: Cloudflare reported a 34% revenue growth this quarter, exceeding expectations, with large customers contributing 73% of total revenue, indicating strong performance in cybersecurity and application development, and is expected to maintain a 28% growth rate moving forward.

- Airbnb's Unexpected Bounce: Despite missing earnings expectations, Airbnb's stock rose due to low market expectations, with projected double-digit revenue growth in 2026, showcasing resilience amid macroeconomic pressures.

- Shopify's Sustained Growth: Shopify achieved a 30% revenue increase this quarter, surpassing $100 billion in gross merchandise volume for the first time, although trading at over 150 times earnings, the market remains optimistic about its future growth potential in the e-commerce sector.

- AI's Impact on Logistics: A recent claim by a company that its AI platform can enhance trucking efficiency by 300% led to a 20% drop in logistics stocks, reflecting the market's heightened sensitivity to the potential disruptive effects of AI technology in traditional industries, necessitating cautious evaluation by investors.

- Cloudflare Earnings Highlights: Cloudflare reported a 34% revenue growth in its latest earnings, exceeding its own guidance, showcasing strong performance in cybersecurity and application development, with expectations of maintaining a 28% growth in the coming year, indicating the company's increasing competitiveness in the market.

- Significant Contribution from Large Customers: Revenue contribution from Cloudflare's large customers (paying over $100,000 annually) grew by 42%, now accounting for 73% of total revenue, up from 69% a year ago, demonstrating the company's appeal and enhanced customer stickiness within high-value client segments.

- Shopify Growth and Valuation: Shopify's quarterly revenue grew by 30%, surpassing $100 billion in gross merchandise volume for the first time, although its stock price fell due to high valuation, its market share and growth potential in the e-commerce sector remain strong, likely to continue attracting investor interest.

- Airbnb Earnings and Market Reaction: Despite Airbnb missing earnings expectations this quarter, its stock rose, reflecting market optimism about its future double-digit revenue growth, indicating that investor confidence in its long-term growth potential remains intact.

- Analyst Ranking: C.H. Robinson Worldwide has been ranked favorably among 500 components based on averaged analyst opinions, indicating strong market confidence in its future performance.

- Stock Performance: The stock has gained 14.4% year-to-date, reflecting positive investor expectations regarding the company's earnings, which may attract further investor interest.

- Market Reaction: The upward trend in the stock price suggests that the market holds an optimistic view of C.H. Robinson's operational efficiency and profitability, potentially driving its market share in the logistics sector.

- Investor Confidence: The combination of favorable analyst opinions and positive stock movement enhances investor confidence in C.H. Robinson, likely prompting more institutional investors to increase their holdings.

- Market Performance: The S&P 500 experienced a slight increase, putting it marginally ahead for the year.

- Underlying Volatility: Despite the overall break-even performance, significant fluctuations are occurring beneath the surface.

- Future Expectations: There are indications that more volatility may be on the horizon for the market.

- Investor Sentiment: The current market conditions suggest a complex environment for investors, with potential for both gains and losses.

- Drug Lord Killed: The Mexican military, aided by U.S. intelligence, killed drug cartel leader Nemesio Oseguera, resulting in widespread violence across multiple states, which poses severe challenges to public safety and infrastructure.

- Trade Disruption Risk: Logistics companies warn that continued violence could dramatically impact trade between the U.S. and Mexico, particularly affecting freight operations on key transport routes, thereby straining economic relations between the two countries.

- Flight Cancellations Impact: Major U.S. airlines, including American Airlines and Southwest Airlines, canceled numerous flights due to the violence, affecting approximately 50% of air freight, which raises the risk of delays and increased costs for shipping.

- Port Operations Disrupted: The Port of Manzanillo, Mexico's busiest container port, has resumed normal operations, but ongoing road blockades due to violence continue to challenge cargo movement, impacting container traffic significantly.

- Market Overreaction: Following Algorhythm Holdings' claim that its AI platform could increase freight volumes by 300% to 400%, C.H. Robinson's stock plummeted 14.5%, marking its largest single-day loss in over six years, indicating a panic-driven sell-off that may not reflect the company's fundamentals.

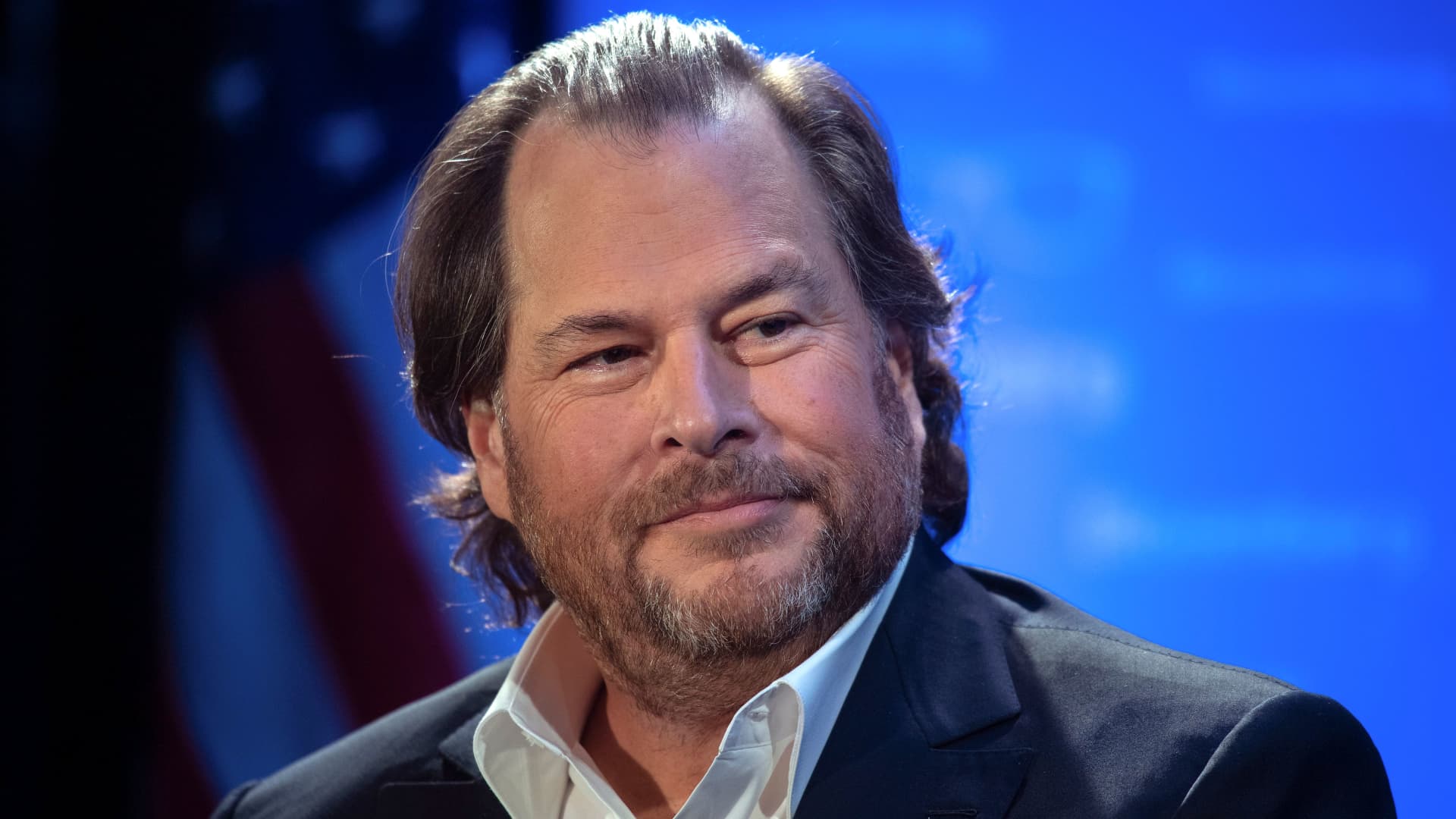

- Leadership Confidence: C.H. Robinson CEO Dave Bozeman emphasized the company's leadership in AI, maintaining strong growth rates despite an ongoing freight recession, suggesting that the company is well-positioned for continued profitability over the next two years.

- Analyst Support: JPMorgan analyst Brian Ossenbeck reaffirmed confidence in C.H. Robinson post-sell-off, noting the company's differentiated business model, although AI-related risks may impact stock performance in the short term, the fundamentals remain intact.

- Optimistic Industry Outlook: Bozeman expressed excitement about the next two years, highlighting the company's efforts to enhance operating profits through AI, indicating that C.H. Robinson will continue to play a significant role in the logistics sector.