Significant ETF Inflows: SSO, ABBV, BAC, KO

52 Week Range of SSO: SSO's share price has a low of $60.84 and a high of $105.99 over the past year, with the latest trade at $105.03.

200 Day Moving Average: The article suggests that comparing the current share price to the 200-day moving average can provide useful insights for technical analysis.

ETFs Trading Mechanism: Exchange-traded funds (ETFs) operate like stocks but involve trading "units" that can be created or destroyed based on investor demand.

Impact of Unit Flows: Significant inflows or outflows in ETFs can affect the underlying holdings, as new units require purchasing assets while unit destruction involves selling them.

Trade with 70% Backtested Accuracy

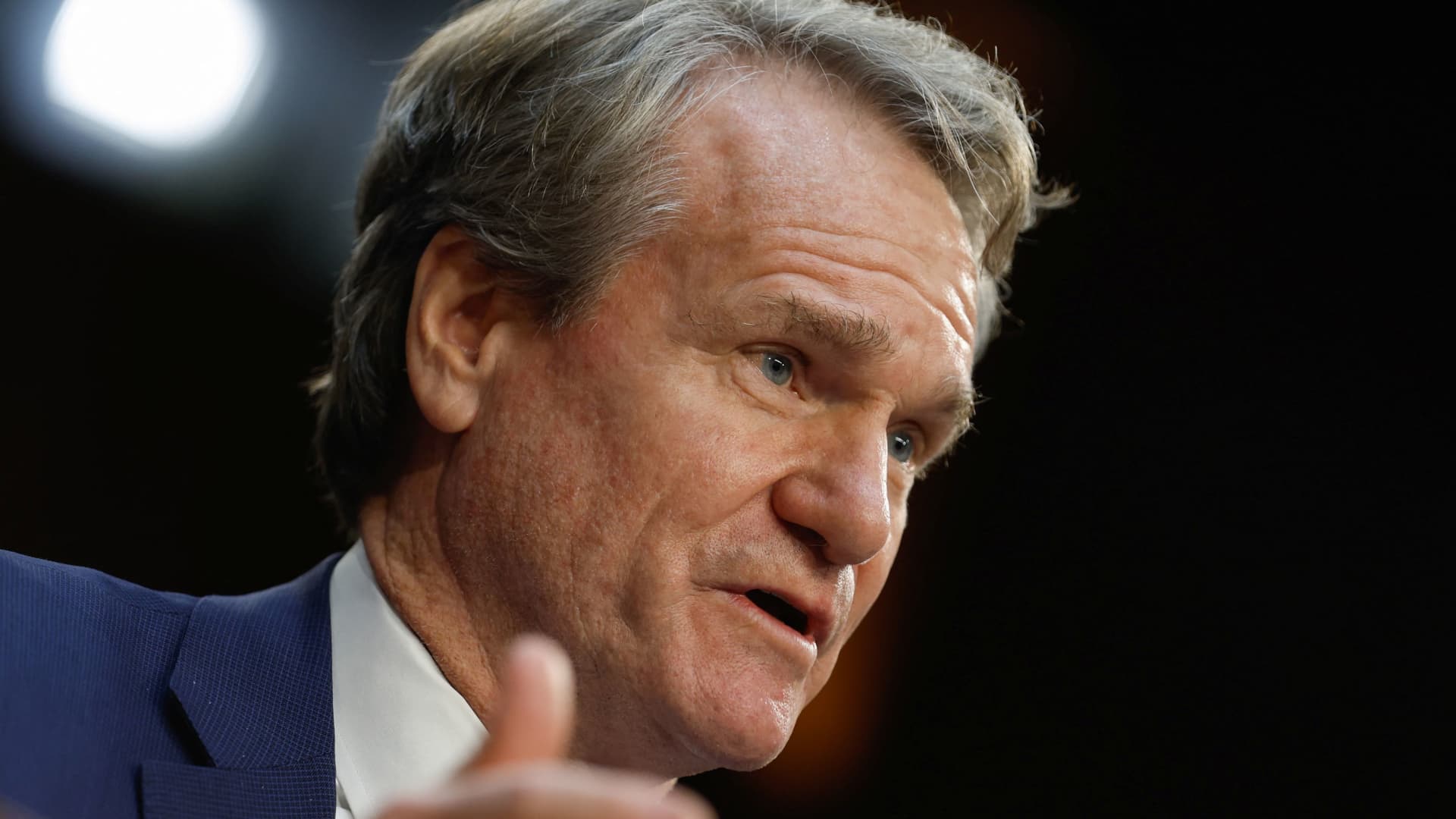

Analyst Views on BAC

About BAC

About the author

- Redemption Announcement: Bank of America has announced the redemption of $2.8 billion in 1.658% Fixed/Floating Rate Senior Notes on March 11, 2026, at a price equal to 100% of the principal plus accrued interest, demonstrating the company's liquidity management capabilities.

- Interest Cessation: Interest on the notes will cease to accrue on the redemption date, meaning investors will receive their final interest payment, reflecting the company's robust debt management strategy.

- Payment Arrangements: The redemption payment will be made through The Depository Trust Company, with The Bank of New York Mellon Trust Company acting as trustee and paying agent, ensuring a smooth redemption process and enhancing investor confidence.

- Company Overview: As a global leader in financial services, Bank of America serves nearly 70 million clients with approximately 3,600 retail financial centers and 15,000 ATMs, showcasing its strong market presence and influence in the financial services sector.

- Accusations Against Banking Giants: Eric Trump publicly criticized major U.S. banks like JPMorgan and Bank of America, claiming they are 'desperately targeting' the cryptocurrency industry by using the CLARITY Act to restrict stablecoin yields, which could negatively impact the crypto market's growth.

- Family Feud with Banks: The Trump family alleges that JPMorgan and Bank of America closed hundreds of accounts linked to their businesses for politically motivated reasons, although these banks have consistently denied such claims, potentially exacerbating public distrust in the banking sector.

- Crypto vs. Traditional Finance Clash: Eric Trump's remarks followed his father Donald Trump's post on Truth Social, which stated that banks are attempting to undermine crucial cryptocurrency legislation, risking the loss of innovation to countries like China, highlighting the ongoing tension between the crypto industry and traditional finance.

- Market Reaction: Following Trump's comments, JPMorgan's shares rose 0.11% in after-hours trading after a 0.29% decline to $299.39 during regular trading, indicating a complex market response to the relationship between banking and cryptocurrency, while American Bitcoin shares surged by 11.65%.

Impact of Chatbots on Insurance Stocks: The introduction of two insurance-selling chatbots led to a decline of over 10% in the stocks of major insurance brokers such as Marsh, Arthur J. Gallagher, and Goosehead Insurance.

Stock Recovery: Following the initial drop, the stocks of these insurance brokers have mostly recovered, indicating a shift in investor sentiment.

Investor Confidence: Investors appear to be less concerned about the potential for artificial intelligence applications to disrupt traditional brokerage commissions.

Market Reaction: The initial market reaction to the chatbots suggests a temporary panic that has since subsided as the market stabilizes.

- Equity Change Notification: Galapagos received transparency notifications from Bank of America on February 27 and March 2, 2026, indicating that Bank of America and its controlled entity BofA Securities crossed the 5% voting rights threshold on February 26, 2026, highlighting significant interest in the company's equity.

- Shareholding Proportion Change: As of March 2, 2026, Bank of America and its affiliates owned 292,642 voting rights and 3,491,679 equivalent financial instruments, representing a total of 5.74% of Galapagos' current 65,897,071 shares, reflecting their important position in corporate governance.

- Voting Rights Dynamics: On February 27, 2026, BofA Securities fell below the 5% threshold again due to the disposal of financial instruments, demonstrating flexibility and dynamic adjustment in their holding strategy regarding Galapagos.

- Market Impact Analysis: This transparency notification not only reflects Bank of America's investment interest in Galapagos but may also influence market confidence in the company, prompting investors to monitor future changes in shareholding and their potential impact on stock prices.

- Market Concerns: According to a recent Bank of America survey, credit investors have identified an AI bubble as their top concern, with expectations of $285 billion in bond issuance from hyperscalers this year, indicating heightened scrutiny on tech investments that could impact investor confidence.

- Increased Capital Expenditures: Major hyperscalers like Alphabet, Amazon, and Oracle are turning to the bond market to finance their significantly increased capital expenditure plans, a shift that may alter market perceptions of their financing strategies and affect their future financial flexibility.

- Market Absorption Capacity: Bob Michele, CIO at JPMorgan, noted that despite rising bond issuance, the market has the capacity to absorb this debt, as historical precedents show that it can differentiate between good and bad borrowers, influencing investor decision-making.

- Investor Strategy Adjustments: Guy LeBas from Janney Montgomery Scott anticipates a 9% to 11% growth in the investment-grade corporate bond market by 2026, suggesting strong ongoing demand for bonds, prompting investors to reassess their portfolios in light of the upcoming debt supply changes.

- High-Level Meeting: Coinbase CEO Brian Armstrong met privately with President Trump at the White House on Tuesday, after which Trump urged banks to make a good deal with the crypto industry on social media, indicating a shared agenda in pushing for crypto legislation.

- Legislative Support: The CLARITY Act mentioned by Trump is reportedly threatened by banks, with Armstrong previously accusing them of stifling competition, highlighting the escalating tension between the crypto sector and traditional banking institutions.

- Market Reaction: Coinbase shares surged over 15% following the news, trading around $209, reflecting market optimism regarding the prospects of crypto legislation, particularly in light of potential growth in stablecoin-related revenues.

- Political Funding: The Fairshake super PAC has raised $190 million for the 2026 midterms, primarily funded by Coinbase, Ripple, and Andreessen Horowitz, indicating the growing political influence of the crypto industry, which may impact the legislative process.