Riley Exploration Permian Declares $0.40 Cash Dividend Per Share

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 09 2026

0mins

Should l Buy REPX?

Source: Newsfilter

- Cash Dividend Announcement: Riley Exploration Permian has declared a cash dividend of $0.40 per share, payable on February 5, 2026, which aims to reward shareholders and enhance investor confidence in the company.

- Record Date for Shareholders: The record date for this dividend is set for January 22, 2026, ensuring that shareholders holding stock before this date will receive the dividend, thereby increasing the company's appeal in the capital markets.

- Growth-Oriented Strategy: As a growth-focused upstream oil and gas company operating in Texas and New Mexico, Riley Permian aims to enhance operational efficiency and drive future growth through investments in infrastructure projects.

- Market Reaction Expectations: The announcement of this dividend is likely to attract more investor attention, improving the liquidity and market performance of the company's stock, thus laying a foundation for future capital operations.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy REPX?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on REPX

Wall Street analysts forecast REPX stock price to rise

2 Analyst Rating

2 Buy

0 Hold

0 Sell

Moderate Buy

Current: 28.500

Low

36.00

Averages

36.00

High

36.00

Current: 28.500

Low

36.00

Averages

36.00

High

36.00

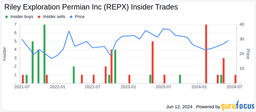

About REPX

Riley Exploration Permian, Inc. is an independent oil and natural gas company focused on the acquisition, exploration, development and production of oil, natural gas and natural gas liquids. The Company is focused on horizontal drilling of conventional oil-saturated and liquids-rich formations in the Permian Basin that produce long-term cash flows. The Permian Basin is an oil and natural gas producing area located in West Texas and the adjoining area of Southeastern New Mexico covering an area approximately 250 miles wide and 300 miles long, and encompasses several sub-basins, including the Delaware Basin, Midland Basin, Central Basin Platform and Northwest Shelf. The Company's acreage is primarily located on large contiguous blocks in Yoakum County, Texas, which represents its Champions field and in Eddy County, New Mexico, which represents its Red Lake field. Its land-based oil and natural gas facilities are typical of those found in the Permian Basin.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- New Board Member: Riley Exploration Permian appointed Bobby Saadati as an independent director effective February 4, 2026, bringing extensive experience in energy investing, operations, and M&A, which is expected to enhance strategic guidance and operational leadership for the company.

- Industry Background: Saadati has served as CEO of IKAV Energy USA since May 2020, leading its North American platform, and previously held the position of Chairman at Aera Energy, adding diversity and expertise to the board.

- Educational Credentials: Saadati holds a B.A. in Political Science from the University of California, San Diego, a J.D. from Trinity Law School, and an MBA from the University of Chicago, providing a solid foundation for decision-making in complex business environments.

- Enhancing Shareholder Value: Bobby Riley, Chairman and CEO of Riley Exploration, stated that Saadati's addition will strengthen the board's ability to create value, further driving the enhancement of long-term shareholder value.

See More

- Earnings Release Schedule: Riley Exploration Permian plans to release its fourth quarter and full year 2025 financial and operating results on March 4, 2026, after U.S. market close, providing crucial performance data for investors.

- Investor Conference Call: Management will host a conference call on March 5, 2026, at 9:00 a.m. CT to discuss the financial results and conduct a Q&A session, enhancing transparency and engagement with stakeholders.

- Participation Details: Interested parties can join the call by dialing toll-free 1 (888) 596-4144 or 1 (646) 968-2525, with Conference ID 1303008, ensuring easy access to important information for investors.

- Replay Availability: A replay of the call will be accessible until March 19, 2026, via toll-free numbers 1 (800) 770-2030 or 1 (609) 800-9909, further facilitating information retrieval for stakeholders.

See More

- Cash Flow Growth: DNOW is projected to have a 20.5% earnings growth rate for 2026, with a consensus estimate revised upward by 8.7% over the past 30 days, indicating effective cash flow management that enhances its market competitiveness.

- Earnings Estimate Improvement: Pursuit Attractions' earnings per share estimates for 2025 and 2026 have increased by 1.6% and 10.3%, respectively, reflecting the company's ongoing efforts to attract customers and enhance service quality, which supports its robust growth in the tourism and hospitality sector.

- Oil and Gas Industry Outlook: Riley Exploration Permian's earnings per share estimates for 2025 and 2026 have been raised by 5.0% and 14.2%, respectively, showcasing the success of its drilling activities in Texas and New Mexico, thereby strengthening its position in the oil and gas market.

- Technological Innovation: RF Industries' fiscal 2026 earnings estimate was revised up by 22.9% in the past week, indicating strong demand in the telecom and data communications markets, further solidifying its leadership in global connectivity solutions.

See More

- Earnings Estimate Increase: Riley Exploration Permian, Inc. has seen a 4.5% increase in its current year earnings estimate over the last 60 days, indicating enhanced profitability that may attract more investor interest.

- High Dividend Yield: The company boasts a dividend yield of 5.7%, significantly higher than the industry average of 0.0%, making it a more appealing option for income-focused investors.

- Banking Sector Performance: United Community Banks, Inc. also holds a Zacks Rank #1, with a 0.7% increase in its current year earnings estimate over the past 60 days, reflecting its stable growth potential.

- Dividend Advantage: United Community Banks offers a dividend yield of 3%, surpassing the industry average of 2.1%, further enhancing its attractiveness as an income investment choice.

See More

- Riley Exploration Dividend Announcement: The company's Board of Directors has approved a cash dividend of $0.40 per share, payable on February 5, 2026, which aims to reward shareholders and enhance investor confidence.

- Ellington Financial Monthly Dividend: The Board declared a monthly cash dividend of $0.13 per share, payable on February 27, 2026, reflecting the company's stable cash flow and ongoing commitment to shareholders.

- Lindsay Regular Dividend: The Board announced a quarterly cash dividend of $0.37 per share, scheduled for payment on February 27, 2026, demonstrating the company's strong performance in profitability and shareholder returns.

- AGNC Investment Dividend: The Board declared a cash dividend of $0.12 per share, payable on February 10, 2026, indicating the company's stable dividend policy amidst market fluctuations.

See More

- Cash Dividend Announcement: Riley Exploration Permian has declared a cash dividend of $0.40 per share, payable on February 5, 2026, which will provide shareholders with a stable cash return and enhance investor confidence in the company.

- Record Date for Shareholders: The record date for this dividend is set for January 22, 2026, ensuring that shareholders who own stock by this date will benefit from the dividend, thereby potentially increasing the liquidity of the company's shares.

- Company Background: Riley Exploration is a growth-oriented upstream oil and gas company operating in Texas and New Mexico, with infrastructure projects that complement its operations, indicating its potential for growth within the industry.

- Strategic Implications: By maintaining a consistent cash dividend, Riley Exploration not only enhances its attractiveness to investors but also may draw in more long-term investors, thereby supporting the company's long-term growth strategy.

See More