Novo Nordisk Receives FDA Approval for Wegovy, Shares Surge 8.6%

- FDA Approval: Novo Nordisk's GLP-1 drug Wegovy received FDA approval, marking the first of its kind globally, which signifies a major breakthrough for the company in the weight loss medication market and is expected to drive sales growth and enhance competitive positioning.

- Stock Surge: Following the approval news, Novo Nordisk's shares rose 8.6% to $52.26, reflecting strong investor confidence in the potential market demand for the new drug, which may enhance the company's market capitalization and investment appeal.

- Market Reaction: Other related companies like WW International and Lifezone Metals also saw gains due to positive market sentiment, with WW International's stock jumping 14.4%, indicating increased investor interest in health and weight loss-related products, potentially boosting overall industry growth.

- Industry Impact: Novo Nordisk's successful approval may prompt other pharmaceutical companies to accelerate the development of similar products, thereby driving competition in the GLP-1 market and fostering innovation and market expansion.

Trade with 70% Backtested Accuracy

Analyst Views on LZM

About LZM

About the author

- FDA Approval: Novo Nordisk's GLP-1 drug Wegovy received FDA approval, marking the first of its kind globally, which signifies a major breakthrough for the company in the weight loss medication market and is expected to drive sales growth and enhance competitive positioning.

- Stock Surge: Following the approval news, Novo Nordisk's shares rose 8.6% to $52.26, reflecting strong investor confidence in the potential market demand for the new drug, which may enhance the company's market capitalization and investment appeal.

- Market Reaction: Other related companies like WW International and Lifezone Metals also saw gains due to positive market sentiment, with WW International's stock jumping 14.4%, indicating increased investor interest in health and weight loss-related products, potentially boosting overall industry growth.

- Industry Impact: Novo Nordisk's successful approval may prompt other pharmaceutical companies to accelerate the development of similar products, thereby driving competition in the GLP-1 market and fostering innovation and market expansion.

Offering Details: Lifezone Metals Limited announced a registered direct offering of 4,411,764 ordinary shares and warrants at an offering price of $3.40, aiming to raise approximately $15 million for the Kabanga Nickel Project and general corporate purposes.

Warrant Information: The accompanying warrants will have an exercise price of $4.00 per share and will be exercisable for four years, with the offering expected to close around November 12, 2025.

Company Overview: Lifezone Metals focuses on cleaner metals production through its Hydromet Technology, which aims to reduce energy consumption and emissions, particularly in the context of the Kabanga Nickel Project in Tanzania.

Forward-Looking Statements: The announcement includes forward-looking statements regarding the company's future plans and risks, emphasizing that actual results may differ due to various uncertainties and factors beyond the company's control.

Funding Update: Lifezone Metals' subsidiary, Kabanga Nickel Limited, has secured a $60 million bridge loan from Taurus Mining Finance to advance the Kabanga Nickel Project in Tanzania, with the first tranche of $20 million already received to support early works and project financing.

Strategic Investment Process: The company is exploring long-term partnerships and equity investments, having received several non-binding offers for the Kabanga Nickel Project, while evaluating various strategic options to benefit stakeholders.

Funding Announcement: Lifezone Metals Limited's subsidiary, Kabanga Nickel Limited, has secured a $60 million bridge loan from Taurus Mining Finance to advance the Kabanga Nickel Project in Tanzania, facilitating early works and infrastructure development as they seek long-term financing.

Project Overview: The Kabanga Nickel Project is one of the largest high-grade nickel, copper, and cobalt deposits globally, with an 18-year operational life, projected revenues of $14.1 billion, and a low cost structure, aiming for production readiness by mid-2026.

Kabanga Nickel Project Feasibility Study: Lifezone Metals has announced the completion of a feasibility study for its Kabanga Nickel Project in Tanzania, confirming proven and probable mineral reserves of 52.2 million tonnes with an average grade of 1.98% nickel, alongside robust economic metrics including an after-tax NPV of $1.58 billion and a 23.3% IRR.

Project Development and Economic Impact: The project is expected to have an 18-year mine life with a production rate of 3.4 million tonnes per annum, generating significant economic benefits for Tanzania through job creation, infrastructure investment, and equitable revenue sharing with the government, while adhering to international environmental and social governance standards.

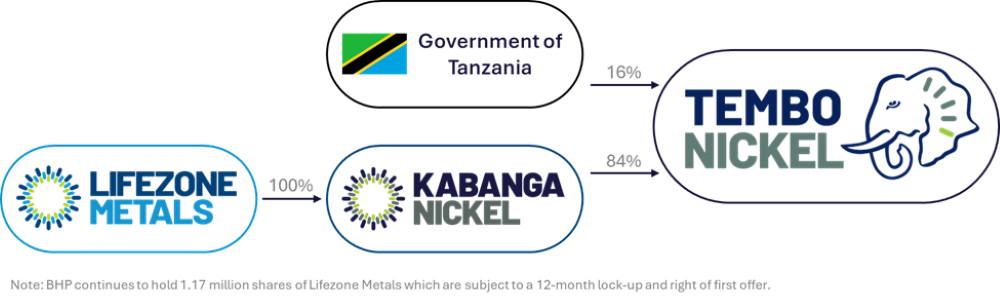

Acquisition Details: Lifezone Metals Limited has acquired BHP's 17% interest in Kabanga Nickel Ltd., resulting in full ownership of the company and its majority stake in the Kabanga Nickel Project in Tanzania. The transaction includes deferred cash payments based on share price performance and a total consideration cap of $83 million.

Future Plans and Financing: Lifezone is working with Standard Chartered Bank for short-term financing to advance the project towards a Final Investment Decision, while also engaging Societe Generale for project finance support. The company aims to align its operations with environmental, social, and governance (ESG) standards as it develops the Kabanga Nickel Project.