Globalstar supports FY25 revenue forecast of $260M-$285M, with two estimates averaging $264.86M.

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Nov 06 2025

0mins

Should l Buy GSAT?

FY25 Adjusted EBITDA Margin: The company has reaffirmed its expectation for an adjusted EBITDA margin of approximately 50% for the fiscal year 2025.

Financial Outlook: This outlook indicates confidence in maintaining strong profitability levels moving forward.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy GSAT?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on GSAT

Wall Street analysts forecast GSAT stock price to rise

5 Analyst Rating

3 Buy

2 Hold

0 Sell

Moderate Buy

Current: 59.060

Low

60.00

Averages

67.00

High

75.00

Current: 59.060

Low

60.00

Averages

67.00

High

75.00

About GSAT

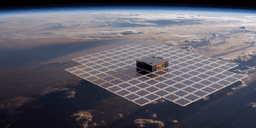

Globalstar, Inc. is an international telecom infrastructure provider. It provides mobile satellite services, including voice and data communications and wholesale capacity services through its global satellite network. Its low earth orbit (LEO) satellite constellation ensures secure data transmission for connecting and protecting assets, transmitting critical operational data, and saving lives for consumers, businesses, and government agencies across the globe. Its terrestrial spectrum, Band 53, and its 5G variant, n53, offer carriers, cable companies, and system integrators a versatile, fully licensed channel for private networks to improve customer wireless connectivity, while its XCOM RAN product offers capacity gains in dense wireless deployments. In addition to SPOT GPS messengers, it offers Internet of things (IoT) hardware and software products for tracking and monitoring assets, processing smart data at the edge, and managing analytics with cloud-based telematics solutions.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Share Sale Overview: On February 13, 2026, Ashford Capital Management sold 410,326 shares of Globalstar, with an estimated transaction value of $22.66 million, reflecting a disciplined risk management strategy amid market fluctuations.

- Holding Changes: Following the sale, Ashford's stake in Globalstar decreased to 998,995 shares, valued at $60.98 million, now representing 6.79% of its reportable AUM, down from 9.32% prior to the trade.

- Performance Highlights: Globalstar reported record third-quarter revenue of $73.8 million, a 1.0% increase year-over-year, and reaffirmed full-year revenue guidance between $260 million and $285 million, indicating strong growth potential.

- Market Performance: As of February 13, 2026, Globalstar shares were priced at $60.06, reflecting a 171.8% increase over the past year, significantly outperforming the S&P 500 by 159.97 percentage points, showcasing its robust position in the satellite communications market.

See More

- Network Infrastructure Integration: Globalstar announced a partnership with Boingo Wireless to integrate XCOM RAN into its private network infrastructure, which is expected to enhance secure, high-bandwidth connectivity at critical locations such as airports and hospitals, thereby strengthening the company's competitive position in the private network market.

- Tracking Antenna Expansion: Globalstar has added three six-meter C-3 tracking antennas at its ground station in Yeo Ju, South Korea, as part of its global expansion plan, which will support its third-generation C-3 satellite system and further solidify its mobile satellite service capabilities in East Asia.

- Strong Stock Performance: Globalstar's shares have surged nearly 172% over the past year and have gained nearly 2% so far this year, reflecting positive market sentiment towards its space and defense stocks, particularly following the SpaceX IPO news, indicating investor confidence in the company's future growth.

- Retail Sentiment Shift: According to Stocktwits data, retail sentiment for Globalstar has shifted from neutral to bullish, reaching a three-month high, with users optimistic about its potential as both a spectrum and satellite investment, predicting the stock could reach $150, representing a 150% upside from the last closing price of $60.06.

See More

- Network Capability Enhancement: Globalstar announced a partnership with Boingo Wireless to integrate XCOM RAN into its private network infrastructure, aiming to enhance connectivity at critical locations such as airports and hospitals, thereby improving customer experience and addressing increasing security demands.

- Successful Technical Validation: Following a technical evaluation, Boingo confirmed that XCOM RAN delivers reliable private connectivity across multiple frequency bands and deployment models, showcasing its robust performance in high-traffic environments and further solidifying its market leadership.

- Innovative Private Network Architecture: The Supercell architecture of XCOM RAN not only increases network capacity by four times but also simplifies the deployment process, reducing the need for site surveys, enabling rapid and seamless integration in industrial environments, and enhancing operational efficiency.

- Industry Recognition and Future Outlook: Boingo's private networks recently won the 2025 TeckNexus Private Network Leadership Awards, highlighting their transformative connectivity capabilities in high-traffic environments, and they will continue to collaborate with Globalstar to promote the widespread adoption of private 5G solutions.

See More

- Broad User Coverage: According to an FCC report, SpaceX's first-generation service covers over 400 million people, with more than 6 million customers accessing it monthly, demonstrating its strong market appeal and user base.

- Intensifying Competition: The FCC noted that AST SpaceMobile plans to deploy 45 to 60 satellites and initiate commercial direct-to-device services in 2026, indicating that market competition is accelerating and SpaceX needs to strengthen its market position.

- Technology Upgrade Plans: SpaceX aims to launch its second-generation Starlink system in 2027, which is expected to significantly enhance its direct-to-device service capabilities, thereby strengthening its competitive edge against traditional providers like Verizon and AT&T.

- Market Sentiment Shifts: While retail sentiment on SpaceX remains in the 'bearish' territory, AST SpaceMobile's sentiment stays 'bullish', highlighting significant differences in investor expectations across different companies.

See More

- Contract Awarded: AST SpaceMobile has been awarded a contract for the MDA's SHIELD program, enabling participation in the development, testing, and maintenance of critical defense systems, thereby enhancing U.S. national security.

- Technology Utilization: The company will leverage its low-Earth orbit satellite network to provide secure communications, sensing, and command-and-control capabilities, improving the responsiveness and operational resilience of missile defense systems.

- Market Competition: AST SpaceMobile faces competition from Globalstar and Viasat, both of which are also providing secure satellite communication solutions for the U.S. military, highlighting the importance of commercial space in national security.

- Stock Performance: AST SpaceMobile's shares have skyrocketed 457.1% over the past year, significantly outpacing the industry's 29.8% growth, reflecting strong market confidence in its future prospects.

See More

- Stock Performance: AST SpaceMobile's stock experienced an increase early Friday, building on gains from the previous day.

- Investor Sentiment: There is growing excitement among investors regarding the company's potential expansion into the defense sector.

See More