Meta Expands Partnership with Nvidia for AI Chip Deployment

Written by Emily J. Thompson, Senior Investment Analyst

Updated: 14 hours ago

0mins

Should l Buy AMD?

Source: CNBC

- Expanded Collaboration: Meta has announced a new deal with Nvidia to deploy millions of AI chips across U.S. data centers, marking a significant upgrade in their technology partnership and is expected to further propel Meta's advancements in AI.

- Investment Commitment: Meta plans to invest $600 billion in the U.S. by 2028 for data centers and infrastructure, including the construction of its two largest AI data centers, Prometheus and Hyperion, demonstrating a long-term commitment to AI technology.

- New Technology Deployment: The partnership will see Meta independently deploy Nvidia's Grace CPUs for the first time, aimed at optimizing AI inference workloads, thereby enhancing its data processing capabilities and strengthening its competitive position in the market.

- Supply Chain Assurance: By collaborating closely with Nvidia, Meta secures a stable supply of Blackwell and Rubin GPUs, alleviating current chip shortages while also developing next-generation AI models to enhance its technological prowess.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy AMD?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on AMD

Wall Street analysts forecast AMD stock price to rise

33 Analyst Rating

25 Buy

8 Hold

0 Sell

Strong Buy

Current: 207.320

Low

210.00

Averages

289.13

High

377.00

Current: 207.320

Low

210.00

Averages

289.13

High

377.00

About AMD

Advanced Micro Devices, Inc. is a global semiconductor company. The Company is focused on high-performance computing, graphics and visualization technologies. Its segments include Data Center, Client and Gaming, and Embedded. Data Center segment includes artificial intelligence (AI) accelerators, microprocessors (CPUs) for servers, graphics processing units (GPUs), accelerated processing units (APUs), data processing units (DPUs), Field Programmable Gate Arrays (FPGAs), smart network interface Cards (SmartNICs) and Adaptive system-on-Chip (SoC) products for data centers. Client and Gaming segment includes CPUs, APUs, chipsets for desktops and notebooks, discrete GPUs, and semi-custom SoC products and development services. Embedded segment includes embedded CPUs, GPUs, APUs, FPGAs, system on modules (SOMs), and Adaptive SoC products. It markets and sells its products under the AMD trademark. Its products include AMD EPYC, AMD Ryzen, AMD Ryzen PRO, Virtex UltraScale+, and others.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Partnerships Drive AI Innovation: Nvidia collaborates with Yotta and E2E Networks to utilize its latest Blackwell semiconductors for developing data centers and AI cloud platforms, with Yotta planning to invest over $2 billion to deploy more than 20,000 Blackwell GPUs, significantly enhancing India's AI ecosystem.

- Venture Capital Support: Nvidia is working closely with several venture capital firms, including Peak XV and Nexus Venture Partners, to identify and fund AI startups in India, which has over 4,000 companies participating in its global startup program, thereby boosting tech investment growth.

- Strategic Investments and Government Collaboration: Nvidia's initiatives are part of India's broader “IndiaAI mission,” aimed at strengthening the country's AI capabilities while providing funding for local entrepreneurs, with data center investments expected to reach $200 billion in the coming years, intensifying market competition.

- Positive Market Reaction: Nvidia shares rose 1.94% to $188.55 during premarket trading on Wednesday, reflecting market optimism regarding its expansion in India's AI sector and investor confidence in the company's future growth potential.

See More

- Partnership Expansion: Meta has expanded its long-term AI infrastructure partnership with Nvidia, collaborating closely on chips, networking, and software to optimize AI training and inference workloads, thereby enhancing Meta's competitive edge in the AI sector.

- Supply Chain Concerns: CNBC's Jim Cramer warned that competitors attempting to reduce reliance on Nvidia may face tighter chip supplies, indicating that demand for Nvidia's products will intensify, potentially impacting production capabilities for other companies.

- Technological Innovation: Meta plans to build advanced AI clusters using Nvidia's next-generation Rubin platform and has adopted Nvidia's Confidential Computing technology to enhance WhatsApp's private messaging capabilities, demonstrating Meta's ongoing commitment to technological innovation.

- Market Dynamics: Meta's stock rose 0.66% in after-hours trading, while Nvidia gained 0.79%, reflecting positive market expectations regarding the partnership, while Meta continues to diversify its suppliers, including ongoing purchases from AMD.

See More

- Broadcom Trade: ARKK and ARKQ funds purchased a total of 24,205 shares of Broadcom, valued at approximately $8 million, with the stock closing at $332.54, benefiting from Alphabet Inc.'s forecast of increased capital expenditures, which has positively influenced Broadcom's stock performance.

- Coinbase Market Share Growth: Coinbase is viewed as a key player in the cryptocurrency economy, with analysts noting its diversification strategy and market positioning, which have allowed it to gain significant market share in a competitive crypto landscape.

- Airbnb Reduction: ARKF and ARKK funds sold a total of 15,711 shares of Airbnb, valued at approximately $2 million, and despite Airbnb's stock rising due to positive earnings and analyst revisions, Ark Invest opted to reduce its holdings to adjust its portfolio.

- AMD Stock Performance: Benzinga Edge stock rankings indicate that AMD's momentum is in the 89th percentile and value in the 10th percentile, highlighting its strong performance and potential investment appeal in the market.

See More

- Market Rebound: The stock market experienced a slight rebound on Tuesday, despite remaining divided, indicating cautious optimism among investors that could provide some support for future trading.

- Nvidia Gains: Nvidia's stock rose late in the session due to a deal with Meta in the AI sector, reflecting ongoing market confidence in its capabilities, which may drive future earnings growth.

- AMD and Broadcom Decline: In contrast, AMD and Broadcom saw their stock prices slump, suggesting a cautious outlook from the market regarding these companies, which could affect their short-term investment appeal.

- Increased Industry Divergence: The overall market divergence has intensified, with some tech stocks performing well while others face pressure, potentially leading investors to be more selective in their stock choices, impacting overall market liquidity.

See More

- Broadcom Trade: Ark Invest's ARKK and ARKQ funds purchased a total of 24,205 shares of Broadcom, valued at approximately $8 million, with the stock closing at $332.54, benefiting from Alphabet Inc.'s forecast of increased capital expenditures, which has positively influenced Broadcom's stock performance.

- Coinbase Market Position: Coinbase is gaining market share in the cryptocurrency economy, with analysts noting its diversification and strategic positioning as key factors, although specific trade data was not disclosed, its market performance is widely viewed positively.

- Airbnb Holdings Adjustment: Ark Invest reduced its holdings in Airbnb by selling 15,711 shares through its ARKF and ARKK funds, valued at approximately $2 million; despite Airbnb's stock rising due to positive earnings, it still missed EPS expectations, indicating market caution regarding its future performance.

- AMD Stock Performance: According to Benzinga Edge stock rankings, AMD stock is in the 89th percentile for momentum and the 10th percentile for value, indicating a strong market performance and potential value disparity that may influence investor decisions.

See More

- Dow Jones Edges Up: The Dow Jones Industrial Average increased by 0.07% to close at 49,533.19, reflecting a moderate optimism in the market despite low trading volumes, indicating investor caution regarding future economic prospects.

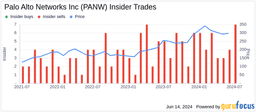

- Palo Alto Networks Decline: Palo Alto Networks saw a 2.07% drop in stock price, closing at $163.50, as the company raised its full-year revenue outlook to $11.28–$11.31 billion, but lowered its adjusted EPS guidance below market expectations, negatively impacting investor sentiment.

- AMD Stock Retreats: Advanced Micro Devices' stock fell by 2.05% to $203.08, as investors expressed caution over high valuations and demand cycles in the semiconductor sector, despite the company's strong earnings performance.

- Meta Partners with Nvidia: Meta Platforms' stock slightly dipped by 0.075% to $639.29, but gained in after-hours trading after announcing a long-term AI infrastructure partnership with Nvidia, indicating market confidence in its future technological advancements.

See More