Lithium Stocks and ETFs Rise Following Lithium Americas' Equity Discussions with Trump Administration

U.S. Lithium Stocks Surge: U.S.-listed lithium stocks and ETFs experienced a rise, particularly Lithium Americas (LAC), following reports that the Trump administration is seeking a 10% equity stake in the company as part of renegotiations for a $2.3 billion loan for its Thacker Pass project.

Market Volatility and Supply Issues: The lithium sector has faced volatility due to supply interruptions in China and a global glut that has significantly reduced prices, with reports indicating that a major Chinese mine is set to restart operations sooner than anticipated.

Trade with 70% Backtested Accuracy

Analyst Views on BATT

About the author

Lithium Price Decline: Lithium prices in China dropped by 9% to 91,020 yuan/metric ton after the Guangzhou Futures Exchange intervened to curb speculative trading and amid news of potential production resumption by CATL at its lithium mine.

CATL Production Plans: Battery manufacturer CATL is expected to restart production at its Jianxiawo lithium mine next month, which has been inactive since August due to a mining license expiration, contributing to about 3% of global lithium output for 2025.

Market Reactions: Major lithium companies, including Albemarle and SQM, saw declines in their stock prices, reflecting the impact of the falling lithium prices and market adjustments.

Future Demand Predictions: The chairman of Ganfeng Lithium anticipates a 30% increase in lithium demand by 2026, potentially driving prices up to 200,000 yuan/ton.

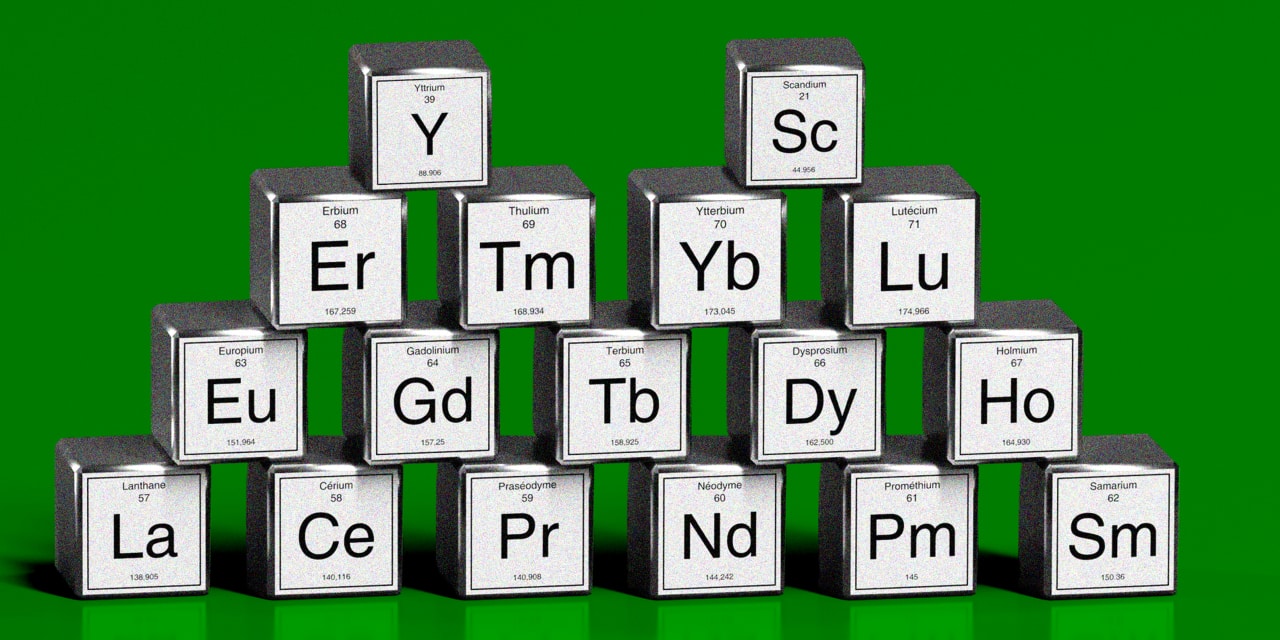

Putin's National Roadmap: Russian President Vladimir Putin has ordered the creation of a national roadmap for rare earth extraction by December, aiming to compete in the strategic minerals race and challenge China's dominance in refining.

Impact on Clean Energy ETFs: The focus on rare earth elements (REEs) introduces new uncertainties for clean energy ETFs, which have seen significant price increases this year, as they rely heavily on these critical inputs.

Emerging Commodities ETFs: ETFs like the VanEck Rare Earth/Strategic Metals ETF and Global X Lithium & Battery Tech ETF are gaining popularity as they provide exposure to mining and processing companies, reflecting a shift towards securing non-Chinese supply chains.

Investment Landscape Shift: Putin's actions may not derail clean energy ETFs but could reshape the investment landscape, emphasizing the need for portfolios that balance renewable energy sources with strategic mineral investments.

Critical Minerals Rush: A surge in demand for critical minerals essential for electric vehicles and clean energy systems is highlighted, with two U.S.-listed ETFs, VanEck Rare Earth And Strategic Metals ETF (REMX) and Amplify Lithium & Battery Technology ETF (BATT), showing significant gains in the past month.

Different Investment Strategies: REMX focuses on rare earth and strategic metal miners, while BATT diversifies across the entire battery value chain, including lithium extraction and EV component manufacturers.

Performance Comparison: REMX has outperformed BATT with 79% year-to-date returns compared to BATT's 55%, driven by increased interest in non-Chinese supply chains, although both face volatility and risks related to market conditions and policies.

Investor Insights: REMX is suited for investors looking for concentrated exposure to mining geopolitics, while BATT offers a more diversified approach to clean energy investments, emphasizing the growing importance of rare earths in the electrification trend.

Rare Earth Market Growth: Stocks of rare earth producers have seen significant growth this year, indicating a potential early growth stage for many companies, particularly those outside of China.

Investment Opportunities: Investors can capitalize on this trend through exchange-traded funds that focus on rare-earth producers, though individual stocks may vary in risk and potential returns.

Speculative Nature of Stocks: Some rare earth stocks are considered more speculative than others, highlighting the importance of careful selection for concentrated investments.

Future Projections: A screening of rare earth companies reveals those expected to experience rapid sales growth and improved earnings or profitability by 2027.

Funding and Growth: Redwood Materials has successfully raised over $2.5 billion, including a recent $350 million in a Series E round, to enhance its energy storage business amid the growing demand from AI data centers.

Transition to Manufacturing: The company has shifted from battery recycling to producing high-performance battery materials and energy storage systems, operating a microgrid in Nevada and repurposing used EV batteries for various industries.

Founding and Mission: Founded in 2017 by JB Straubel and Andrew Stevenson, Redwood Materials aims to create a closed-loop battery supply chain in the U.S. to reduce reliance on foreign materials and promote sustainable electrification.

Potential IPO Candidate: Analysts view Redwood Materials as a strong candidate for an IPO due to its rapid growth, significant institutional backing, and increasing capital requirements.

Lithium Market Resurgence: The lithium market is gaining attention following the Trump administration's consideration of a stake in Lithium Americas, which has seen its stock price nearly double recently. The Thacker Pass project in Nevada, a key resource, is expected to produce significant lithium output, with General Motors holding a substantial stake.

Emerging Lithium Resources: New lithium resources are being explored in Texas and the Northwest, with the Smackover Formation showing high lithium-in-brine grades and the McDermitt Caldera estimated to contain millions of tons of lithium. However, environmental concerns and local community impacts pose risks to these developments.

Market Price Forecasts: Goldman Sachs predicts lithium prices will average $8,900 per ton by 2026, with expectations of oversupply keeping prices down before a potential rebound in 2027. This forecast indicates a significant drop from the 2022 peak prices of nearly $80,000 per ton.

Cautious Investment Approach: Given the fluctuating market conditions and environmental implications, a cost-conscious approach is essential for evaluating the potential of new lithium projects, as the market remains tempered despite the growing interest in lithium resources.