Investor Increases Investment in International Stocks by Acquiring $5 Million in Emerging Market ETF

Winthrop Advisory Group's Investment: The Boston-based firm purchased 78,982 shares of the iShares MSCI ACWI ex U.S. ETF (ACWX) for approximately $4.9 million, increasing its total holdings to over 1 million shares valued at $68.1 million.

Performance of ACWX: The ETF has returned 21% over the past year, outperforming the S&P 500's 18% gain, indicating a positive trend in international equities.

Strategic Implications: Winthrop's increased stake in ACWX reflects growing confidence in international markets, suggesting a shift towards global diversification for long-term investors.

ETF Overview: The iShares MSCI ACWI ex U.S. ETF provides broad exposure to international equities, excluding U.S. companies, and aims to capture performance across both developed and emerging markets.

Trade with 70% Backtested Accuracy

Analyst Views on ACWX

About the author

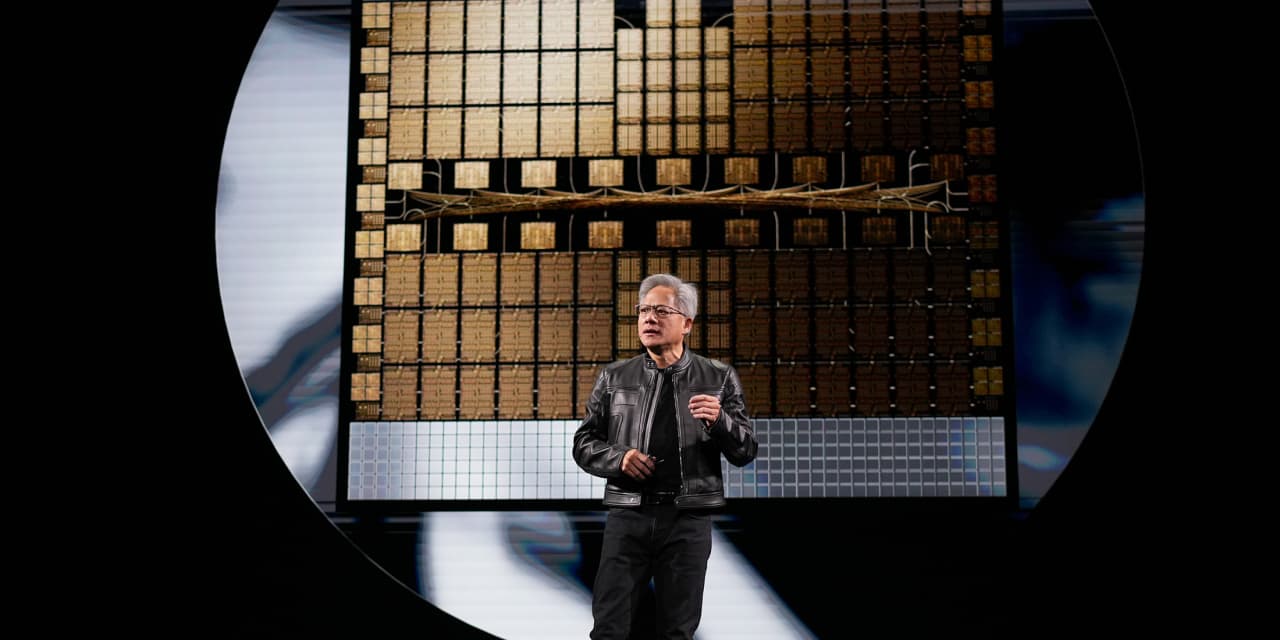

Nvidia's Impact on the Market: The stock market is facing challenges largely attributed to Nvidia's performance and valuation.

Investor Concerns: There are growing concerns among investors regarding Nvidia's high stock price and its implications for the broader market.

U.S. Stock Performance: The S&P 500 has had a challenging year, remaining flat due to high valuations, concentration in certain indices, and a weaker dollar.

Foreign Equities Outperforming: The iShares MSCI ACWI ex U.S. ETF has outperformed the State Street SPDR S&P 500 ETF Trust by eight percentage points in 2025 and continues to lead by over seven points this year.

Shift in Market Dynamics: This marks a significant shift after nearly two decades of U.S. stock market dominance, raising questions about the sustainability of this trend.

Investment Professionals' Perspectives: Investment professionals are being surveyed on whether they will continue to allocate more resources to foreign markets amidst these changes.

Historical Context: Windows 95 was launched, Toy Story premiered, and O.J. Simpson was acquitted, reflecting a significant moment in history.

Market Behavior: Jeffrey Gundlach, known as the "bond king," noted that current financial market behaviors resemble those from that historical period.

Expert Insight: Gundlach shared his views on the financial markets in a discussion with CNBC following a Federal Reserve rate decision.

Industry Influence: As CEO of DoubleLine Capital, Gundlach's perspectives are influential in understanding market trends and economic conditions.

- Portfolio Review Importance: December is a crucial time for reviewing investment portfolios, especially in light of potential shifts in the investment landscape.

- Retiree Considerations: Retirees need to be proactive and cannot afford to manage their investments passively as they approach 2026.

Author Background: Brij S. Khurana is a fixed income portfolio manager and senior managing director at Wellington Management.

Expertise: His role involves managing fixed income investments, indicating a strong background in financial markets and investment strategies.

Bank of America Warning: Strategists at Bank of America caution that the current optimism among fund managers may lead to a significant drop in stock prices if the Federal Reserve does not lower interest rates in its next meeting.

Fund Manager Survey Insights: The November fund manager survey from Bank of America indicates that a composite measure, reflecting cash levels, equity allocation, and global growth expectations, has reached its highest point since February.