Intel Shares Rise Following Upgrade: Understanding the Positive Outlook.

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 13 2026

0mins

Should l Buy HLIO?

Source: Barron's

Intel Stock Performance: Intel's stock saw gains after receiving an upgrade from KeyBanc.

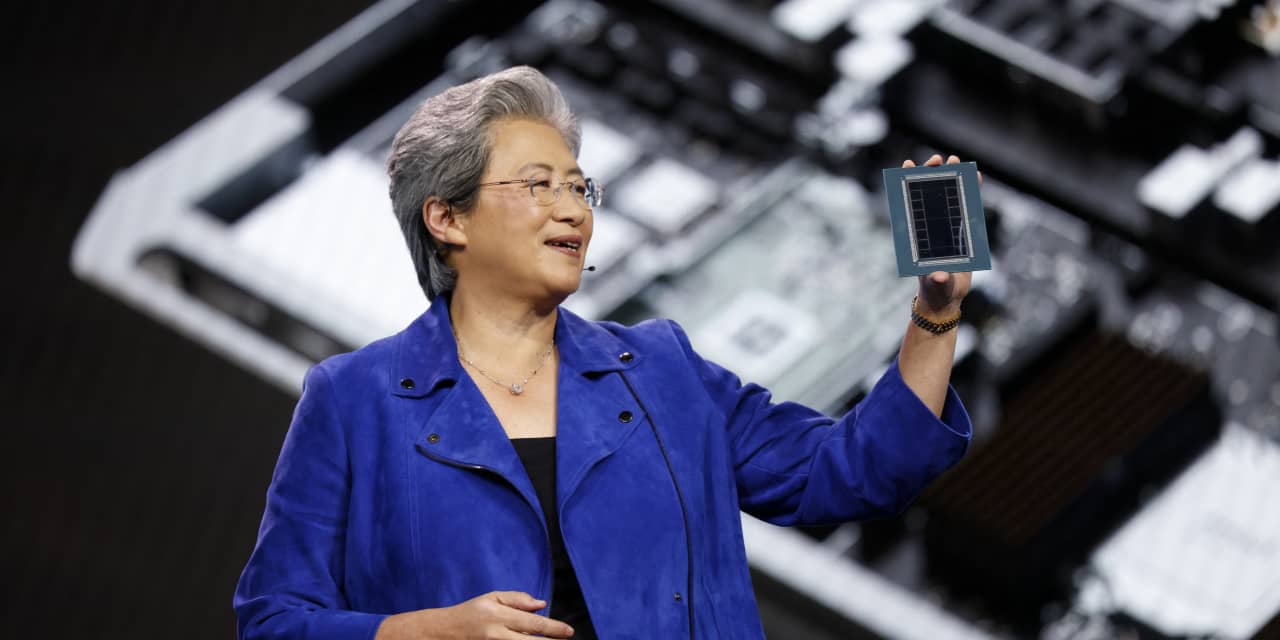

Positive Outlook for CPU Makers: Analysts predict a favorable year for central processing unit manufacturers, including Advanced Micro Devices.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy HLIO?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on HLIO

Wall Street analysts forecast HLIO stock price to fall

2 Analyst Rating

2 Buy

0 Hold

0 Sell

Moderate Buy

Current: 71.320

Low

65.00

Averages

65.00

High

65.00

Current: 71.320

Low

65.00

Averages

65.00

High

65.00

About HLIO

Helios Technologies, Inc. provides engineered motion control and electronic controls technology for diverse end markets, including construction, material handling, agriculture, energy, recreational vehicles, marine and health and wellness. The Company's segments include Hydraulics and Electronics. The Hydraulics segment designs and manufactures hydraulic motion control and fluid conveyance technology products, including cartridge valves, manifolds, quick release couplings, as well as engineers’ hydraulic solutions and, in some cases, complete systems. Its Hydraulics segment includes products sold under the Sun Hydraulics, Faster, NEM, Taimi, Daman and Schultes brands. The Electronics segment designs and manufactures customized electronic controls systems, displays, wire harnesses and software solutions for a variety of end markets. The Electronics segment includes products sold under the Enovation Controls, Murphy, Zero Off, HCT, Balboa Water Group and Joyonway brands.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Profit Growth: HELIOS Technologies reported a fourth-quarter profit of $19.5 million, or $0.58 per share, a substantial increase from last year's $4.8 million and $0.14 per share, indicating a strong enhancement in profitability and competitive positioning in the market.

- Adjusted Earnings Performance: Excluding items, HELIOS reported adjusted earnings of $26.9 million, or $0.81 per share, reflecting ongoing improvements in core business profitability, which further solidifies its market standing.

- Strong Revenue Growth: The company's revenue for the fourth quarter reached $210.7 million, a 17.4% increase from $179.5 million last year, demonstrating HELIOS's robust performance amid rising market demand and boosting confidence in future growth.

- Optimistic Guidance: HELIOS provided guidance for the next quarter with EPS expected between $0.65 and $0.70 and revenue projected at $218 million to $223 million, showcasing the company's positive outlook for future performance, which may attract more investor interest.

See More

- Earnings Beat: Helios Technologies reported a Q4 non-GAAP EPS of $0.81, exceeding expectations by $0.09, indicating sustained profitability improvements that bolster investor confidence.

- Significant Revenue Growth: The company achieved Q4 revenue of $210.7 million, a 17.4% year-over-year increase, surpassing estimates by $13.69 million, reflecting strong demand and competitive positioning in the market.

- Investor Conference Presentation: Helios Technologies showcased its potential at the CJS Securities 26th Annual 'New Ideas for the New Year' Investor Conference, enhancing market interest in its growth prospects and attracting more investor attention.

- Market Rating Dynamics: Despite signs of improvement, Helios Technologies maintains a 'Hold' rating on Seeking Alpha, indicating market caution regarding its future performance, which may impact short-term stock price movements.

See More

- Dividend History Analysis: Helios Technologies Inc's dividend history chart indicates that the most recent dividend is likely to continue, with an expected annualized dividend yield of 0.5%, providing a reference point for investors.

- Volatility Assessment: The trailing twelve-month volatility for HLIO is calculated at 51% based on the last 251 trading days' closing values, indicating significant price fluctuations and necessitating careful risk evaluation by investors.

- Options Trading Dynamics: In mid-afternoon trading on Wednesday, the put volume among S&P 500 components reached 894,008 contracts, while call volume was at 2.19 million, showing a preference for call options among investors, reflecting a bullish market sentiment.

- Options Market Trends: The current put:call ratio stands at 0.41, significantly lower than the long-term median of 0.65, indicating a marked increase in demand for call options, which may suggest potential upward movement in stock prices.

See More

- Earnings Release Schedule: Helios Technologies has announced that it will release its Q4 and FY 2025 financial results after market close on March 2, 2026, indicating the company's commitment to transparency and investor communication.

- Conference Call Details: The company will host a conference call on March 3, 2026, at 9:00 a.m. ET, led by CEO Sean Bagan and CFO Jeremy Evans, aimed at providing in-depth analysis of financial and operational results to bolster investor confidence.

- Replay and Material Access: A telephonic replay of the conference call will be available from approximately 1:00 p.m. ET on the day of the call through March 17, 2026, allowing investors to access critical information conveniently.

- Company Background Information: Helios Technologies has paid cash dividends to shareholders every quarter since going public in 1997, demonstrating its stable financial performance and commitment to shareholders while maintaining a leading position across various industries.

See More

- Platform Enhancement: Helios Technologies announced the addition of CODESYS® functionality to its OpenView™ display platform, enabling customers to program both uControl™ controllers and OpenView™ displays within the same industrial development environment, significantly reducing engineering efforts and accelerating time to market for OEMs and system integrators.

- Customer-Driven Strategy: CEO Sean Bagan emphasized that this expansion reflects the company's commitment to open, customer-driven software strategies, as supporting CODESYS® will allow customers and distribution partners to work more efficiently, leverage proven code, and deploy scalable HMI solutions.

- Remote Visualization Capability: The CODESYS®-enabled OpenView™ platform unlocks access to CODESYS®WebVisu, allowing users to remotely access and monitor their HMI applications, delivering added value for both developers and end users, thereby enhancing the product's competitive edge in the market.

- Industry Showcase Opportunity: Helios will showcase CODESYS®-enabled products at the 2026 CONEXPO-CON/AGG, presenting a wide range of electronic and hydraulic solutions for construction, industrial, and mobile equipment applications, further solidifying its leadership position in relevant markets.

See More

- Positive Outlook: Advanced Micro Devices (AMD) is expected to have a very good year, as indicated by Piper Sandler's analysis.

- Market Confidence: The optimistic forecast reflects confidence in AMD's performance and potential growth in the semiconductor market.

See More