Inhibrx Updates on INBRX-106 Clinical Trial Progress

Inhibrx Biosciences announced an update on the INBRX-106 Phase 2/3 clinical trial in combination with Keytruda, or pembrolizumab, as a first-line treatment for patients with locally advanced unresectable or metastatic head and neck squamous cell carcinoma, or HNSCC, and the Phase 1/2 trial evaluating patients with checkpoint inhibitor refractory or relapsed non-small cell lung cancer, or NSCLC, in combination with Keytruda. The Company also provided a brief progress update on the expansion cohorts investigating ozekibart in combination with FOLFIRI in late-line colorectal cancer and in combination with irinotecan and temozolomide in refractory Ewing sarcoma. Inhibrx has recruited 46 of the 60 patients in the randomized Phase 2 portion of the Phase 2/3 clinical trial evaluating INBRX-106 in combination with Keytruda versus Keytruda as a first-line treatment for patients with unresectable or metastatic HNSCC. Inhibrx expects to complete enrollment in the Phase 2 portion of the trial during the first quarter of 2026. This trial is recruiting patients who have not received prior systemic therapy for unresectable or metastatic HNSCC and have tumor PD-L1 CPS expression equal to or greater than 20. In November 2025, Inhibrx completed enrollment of the Phase 1/2 trial evaluating 34 patients in checkpoint inhibitor refractory or relapsed NSCLC in combination with Keytruda. Primary endpoints for this cohort are objective response rate, disease control rate, duration of response and safety. The current datasets for both HNSCC and NSCLC lack sufficient maturity to support an interpretation and conclusion on the viability of this program. Inhibrx expects that in the second half of 2026, the data should be mature enough to inform whether INBRX-106, in combination with Keytruda, demonstrates superior efficacy and sustained clinical benefit relative to the current standard of care. In late October 2025, Inhibrx completed enrollment of 44 patients in the expansion cohort of the Phase 1/2 trial evaluating ozekibart in combination with FOLFIRI in heavily pretreated advanced or metastatic, unresectable colorectal cancer. As previously reported, ozekibart in combination with FOLFIRI was well tolerated, with durable responses and a high rate of disease control. The progression free survival data should be mature in the Q2 of 2026, and we plan to provide an update at that time. Inhibrx expects to complete enrollment in the Phase 1/2 trial of ozekibart in combination with irinotecan and temozolomide for advanced or metastatic, unresectable, relapsed, or refractory Ewing sarcoma in the second quarter of 2026. If the current response and duration trends observed continue,

Trade with 70% Backtested Accuracy

Analyst Views on INBX

About INBX

About the author

- Options Selling Risk: Selling puts on Inhibrx Biosciences does not provide the same upside potential as owning shares, as the put seller only acquires shares if the contract is exercised, highlighting the inherent risks of options trading.

- Exercise Condition Analysis: The put seller will only own shares at a cost basis of $42.00 if Inhibrx's stock declines by 31.7% and the contract is exercised, illustrating the complexity and potential losses associated with exercising options.

- Annualized Yield: The only upside for the put seller comes from the premium collected, yielding an annualized return of 16.7%, indicating that the risk-reward balance must be carefully evaluated under current market conditions.

- Volatility Consideration: With a trailing twelve-month volatility of 95% for Inhibrx, combining this with fundamental analysis can assist investors in determining whether selling the $50 strike put represents a worthwhile risk to take.

- Stock Performance: Palvella Therapeutics saw its stock surge from $25 on March 10, 2025, to a 52-week high of $114.69 on December 22, 2025, reflecting strong market potential in rare disease treatments.

- Product Development: Its lead product, QTORIN rapamycin, targets microcystic lymphatic malformations and other rare diseases, with potential FDA approval expected to unlock a multi-billion-dollar market opportunity, further solidifying the company's position in the biopharmaceutical sector.

- Acquisition Activity: Cidara Therapeutics agreed to be acquired by Merck for $221.50 per share, totaling approximately $9.2 billion, with the deal expected to close in Q1 2026, highlighting major pharmaceutical interest in innovative therapies.

- Clinical Progress: Celcuity's Gedatolisib submitted a New Drug Application to the FDA in November 2025 for HR+, HER2- advanced breast cancer, which, if approved, would significantly enhance its competitive edge in the oncology market.

- Stock Surge: Inhibrx's stock price skyrocketed over 150% shortly after reporting positive topline results from its Ozekibart (INBRX-109) registrational trial in October 2025, indicating strong market confidence in its product.

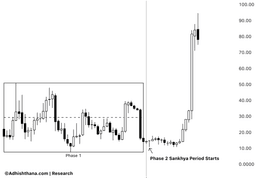

- Cycle Analysis: Currently in Phase 2 of the 18-phase Adhishthana cycle, Inhibrx's stock is deviating from expected behavior, as it should typically consolidate or correct during this phase, raising concerns about potential instability ahead.

- Historical Lessons: Similar to Lamb Weston, where premature rallies led to over 60% corrections upon entering the Buddhi phase, investors should remain cautious to avoid significant losses.

- Investor Outlook: While the stock may continue to rise in the short term, the misalignment with the natural rhythm of the Adhishthana cycle suggests that investors should carefully assess potential risks before chasing the stock at current levels.

INBRX-106 Development: Inhibrx Biosciences is advancing its INBRX-106 program, which activates the OX40 protein to enhance immune response against cancer, currently being tested in combination with Merck's Keytruda for head and neck and non-small cell lung cancers.

Clinical Trials Status: A phase 2/3 trial for INBRX-106 in head and neck cancer is ongoing, with 46 out of 60 patients enrolled, while a phase 1/2 trial for non-small cell lung cancer has completed enrollment of 34 patients.

Ozekibart Trials: Ozekibart is under investigation in phase 1/2 trials for advanced colorectal cancer and Ewing sarcoma, with expected data maturity for colorectal cancer in Q2 2026 and plans for FDA discussions regarding accelerated approval for Ewing sarcoma.

Market Performance: Inhibrx's stock closed at $81.57, reflecting a 7.03% increase, indicating positive market sentiment amidst ongoing clinical developments.

- Clinical Trial Progress: Inhibrx has enrolled 46 out of 60 patients in the Phase 2 portion of the INBRX-106 trial, expected to complete enrollment by Q1 2026, aiming to evaluate its efficacy in combination with Keytruda for patients with unresectable head and neck cancer, potentially offering new treatment options.

- Efficacy Assessment: The primary endpoint is overall response rate, supported by secondary endpoints including duration of response and progression-free survival, and successful completion could enhance Inhibrx's positioning in the oncology market.

- New Drug Development: Inhibrx is also conducting an expansion cohort trial for ozekibart, having enrolled 44 patients to evaluate its efficacy in combination with FOLFIRI for late-stage colorectal cancer, with progression-free survival data expected in Q2 2026, which may support the drug's market potential.

- FDA Communication Plan: Should ozekibart continue to show favorable responses in Ewing sarcoma trials, Inhibrx plans to meet with the FDA in H2 2026 to discuss an accelerated approval pathway, further advancing its product commercialization efforts.

Eli Lilly's Milestone: Eli Lilly becomes the first pharmaceutical company to reach a $1 trillion market cap, highlighting significant growth in the healthcare sector.

Quant-Rated Stocks: Seeking Alpha identifies several mid-to-small-cap healthcare stocks rated as "Strong Buy" by its Quant rating system, all under $7 billion in market cap.

Performance of Quant Model: The Seeking Alpha Quant Model has shown exceptional performance, with its stock recommendations outperforming the S&P 500 by 1,755% from January 2010 to June 2021.

Top Rated Stocks: Featured stocks include Inhibrx Biosciences, Nektar Therapeutics, and GRAIL, Inc., all showing substantial year-to-date gains and strong buy ratings.