Heartflow Secures Full Coverage for Plaque Analysis by Aetna

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 06 2026

0mins

Should l Buy HTFL?

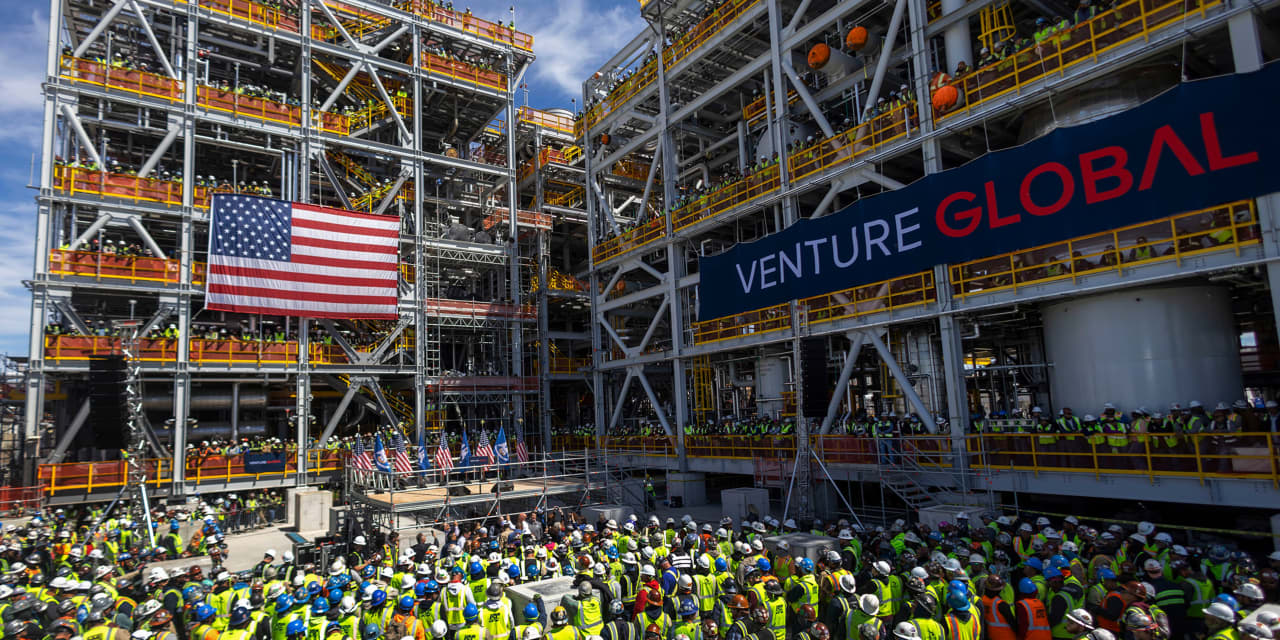

Heartflow announced Heartflow Plaque Analysis is now covered by Aetna across all lines of business, including Commercial, Medicare Advantage, and Aetna Better Health Medicaid plans. Aetna is the fourth major national commercial insurer to update its policies to cover Heartflow Plaque Analysis to fully align with the guidelines issued by radiology benefit manager EviCore, following similar decisions by Humana, Cigna, and UnitedHealthcare. Heartflow Plaque Analysis is covered for the majority of insured lives across the United States.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy HTFL?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on HTFL

Wall Street analysts forecast HTFL stock price to rise

5 Analyst Rating

4 Buy

1 Hold

0 Sell

Strong Buy

Current: 24.090

Low

35.00

Averages

38.60

High

40.00

Current: 24.090

Low

35.00

Averages

38.60

High

40.00

About HTFL

HeartFlow Inc. is a commercial-stage medical technology company that has pioneered the use of software and artificial intelligence (AI) to deliver a non-invasive solution for diagnosing and managing coronary artery disease (CAD). The Company’s novel HeartFlow Platform uses AI and advanced computational fluid dynamics to create a personalized three-dimensional (3D) model of a patient’s heart based on a single coronary computed tomography angiography (CCTA). Its AI-driven platform includes Roadmap Analysis, FFRCT Analysis and Plaque Analysis. The HeartFlow FFRCT Analysis and Plaque Analysis software assists physicians in diagnosing, managing and delivering precision care to patients with CAD. The RoadMap Analysis offers a highly intuitive anatomic visualization of the coronary arteries, helping physicians quickly identify clinically relevant areas to focus their review.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Earnings Release Schedule: Heartflow will announce its financial results for Q4 and the full year of 2025 after market close on March 18, 2026, with management hosting a conference call at 1:30 PM PT to discuss performance, likely drawing significant investor interest.

- Technological Edge: Heartflow's proprietary data pipeline, built from over 160 million annotated CTA images, powers its AI models to deliver highly accurate cardiovascular disease management solutions, having been adopted by more than 1,400 institutions globally, showcasing broad recognition of its technology.

- Clinical Validation: Heartflow's AI-driven solutions have been validated through over 200 studies involving more than 365,000 patients, with coronary CTA image acceptance rates exceeding 97%, indicating reliability and accuracy in real-world applications.

- Compliance and Security: Heartflow meets leading international standards such as HITRUST, SOC 2 Type 2, ISO 13485, and ISO 27001, ensuring patient data integrity and security, which further enhances its competitive position in the market.

See More

- Market Opportunity Analysis: CEO Brent Ness highlighted that approximately 266 million people globally suffer from chronic low back pain, with Aclarion's market opportunity spanning spinal fusion surgeries, non-fusion procedures, and pain management, which are expected to increase scan volumes over time, driving revenue growth.

- Early Revenue Sources: Aclarion is generating revenue from Nociscan scans in the UK, cash-pay usage, and clinical trials, particularly in London where insurance coverage reduces financial friction for physicians and patients, thereby supporting higher scan utilization and growth.

- Clinical Trials and Reimbursement Pathway: Aclarion's Clarity trial aims to enroll 300 patients and features an early-stop design to accelerate discussions with insurers, with findings indicating that Nociscan reduces costs by about $1,700 per patient, strengthening the case for payer adoption.

- Comparison with HeartFlow: Ness compared Aclarion's strategy to HeartFlow, which saw quarterly revenue grow from $26.8 million to $46.3 million in 2025, illustrating the challenges Aclarion faces in regaining investor confidence and improving market performance.

See More

- Analyst Rating Changes: Top Wall Street analysts have adjusted their ratings on several stocks, including upgrades, downgrades, and initiations, reflecting varying market perspectives on these companies.

- Market Dynamics Observation: While specific stock names are not mentioned, changes in analyst ratings typically influence investor decisions, potentially leading to price volatility in the affected stocks.

- Investor Attention: Investors considering buying OKLO stock should pay attention to analysts' opinions to make more informed investment decisions, especially amid increasing market uncertainty.

- Impact of Rating Changes: Analyst rating adjustments not only affect short-term market sentiment but may also have profound implications for the long-term stock performance of the companies involved, necessitating close monitoring of subsequent developments.

See More

- Market Growth Potential: The AI medical imaging market is projected to grow at an annual rate of 25.8% through 2034, driving a shift in healthcare from traditional hardware to agile, software-defined intelligence, creating significant opportunities for companies like VentriPoint.

- Successful Funding: VentriPoint doubled its private placement from $500,000 to $1 million, with proceeds earmarked for critical commercialization activities and manufacturing scale-up, ensuring the company maintains a competitive edge in the rapidly evolving market.

- Strategic Partnership: VentriPoint is collaborating with Summit Sciences to develop advanced ROI models aimed at demonstrating the economic value of its technology to healthcare providers, thereby enhancing market competitiveness and driving customer adoption.

- Executive Appointment: VentriPoint appointed David Swetlow as CFO, bringing over 15 years of management experience in the medical technology sector, which is viewed as a key step in executing strategies to drive market adoption and revenue growth.

See More

- Technology Showcase: Heartflow will present its AI technology for coronary artery disease at the 44th J.P. Morgan Healthcare Conference on January 13, 2026, which is expected to attract attention from over 1,400 global institutions, thereby enhancing its market influence.

- Clinical Validation: Heartflow's AI-driven solutions have been validated through over 100 studies involving more than 365,000 patients, demonstrating high accuracy and reproducibility in clinical practice, further solidifying its leadership in cardiovascular care.

- Data Foundation: The proprietary data pipeline built from over 160 million annotated CTA images powers advanced AI models that deliver highly accurate clinical insights, aiding in the management of care for over 500,000 patients worldwide.

- Seamless Integration: With upgraded workflows, Heartflow provides instant final quality-reviewed analyses, enabling clinicians to swiftly transition from diagnosis to decision-making, significantly improving medical efficiency.

See More