Faraday Future Signs Agreement with Hebei Huanzhou to Advance FX Super One

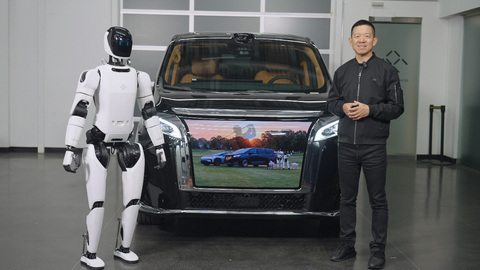

Faraday Future Intelligent Electric announced that it has entered into, as planned, a package of agreements with its bridge strategy partner, Hebei Huanzhou Automobile Sales Co., Ltd., who will jointly advance the compliant development, production, scaled deliveries and sales of a battery electric version of the Super One for the U.S. market. These agreements mark a further upgrade and deepening of FF's strategic collaboration with the Partner. The two parties will work together to ensure the timely development, production and delivery of FX Super One remains on time and hit every milestone of the Company's multi-stage start of delivery goals this year. Based on the successful progress of the Super One Project, both parties could seek to negotiate to add vehicle development projects for the FX 4 and others. "With the signing of these agreements with our valuable partner, we have now successfully reached the most important cooperation milestone for FX Super One to reach our eventual mass production goal for this vehicle," said YT Jia, FF Founder and Co-CEO. "We will work hand in hand with our strategic partner to ensure we hit our production and delivery goals for the FX Super One, and may seek agreement to expand to three new future models including the FX 4-so we can realize the vision of An AIEV for Everyone."

Trade with 70% Backtested Accuracy

Analyst Views on FFAI

About FFAI

About the author

- Delivery Progress: Faraday Future has successfully delivered its Master and pilot Aegis robots to NS Federation in Texas, marking a significant advancement in the company's EAI robotics deployment, which is expected to enhance its market share.

- Educational Application: Under the 'Robot & Vehicle + Education' scenario, FF's EAI robots will support robotics training and data collection in schools and research institutions, improving educational quality and meeting market demand for AI education, thereby solidifying FF's position in the education sector.

- Performance Application: The newly delivered robots will also be utilized in the 'Robot & Vehicle + Performance' scenario, serving as interactive performers in events and entertainment, creating engaging audience experiences and expanding FF's opportunities in consumer and light commercial markets.

- Community Service Collaboration: A representative from NS Federation stated that collaborating with Faraday Future will explore how advanced technologies can enhance the accessibility of community services, highlighting FF's strategic value in driving community engagement and service innovation.

- Conference Participation: Jerry Wang, Global President of Faraday Future, will attend the Cantor Global Technology & Industrial Growth Conference on March 10-11, 2026, in New York, where he will engage with investors about the company's strategic roadmap and key developments.

- Industry Impact: The conference gathers forward-looking thought leaders from public and private sectors to explore disruptive forces reshaping technology and industrial innovation, and FF's participation is expected to enhance its visibility among investors.

- Product Showcase: Wang will discuss updates related to the FX Super One and the company's inaugural embodied AI robotics products, showcasing FF's innovative capabilities in electric vehicles and intelligent technologies.

- Transparent Communication: FF's involvement in the Cantor conference reflects its ongoing engagement with the investment community, emphasizing the importance of transparent communication and long-term value creation, which is anticipated to bolster investor confidence.

- Government Engagement: Faraday Future's leadership held in-depth discussions last week in Washington, D.C. with officials from the U.S. Department of Transportation and the Department of Commerce, focusing on tariff policies and the development of the EAI EV and robotics industries, indicating the company's proactive involvement in shaping policy.

- Robotics Delivery Breakthrough: The successful delivery of the Master and pilot Aegis robots in Texas expands into education and performance use cases, laying a strong foundation for future scaled deliveries and advancing the company's EAI strategy.

- Education Market Potential: By integrating robots into educational settings, Faraday Future aims to accelerate the development of K-12 robotics education systems, enhancing teaching quality and unlocking new business opportunities, showcasing the company's strategic positioning in educational technology.

- Middle East Market Expansion: The delivery of FX Super One vehicles to two companies in the Middle East demonstrates Faraday Future's commitment to exploring local user bases and accelerating the deployment of the EAI mobility ecosystem, reflecting the company's ambition in international markets.

- Delivery Breakthrough: Faraday Future successfully delivered the Master and pilot Aegis robots in Texas, expanding into education and performance market applications, meeting real demand and laying the groundwork for future scaled deliveries.

- Education Market Potential: The new robots will serve as research training tools, supporting rapid development in the K-12 education market, enhancing teaching quality, and creating new business opportunities through collaborations with schools and research institutions.

- Performance Market Innovation: FF plans to position robots as the centerpiece of performances in the U.S. market, offering personalized and immersive experiences, thereby opening broader consumer and light commercial markets and promoting the adoption of EAI technology.

- Policy Support and Strategic Development: FF leadership engaged in in-depth discussions with U.S. Department of Transportation and Commerce officials, receiving encouragement for its strategic roadmap and technological innovations, further solidifying its leadership in the EAI EV and robotics industries.

- Robot Delivery Season Launch: Faraday Future has initiated its 2026 EAI robot delivery season with a target of delivering 20 robots in the first month and a total of 200 robots for the year, with an expected ramp-up in the second half to meet market demand, indicating the company's proactive positioning in the intelligent electric mobility ecosystem.

- Golf Event Showcase: The FF President's Cup Golf Friendship Tournament held in Los Angeles attracted over 100 participants and showcased the applications of Master and Aegis series robots, further expanding the practical application scenario of 'Robot + Vehicle + Golf' and enhancing brand visibility.

- Industry-Resetting Pricing Strategy: Founder and Co-CEO YT Jia emphasized the 'industry-resetting' pricing strategy aimed at lowering price barriers and accelerating market adoption of robotics products by shifting value towards practical functionality, which is expected to drive long-term growth potential.

- New Growth Curve: The robotics business is viewed as a new source of cash inflow, and with the launch of the 2026 EAI robot deliveries, it is anticipated to create a new growth curve for the company, further solidifying its leadership position in the intelligent electric mobility sector.

- Golf Tournament Held: Faraday Future hosted the FF President’s Cup Golf Friendship Tournament in Los Angeles, attracting over 100 participants including business leaders and guests, showcasing the company's influence in the intelligent electric mobility ecosystem.

- Robot Application Demonstration: The event featured live demonstrations of Master humanoid robots and Aegis bionic robots, highlighting the practical applications of EAI robots in golf events, further promoting the 'Robot + Vehicle + Golf' scenario.

- Delivery Season Launch: Faraday Future initiated its 2026 EAI robot delivery season, targeting the delivery of 20 robots in the first month and a total of 200 robots for the year, with an expected ramp-up in the second half to meet market demand.

- Industry-Resetting Pricing Strategy: The company emphasized its 'industry-resetting' pricing strategy aimed at lowering price barriers to enhance market acceptance of robotics products, potentially generating new cash inflows and growth curves, thereby strengthening its competitive position.