Eli Lilly Dominance: The Impact of a Single Stock on Pharma ETF Performance

Eli Lilly's Influence on Healthcare ETFs: Eli Lilly has become a significant driver in the pharmaceutical ETF market, with around 15 ETFs allocating double-digit weights to the company, making it a key player in healthcare fund performance.

Strong Q3 Performance: In Q3, Eli Lilly reported a 54% year-over-year revenue increase, surpassing Wall Street expectations, and raised its full-year sales and EPS guidance, solidifying its status as a growth engine in the sector.

Major ETF Allocations: Leading ETFs like iShares US Pharmaceuticals ETF and VanEck Pharmaceutical ETF have substantial allocations to Lilly, with weights of 26.9% and 24.1% respectively, indicating a strong reliance on the stock for performance.

Concerns Over Concentration: While Eli Lilly's growth is beneficial for investors, there are concerns about the potential over-dependence of ETFs on a single stock, as Lilly's performance continues to significantly impact the broader pharmaceutical ETF market.

Trade with 70% Backtested Accuracy

Analyst Views on LLY

About LLY

About the author

- Price Target Analysis: Analysts currently project Eli Lilly's price target to be just under $1,230, indicating approximately 17% upside from its current price of $1,031.79, which presents a potential return opportunity for investors.

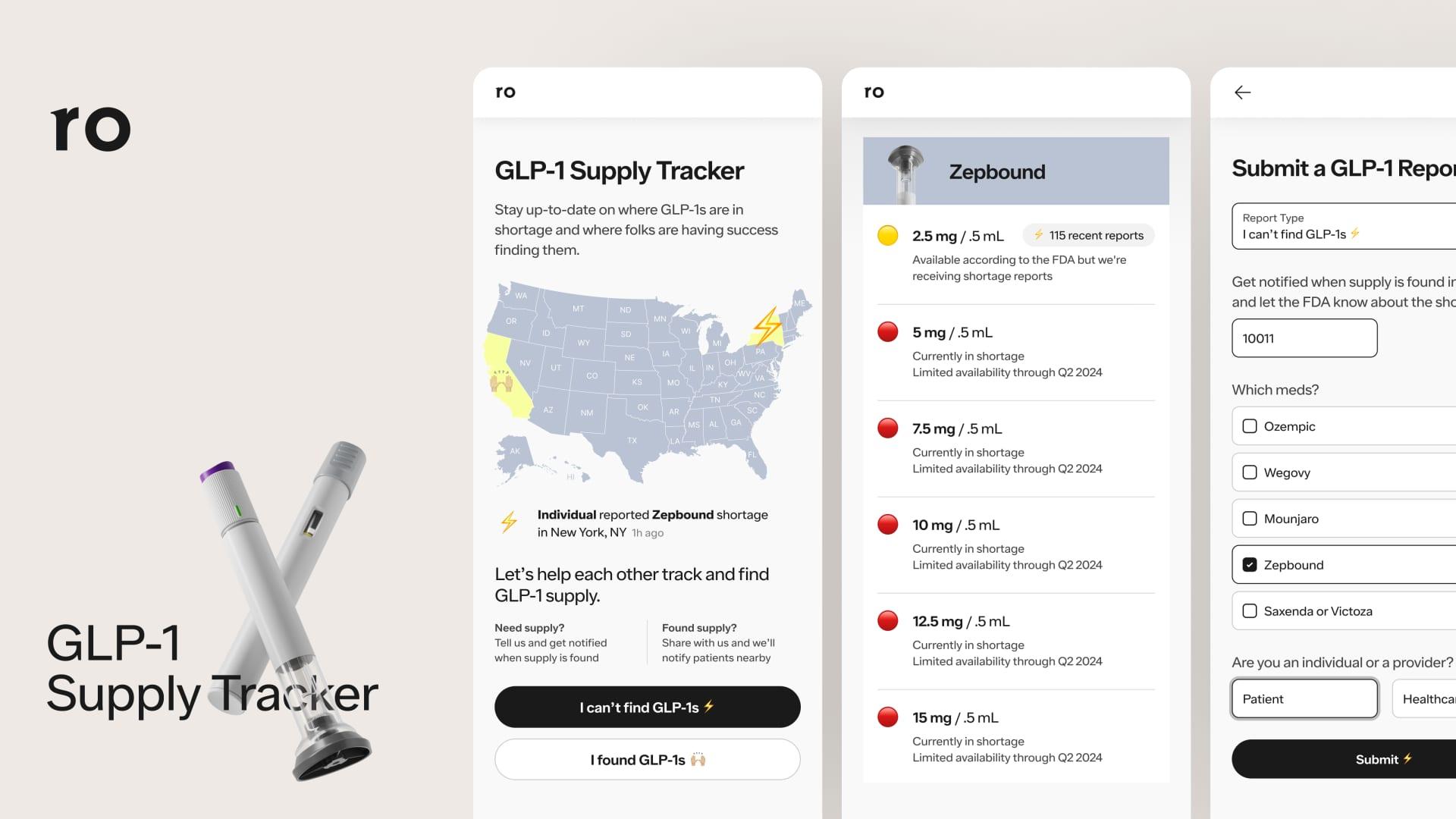

- Growth Drivers: The strong growth of Eli Lilly's GLP-1 drugs, Zepbound and Mounjaro, has fueled bullish sentiment, as investors grow confident in the company's potential to dominate the anti-obesity drug market, thereby continuing to drive the stock's rally.

- Valuation Considerations: Despite Eli Lilly's market cap nearing $1 trillion, its price-to-earnings ratio stands at 46, significantly higher than the S&P 500 average of 25, suggesting that much of the future growth is already priced in, which could lead to correction risks if expectations are not met.

- Long-term Investment Advice: For long-term investors, Eli Lilly remains a solid investment option, but it is crucial to temper expectations to avoid overestimating future gains, especially given the current high valuation context.

- Eli Lilly's Growth Momentum: Eli Lilly has demonstrated revenue growth rates exceeding mid-double digits in recent quarters, significantly outperforming large pharmaceutical companies, showcasing its leadership in the anti-obesity drug market, with new drug launches expected to further solidify its market share.

- Leader in Anti-Obesity Market: Eli Lilly's tirzepatide became the world's best-selling drug last year, with the anticipated launch of the oral GLP-1 drug forglipron this year and additional approvals expected in the coming years, enhancing the diversity of its product pipeline.

- Veeva Systems' Market Opportunity: Veeva Systems provides cloud solutions to life science companies, boasting over 1,500 customers, with a goal to double its annual revenue by 2030, indicating a compound annual growth rate of nearly 18%, reflecting its strong competitive position in a rapidly growing market.

- Growth Potential in Cloud Market: Veeva Systems estimates an addressable market of $20 billion, significantly higher than its trailing 12-month revenue of $3.1 billion, indicating substantial growth opportunities ahead, prompting investors to consider buying at current low levels.

- Strong Growth for Eli Lilly: Eli Lilly has achieved mid-double-digit revenue growth rates in recent quarters, significantly exceeding the pharmaceutical industry average, demonstrating its robust competitive position and future growth potential.

- Leader in Anti-Obesity Market: Eli Lilly's tirzepatide became the world's best-selling drug last year, and the anticipated launch of the oral GLP-1 drug forglipron this year will further solidify its leadership in the rapidly growing anti-obesity market.

- Market Opportunities for Veeva Systems: Veeva Systems provides cloud solutions to life science companies, boasting over 1,500 customers, and aims to double its annual revenue by 2030, indicating a compound annual growth rate of nearly 18%, showcasing its strong competitive edge in the large cloud market.

- Optimistic Industry Outlook: Despite intensified competition, Veeva Systems' high switching costs and unique market positioning provide ample growth opportunities, with an addressable market estimated at $20 billion, significantly surpassing its current revenue of $3.1 billion.

- Market Size Growth: According to analysis, the chronic kidney disease (CKD) market size was approximately $4.8 billion in 2024 and is expected to grow further by 2034, reflecting increased demand for new therapies and an expanding patient base.

- Rising Patient Numbers: In 2024, there were about 82 million prevalent cases of CKD across the 7 major markets (7MM), with projections indicating continued growth from 2025 to 2034, primarily driven by an aging population and the rising prevalence of diabetes and hypertension.

- Launch of New Therapies: The introduction of emerging therapies such as AstraZeneca's Zibotentan/Dapagliflozin and Boehringer Ingelheim's Vicadrostat + Empagliflozin is expected to significantly boost market growth and improve treatment outcomes for patients.

- Advancements in Biomarkers: Progress in biomarkers like KIM-1 and NGAL enables more precise early detection of CKD, thereby enhancing the potential for timely interventions and improving overall patient prognosis.

- Sales Growth Dependency: Eli Lilly's Mounjaro and Zepbound drugs achieved impressive sales growth of 99% and 175% in 2025, respectively, yet these two drugs account for nearly 45% of the company's total sales, raising concerns about the sustainability of such growth.

- Overvaluation Concerns: Despite the strong performance of Eli Lilly's drugs, its stock price has surged to a price-to-earnings ratio of 44, with a meager dividend yield of 0.6%, indicating that the market's expectations for future growth may be overly optimistic.

- Competitors' Opportunities: GLP-1 competitors Novo Nordisk and Pfizer offer more attractive investment profiles with dividend yields of 4.57% and 6.31%, respectively, and price-to-earnings ratios of 10 and 20, especially as Eli Lilly faces risks from patent expirations.

- Intensifying Industry Competition: While Eli Lilly's success in the GLP-1 space is notable, it may overshadow the risks it faces; as competition intensifies, the strong historical performance of Novo Nordisk and Pfizer could enable them to rebound in the market, presenting new opportunities for investors.

- Significant Sales Growth: Eli Lilly's Mounjaro and Zepbound drugs achieved sales increases of 99% and 175% respectively in 2025; however, such growth may not be sustainable, introducing uncertainty into the company's future performance.

- Market Share Risk: These two GLP-1 drugs account for 56% of Eli Lilly's total revenue, and with patent protections set to expire, the company may face a substantial revenue gap that could impact its long-term financial health.

- Competitor Dynamics: While Novo Nordisk and Pfizer lag in the GLP-1 market, Novo Nordisk recently launched an oral GLP-1 medication, and its dividend yield stands at 4.9%, indicating its ongoing competitiveness in the market.

- Investor Sentiment Analysis: Despite Eli Lilly's stock price surging due to market enthusiasm, resulting in a high P/E ratio of 44 and a meager dividend yield of 0.6%, analysts suggest that investors consider competitors like Novo Nordisk and Pfizer for potentially better returns.