Digimarc Second Quarter 2025 Earnings: Misses Expectations

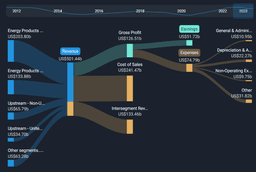

Company Performance: Digimarc reported a revenue of US$8.01 million, down 23% from the previous quarter, with a net loss of US$8.22 million, although the loss per share improved to US$0.38. Revenue is expected to decline further over the next two years, contrasting with industry growth projections.

Market Outlook and Risks: The company's shares have dropped 21% in the past week, and analysts noted that both revenue and earnings per share missed expectations. Additionally, there are two warning signs regarding potential risks for Digimarc, one of which is particularly concerning.

Trade with 70% Backtested Accuracy

Analyst Views on DMRC

About DMRC

About the author

- Conference Participation: Digimarc Corporation will attend the 28th Annual Needham Growth Conference on January 13, 2026, showcasing its leadership in digital identity and authentication solutions, which is expected to attract investor interest.

- Executive Attendance: President and CEO Riley McCormack and CFO Charles Beck will host one-on-one meetings at the event, aiming to strengthen relationships with potential investors and enhance the company's visibility.

- Industry Context: As AI technology rapidly evolves, Digimarc is committed to providing highly secure solutions to combat the growing risks of fraud and counterfeiting, highlighting its significance in the modern business landscape.

- Market Positioning: Digimarc's solutions are trusted by central banks worldwide to deter currency counterfeiting, further solidifying its market position in the digital identity verification sector.

- Market Launch: Zebra handheld imagers are the first to feature Digimarc-enabled scanner software that automatically detects tampered gift cards, significantly enhancing retailers' fraud prevention capabilities at the point of sale.

- Enhanced Security: Digimarc's solution is over 3x more secure than traditional 'card-only' features, reducing the need for cashiers to manually inspect cards, which accelerates checkout speed and lowers fraud risk.

- Initial Success: In the first in-store rollout with a grocery retailer, Zebra's devices achieved zero fraud incidents, improved card scanning speed, and simplified cashier workflows, delighting both consumers and retailers.

- Future Plans: Zebra plans to roll out the latest version of Digimarc's software across more retail scanners in early 2026, further enhancing tamper detection and improving Items Per Minute (IPM), addressing retailers' demands for anti-fraud protection and a seamless checkout experience.

Partnership for Loyalty Program: BERO Brewing has teamed up with Digimarc Corporation to launch an innovative loyalty program that enhances customer engagement through a seamless, fraud-resistant rewards experience using QR codes and connected packaging.

Effortless Rewards Experience: The program allows customers to participate instantly by scanning a QR code, eliminating the need for manual entry of product codes, and ensuring secure tracking and redemption of loyalty credits across various retailers.

Scalable and Secure Platform: Digimarc's technology enables BERO to create a customized rewards system that fosters community and customer connections, offering benefits like free shipping, early product access, and exclusive events for members.

Future Growth and Engagement: BERO plans to expand its loyalty program with a direct communication channel powered by Digimarc, aiming to deliver personalized content and real-time engagement throughout the product lifecycle.

Analyst Upgrades: Stifel raised the price target for Amazon from $269 to $295 and maintained a Buy rating, while Telsey Advisory Group increased Estée Lauder's target from $99 to $105, also keeping a Market Perform rating.

Analyst Downgrades: Cantor Fitzgerald cut SPS Commerce's price target from $135 to $80 and downgraded it from Overweight to Neutral, while Needham reduced Digimarc's target from $30 to $20 but maintained a Buy rating.

Other Notable Changes: B of A Securities raised the price targets for both Western Digital from $145 to $170 and Apple from $320 to $325, maintaining Buy ratings for both stocks.

Additional Upgrades: HC Wainwright & Co. increased Neurogene's price target from $45 to $65, and Evercore ISI Group raised Sun Communities' target from $138 to $141, upgrading it from In-Line to Outperform.

Altimmune, Inc. Investigation: Grabar Law Office is investigating claims against Altimmune, Inc. for potential breaches of fiduciary duties by its officers and directors, particularly regarding misleading statements about the results of its IMPACT Phase 2b MASH trial.

Digimarc Corporation Investigation: An investigation is underway into Digimarc Corporation for allegedly making false statements and failing to disclose material facts about its business operations, which may have misled investors regarding its financial health.

Nutex Health Inc. Investigation: Nutex Health Inc. is being investigated for allegedly making materially false statements about its business and financial prospects, including issues related to its internal controls and revenue recognition.

Quantum Corporation Investigation: Quantum Corporation faces scrutiny for improperly recognizing revenue and the need to restate financial statements, leading to claims that its public statements about business operations were misleading.

Company Performance: Digimarc reported a revenue of US$8.01 million, down 23% from the previous quarter, with a net loss of US$8.22 million, although the loss per share improved to US$0.38. Revenue is expected to decline further over the next two years, contrasting with industry growth projections.

Market Outlook and Risks: The company's shares have dropped 21% in the past week, and analysts noted that both revenue and earnings per share missed expectations. Additionally, there are two warning signs regarding potential risks for Digimarc, one of which is particularly concerning.