Building-Products Distributor QXO Prepares to Nominate Directors Over Beacon Deal

QXO's Acquisition Efforts: QXO, a new player in building-products distribution, is actively pursuing the acquisition of Beacon Roofing Supply with a cash offer of $124.25 per share.

Beacon's Response: Despite the offer being submitted on November 11, Beacon has reportedly refused to engage substantially with QXO regarding the proposal.

Trade with 70% Backtested Accuracy

Analyst Views on BCE

About BCE

About the author

Stock Performance: AST SpaceMobile shares experienced significant volatility, gaining over 46% in January before falling nearly 29%, but saw a 6% rise following a positive market reaction to its earnings report on March 3.

Revenue Growth: The company reported quarterly revenue of $54.31 million, exceeding analyst expectations and marking a year-over-year growth rate of nearly 2,758%, despite a loss per share of 26 cents.

Future Contracts: AST SpaceMobile secured over $1.2 billion in contracted revenue commitments for 2025, indicating strong future prospects and a growing list of clients, including major telecommunications companies.

Market Positioning: The company is positioning itself as a key federal government contractor, having recently secured a $30 million prime contract from the U.S. Space Development Agency, enhancing its role in national security communications.

- Executive Participation: BCE Inc. CEO Mirko Bibic will participate in a fireside chat at the Morgan Stanley Technology, Media & Telecom Conference on March 3, 2026, highlighting the company's leadership in the industry.

- Live Webcast Available: The event will be webcast live on BCE's website, ensuring that investors and the public can access real-time updates on the company's latest developments and strategic direction.

- Company Background: BCE is Canada's largest communications company, leading the way in advanced fibre and wireless networks, enterprise services, and digital media, enhancing customer connectivity, information access, and entertainment experiences while strengthening its competitive position in the global market.

- Tech-Driven Strategy: BCE is committed to delivering next-generation technology through cloud-based and AI-driven solutions, aiming to enhance customer service and improve business competitiveness on the world stage, thereby solidifying its market leadership.

- Executive Participation: Curtis Millen, CFO of BCE Inc., will participate in a fireside chat at the 29th Annual Scotiabank Telecom, Media & Technology Conference in Toronto on March 3, 2026, highlighting the company's leadership in the industry.

- Live Webcast Availability: The event will be available via live webcast on BCE's website, ensuring that investors and the public can access real-time updates about the company, enhancing transparency and engagement.

- Company Background: BCE is Canada's largest communications company, leading the way in advanced fibre and wireless networks, enterprise services, and digital media, which strengthens its market position and enhances customer experience.

- Technology-Driven Strategy: By leveraging cloud-based and AI-driven solutions, BCE aims to keep customers connected, informed, and entertained while enabling businesses to compete globally, showcasing its strategic importance in technological innovation.

- Executive Participation: BCE CEO Mirko Bibic will participate in the Morgan Stanley Technology, Media & Telecom Conference on March 3, 2026, showcasing the company's leadership in the industry and likely attracting investor and media attention.

- Live Webcast Available: The event will be webcast live on BCE's website, allowing a global audience to stay updated on the company's latest developments, thereby enhancing transparency and investor confidence.

- Company Background: BCE is Canada's largest communications company, leading with advanced fiber and wireless networks, enterprise services, and digital media, which enhances customer connectivity and information access, boosting its competitiveness in the global market.

- Technology-Driven Strategy: BCE is committed to delivering next-generation technology through cloud-based and AI-driven solutions, ensuring it maintains a competitive edge in a rapidly evolving market.

- Executive Participation: Curtis Millen, CFO of BCE Inc., will participate in the 29th Annual Scotiabank Telecom, Media & Technology Conference in Toronto on March 3, 2026, highlighting the company's leadership in the industry.

- Live Webcast Available: The event will be webcast live on BCE's official website, ensuring that investors and the public can access real-time updates on the company's developments, thereby enhancing transparency and investor confidence.

- Company Overview: BCE is Canada's largest communications company, leading in advanced fibre and wireless networks, enterprise services, and digital media, driving customer connectivity, information access, and entertainment experiences to enhance market competitiveness.

- Tech-Driven Strategy: By leveraging cloud-based and AI-driven solutions, BCE aims to provide next-generation technology that helps businesses compete on the global stage, showcasing its strategic significance in technological innovation.

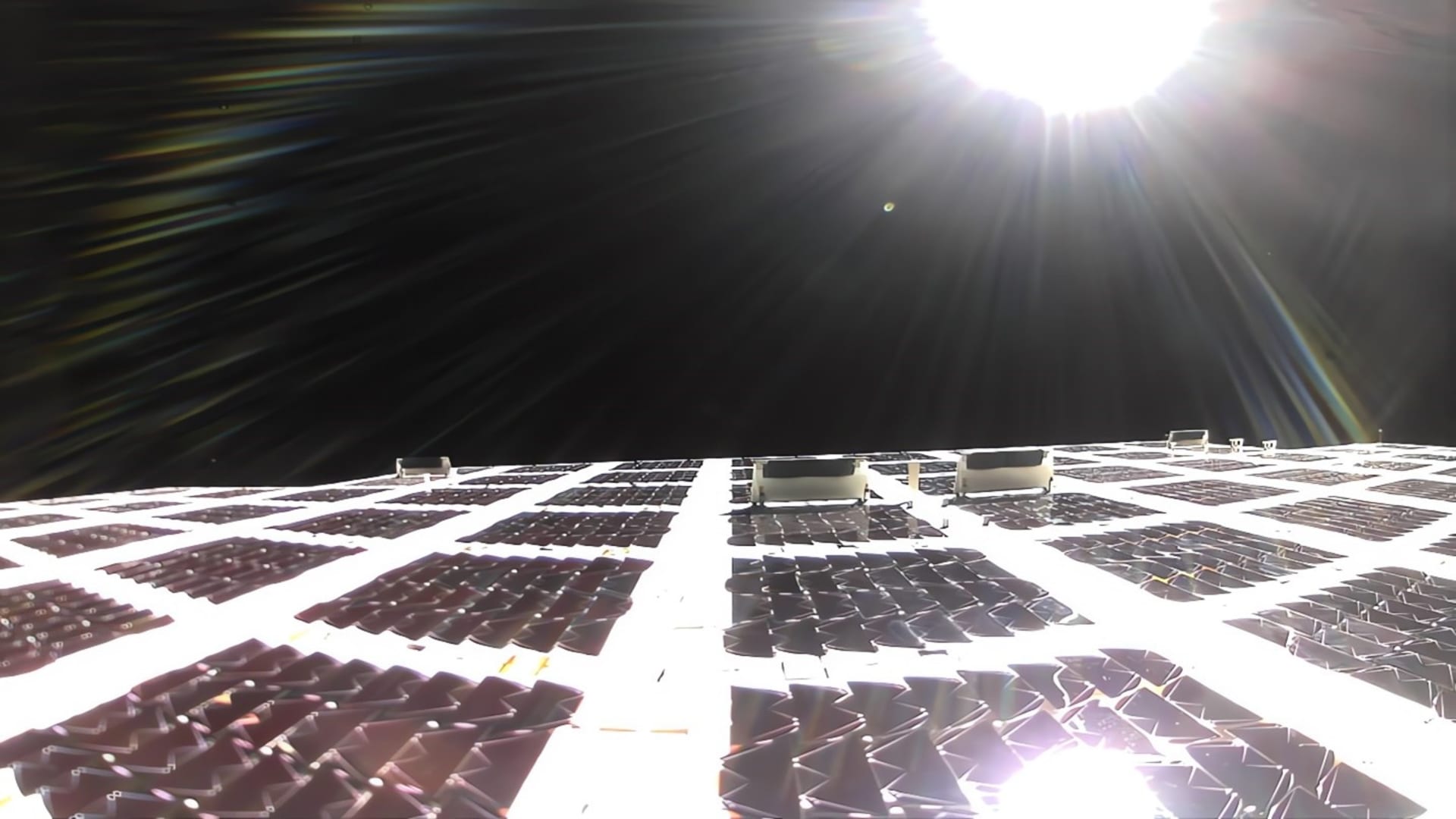

Recent Contract Award: AST SpaceMobile shares have surged over 9% following the announcement of a $30 million prime contract awarded by the U.S. Space Development Agency for the HALO Europe Program, marking a significant milestone for the company.

Emerging Government Contractor: AST SpaceMobile is positioning itself as a major government contractor, leveraging its partnerships with various telecommunications companies to enhance its capabilities in delivering rapid communication services via its Bluebird satellite constellation.

Future Launch Targets: The company aims to launch 45 to 60 Bluebird satellites into orbit by the end of 2026, with ongoing discussions about its ability to meet these ambitious targets amidst market skepticism.

Investor Sentiment: Despite short-term concerns regarding its upcoming earnings report and previous revenue misses, institutional investors have shown strong interest, with significant inflows into AST SpaceMobile, indicating confidence in its long-term growth potential.