Brown & Brown To Acquire Accession Risk Management Group For $9.83 Billion

Acquisition Details: Brown & Brown Inc. has agreed to acquire RSC Topco Inc., the parent company of Accession Risk Management Group, for $9.825 billion in cash, with the deal expected to close in Q3 2025. This merger will integrate major firms into Brown & Brown's operations, enhancing its specialty market access and North American presence.

Strategic Impact: The acquisition aims to strengthen customer relationships and drive long-term growth, while also being financially beneficial for Brown & Brown's earnings per share in 2024. It positions the company to expand its niche insurance solutions and improve collaboration with carrier partners.

Trade with 70% Backtested Accuracy

Analyst Views on KIE

About the author

KIE Share Price Analysis: KIE's share price is currently at $58.74, with a 52-week low of $52.37 and a high of $61.27, indicating a moderate position within its trading range.

Understanding ETFs: Exchange-traded funds (ETFs) function like stocks, where investors buy and sell "units" that can be created or destroyed based on demand, impacting the underlying assets.

Monitoring ETF Flows: Weekly monitoring of ETF share changes helps identify significant inflows (new units created) or outflows (units destroyed), which can affect the individual components of the ETFs.

Disclaimer on Views: The opinions expressed in the article are those of the author and do not necessarily represent the views of Nasdaq, Inc.

Berkshire Hathaway Stock Performance: Investors are concerned that the recent rally in Berkshire Hathaway's stock may be losing momentum after its August lows.

Bullish Chart Pattern: A significant bullish chart pattern emerged, indicating a potential positive outlook for the company, as the 50-day moving average crossed above the 200-day moving average for the first time in nearly three years.

ETF Analysis: The SPDR S&P Insurance ETF (KIE) has an implied analyst target price of $63.98, indicating a potential upside of 9.70% from its current trading price of $58.32.

Notable Holdings: Key underlying holdings such as The Baldwin Insurance Group (BWIN), Globe Life Inc (GL), and Allstate Corp (ALL) show significant upside potential, with target prices suggesting increases of 44.43%, 19.37%, and 16.28% respectively from their recent trading prices.

KIE Share Price Analysis: KIE's current share price is $59.86, situated between its 52-week low of $52.37 and high of $62.47, with a reference to the 200-day moving average for technical analysis.

ETFs Trading Dynamics: ETFs function like stocks, trading in "units" that can be created or destroyed based on investor demand, impacting the underlying holdings and necessitating monitoring of weekly changes in shares outstanding.

Acquisition Announcement: Radian Group Inc. will acquire Inigo Limited, a specialty insurer, for $1.7 billion, transforming Radian into a global multi-line insurer and nearly doubling its revenue.

Strategic Shift: The acquisition allows Radian to diversify beyond mortgage insurance and enter the Lloyd's global specialty market, while also planning to sell its Mortgage Conduit, Title, and Real Estate Services units by 2026 to simplify operations.

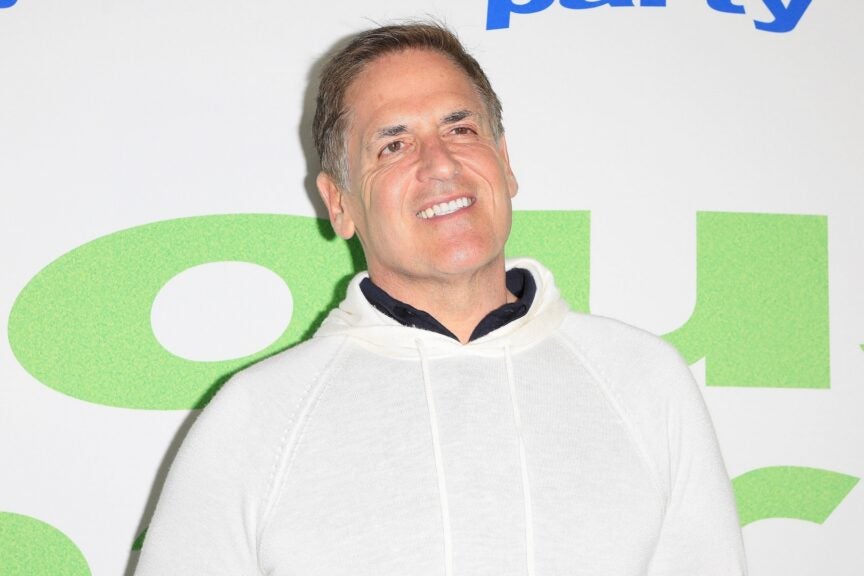

Concerns Over Antarctic Ice Loss: Mark Cuban highlighted alarming research indicating that Antarctic ice loss has reached a critical tipping point, posing significant risks for coastal markets and insurance pricing.

Accelerated Ice Shrinkage: A study published in Nature reveals that Antarctica's sea ice is diminishing more rapidly and unpredictably than previously anticipated, with potential irreversible consequences.

Insurance Industry Challenges: The insurance sector is struggling to adapt to increasingly erratic weather patterns, necessitating collaboration between public and private sectors to ensure affordable risk protection.

Mixed ETF Performance: Despite growing climate concerns, insurance exchange-traded funds (ETFs) have shown varied performance, with some ETFs experiencing gains year-to-date.