AST SpaceMobile Successfully Launches BlueBird 6, Setting Record for Size and Capacity

Written by Emily J. Thompson, Senior Investment Analyst

Updated: Jan 16 2026

0mins

Should l Buy ASTS?

Source: stocktwits

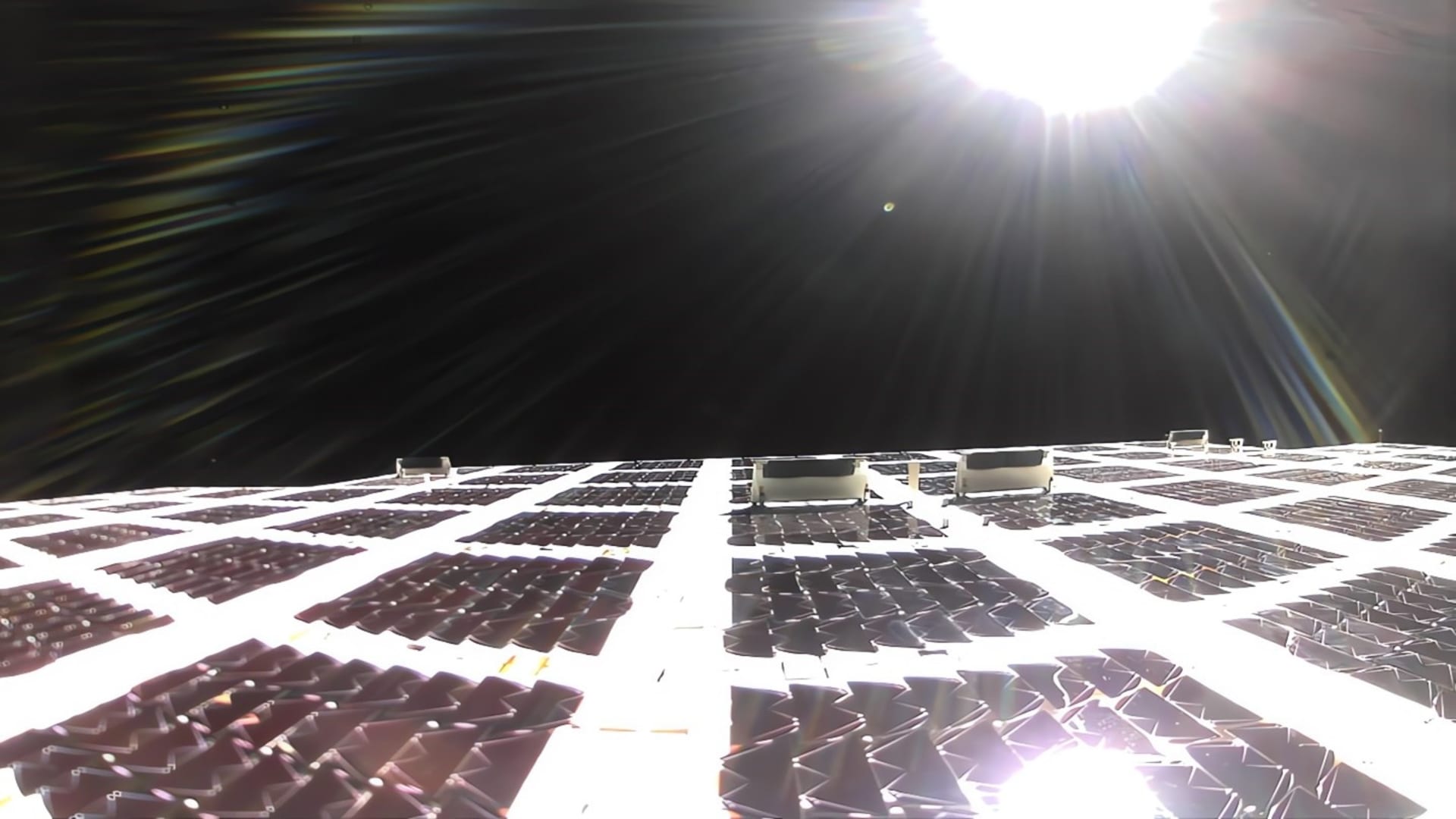

- Successful Launch: AST SpaceMobile successfully launched its BlueBird 6 mission in 2025, which is the largest commercial communications array ever deployed in low Earth orbit, covering nearly 2,400 square feet, marking a significant breakthrough in the space communications sector.

- Capacity Enhancement: BlueBird 6 is three times larger and has ten times the capacity of the company's previous satellites, which will significantly enhance its competitiveness in the global market and meet the increasing demand for communication services.

- Stock Surge: Following the launch, AST SpaceMobile's stock rose over 6.3% to close at $101.25, reaching an all-time high, with retail investors showing strong enthusiasm for the stock, reflecting market confidence in its future growth potential.

- Strategic Partnerships: In 2025, AST SpaceMobile struck significant deals with the U.S. government and Verizon, expanded its manufacturing capacity, and established agreements with over 50 mobile network operators globally, further solidifying its market position.

Trade with 70% Backtested Accuracy

Stop guessing "Should I Buy ASTS?" and start using high-conviction signals backed by rigorous historical data.

Sign up today to access powerful investing tools and make smarter, data-driven decisions.

Analyst Views on ASTS

Wall Street analysts forecast ASTS stock price to fall

8 Analyst Rating

3 Buy

4 Hold

1 Sell

Hold

Current: 104.890

Low

43.00

Averages

91.68

High

137.00

Current: 104.890

Low

43.00

Averages

91.68

High

137.00

About ASTS

AST SpaceMobile, Inc. is engaged in building a global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on its intellectual property (IP) and patent portfolio and designed for both commercial and government applications. The Company is engaged in designing and developing the constellation of BlueBird (BB) satellites and has planned space-based Cellular Broadband network distributed through a constellation of low Earth orbit (LEO) satellites. Its SpaceMobile Service is being designed to provide high-speed cellular broadband services to end-users who are out of terrestrial cellular coverage using existing mobile devices. The Company intends to continue testing capabilities of the BW3 test satellite, including further testing with cellular service providers and the government. The Company has operations in India, Scotland, Spain, and Israel.

About the author

Emily J. Thompson

Emily J. Thompson, a Chartered Financial Analyst (CFA) with 12 years in investment research, graduated with honors from the Wharton School. Specializing in industrial and technology stocks, she provides in-depth analysis for Intellectia’s earnings and market brief reports.

- Significant Revenue Growth: AST SpaceMobile's Q4 revenue surged 2731% year-over-year to $54.3 million, significantly exceeding analysts' expectations of $39.5 million, indicating the company's robust market performance and growth potential.

- Sales Forecast Upgrade: Roth Capital raised AST SpaceMobile's 2027 sales estimate to nearly $1 billion, anticipating that increasing mobile network operator activity and government opportunities will drive revenue growth, highlighting the company's strengthening strategic position in the industry.

- Satellite Launch Plans: AST plans to deploy approximately 45 to 60 Block 2 BB satellites by the end of 2026, launching one every month, aiming to provide intermittent service in selected markets, which will lay the groundwork for the company's commercial service activation.

- Positive Market Reaction: Following the Q4 revenue report, AST SpaceMobile's shares rose over 10%, and the stock has soared 234% over the past 12 months, reflecting strong investor confidence in the company's future prospects.

See More

- Company Performance: A report indicates that Space Mobile shares have gained 2.5% following the release of their Q4 results.

- Market Reaction: The increase in share value reflects positive investor sentiment after the company's quarterly performance announcement.

See More

- Market Valuation Discrepancy: Rocket Lab has a market capitalization of approximately $40 billion with trailing revenue of nearly $601.8 million, while AST SpaceMobile trades at $24 billion with only $18.5 million in revenue, indicating Rocket Lab's valuation is relatively high and AST's extremely expensive.

- Business Maturity Comparison: Rocket Lab boasts a proven rocket system and a backlog exceeding $1.8 billion, recently securing an $816 million defense contract, showcasing its solid market position; in contrast, AST SpaceMobile is in an earlier stage, planning to launch more satellites by year-end but facing significant uncertainty.

- Revenue Potential Analysis: Should AST successfully build its satellite constellation and activate commercial services with partners like AT&T, Verizon, and Vodafone, the recurring revenue potential could reach billions, although forecasts remain highly uncertain; conversely, Rocket Lab's Neutron rocket is expected to debut in late 2026, significantly increasing per-launch revenue.

- Investment Risk Assessment: While Rocket Lab presents a more reliable historical performance and clearer opportunities, both companies' high valuations and potential execution risks warrant careful consideration from investors to avoid possible financial losses.

See More

- Revenue and Market Valuation: Rocket Lab generates $601.8 million in annual revenue with a market cap of approximately $40 billion, while AST SpaceMobile has only $18.5 million in revenue and a valuation of $24 billion, highlighting Rocket Lab's advantage in maturity and market recognition.

- Business Development Stage: Rocket Lab boasts a proven rocket system and a backlog exceeding $1.8 billion, recently bolstered by an $816 million defense contract, indicating robust growth potential in the commercial space sector.

- Satellite Constellation Potential: Although AST SpaceMobile is in an earlier development phase, if it successfully builds its satellite constellation and partners with carriers like AT&T and Verizon, its annual revenue potential could reach tens of billions, showcasing significant market opportunities.

- Execution Risks and Investment Advice: While both companies face high valuations and execution risks, Rocket Lab is viewed as the safer investment choice due to its strong track record and clearer growth opportunities.

See More

- Impact of Iran War: The ongoing conflict in Iran has significantly influenced investor sentiment throughout the week.

- U.S. Economic Data: Recent U.S. economic data has demonstrated the strong ability of hard economic figures to affect market movements.

See More

- Portfolio Highlight: Alphabet's fourth-quarter 13F filing reveals that 25% of its nearly $2.6 billion investment portfolio is tied to its largest holding, AST SpaceMobile, indicating a strong commitment and potential for future growth.

- Stock Performance: AST SpaceMobile's stock has surged over 300% in the past year and more than 2,800% over the last two years, reflecting strong interest and confidence from institutional investors.

- Market Collaboration Advantage: By partnering with over 50 global mobile network providers serving nearly 6 billion users and utilizing existing smartphone technology, AST SpaceMobile lowers market entry barriers, paving the way for future sales growth.

- Financial Outlook: AST SpaceMobile's sales are projected to explode from $59 million in 2025 to nearly $3.1 billion by 2029, despite challenges such as satellite launch delays and inflation, showcasing robust growth potential.

See More