American Tower Stock: Is Wall Street Bullish or Bearish?

Company Performance: American Tower Corporation (AMT) has shown strong performance with an 18% stock increase over the past year, significantly outperforming the S&P 500 and industry peers, driven by solid leasing trends and better-than-expected Q1 results.

Analyst Ratings and Future Outlook: AMT holds a "Strong Buy" consensus rating from analysts, with expectations for continued growth despite a projected decline in AFFO per share for FY 2025; RBC Capital has raised its price target for AMT, indicating potential upside.

Trade with 70% Backtested Accuracy

Analyst Views on AMT

About AMT

About the author

Stock Performance: AST SpaceMobile shares experienced significant volatility, gaining over 46% in January before falling nearly 29%, but saw a 6% rise following a positive market reaction to its earnings report on March 3.

Revenue Growth: The company reported quarterly revenue of $54.31 million, exceeding analyst expectations and marking a year-over-year growth rate of nearly 2,758%, despite a loss per share of 26 cents.

Future Contracts: AST SpaceMobile secured over $1.2 billion in contracted revenue commitments for 2025, indicating strong future prospects and a growing list of clients, including major telecommunications companies.

Market Positioning: The company is positioning itself as a key federal government contractor, having recently secured a $30 million prime contract from the U.S. Space Development Agency, enhancing its role in national security communications.

- Target Price Adjustment: Scotiabank lowered its price target for American Tower from $220 to $214 while maintaining an Outperform rating, reflecting confidence in the company's long-term outlook supported by its international asset base and strong balance sheet.

- Strong Financial Performance: During the Q4 2025 earnings call, CEO Steven Vondran reported an 8% increase in adjusted AFFO per share for the year, with Q4 growth exceeding 13%, indicating steady leasing activity across both tower and data center segments driving overall performance.

- Future Strategic Priorities: Vondran outlined three key priorities for 2026, including maintaining revenue growth, improving operational efficiency, and continuing disciplined capital allocation to meet the growing demand for 5G and future 6G technology from wireless carriers.

- Legal Action Update: American Tower is pursuing legal action against DISH to recover remaining value tied to lease commitments, demonstrating the company's proactive approach to addressing default issues while highlighting its independent operational capabilities in the multitenant communications real estate sector.

Current Interest Rates and Investment Trends: The Federal Reserve's recent interest rate cut has led to a decline in yields on fixed income products, prompting investors to turn to equities for better returns, with some equity markets already offering higher yields.

Realty Income's Performance: Realty Income has become a household name among yield-focused investors, consistently raising its dividend for 113 consecutive quarters, and is noted for its stability and high occupancy rates in its portfolio.

Financial Health and Revenue Growth: Realty Income reported a significant year-over-year revenue increase of 11%, with a strong average revenue growth of nearly 30% over the past five years, indicating robust financial health.

Investment Recommendations: Analysts are recommending five specific stocks for investors to consider now, emphasizing their potential for growth and stability in the current market environment.

- New Internet Exchange Points: Community IX will establish FL-IX and CIX-NoVA at CoreSite's Miami and Northern Virginia facilities, significantly enhancing internet exchange capabilities on the East Coast, expected to provide more efficient IP traffic exchange services for ISPs and enterprises.

- Market-Leading Pricing: FL-IX and CIX-NoVA offer market-leading pricing for 10G and 100G ports, with 400G available at all CIX-NoVA locations and select FL-IX sites, reducing connectivity costs and improving network performance, thereby enhancing business competitiveness.

- Interconnectivity Advantages: By deploying internet exchange points at MI1 and VA1, Community IX gains access to critical interconnection points, including the NAP of Americas and Equinix 41715 Filigree, further expanding its network ecosystem and supporting over 225 connected networks.

- Deepened Strategic Partnership: The collaboration between CoreSite and Community IX not only enhances mutual interconnectivity but also supports businesses in achieving digital transformation through high-quality network connections, driving regional economic growth.

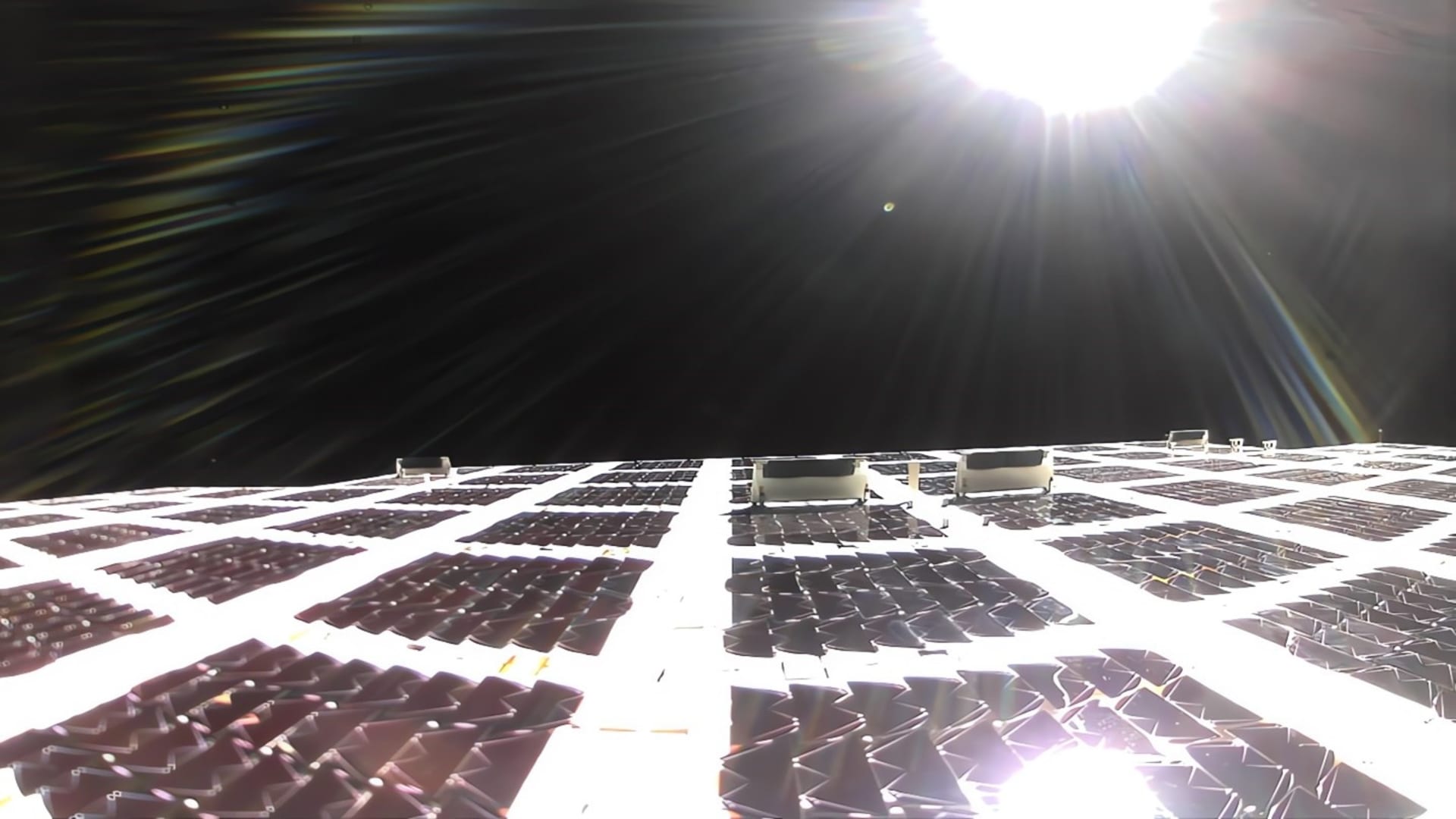

Recent Contract Award: AST SpaceMobile shares have surged over 9% following the announcement of a $30 million prime contract awarded by the U.S. Space Development Agency for the HALO Europe Program, marking a significant milestone for the company.

Emerging Government Contractor: AST SpaceMobile is positioning itself as a major government contractor, leveraging its partnerships with various telecommunications companies to enhance its capabilities in delivering rapid communication services via its Bluebird satellite constellation.

Future Launch Targets: The company aims to launch 45 to 60 Bluebird satellites into orbit by the end of 2026, with ongoing discussions about its ability to meet these ambitious targets amidst market skepticism.

Investor Sentiment: Despite short-term concerns regarding its upcoming earnings report and previous revenue misses, institutional investors have shown strong interest, with significant inflows into AST SpaceMobile, indicating confidence in its long-term growth potential.

- Put Option Appeal: The current bid for the $185.00 put option is $17.30, and if an investor sells this contract, they commit to buying the stock at $185.00, effectively lowering their cost basis to $167.70, which is a 1% discount from the current price of $187.36, making it attractive for those interested in AMT shares.

- Yield Potential Analysis: Should the put option expire worthless, the premium would yield a 9.35% return on the cash commitment, or 8.82% annualized, referred to as YieldBoost, highlighting the potential attractiveness of this investment strategy.

- Call Option Returns: The $190.00 call option has a current bid of $19.20, and if an investor buys AMT shares at $187.36 and sells this contract, they could achieve an 11.66% total return if the stock is called away at the March 2027 expiration, showcasing the potential profitability of this strategy.

- Risk Assessment: Current data indicates a 58% chance that the put option will expire worthless, while the call option has a 45% chance, suggesting that investors need to carefully evaluate the balance of risk and reward when selecting their options strategies.