Victoria's Secret stock rises amid valuation analysis insights

Victoria's Secret shares increased by 5.81% as it crossed above its 5-day SMA, closing at $54.51.

The stock's performance reflects a 49.9% return over the past year, with a DCF model suggesting it is undervalued by 41.3%, potentially attracting value-focused investors. Despite recent volatility, the brand's strength and profit expectations remain positive, encouraging investor engagement in community discussions.

This upward movement may indicate renewed investor confidence as the company navigates its valuation challenges and market positioning.

Trade with 70% Backtested Accuracy

Analyst Views on VSCO

About VSCO

About the author

- Social Media Surge: Since January 1, user-generated '2016' playlists on Spotify have surged by 790%, indicating a strong nostalgic sentiment among young consumers that could drive sales for brands associated with that era.

- Return to Brick-and-Mortar: Young consumers are rediscovering the joy of in-store shopping, reflecting a longing for the carefree atmosphere of 2016, which may lead to improved performance for retailers.

- Brand Opportunities: Brands like Abercrombie & Fitch could leverage this nostalgia wave to reshape their image, particularly if they successfully distance themselves from past controversies, potentially attracting more young consumers.

- Market Outlook: Retail trends typically last about 18 months, and this nostalgia cycle is expected to persist through the midterm elections this year, possibly extending into next year, providing long-term market opportunities for related brands.

- Nostalgia Trend Emergence: Gen Z's nostalgia for 2016 has rapidly spread across social media, with Spotify user-generated '2016' playlists soaring by 790% since January 1, indicating a strong yearning for the cultural elements of that time, potentially driving a revival for related brands.

- Return to Brick-and-Mortar: Young consumers are rediscovering the appeal of in-store shopping after years dominated by e-commerce, reflecting a longing for the carefree and familiar comfort of 2016, which could stimulate a retail resurgence.

- Brand Opportunities Arise: Brands like Abercrombie & Fitch and Levi Strauss, which held significant cultural relevance in 2016, may leverage this nostalgia wave to regain market traction, especially as consumers show renewed interest in classic styles.

- Market Strategy Adjustments: As nostalgia rises, brands must adjust their market strategies to align with Gen Z's desire for authenticity and less intentionality, with successful brands likely to harness this emotional connection to reshape their cultural relevance.

- Stock Performance: Victoria's Secret shares closed at $54.51, reflecting a 49.9% return over the past year, a 2.2% gain year-to-date, a 0.6% increase over the last 30 days, but an 8.8% decline last week, indicating increased short-term volatility that may affect investor confidence.

- Valuation Assessment: The DCF model indicates that Victoria's Secret's free cash flow was $282.9 million over the past twelve months, with projections of $448.0 million by 2028, suggesting the stock is undervalued by 41.3%, which could attract value-focused investors.

- P/E Ratio Analysis: Currently, Victoria's Secret trades at a P/E ratio of 25.74x, above the industry average of 19.29x and peer average of 16.66x, indicating potential overvaluation, prompting investors to carefully assess risk versus reward.

- Future Outlook: Despite valuation debates, Victoria's Secret retains potential in brand strength and profit expectations, with investors encouraged to engage with community discussions for insights on the company's future developments.

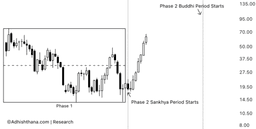

- Price Surge: Since August 2025, Victoria's Secret's stock has surged from around $18 to nearly $65, presenting a strong facade while concealing underlying structural risks that investors should not overlook.

- Phase Analysis: The stock is currently in Phase 2 of the Adhishthana cycle, still within the Sankhya period, which typically features consolidation and sluggish price movements rather than a persistent rally.

- Volatility Risks: Aggressive rallies during the Sankhya period are often unstable, with historical patterns indicating that such deviations tend to be corrected as the stock transitions into the Buddhi period, potentially leading to sharp price reversals.

- Investor Outlook: While the stock may continue to rise in the short term, the unfavorable structural positioning raises concerns about long-term sustainability, necessitating vigilance and risk management as volatility is likely to increase with the approaching Buddhi transition.

- Bank Stock Decline: Following President Trump's proposal to cap credit card rates at 10%, Capital One's stock fell by 6%, with Synchrony Financial and Citigroup also declining by 8% and 3% respectively, indicating market concerns over bank profitability.

- Duolingo User Growth: Despite the resignation of CFO Matt Skaruppa, Duolingo reported a 30% year-over-year increase in daily active users for Q4, slightly exceeding FactSet's consensus estimate, demonstrating its ongoing appeal in the language learning market.

- Lithium Stocks Rise: After Scotiabank upgraded lithium miners to outperform, Albemarle and Lithium Argentina saw their stocks rise by approximately 5% and 8%, reflecting optimistic market expectations regarding lithium demand.

- Dexcom Earnings Forecast: Dexcom anticipates Q4 revenue of about $1.26 billion and projects revenue growth to between $5.16 billion and $5.25 billion by 2026, leading to a stock increase of over 5%, showcasing its strong growth potential in the glucose monitoring market.

Market Performance: The bull run in the market continued, with both the S&P 500 and the Dow Jones Industrial Average reaching record highs.

Investor Sentiment: The ongoing upward trend indicates strong investor confidence and optimism in the market's future performance.