Flex Ltd rises amid sector rotation despite market trends

Flex Ltd's stock price increased by 5.01% as it crossed above the 5-day SMA, indicating a positive shift in investor sentiment.

This rise comes amid sector rotation, as investors are increasingly focusing on technology stocks, even as the broader market shows mixed signals with the Nasdaq-100 down 0.04% and the S&P 500 up 0.19%. The shift suggests that Flex Ltd is benefiting from a reallocation of capital towards tech, particularly in light of recent developments in the AI sector that have highlighted the potential of overlooked technology stocks.

The implications of this movement indicate a growing confidence in Flex Ltd's future prospects, especially as the company continues to adapt to the evolving market landscape and capitalize on emerging opportunities.

Trade with 70% Backtested Accuracy

Analyst Views on FLEX

About FLEX

About the author

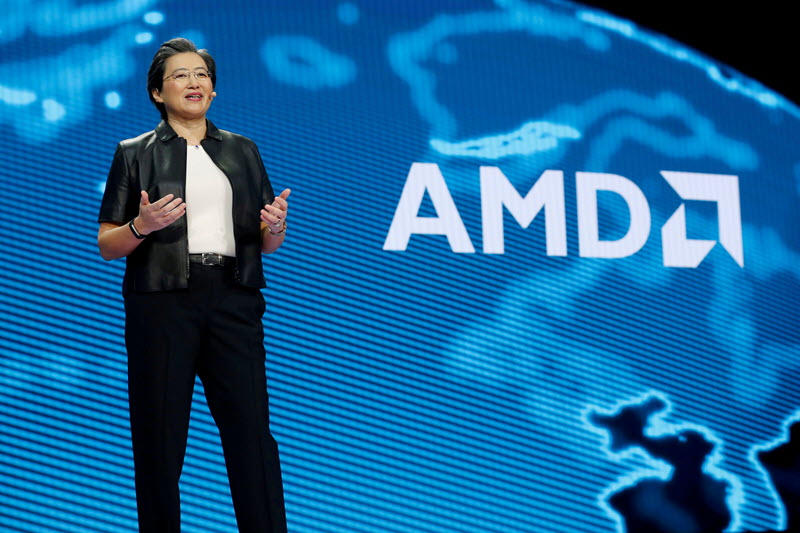

- U.S. Manufacturing Launch: Flex has commenced production of the AMD Instinct MI355X GPU platform at its Austin, Texas facility, marking a significant enhancement in domestic production capabilities for high-performance computing and AI technologies, with volume ramp expected next quarter.

- Future Platform Support: The collaboration extends beyond the current generation, as Flex will also support the manufacturing of future AMD Instinct platforms to meet the surging demand for large-scale AI deployments across data centers, further solidifying its market position.

- Advanced Manufacturing Capabilities: Flex's Austin headquarters spans 1.4 million square feet and is designed for complex, high-volume production with sustainable manufacturing practices, enhancing production efficiency and product quality to enable customers to scale AI infrastructure more rapidly.

- Supply Chain Resilience: By partnering with AMD, Flex aims to build a more resilient and diverse supply chain to better meet AI demand and deliver at scale, thereby enhancing customer competitiveness and market responsiveness.

- Collaborative Manufacturing Opportunity: Flex has initiated U.S.-based production of AMD's Instinct MI355X GPU platforms at its Austin, Texas facility, with a volume ramp expected next quarter to meet the growing demand for AI in data centers.

- Technical Validation and Testing: The partnership involves assembling eight AMD Instinct GPUs and essential components into a high-density system design, which will undergo rigorous testing and validation, thereby reinforcing Flex's manufacturing position in advanced AI infrastructure.

- Market Performance Analysis: Flex shares are currently priced at $64.02, trading 4.5% below the 20-day simple moving average, indicating a bearish trend in the short term, yet the stock has increased approximately 25% over the past 12 months, suggesting long-term growth potential.

- Future Earnings Outlook: Flex is set to report earnings on May 6, 2026, with an estimated EPS of $0.83 and projected revenue of $6.93 billion, reflecting strong growth expectations in the AI sector.

- Strategic Collaboration Expansion: Flex has expanded its partnership with AMD to manufacture the AMD Instinct MI355X GPU platform in the U.S., marking a significant milestone in domestic production of advanced AI and high-performance technologies, expected to meet surging demand for large-scale AI deployments across data centers.

- Production Capacity Enhancement: Manufacturing of the AMD Instinct MI355X platform has commenced at Flex's headquarters in Austin, Texas, with volume ramp expected next quarter, further strengthening Flex's competitive edge in high-density system design.

- Comprehensive Manufacturing Solutions: Flex is responsible for the complete manufacturing of the AMD Instinct platform, assembling eight AMD Instinct GPUs along with surrounding components into a single high-density system, ensuring each platform undergoes rigorous factory testing and validation to enhance product reliability.

- Sustainable Manufacturing Practices: Flex's Austin headquarters spans 1.4 million square feet and is designed to support complex, high-volume production with sustainable manufacturing practices, showcasing Flex's robust manufacturing capabilities and agile supply chain advantages in the U.S. market.

- Investor Conference Schedule: Flex will participate in the Raymond James 47th Annual Institutional Investors Conference on March 2, 2026, with a presentation scheduled for 7:05 a.m. CT / 8:05 a.m. ET, showcasing the company's strategic direction and market potential to investors.

- Live Webcast Availability: The live webcast of the event will be accessible on the Flex Investor Relations website, ensuring that global investors can receive real-time updates on the company, enhancing transparency and building investor trust.

- Global Manufacturing Capability: With a presence in 30 countries, Flex serves as the manufacturing partner of choice for leading brands, providing advanced manufacturing and supply chain solutions that assist customers in managing products from concept to scale, further solidifying its market leadership.

- Technological Support in AI Era: In the age of artificial intelligence, Flex is helping customers accelerate data center deployment by addressing power, heat, and scale challenges through cutting-edge power and cooling technologies and scalable IT infrastructure solutions, driving innovation and growth in the industry.

- Investor Conference Announcement: Flex will participate in the Raymond James 47th Annual Institutional Investors Conference on March 2, 2026, with a presentation scheduled for 7:05 a.m. CT / 8:05 a.m. ET, showcasing the company's proactive communication strategy with investors.

- Live Webcast Availability: The live presentation will be accessible via the Flex Investor Relations website, ensuring global investors can receive real-time updates on the company, with a replay available post-event to enhance transparency and information dissemination.

- Global Manufacturing Footprint: With operations in 30 countries, Flex serves as the manufacturing partner of choice for leading brands, delivering advanced manufacturing and supply chain solutions that support customers from concept to scale, highlighting its competitive edge in the global market.

- Technological Support in AI Era: In the age of AI, Flex aids customers in accelerating data center deployment by addressing power, heat, and scalability challenges through cutting-edge power and cooling technologies and scalable IT infrastructure solutions, further solidifying its market leadership.

- Continued Tech Decline: The iShares Expanded Tech-Software Sector ETF (NYSE:IGV) fell for the seventh consecutive day, returning to levels last seen during the April 2025 tariff shock, indicating a severe lack of confidence in tech stocks.

- Nasdaq Index Drop: The Nasdaq 100 dropped 2.2% after a 1.7% decline on Tuesday, as investors aggressively rotated out of long-duration growth stocks into energy and materials, reflecting a risk-off sentiment in the market.

- Bitcoin Price Decline: Bitcoin (CRYPTO:BTC) slid 2.5% to around $73,000, marking its lowest level since early November 2024, fully erasing the post-Trump election rally, which highlights the risk-averse tone in the crypto markets.

- Palantir Stock Plunge: Palantir Technologies Inc. (NASDAQ:PLTR) tumbled over 12%, reversing part of Tuesday's 6.9% surge, indicating investor concerns about the company's outlook, which may impact its future financing and market performance.