EPAM Systems Reports Strong Earnings but Cautious Outlook Affects Stock

EPAM Systems' stock fell sharply, hitting a 52-week low, as the company reported strong Q4 earnings but provided a cautious outlook for 2026.

Despite reporting a non-GAAP EPS of $3.26, exceeding expectations by $0.10, and a revenue growth of 12.8% year-over-year to $1.41 billion, the company's guidance for Q1 2026 revenue was slightly below analyst estimates. This cautious outlook, amid a backdrop of broader market weakness, raised concerns among investors about future growth potential, leading to a significant decline in the stock price.

The mixed results have created uncertainty in the market, as investors weigh the strong past performance against the cautious future guidance. The company’s commitment to strategic investments in AI and operational efficiency may provide long-term benefits, but immediate investor sentiment appears to be negatively impacted.

Trade with 70% Backtested Accuracy

Analyst Views on EPAM

About EPAM

About the author

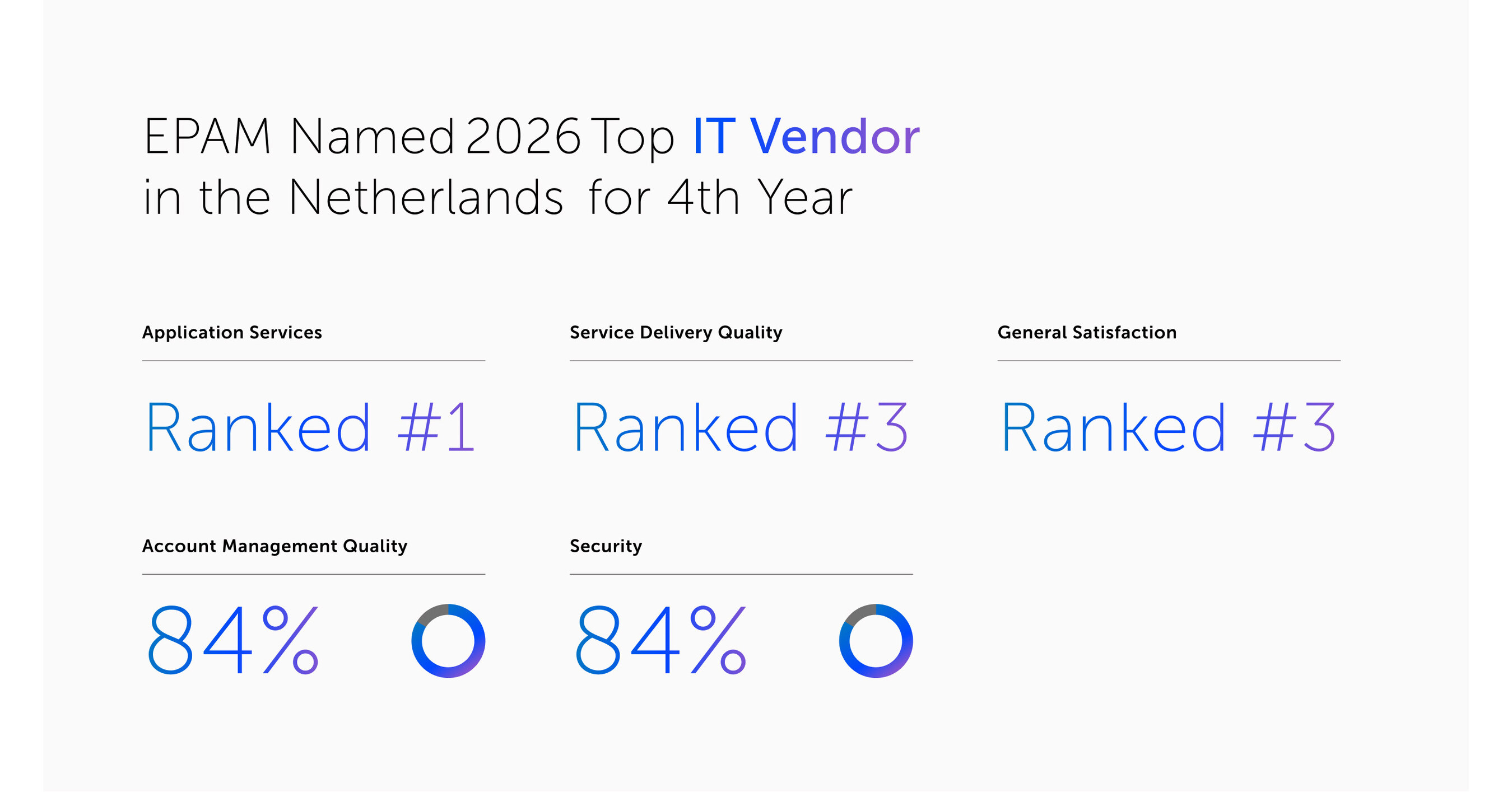

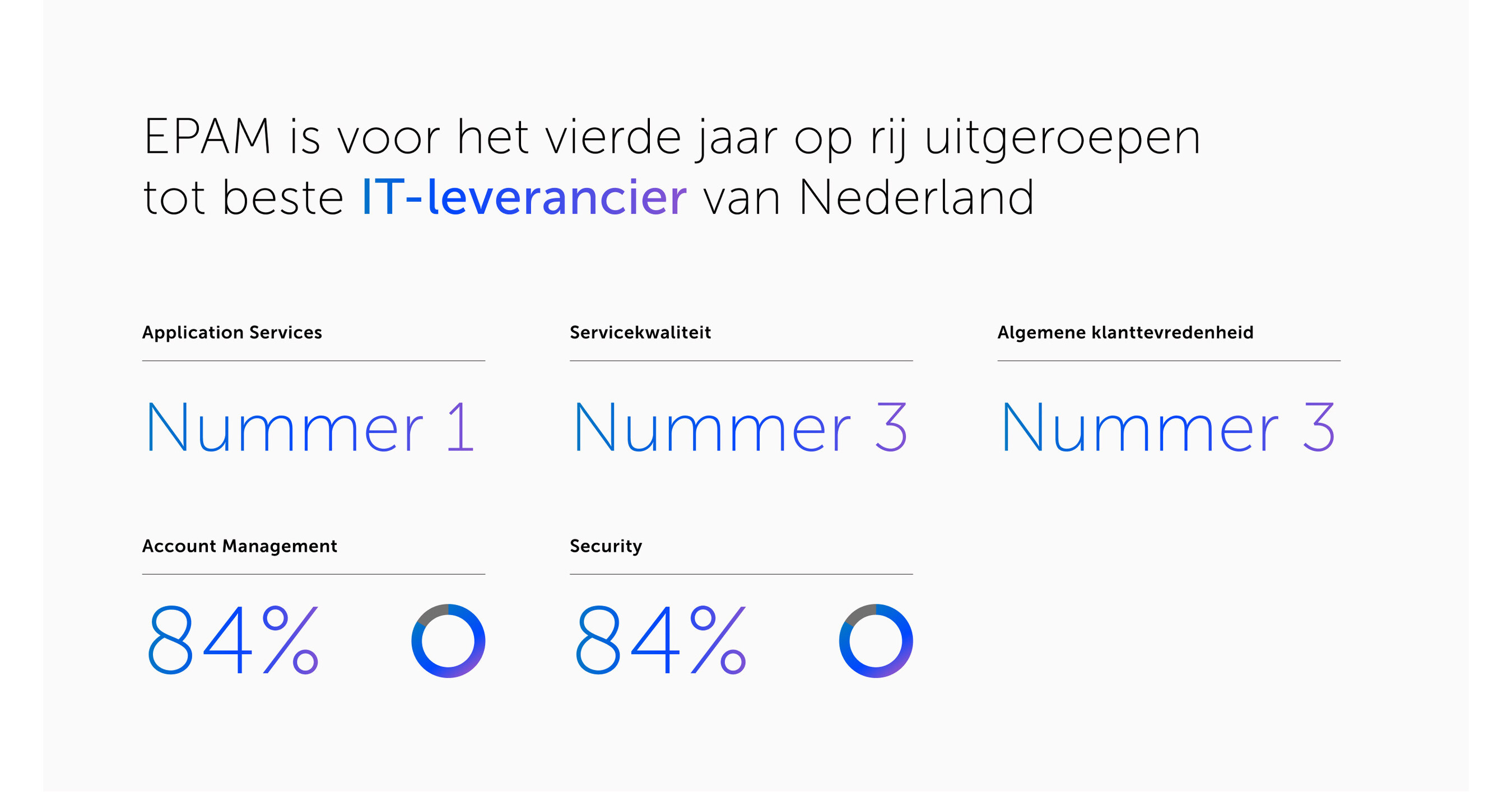

- Recognition of Excellence: EPAM has been named one of the top three IT vendors in the Netherlands by Whitelane Research for the fourth consecutive year, achieving an 88% satisfaction rate in application services and 87% overall satisfaction, indicating strong client trust and satisfaction in a competitive market.

- Positive Client Feedback: Over 350 participants evaluated nearly 800 IT outsourcing relationships, with EPAM receiving exceptional performer rankings in application services and overall satisfaction, reflecting its critical role in digital transformation and solidifying its position as a trusted partner.

- Driving Technological Transformation: EPAM is committed to delivering advanced AI capabilities, secure cloud solutions, and modern engineering practices that help clients scale efficiently and adopt emerging technologies confidently, thereby driving measurable business outcomes to meet urgent market demands for digital transformation.

- Market Leadership Position: This recognition not only strengthens EPAM's market position in the Netherlands but also reinforces its performance across other European markets, showcasing the company's influence and potential for sustained growth on a global scale.

- Strategic Milestone: EPAM Systems announced its membership in the Microsoft Intelligent Security Association (MISA), reflecting the maturity of its security services and enhancing its existing collaboration with Microsoft to better protect customers against increasing cyber threats.

- Integrated Security Services: EPAM's security services are centered on an engineering-led approach utilizing Microsoft Security technologies, such as Microsoft Sentinel and Microsoft Defender XDR, helping clients integrate and operate security as a unified platform, thereby improving efficiency and effectiveness in security management.

- Ecosystem Collaboration: Joining MISA means tighter technical collaboration between EPAM and Microsoft, accelerating execution and improving security outcomes in production environments while supporting customers in continuously enhancing their security operations across cloud and AI-enabled environments.

- Industry Leadership: Since its establishment in 2018, MISA has grown into a vibrant ecosystem of the most reliable security vendors globally, and EPAM's membership further solidifies its leadership position in the cybersecurity community, enabling customers to predict, detect, and respond to security threats more rapidly.

- Strategic Milestone: EPAM Systems has officially joined the Microsoft Intelligent Security Association (MISA), reflecting the maturity of its security services and strengthening its collaboration with Microsoft to jointly address increasing cyber threats.

- Integrated Security Services: EPAM's security offerings are based on an engineering-led approach utilizing Microsoft security technologies, such as Microsoft Sentinel and Microsoft Defender XDR, helping clients integrate security into a unified platform, thereby enhancing operational efficiency and effectiveness.

- Enhanced Customer Value: With MISA membership, EPAM will have closer technical collaboration with Microsoft, accelerating execution and improving security outcomes in production environments, ultimately providing customers with stronger security capabilities.

- Ecosystem Development: Since its establishment in 2018, MISA has evolved into a vibrant ecosystem of the most reliable security vendors globally, and EPAM's inclusion further enhances the collaborative capacity of this ecosystem, aiming to improve customers' ability to predict, detect, and respond to security threats.

- Exceptional Customer Satisfaction: EPAM achieved an 88% score for application services and 87% for overall customer satisfaction in the 2026 Dutch IT Sourcing Study, demonstrating its strong position as a reliable partner in a competitive market.

- Sustained Industry Recognition: This honor marks EPAM's fourth consecutive year of recognition, reflecting its leadership in digital transformation, particularly in the implementation of AI and cloud solutions.

- Expanded Market Influence: EPAM excelled in evaluations of nearly 800 IT sourcing relationships across over 350 IT spending organizations, further solidifying its influence in European markets, especially in Germany, Switzerland, and the UK.

- Strategic Investment and Development: EPAM is committed to delivering advanced AI capabilities and modern engineering practices to help clients achieve measurable business outcomes, thereby driving its continued growth in global markets.

- Recognition of Excellence: EPAM achieved an 88% rating in application services and a 87% overall satisfaction score in the 2026 Dutch IT Sourcing Study, being named a top IT vendor for the fourth consecutive year, which underscores its leadership position in a highly competitive market.

- Customer Satisfaction Improvement: Among 43 IT service providers, EPAM received high scores of 88% in service delivery quality and 84% in account management quality, indicating ongoing enhancements in customer service and management that further solidify client trust.

- Support for Digital Transformation: The VP of EPAM noted that as organizations accelerate digital transformation, they increasingly rely on EPAM's advanced AI capabilities and secure cloud solutions, which not only enhance the company's market competitiveness but also create measurable business outcomes for clients.

- Market Expansion Potential: EPAM's continued strong performance across various European markets, particularly in Germany, Switzerland, and the Nordics, demonstrates its robust influence and market expansion potential globally, further driving the company's long-term growth strategy.

- Securities Fraud Investigation: Pomerantz LLP is investigating whether EPAM Systems and its executives have engaged in securities fraud or other unlawful business practices, aiming to protect investor rights and potentially initiate a class action lawsuit.

- Declining Financial Performance: On February 19, 2026, EPAM reported its financial results for Q4 and full year 2025, with the CFO acknowledging a revenue decline from its largest NEORIS customer, indicating a business ramp-down between Q4 and Q1.

- Significant Stock Reaction: Following the earnings report, EPAM's stock price fell by $9.20, or 6.61%, over the next two trading sessions, closing at $129.96 per share, reflecting market concerns about the company's outlook.

- Legal Firm Background: Pomerantz LLP is a prominent firm in securities and antitrust class litigation, founded over 85 years ago, dedicated to fighting for the rights of victims of securities fraud and corporate misconduct, having recovered multimillion-dollar damages for class members historically.