Digital Realty Trust shows stable income amid AI infrastructure growth

Digital Realty Trust Inc's stock rose by 3.00% and reached a 20-day high, reflecting positive investor sentiment amidst a challenging market environment where the Nasdaq-100 is down 1.08% and the S&P 500 is down 0.54%.

The catalyst for this movement is the company's stable revenue generation, with $1.6 billion reported in Q3 2023, marking a 10% year-over-year increase. As a real estate investment trust, Digital Realty Trust offers a reliable dividend yield of 3.1%, attracting investors looking for stable income sources even as the broader market faces volatility.

This performance highlights Digital Realty's resilience in the face of market challenges, positioning it as a strong player in the growing AI infrastructure sector, which is expected to see significant investment in the coming years.

Trade with 70% Backtested Accuracy

Analyst Views on DLR

About DLR

About the author

- Data Center Certification: Digital Realty's NRT14 data center in Tokyo achieves NVIDIA DGX-Ready Data Center certification, becoming one of the first facilities in Japan to meet high-density AI workload standards, reinforcing its strategic position in AI infrastructure.

- Performance Support: NRT14 supports high-density AI workloads of over 100 kW per rack, utilizing liquid-cooled Blackwell architecture that can deliver 25 times greater energy efficiency than traditional air-cooled systems, significantly reducing operational costs and enhancing performance.

- Regional Collaboration Expansion: This certification continues Digital Realty's partnership with NVIDIA, further expanding its AI infrastructure footprint in the Asia Pacific, enhancing scalability across a globally consistent platform to help enterprises rapidly deploy and scale AI applications.

- Sustainability Commitment: Digital Realty's development of AI-ready infrastructure in the Asia Pacific underscores its commitment to low-carbon infrastructure, supporting customers in balancing high-performance computing needs with regional sustainability goals.

- Data Center Certification: Digital Realty's NRT14 data center in the Greater Tokyo area achieves NVIDIA DGX-Ready Data Center certification, becoming one of the first facilities in Japan to support high-density AI workloads, reinforcing its strategic position in AI infrastructure.

- Performance Support: NRT14 is capable of supporting high-density AI workloads of over 100 kW per rack, utilizing liquid cooling technology that offers up to 25 times the energy efficiency of traditional air-cooled systems, significantly reducing operational costs and enhancing performance for enterprises.

- Regional Collaboration Expansion: This certification continues Digital Realty's partnership with NVIDIA, further expanding its AI infrastructure footprint in the Asia Pacific, enabling enterprises to rapidly deploy and scale their AI-driven transformation needs.

- Sustainability Commitment: The development of AI-ready infrastructure in the Asia Pacific reflects Digital Realty's commitment to low-carbon infrastructure, supporting customers in balancing high-performance computing needs with regional sustainability goals.

- Investor Trends: Investors are moving away from AI investments despite a significant market surge today.

- Data Center REITs: The only exception to this trend is the continued interest in data center real estate investment trusts (REITs).

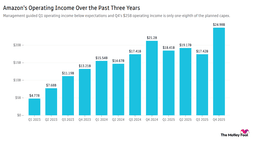

- Amazon's Capital Expenditure Surge: Amazon plans to increase its capital expenditure to $200 billion in 2026, nearly matching its total revenue of $213 billion for Q4, leading to an over 8% drop in stock price during morning trading, indicating market concerns about its financial health.

- Accelerating AWS Growth: CEO Andy Jassy reported a 24% growth rate for AWS, the fastest in 13 quarters, with an annualized revenue of $142 billion; however, management anticipates Q1 operating income will fall short of analyst expectations, reflecting intensified market competition.

- Bitcoin Price Volatility: Bitcoin has dropped 50% from its 2025 peak, falling to around $60,000, which reflects waning confidence in government support for cryptocurrencies, although some analysts suggest this is merely a market correction rather than the end of crypto.

- Severe Market Reactions: Despite a 10% revenue increase in Q3, DOCS and PIDoximity saw their stock plunge over 30% due to declining net income under margin pressure, highlighting investors' acute sensitivity to profitability.

- Price Adjustment: Stifel has reduced the target price for Digital Realty Trust Inc. from $210 to $200.

- Market Impact: This adjustment reflects changes in market conditions and expectations for the company's performance.