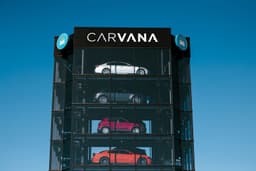

Carvana Stock Faces High Stakes: Strategies for Profit if Prices Decline

Carvana's Market Position: Carvana's share price has surged significantly, leading to its inclusion in the S&P 500 and surpassing the market values of major automakers like Ford and GM, with an enterprise value exceeding $100 billion.

Business Model Insights: The company operates as a vertically integrated lender and securitizer, focusing on subprime auto loans, which contributes to its profitability despite the risks associated with lending to lower-credit borrowers.

Loan Terms and Risks: Carvana's loans often have extended terms, increasing default risk as the value of used cars depreciates over time, raising concerns about the sustainability of its business model in a challenging credit environment.

Investment Considerations: While Carvana has shown impressive recovery and growth, potential investors are cautioned about the high valuation and risks associated with its reliance on subprime lending, suggesting a careful approach to stock ownership.

Trade with 70% Backtested Accuracy

Analyst Views on CVNA

About CVNA

About the author

- Rising Financing Costs: Used car loan rates have surged to between 10% and 12%, compared to 6% to 7% for new cars, creating higher monthly payment pressures for consumers and undermining Carvana's market appeal.

- Sales Decline Forecast: Used retail sales are expected to drop by 0.7% in 2026 to 20.3 million units, primarily due to reduced new car production and weak electric vehicle demand, further exacerbating challenges for Carvana.

- Insider Selling Warning: CEO Ernest Garcia III has sold over $1.4 billion in shares since April 2024, including more than $500 million in August 2025, raising concerns about corporate governance and future prospects among investors.

- Financial Transparency Issues: Gotham City Research accused Carvana of hiding over $1 billion in expenses through related-party transactions, leading to a 20% drop in stock price, indicating significant risks in financial management that could affect investor confidence.

- Stock Decline: Carvana's stock has fallen approximately 27% from its January peak of $485 to around $347, indicating market concerns about its future prospects, particularly amid weakening demand.

- Financial Performance: Despite posting record revenue of $5.65 billion in Q3 2025, a 54.5% year-over-year increase, and delivering 156,000 vehicles, confidence in Carvana's sustained growth is waning as used car demand softens.

- Rising Financing Costs: Used car loan rates are running between 10% and 12%, compared to 6% to 7% for new cars, putting pressure on consumers' monthly payments and potentially impacting Carvana's sales potential.

- Insider Selling Warning: The CEO has sold over $1.4 billion in shares since April 2024, including more than $500 million in August 2025, raising concerns about insider confidence in the company's future and increasing investor risk perceptions.

- Market Performance: Equities experienced a decline last week, with all three major indexes falling by at least 1.2%.

- Economic Indicators: This downturn occurred despite a better-than-expected jobs report from the Bureau of Labor Statistics and a relatively stable inflation report.

- Increased Market Volatility: Last week, stocks in software, real estate, financial services, and logistics faced selling pressure due to concerns over AI-related disruptions, with the Nasdaq Composite falling 0.2% and a weekly loss of 2.1%, indicating market sensitivity to AI impacts.

- Consumer Spending Data Focus: This week's highlight will be the Personal Consumption Expenditures (PCE) report on Friday, which will provide insights into consumer spending in December and inflation trends, especially following last week's unexpected slowdown in the Consumer Price Index (CPI).

- Corporate Earnings in Spotlight: Walmart (WMT) is set to release its fourth-quarter earnings on Thursday, marking the first report under new CEO John Furner, making it a key indicator of consumer spending that the market is eagerly anticipating.

- Ongoing AI Impact: As AI tools' potential effects intensify across various sectors, software stocks like Salesforce (CRM) and ServiceNow (NOW) have seen significant declines, reflecting the market's heightened vigilance regarding AI disruptions, necessitating close monitoring of future industry developments.

- Positive Job Data: Recent U.S. employment figures indicate a rise in new jobs, and while inflation eases, the overall market remains volatile, reflecting investor concerns about future economic prospects that could impact stock performance.

- Mixed Industry Results: Automakers reported mixed earnings, with some industrial stocks outperforming the broader market; however, overall equity demand remains capped, indicating a growing risk-off sentiment among investors.

- AI Panic Trade: The launch of a new freight efficiency platform by an AI firm has spooked markets, leading to sharp declines in traditionally resilient trucking and logistics stocks, as fears grow over the vulnerability of labor-intensive business models to automation.

- Real Estate Impacted: The real estate sector and other old-economy industries have also been hit, as traders express unease over potential AI-driven disruptions, further exacerbating market uncertainty.

- Walmart Earnings Expectations: Analysts anticipate Walmart will report its fourth-quarter earnings on Thursday, with net sales expected to rise approximately 4% and operating income potentially increasing by 11%, further solidifying its status as a trillion-dollar company.

- Consumer Health Insights: Investors will closely monitor Walmart's commentary on consumer health and its 2026 financial guidance to assess future market trends and corporate strategy.

- FOMC Meeting Minutes Release: The minutes from the January FOMC meeting will be released on Wednesday, providing insights into policymakers' views on the path of interest rates, especially after holding rates steady at the start of the year, which has generated significant market interest.

- Personal Consumption Expenditures Data: On Friday, the Personal Consumption Expenditures (PCE) data will be released, which is the Fed's preferred inflation gauge, and the market will be keen to see if it confirms that inflation is steadily cooling or prompts the Fed to maintain a cautious stance.