US Stock Market Preview: Mixed Futures, Tesla Rises, Strong Performance in Rare Earths and Airlines.

U.S. Stock Market Update Ahead of Earnings Season

As of Thursday morning, U.S. stock futures showed mixed results ahead of the first earnings season under the ongoing trade war. Major banks, including JPMorgan Chase, are set to report their earnings next Tuesday (July 15), marking the official start of this earnings season.

Market Reactions to Tariff Announcements

The Trump administration's sudden tariff actions have caused short-term fluctuations in the market, but strong corporate earnings expectations and enthusiasm for artificial intelligence are helping investors navigate the uncertainty surrounding trade policies.

On Wednesday, President Trump announced a series of new tariff requirements, including a 50% tariff on imports from Brazil and a 50% tariff on copper starting next month. This news led to a slight decline in U.S. stock futures but did not disrupt the overall upward trend in the market.

Notable Stock Movements

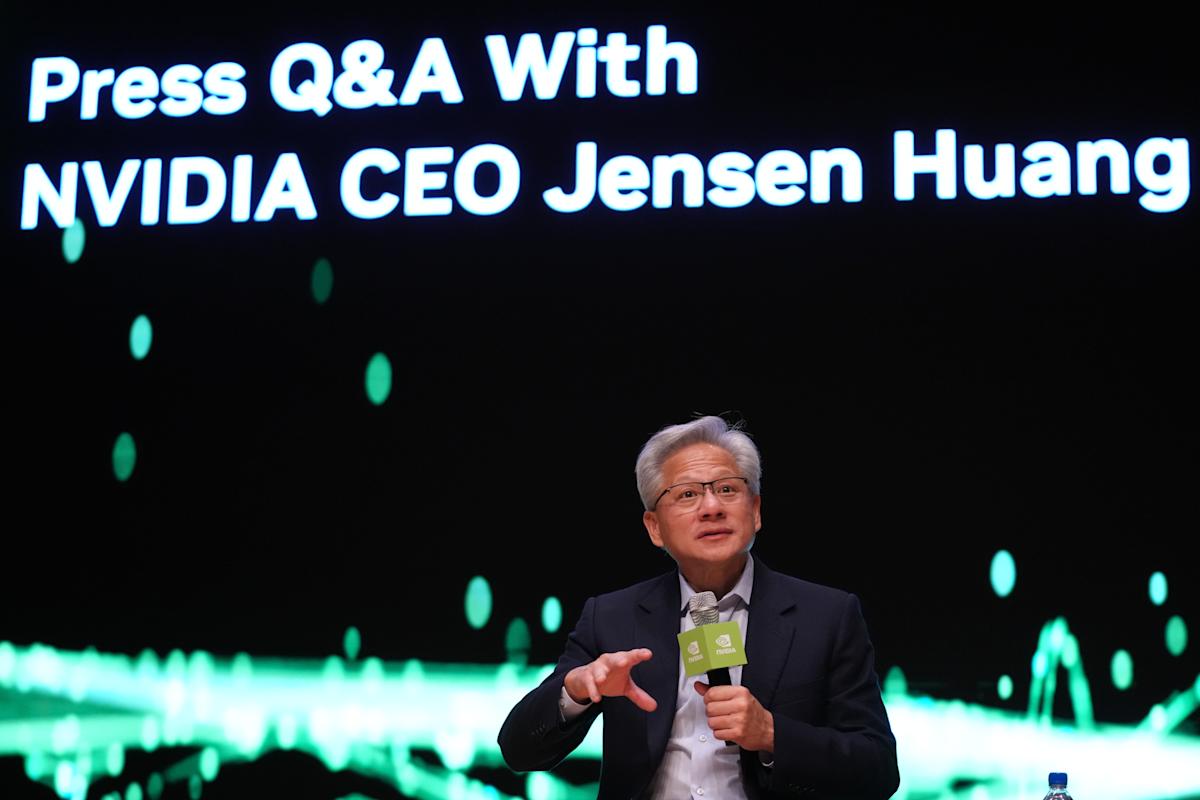

- Tech Stocks: Most major tech stocks rose before the market opened, with Tesla (TSLA) up over 1%, AMD up over 2%, and Nvidia (NVDA) and ASML both rising nearly 1%.

Cryptocurrency Stocks: Many cryptocurrency-related stocks also saw gains, with BIT Mining (BTCM) surging over 276% and SharpLink Gaming (SBET) up over 3%. However, Bitmine Immersion Technologies (BMNR) fell over 17%.

Chinese Stocks: Popular Chinese stocks mostly increased, with NIO up over 2%, Alibaba (BABA) nearly 1%, and Pinduoduo (PDD) slightly up.

Rare Earth Stocks: Rare earth stocks soared, with MP Materials (MP) rising over 40% and USA Rare Earth (USAR) up over 12%.

Copper Sector: The copper sector saw collective gains, with Freeport-McMoRan (FCX) and Southern Copper (SCCO) both rising in response to the new tariffs.

Real Estate Services: Chinese real estate service stocks also rose, with Fangdd (DUO) up nearly 16% and Beike (BEKE) up over 5%.

Earnings Season Outlook

As the first earnings season under the trade war approaches, analysts note that while earnings growth for U.S. companies in Q2 is expected to slow compared to the first quarter, the sharp depreciation of the dollar may help offset some potential tariff impacts.

Federal Reserve Insights

The Wall Street Journal's Nick Timiraos highlighted that upcoming inflation data will be crucial in determining whether tariffs will drive inflation higher and if there will be any internal disagreements within the Federal Reserve regarding response strategies.

New AI Developments

Grok 4 has officially launched, boasting a context window of 256,000 tokens and enhanced multimodal capabilities. The subscription fee is set at $30/month, with a Heavy version available for $300/month.

Dollar's Performance

Goldman Sachs noted that the dollar's ability to regain its "safe-haven" status is challenged by three key factors: U.S. policy uncertainty, a preference for diversified investments, and ongoing fiscal risks.

Japanese Auto Industry Response

Japanese automakers are sacrificing profits to maintain competitiveness in the U.S. market, with a record 19.4% drop in the export price index for North American cars last month, raising concerns about corporate profitability and the sustainability of wage growth in Japan.

Upcoming Economic Data

- 20:30: Initial jobless claims for the week ending July 5

- 21:00: Speech by St. Louis Fed President Bullard on the U.S. economy and monetary policy

- 22:30: EIA natural gas inventory report

- 01:00: 30-year Treasury auction results

- 01:15: Discussion by Fed Governor Waller at a Dallas Fed event

- 02:30: Speech by San Francisco Fed President Daly on U.S. economic outlook

About the author

Top News

Related Articles

Sigh Up to Get Intellectia Insights

Why has Apple's stock outperformed the Nasdaq and S&P 500 recently?

What factors contributed to Apple's strong market performance amid AI stock declines?

How will Tim Cook's potential resignation impact Apple's stock and leadership?

What could be the long-term effects of Apple's iPhone 17 success in China?

How does the departure of Abidur Chowdhury affect Apple's design team strategy?

People Also Watch