Key Takeaways

XRP has evolved from regulatory uncertainty to institutional legitimacy, offering investors a unique opportunity in the cross-border payments sector with real-world utility backing its value proposition.

• Regulatory clarity unlocks institutional adoption: SEC lawsuit resolution and crypto-friendly leadership enable XRP ETFs, removing compliance barriers for major investors.

• Strong institutional momentum drives demand: Over 300 financial institutions use RippleNet, with XRP ETFs attracting $1.26 billion in inflows and zero outflow days.

• Expert forecasts suggest significant upside potential: Standard Chartered projects XRP reaching $12.50 by 2028, representing potential 500% gains from current levels.

• Real utility differentiates XRP from speculation: Unlike many cryptocurrencies, XRP serves actual cross-border payment needs with 3-5 second settlement times and minimal fees.

• Dual-asset ecosystem enhances adoption: Ripple USD (RLUSD) provides stability while XRP offers liquidity, addressing banks' volatility concerns in practical implementations.

The convergence of regulatory approval, institutional partnerships, and proven utility positions XRP as a compelling investment for those seeking exposure to the transformation of global payment infrastructure, though investors should consider their risk tolerance given cryptocurrency market volatility.

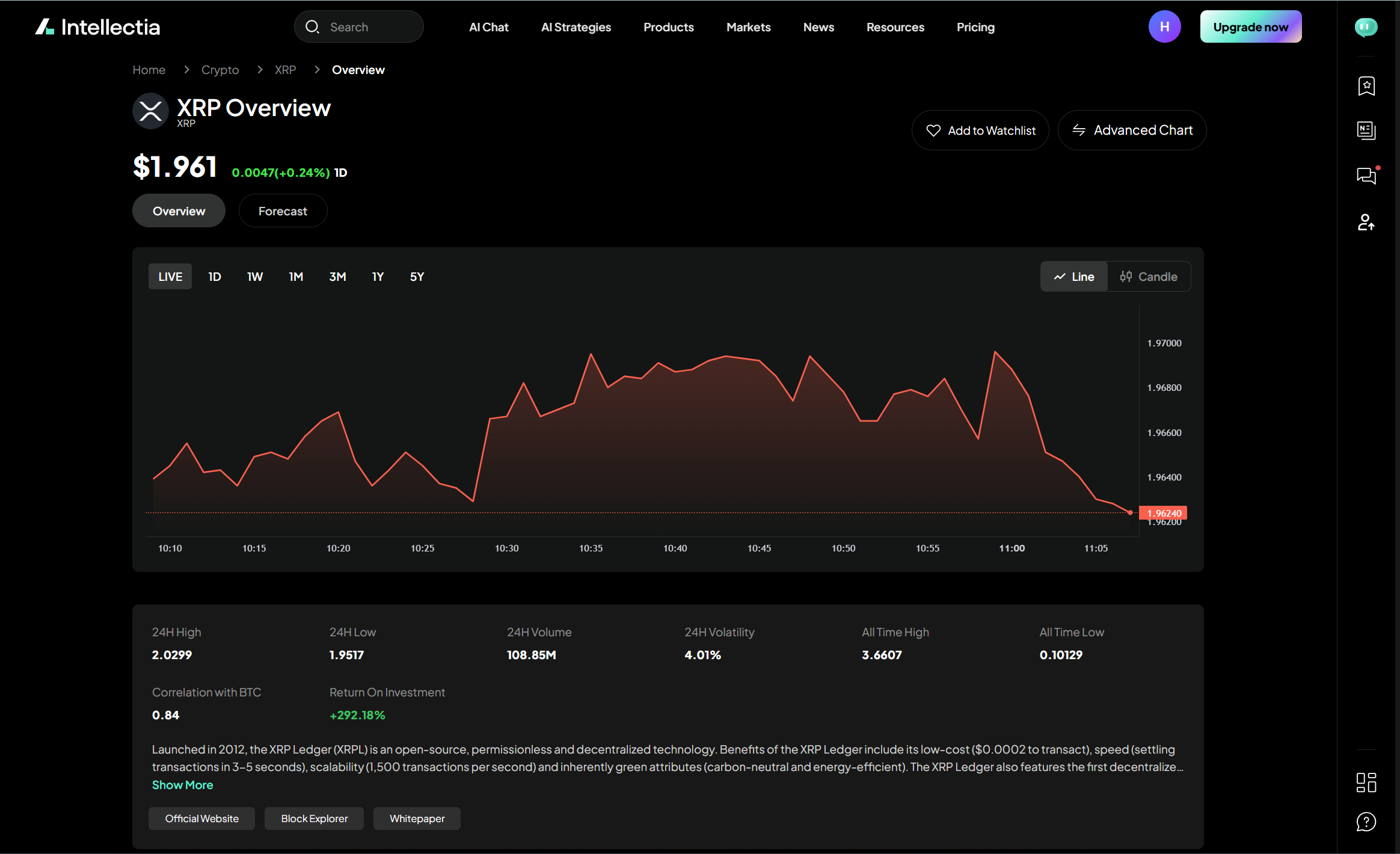

Is Ripple a good investment despite its recent price swings? XRP prices fell 22% to $2.08 in the last year. The fifth-ranked cryptocurrency showed strong returns of 235% in 2024 and beat Bitcoin's 119% gains during that time.

You should think over both short-term swings and long-term potential before investing in Ripple. XRP's market cap stands at $125.2 billion with 60.7 billion tokens in circulation. On top of that, experts see bright prospects for XRP investments. Standard Chartered Bank's Geoffrey Kendrick believes XRP could hit $12.50 by 2028, pointing to a possible 500% gain. Ripple's plan to tap into 14% of SWIFT's global transaction volume backs this growth outlook. The company aims to process about $21 trillion through RippleNet each year by 2030.

This detailed look will help you learn about XRP's future potential, how regulations affect its value, and if Ripple belongs in your 2026 investment portfolio.

What is Ripple (XRP) and how does it work?

XRP came to life in 2012 as a digital asset built for payments on the XRP Ledger—an open-source, permissionless, and decentralized blockchain technology. XRP was created to be faster, cheaper, and more eco-friendly than other digital assets. It acts as a bridge currency that makes swift cross-border transactions easier without needing central intermediaries.

XRP Ledger and consensus mechanism

The XRP Ledger runs on a consensus protocol that is fundamentally different from other blockchain mechanisms. The XRPL uses a network of independent validators who reach consensus every 3-5 seconds instead of energy-intensive mining (Proof of Work) or staking (Proof of Stake). This method delivers almost instant transaction finality while using minimal energy—similar to running an email server.

XRPL's consensus mechanism works on the principle that "a little trust goes a long way". Users pick a set of validators they trust, creating what's known as a Unique Node List (UNL). Transactions need approval from most of these trusted validators, usually about 80% consensus. This system keeps everything secure while processing transactions much faster than other blockchains.

Bitcoin's approach is different - all 100 billion XRP tokens were pre-mined when created, with no way to make more tokens. Ripple Labs received 80 billion tokens as a gift and locked 55 billion in escrow to keep XRP's supply predictable.

RippleNet and cross-border payments

RippleNet is Ripple's global network where financial institutions use distributed financial technology for live messaging, clearing, and settling transactions. Banks, payment providers, digital asset exchanges, and corporations connect here to move money smoothly worldwide.

The system comes with three key products:

xCurrent: Enables banks to process live payments

xRapid: Provides on-demand liquidity through XRP

xVia: Allows sending global payments with a single integration

RippleNet handles various business needs like international supply chain payments, global currency accounts, and live remittances. The network has attracted more than 100 financial institutions worldwide, including major players like Santander, Canadian Imperial Bank of Commerce, and Siam Commercial Bank.

How XRP is different from Bitcoin and Ethereum

XRP was built to work with banking systems, while Bitcoin aimed to replace them. This core difference in thinking leads to several key features:

XRP completes transactions in 3-5 seconds, while Bitcoin takes about 10 minutes. XRP Ledger's transaction fees cost just fractions of a penny, compared to Bitcoin's average fee of $0.80.

XRP uses its unique consensus protocol with validator nodes, unlike Bitcoin's energy-hungry Proof of Work mining. This makes XRP much more environmentally friendly.

Ethereum focuses on broader applications through smart contracts, but XRP specializes in the financial industry as a bridge currency for cross-border payments. This focused approach helps XRP excel in its specific role, making it potentially valuable for investors who believe in better international payment systems.

XRP's technology and Ripple's strategic collaborations with over 300 financial institutions worldwide make it a revolutionary force in international finance. However, many institutions use Ripple's technology without directly using XRP.

XRP's performance and market position in 2026

XRP has emerged as a major player in the digital asset space by 2026. The cryptocurrency overcame the most important market challenges and regulatory hurdles. Ripple's native token now stands out because of its cross-border payment capabilities.

Recent price trends and volatility

XRP's price showed remarkable swings through 2026. The token's value shot up after the SEC lawsuit ended and found stability between $2.00 and $2.50. This is a big deal as it means that previous performance levels, yet the price hasn't reached the bullish $5 predictions.

XRP has matured, and its price swings reflect this change. The token showed 30-day volatility of 4.2% in 2026, nowhere near its previous years' average of 7.8%. The lower volatility shows market maturity and growing institutional interest in XRP.

Your investment strategy should note that XRP's price now associates more with real-life adoption metrics than Bitcoin's movements. This break from Bitcoin shows a fundamental change in XRP's market valuation.

Market cap and trading volume

XRP's market value reached $125 billion by mid-2026, making it the fifth-largest cryptocurrency. The growth from its 2023 market cap of $30 billion has been remarkable.

Daily trading volumes now exceed $1.5 billion consistently on major exchanges. Asian markets lead the charge, with Japan, Singapore, and South Korea making up 40% of XRP trades. These numbers highlight XRP's strong presence in regions with advanced digital payment systems.

The rise of XRP/RLUSD (Ripple USD) trading pairs marks another milestone. These pairs now handle 25% of total volume, alongside traditional XRP/USD and XRP/BTC pairs. This trend shows the expanding ecosystem around Ripple's native assets.

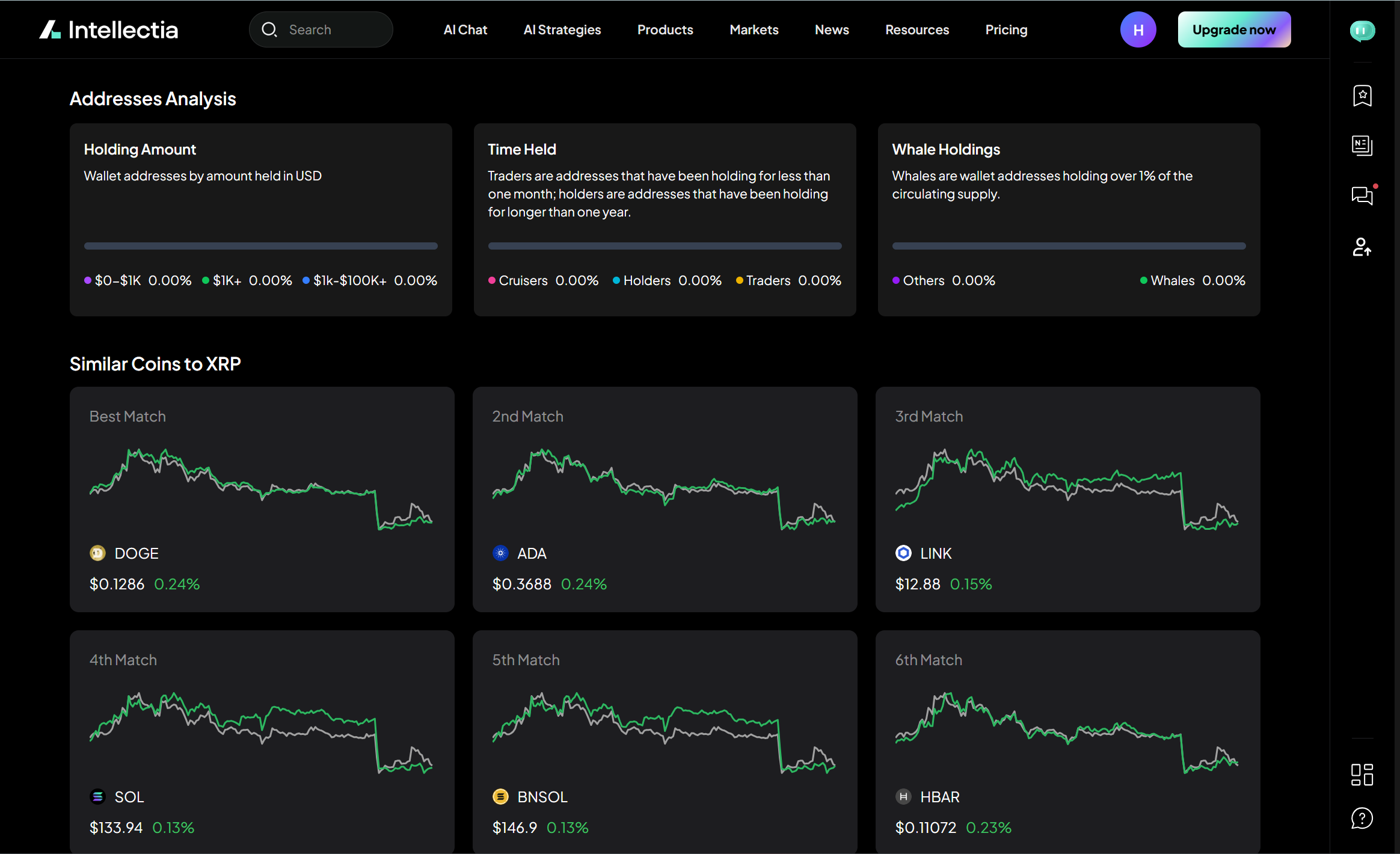

Comparison with other top cryptocurrencies

XRP offers a unique investment case compared to other major cryptocurrencies:

Performance metrics: Bitcoin managed to keep its store of value status with 15% yearly returns. XRP showed more dramatic swings with 235% gains in 2024 and a 22% drop in 2025.

Utility focus: We focused on payment efficiency and cross-border transactions. This differs from Ethereum's smart contract dominance or Solana's high-speed DeFi approach.

Institutional adoption: The core team built partnerships with over 300 financial institutions. This beats most competitors in real-life business integration. Bitcoin's institutional adoption remains investment-focused rather than utility-driven.

XRP proved tougher during market downturns than other altcoins. The early 2026 market correction saw XRP drop just 18% from its peak. Layer-1 competitors fell harder, with 30-35% losses.

XRP bridges traditional finance and cryptocurrency uniquely. Your investment decision should consider that XRP's success now depends on capturing the global remittance and cross-border payment market. This market processes over $150 trillion yearly, not on speculative trading.

Regulatory clarity: The turning point for XRP

Regulatory battles have shaped XRP's trip since 2020 and ended up being the catalyst for its investment potential. The resolution of these challenges marks a turning point for anyone thinking about if Ripple is worth investing in.

SEC lawsuit resolution and implications

The SEC's December 2020 lawsuit against Ripple Labs created years of uncertainty by alleging that XRP sales constituted unregistered securities offerings. This legal battle ended in July 2023 when Judge Torres delivered a landmark ruling that distinguished between different types of XRP sales. The court decided that institutional sales could be classified as securities, while programmatic sales to retail investors on exchanges were not securities.

The court imposed a $125 million civil penalty on Ripple in October 2024, but managed to keep that XRP itself was not inherently a security. A final $50 million settlement in May 2025 officially closed the case. Ripple could now move forward without this regulatory cloud.

Impact of new crypto-friendly SEC leadership

Paul Atkins's appointment as SEC Chair represents a fundamental change in the digital world. The SEC has moved from an adversarial stance to a more breakthrough-friendly approach toward digital assets under Republican leadership. The commission now focuses on clear guidelines rather than enforcement actions.

The SEC is reviewing six spot XRP ETF applications scheduled between October 18-25, 2026. This review process shows the agency's readiness to adopt regulated XRP investment products. Yes, it is true that Atkins' leadership has created what many call "the most crypto-positive" regulatory environment to date.

What regulatory clarity means for investors

Regulatory clarity brings multiple benefits to your XRP investment strategy. The existential threat that once loomed over XRP is gone, which establishes its legitimacy as a digital asset rather than a security. This clarity also paves the way for institutional adoption through familiar investment vehicles like ETFs.

The proposed CLARITY Act strengthens XRP's position by potentially placing it in the same regulatory category as Bitcoin and Ethereum. This legislation would exempt XRP from securities disclosure requirements and treat it as a commodity.

Clear regulations are a great way to get stability—XRP ETFs could increase liquidity and stabilize prices, which benefits both institutional and retail investors. The resolution of regulatory uncertainty lets investment decisions focus on Ripple's technology and adoption rather than legal concerns.

Institutional interest in XRP has grown by a lot. XRP is now available to investors who previously avoided it due to compliance concerns as legal barriers disappear.

Institutional adoption and ecosystem growth

XRP has finally won over institutional capital in 2026. The financial ecosystem now reaches way beyond the reach and influence of speculative trading. XRP's investment potential becomes clear through this adoption pattern.

Spot XRP ETFs and their effect

Spot XRP ETFs have shown impressive market traction. They pulled in about $1.26 billion in total net inflows without a single day of outflows. These numbers look even better when compared to Bitcoin's spot ETF market, which lost $1.50 billion during the same timeframe.

The amount of XRP held on exchanges has dropped below 2 billion tokens. This marks a sharp decline from over 4 billion in late 2025. Lower supply combined with steady ETF interest has helped keep prices stable even when markets get choppy.

Ripple's partnerships with global banks

Ripple's network now includes over 300 financial institutions spread across six continents. Key RippleNet members include:

Major banks: Santander, Canadian Imperial Bank of Commerce, SBI Remit

Regional powerhouses: Siam Commercial Bank (Thailand), Axis Bank (India)

Digital innovators: Zand Bank (UAE's first fully digital bank)

The numbers tell an impressive story - 40% of these 300+ institutions now use XRP for On-Demand Liquidity in real transactions. They've moved past testing and into actual implementation.

Role of Ripple USD (RLUSD) in the ecosystem

Since its December 2024 launch, Ripple USD has grown faster to exceed $1.30 billion in circulation. This stablecoin backs every token with real assets and stays equal to one US dollar.

RLUSD fixes a vital adoption challenge. Banks can now settle transactions with stable value while XRP provides quick liquidity between currencies. This two-asset strategy helps solve the volatility issues that stymied institutional adoption during early trials.

Mastercard pilot and other fintech integrations

Through collaboration with Mastercard, WebBank, and Gemini, XRP moves closer to mainstream use. The partnership explores RLUSD on the XRP Ledger to settle fiat credit card transactions with stablecoins.

The pilot started in November 2025. It stands out as one of the first examples where a regulated US bank settles regular card payments using a regulated stablecoin on a public blockchain. WebBank brings its FDIC-insured status to the table. This turns blockchain from a compliance worry into a tool for backend efficiency.

These developments show investors that XRP has evolved. It's no longer just a theoretical solution - it's becoming real financial infrastructure that institutions actually need.

XRP price predictions and investment outlook

XRP price forecasts show dramatic variations based on how analysts view adoption, regulatory environment, and market conditions.

Conservative vs. bullish forecasts

XRP prices could reach between $2.20 and $3.00 by end-2026 according to conservative projections that expect modest ETF success with limited utility gains. The bullish outlook paints a different picture with targets of $8.00 by 2026. This represents a 250% jump from current levels and pushes the market cap close to $500 billion.

Expert opinions on XRP's future

Standard Chartered leads the pack with optimism. Their analyst Geoffrey Kendrick sees XRP hitting $8.00 by end-2026, $5.50 in 2025, and $12.50 by 2028. These numbers assume ETF inflows will reach $10 billion throughout 2026. Options-based analysis shows XRP has a 25% chance to finish above $2.40 and a 10% chance to exceed $3.90 by December 2026.

Is Ripple worth investing in for 2026?

Your investment strategy should think about three key scenarios. A conservative case sees $3.00 with modest ETF success. The base case projects $3.90-$5.12 with steady inflows. A bullish case targets $8.00 but needs $10 billion in ETF investments. The $4.00 mark needs perfect execution across regulatory, adoption, and macro fronts.

How much XRP could grow by 2030

XRP might reach $12.00-$15.50 by 2030 as it enters its mature growth phase. Some analysts see potential peaks between $15.00-$48.00 by decade's end. These numbers depend heavily on XRP capturing much of the SWIFT payment volume.

Conclusion

XRP has reached a turning point in 2026. It has evolved from a regulatory question mark into a legitimate financial asset backed by institutions. The analysis shows XRP's value comes from its real-life utility, not just speculation. The SEC lawsuit's resolution became the biggest catalyst for XRP's investment case and removed the barriers that kept institutions away.

The numbers tell an interesting story. XRP achieved 235% returns in 2024, though prices fluctuated afterward. The current price sits at $2.08, but experts see room for growth. Standard Chartered projects an ambitious target of $12.50 by 2028. This growth depends on wider adoption and good market conditions.

More than 300 financial institutions now use RippleNet, proving its real-life value. The new Ripple USD creates a system where XRP provides liquidity and RLUSD brings stability. Banks that worried about crypto price swings now have a solution through this two-asset approach.

Your risk tolerance and investment timeline should guide your decision to invest in XRP for 2026. Cautious investors might like XRP's clearer regulations and bank partnerships. Those comfortable with risk could focus on possible gains if Ripple captures even a small part of its targeted 14% of SWIFT's global transactions by 2030.

XRP makes sense as part of a diverse crypto portfolio. While many digital assets still look for uses, Ripple has found its purpose in making cross-border payments better. This clear focus, along with regulatory certainty and institutional support, makes XRP stand out in 2026's digital asset world.