Key Takeaways

- You can supercharge your wealth growth by harnessing compound interest through consistent investing in diversified assets like stocks and ETFs.

- Exploring the best investments to grow money means balancing high-reward options like crypto with stable ones like high-yield savings.

- Passive income strategies, such as dividend stocks, let your money work for you without daily effort.

- How to invest to grow wealth starts with AI-powered tools from Intellectia.ai, which deliver personalized stock picks and trading signals to spot opportunities fast.

- Finally, always pair growth tactics with risk management, like diversification and AI-driven analysis, for sustainable long-term gains.

Introduction

Ever feel like you're hustling hard but your bank account isn't keeping up? You're not alone—many of us stare at rising bills and dream of financial freedom, only to get stuck in the cycle of low savings and missed opportunities. That's the problem: without a clear path, growing your money feels overwhelming, especially with market ups and downs.

I've been there, watching friends chase get-rich-quick schemes that flop, while the real game-changers—like steady compounding—slip by. But here's the aggregate truth: everyday folks just like you are turning modest investments into serious wealth by focusing on timeless principles and smart tools.

The one who's dabbled in trading and seen the power of data-driven decisions, know expertise comes from blending basics with tech. That's where the solution shines: platforms like Intellectia.ai use AI to simplify stock and crypto analysis, predict prices, and hand you tailored trading strategies.

Understanding Wealth Growth Basics

Imagine planting a small seed today and watching it grow into a towering tree—that’s the essence of wealth growth basics. To make your money work harder, you need to master a few core principles that are simpler than they sound. Let’s break them down so you can start applying them to your financial journey right now.

First, compound interest investing is your secret weapon for growing money fast. It’s like a snowball rolling downhill, gaining size and speed. When you earn returns not just on your initial investment but also on the interest it generates, your wealth multiplies exponentially. For example, investing $200 a month at a 7% annual return could balloon to over $500,000 in 40 years. Platforms like Intellectia.ai's AI stock picker help you pinpoint stocks or ETFs primed for this kind of growth, saving you hours of research.

Diversification is your safety net—never put all your eggs in one basket. Spread your investments across stocks, bonds, real estate, and even crypto to cushion against market dips. A balanced portfolio might allocate 50% to stocks, 30% to bonds, and 20% to alternative assets.

Your time horizon is another critical piece. The longer you stay invested, the more compounding works its magic. If you’re young, lean into growth stocks for higher returns. Closer to retirement? Opt for safer bets like bonds or dividend stocks for passive income strategies.

Consistency ties it all together—invest regularly, even small amounts, to build momentum. Want to dig deeper? Check out Investopedia’s guide on compounding for a detailed breakdown. By mastering these principles, you’re not just saving—you’re setting the stage for exponential wealth growth. It’s about strategy, not luck, and you’re already on the right path.

Investment Options to Grow Your Money

Now that you’ve got the foundation, let’s explore the best investments to grow money. You’ve got options galore, from steady growers to high-octane choices, and I’ll guide you through them so you can pick what fits your goals and risk tolerance.

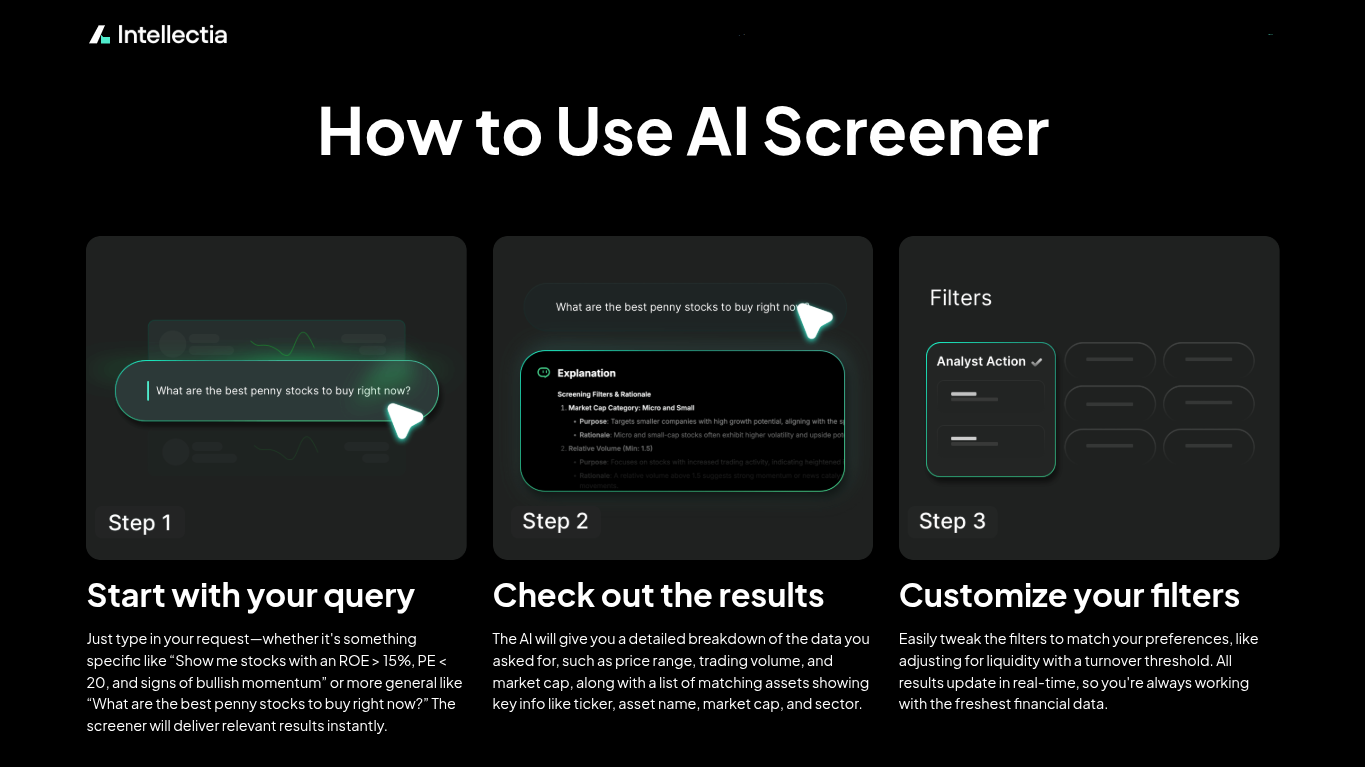

Stocks are a go-to for wealth-building tips. Blue-chip companies like Microsoft or Apple offer stability, growth, and dividends for passive income strategies—think 2-3% yields plus 10% annual appreciation. New to the game? Use Intellectia.ai’s AI Screener to filter for stocks with high return-on-equity and low price-to-earnings ratios in seconds. It’s like having a Wall Street analyst in your pocket.

Exchange-traded funds (ETFs) are perfect for beginners. They’re low-cost, instantly diversified, and track markets like the S&P 500, averaging 10% yearly returns. Vanguard’s VOO or SPY funds are rock-solid picks. You can set and forget, letting your money grow without micromanaging.

Real estate investment trusts (REITs) let you tap into property markets without buying a house. They pay 4-6% dividends and often appreciate, offering a sweet mix of income and growth. Curious about crypto? Intellectia.ai’s Crypto Technical Analysis tracks trends in Bitcoin or Ethereum, helping you time entries for maximum gains.

For low-risk options, high-yield savings accounts or certificates of deposit (CDs) offer 4-5% APY, outpacing inflation. They’re perfect for parking cash you might need soon. A balanced approach? Try 50% stocks/ETFs, 25% REITs, 15% crypto, and 10% cash. Monitor your portfolio with Intellectia.ai’s Stock Monitor for real-time alerts on price shifts or news.

For more on REITs, explore NAREIT’s beginner guide. These options aren’t one-size-fits-all, but they’re proven paths to stack your wealth. Start small, experiment, and scale up as you gain confidence.

Leveraging AI Tools for Growth

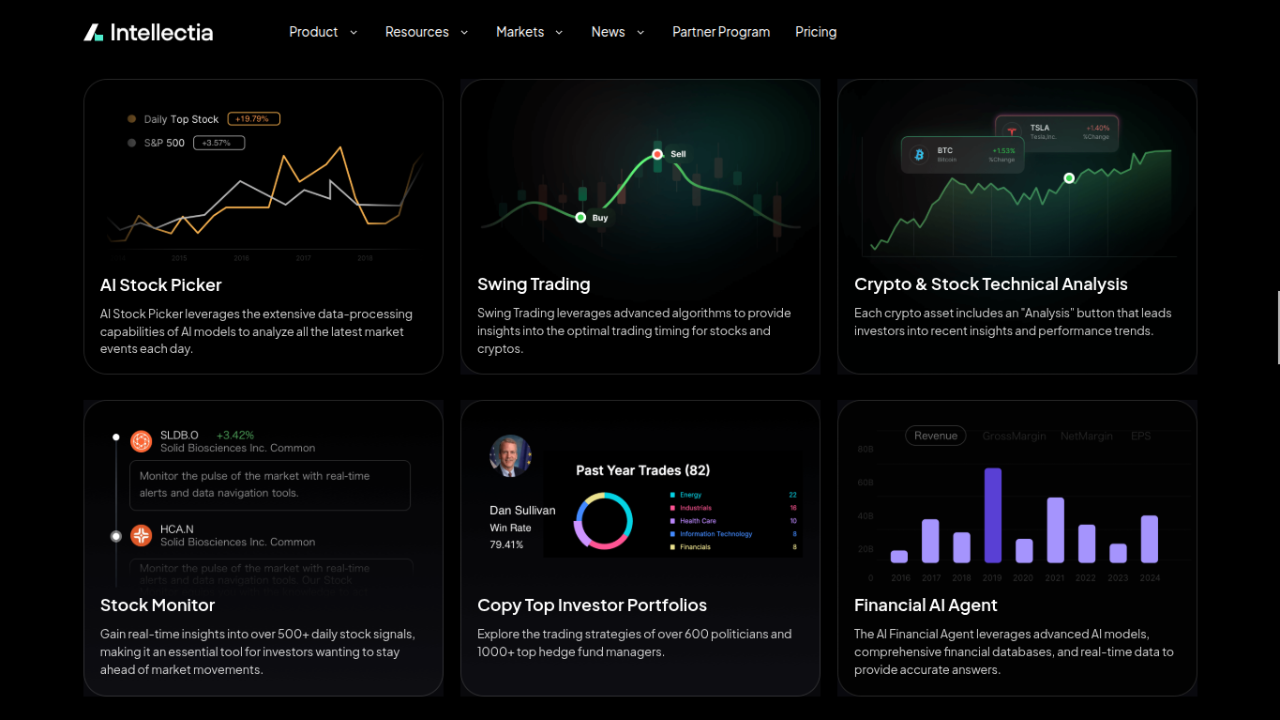

What if you could have a financial advisor who never sleeps, crunching data to spot winners before you finish your coffee? That’s the power of AI tools for growth, and Intellectia.ai is your ticket to smarter investing. Let’s unpack how you can use their platform to supercharge your wealth.

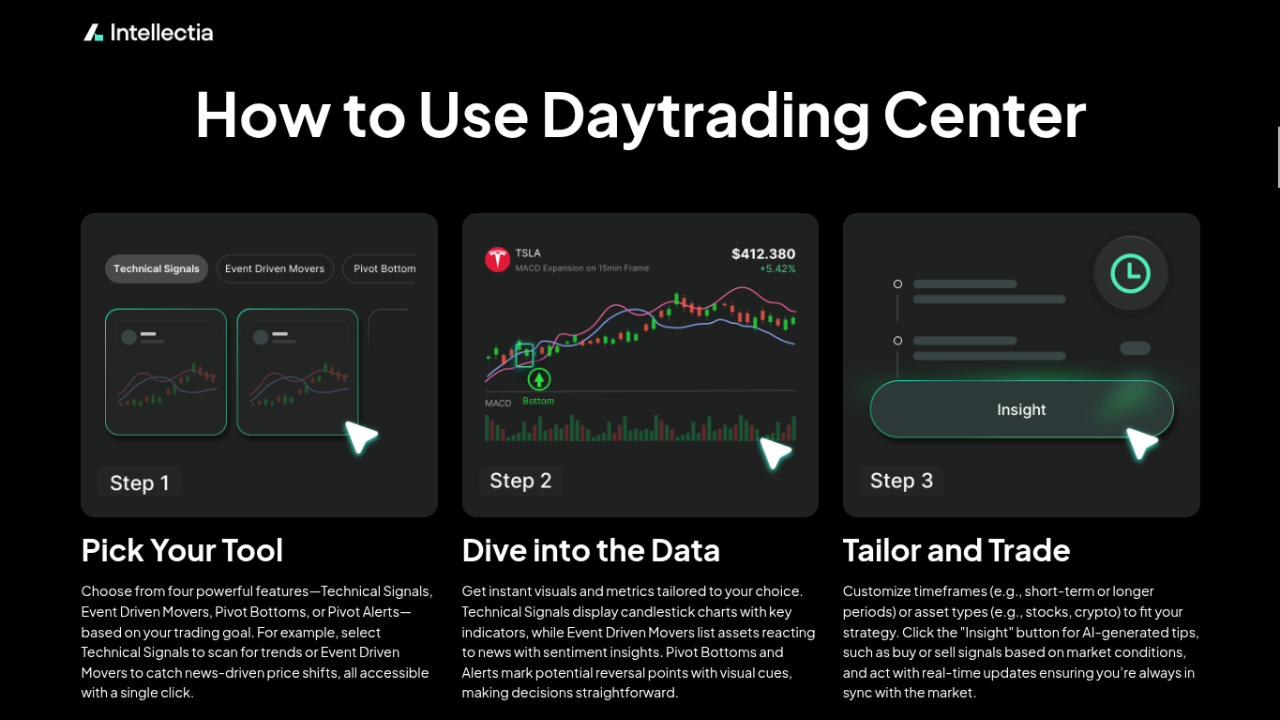

Intellectia.ai’s Swing Trading feature uses advanced XGBoost algorithms to deliver precise entry and exit signals, backtested for high win rates—think 60%+ accuracy on short-term trades. It’s perfect for capturing quick gains without emotional guesswork. For day traders, the Daytrading Center scans for pivot bottoms, breakout patterns, and event-driven movers, helping you snag intraday profits like a pro.

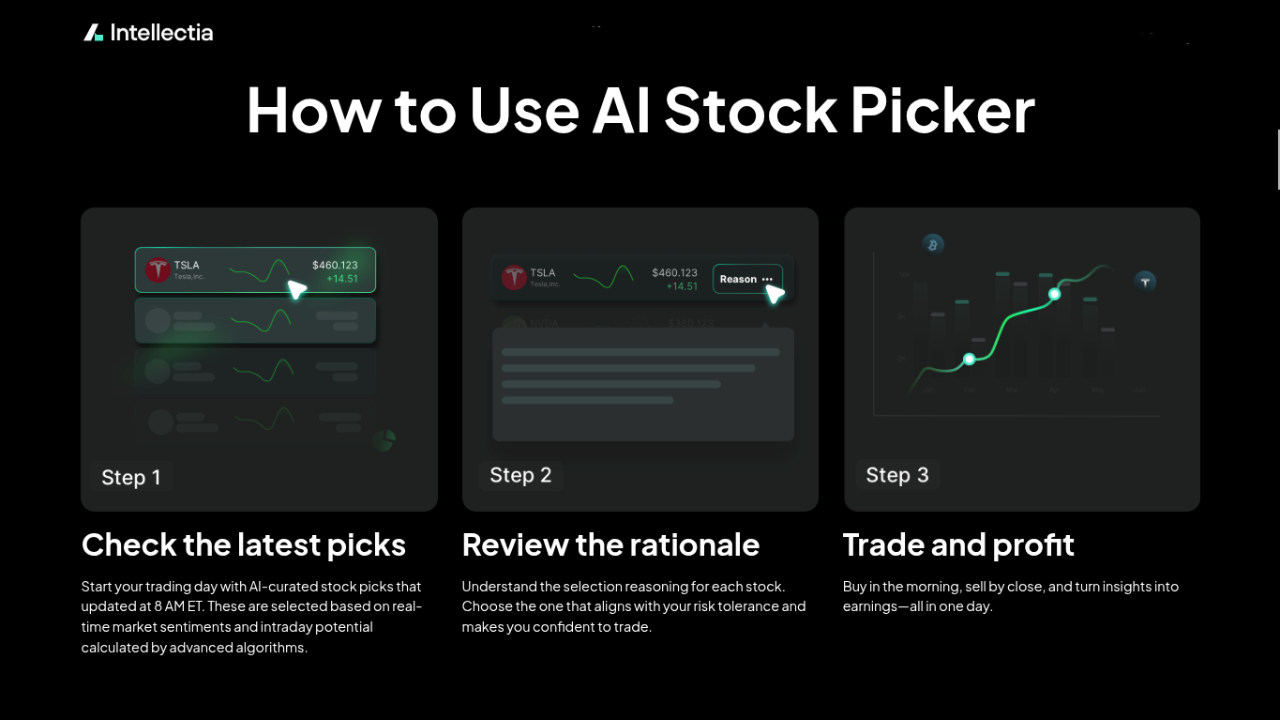

The AI Agent is like chatting with a seasoned broker. Ask it to analyze Tesla’s momentum or Ethereum’s next move, and it delivers instant, data-backed insights. Need stock picks? The AI Stock Picker sends daily recommendations at 8 AM ET, leveraging large language models to outperform market benchmarks. Pair it with Stock Technical Analysis, which crunches over 100 indicators across 10,000 assets, from RSI to MACD, to fine-tune your trades.

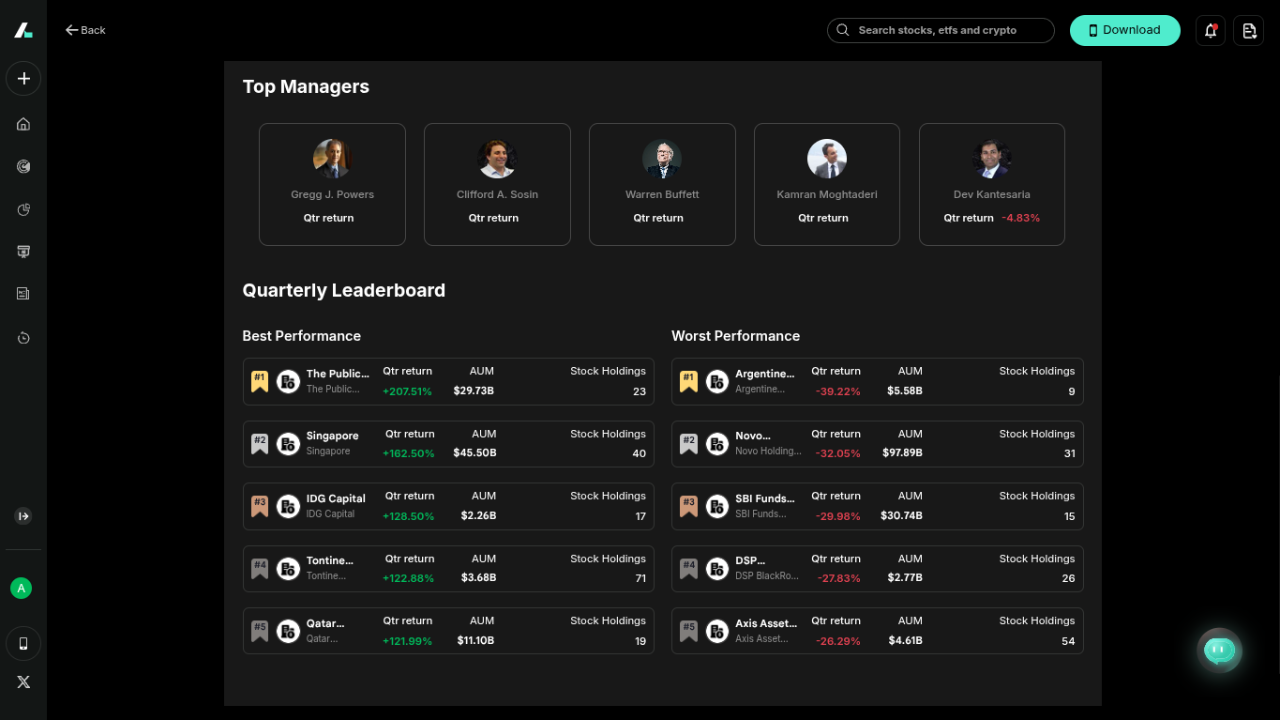

Crypto fans, don’t sleep on Crypto Technical Analysis for real-time trend spotting. Users report 20-30% portfolio boosts by following Intellectia.ai’s signals—proof that AI turns ways to grow your money into reality. Want to see the bigger picture? Check out Forbes’ take on AI in investing. With Intellectia.ai, you’re not just investing—you’re outsmarting the market with precision and ease.

Managing Risks While Growing Wealth

Chasing growth without a safety net is like driving without brakes—you might go fast, but a crash could wipe you out. Managing risks while growing wealth is non-negotiable, and I’ll show you how to balance reward with security so your money keeps growing safely.

Diversification remains your strongest shield. Cap any single stock or crypto at 5% of your portfolio to avoid a single bad bet tanking your wealth. Use Intellectia.ai’s Hedge Fund Tracker to mimic billionaire moves, like Ray Dalio’s all-weather strategy, without the hefty fees.

Set stop-loss orders—say, sell if a stock drops 10%—to protect your downside. Intellectia.ai’s Earnings Trading feature flags stocks likely to swing post-earnings, so you can dodge volatility traps.

Know your risk tolerance: in your 20s? You can afford to swing at crypto or growth stocks. Nearing 60? Shift toward bonds or dividend aristocrats for stability. The AI Agent customizes advice to your age, goals, and risk appetite, ensuring you’re not overexposed.

Rebalance annually—sell high, buy low—to keep your portfolio aligned. Stay ahead of market sentiment with Intellectia.ai’s News feed, which tracks breaking headlines that could sway your picks. For a deeper dive, read Vanguard’s risk management guide.

Smart risk management isn’t about playing it safe—it’s about growing your money sustainably. With these strategies and Intellectia.ai’s tools, you’ll build wealth without losing sleep.

Building Wealth: Key Steps to Grow Your Money

You’re ready to turn knowledge into action. Building wealth is about clear, repeatable steps that anyone can follow. Here’s how to grow your money with confidence, blending strategy, discipline, and a sprinkle of AI magic.

Step 1: Define clear goals. Build a $10,000 emergency fund first, then aim for growth targets like $1M by retirement. Write them down—specificity fuels action.

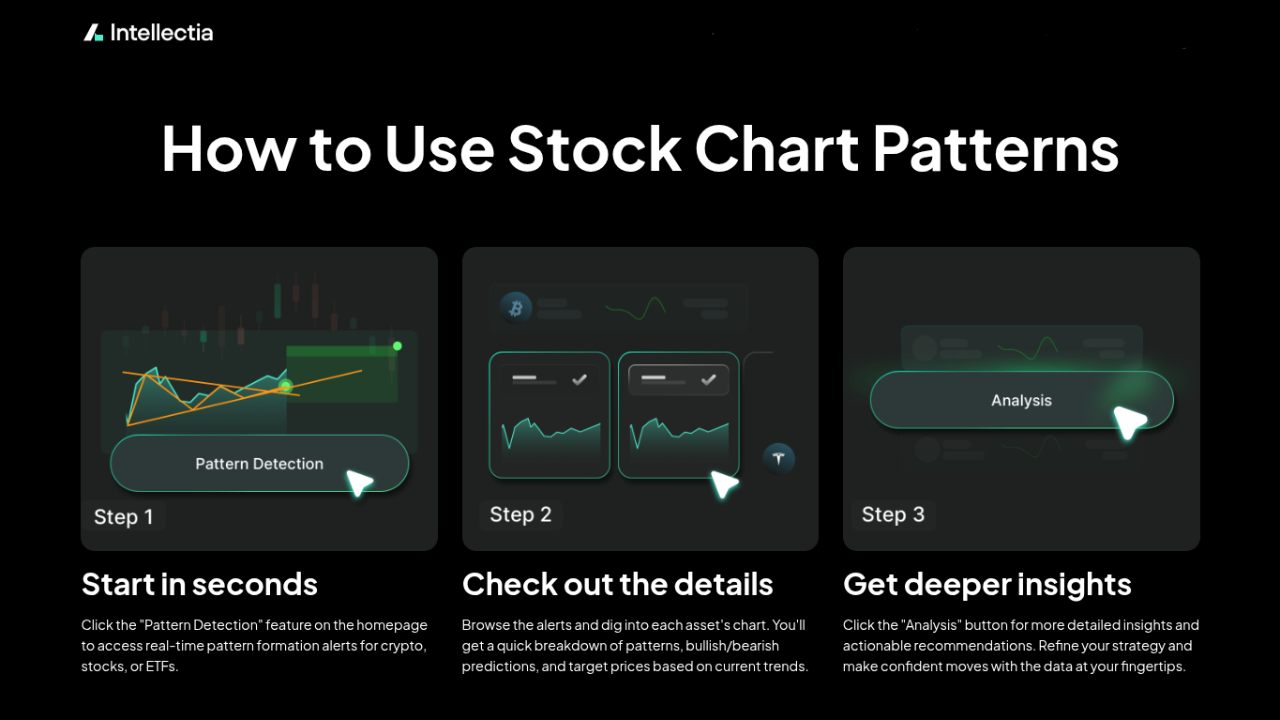

Step 2: Budget like a boss. Automate 20-30% of your income to investments. Apps like Mint track spending, but Intellectia.ai’s Stock Chart Patterns adds visual cues to spot breakout stocks for your next move.

Step 3: Educate yourself. Read classics like “The Intelligent Investor” or follow Intellectia.ai’s Blog for AI-driven market insights. Knowledge is your edge.

Step 4: Invest consistently. Dollar-cost average into ETFs or stocks via Intellectia.ai’s AI Screener to smooth out market bumps. Even $100 a month adds up.

Step 5: Review and tweak. Check your portfolio quarterly, using Intellectia.ai’s Swing Trading signals to optimize entries and exits.

Step 6: Scale smartly. As your confidence grows, explore REITs or crypto with Crypto Technical Analysis for data-backed timing.

Step 7: Stay grounded. Once your wealth grows, give back—charity or mentorship keeps your perspective sharp.

Growing your money requires a mix of strategic investing, diversification, and leveraging time through compounding. AI tools like Intellectia.ai can enhance investment decisions by providing data-driven insights and personalized strategies. Balancing risk with growth potential is crucial for sustainable wealth-building. Consistent, long-term investing is the foundation for significant financial growth.

You don’t need a finance degree—just discipline and the right tools. Start today, and you’ll be amazed at where you land.

Conclusion

You’ve got the full playbook now: master compounding and diversification, choose smart investments from stocks to crypto, leverage Intellectia.ai’s AI tools for precision, and always manage risks to protect your gains. These wealth-building tips aren’t just ideas—they’re proven steps to turn your financial dreams into reality. Whether you’re starting with $100 or $10,000, consistency and smart choices will compound your wealth over time.

Don’t wait for the “perfect” moment—your future self deserves action now. Visit Intellectia.ai’s Sign Up and subscribe for daily AI stock picks, trading signals, and market analysis. With tools like the AI Stock Picker and Daytrading Center, you’ll spot opportunities others miss. Take control, start small, and build big!