Key Takeaways

- Travel stocks are exhibiting high recovery prospects on international reopenings.

- Tools such as Intellectia AI screener can assist you in finding winning travel investments.

- Diversifying into sectors such as airlines, hotels, and online booking sites is essential.

- The outstanding performers to be monitored are BKNG, ABNB, RCL, MMYT, and MAR.

- Intellectia.ai provides day and swing trading signals based on AI to better time the entry and exit of positions for travel stocks.

Introduction

Have you ever had the feeling that the travel industry is about to blow up - once more? You are not alone. As the world continues to open back up to travel and online booking services playing a key role, travel stocks are becoming promising selections to add to your portfolio. Yet there are so many options these days: how do you decide where your money is to be placed among the cruise lines and small hotel chains?

It is here that intelligent tools like Intellectia AI come into play. You can uncover the best travel stocks before they make the headlines using AI-driven stock screening, trade signals, and sentiment analysis. How do we navigate the thrilling world of travel investing as an experienced trader or just starting out? Let us take a look.

What Are Travel Stocks

Travel stocks refer to companies that engage in travel and tourism worldwide. This includes:

Airlines – like Delta or United

Cruise lines – such as Royal Caribbean

Hotels and resorts – like Marriott and Hilton

Online travel agencies - such as Booking.com and Airbnb

Traveling services and websites - such as MakeMyTrip or Expedia

These stocks are mostly cyclical, i.e., they improve when people spend more on traveling and decline in recession, giving traders and investors an eye on the trend and a good trading opportunity.

Why Invest in Travel Stocks

Travel stocks could be a nice asset to your portfolio if you want to enjoy the economic recovery trends and capitalize on future growth opportunities. So why are they beautiful these days:

Post-Pandemic Rebound

International travel is recovering at a high rate since most of the international barriers have been removed, which has spurred a robust tourism sector across the globe. Both corporate and leisure travel are growing, increasing revenues on airlines, hotels, and online travel services.

Cyclical Upside

The travel industry is cyclical, generally performing better during economic booms. This creates opportunities in short-term trading for those who can time the cycles.

Digital Transformation

Online booking agents and technology providers in the travel sector are transforming how individuals plan and undertake their travel. Such innovations promote the development of users, operational effectiveness, and scalability in the long run.

Brand Strength

Well-established travel brands like Marriott and Booking.com can promise guarantees, repeated clients, and a dividing chance. They have solid brand equity, enabling them to dominate the market, even during the down periods.

Criteria for Selecting Best Travel Stocks

Not every travel stock is equally valuable or promising. To find smart picks, pay attention to businesses that qualify based on these criteria, and look to Artificial Intelligence Screener and Technical Analysis tools from Intellectia to speed up your process.

Strong Revenue Growth Post-Pandemic

Seek out businesses that break even and are making more than before the pandemic. That indicates high demand and a good recovery to normalcy.

Healthy Balance Sheets With Manageable Debt

Firms that are highly liquid and lowly indebted can better survive a recession. It also leaves them with the flexibility of expansion or technology upgrades due to a good balance sheet.

Brand Recognition & customer loyalty

Famous brands such as Marriott or Airbnb are more likely to gain clients. This brand equity helps to provide stability over performance and pricing.

Diverse International Presence

Companies in more than one region are less susceptible to regional economic downturns. Exposure on a global level assists in diversifying risk and seizing growth opportunities in emerging markets.

High Booking Volumes And Demand Trends

The stocks related to platforms or services that increase booking volume are more likely to produce consistent revenue. It is a robust sign of consumer confidence and growing demand.

Digital Capabilities And Invention

Travel companies are taking advantage of technologies such as mobile apps, automation, and AI to enhance customer experience and streamline expenses. This innovation aids them in scaling and remaining competent.

5 Best Travel Stocks

Company | Ticker | Sector | Market Cap | Key Strengths |

|---|---|---|---|---|

| Booking Holdings | BKNG | Online Travel Agency | $120B+ | Global scale, strong earnings, dominant OTA |

| Airbnb | ABNB | Vacation Rentals | $90B+ | Asset-light model, strong millennial brand |

| Royal Caribbean | RCL | Cruise Lines | $25B+ | Industry rebound, strong booking momentum |

| MakeMyTrip | MMYT | Online Travel India | $5B+ | Strong growth in India’s travel boom |

| Marriott Int’l | MAR | Hotels & Resorts | $65B+ | High occupancy rates, strong brand network |

Bookings Holding (BKNG)

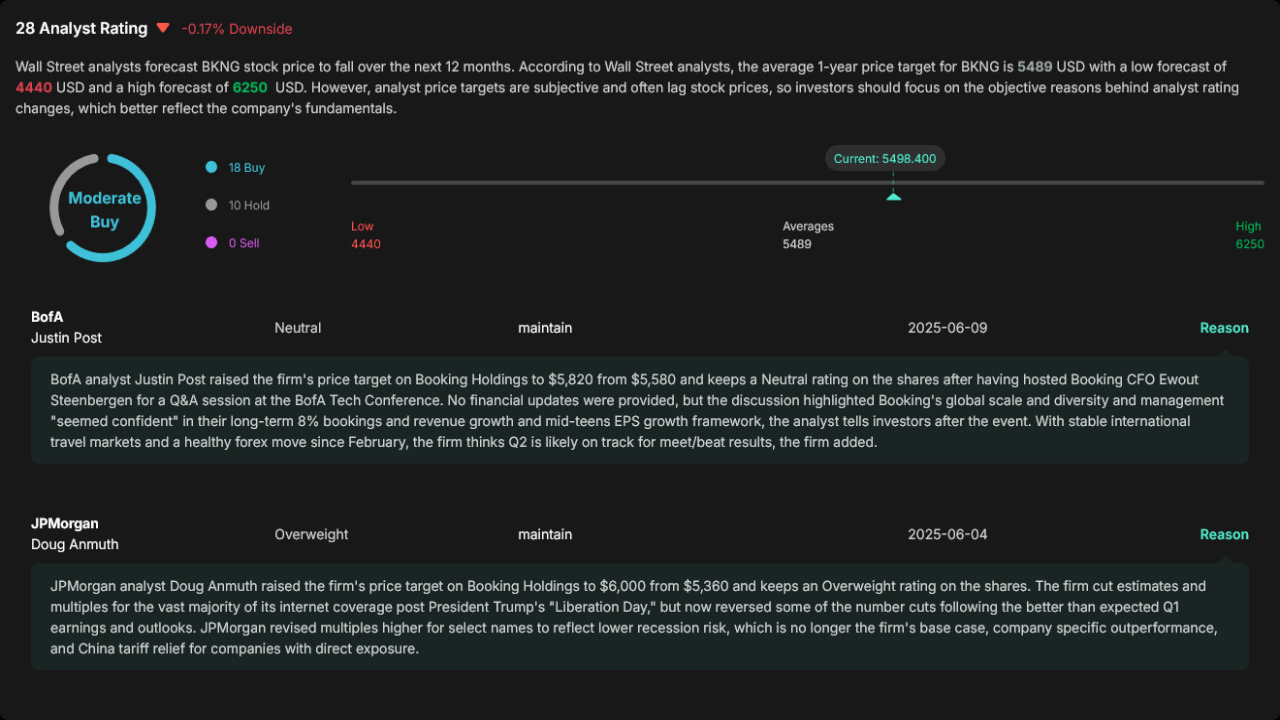

Booking Holdings is an international online travel booking company that controls brands such as Booking.com, Priceline, and Kayak. BKNG is a Moderate Buy at current prices, suggesting the mid-term technical indicators are bullish with an average daily volume of approximately 1.3 billion.

BKNG is unique because it has an extensive global presence and a history of earnings beats, with EPS rising 44% in Q1 2025 and far exceeding expectations. With the technical description of Intellectia, which noted the upward trends and reasonably high allocations and demand levels, BKNG would become a stable investment with growth opportunities for a diversified investor.

Airbnb (ABNB)

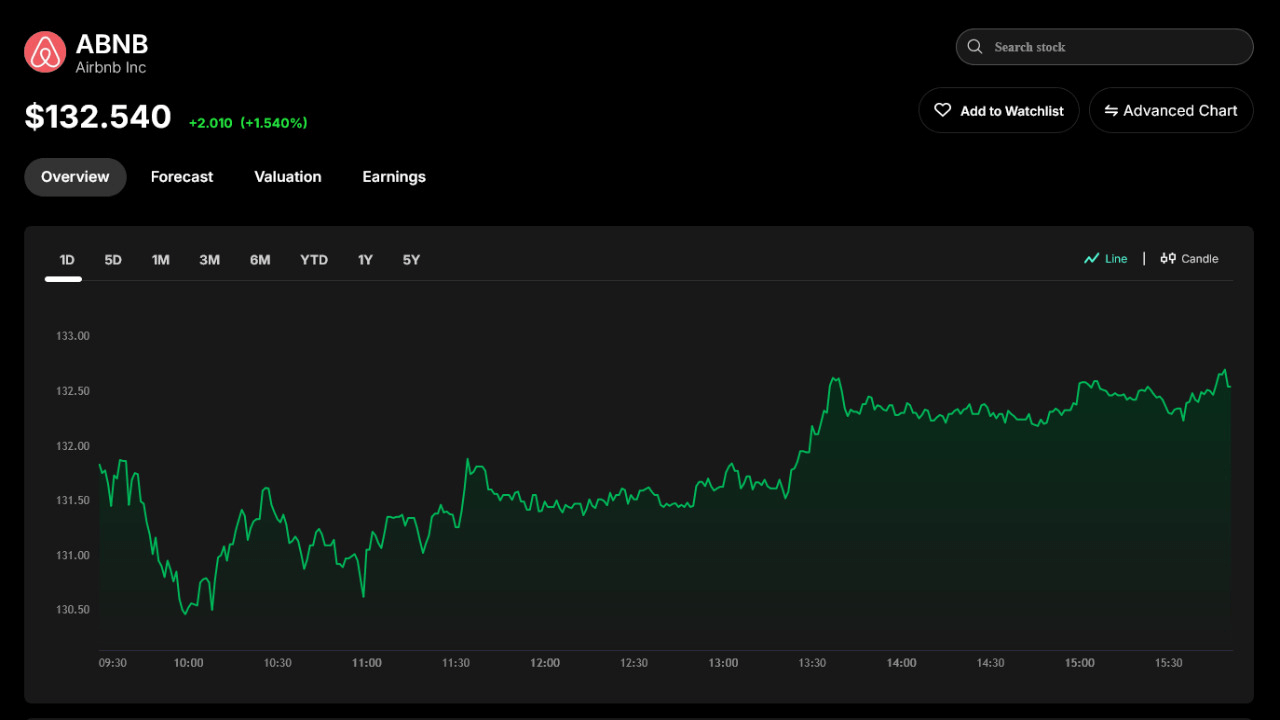

Airbnb is a vacation giant that has gained a modular, asset-light, and highly scalable business model endorsed by millennials. Although Airbnb (ABNB) has a 52-week range of -13.5%, the stock has consistent weekly volatility of 7%. Bernstein recently reaffirmed its Bullish rating of ‘Outperform’ consisting of a target price of 185, due to high growth and improving fundamentals- upward analyst revisions also confirm the favorable reasoning about future increase in value.

Airbnb stands out due to its high brand equity, international presence, and constant innovation outside regular renting; the fact that its CEO Chesky has taken the new step of extending the platform will further reinforce the path to its future success. The technical indicators of Intellectia identify a consistent pace; therefore, ABNB is an interesting choice for investors interested in growth.

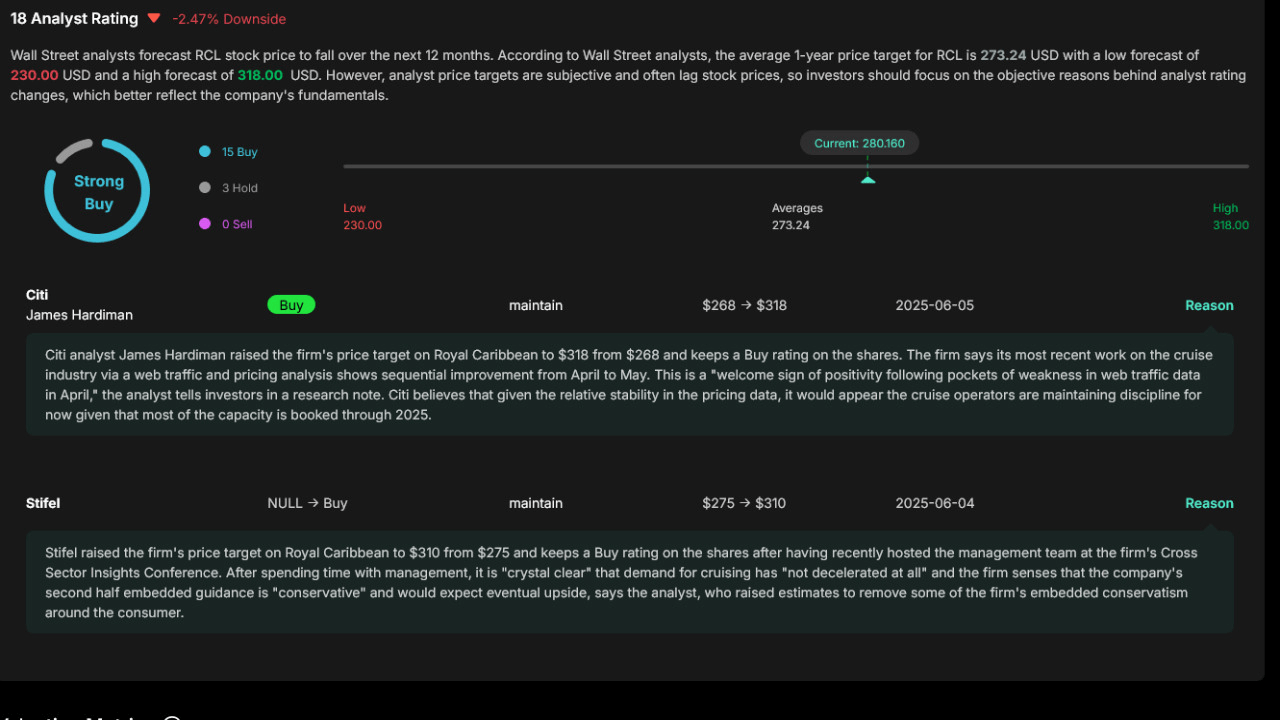

Royal Caribbean Cruises (RCL)

Royal Caribbean is on a cruise industry rebound and currently has a forward P/E of ~12.9, which is in the range of valuation dubbed 941371 USD within Intellectia. The technical analysis inclination is overweight towards Strong Buy, with strong indicators on RSI and moving averages.

Having recently outperformed 94 percent of leisure stocks and with a strong trend momentum, RCL stands above the industry with a top-tier performance that conforms with positive signals and a favorable valuation to make it a great cyclical travel recovery play.

MakeMyTrip (MMYT)

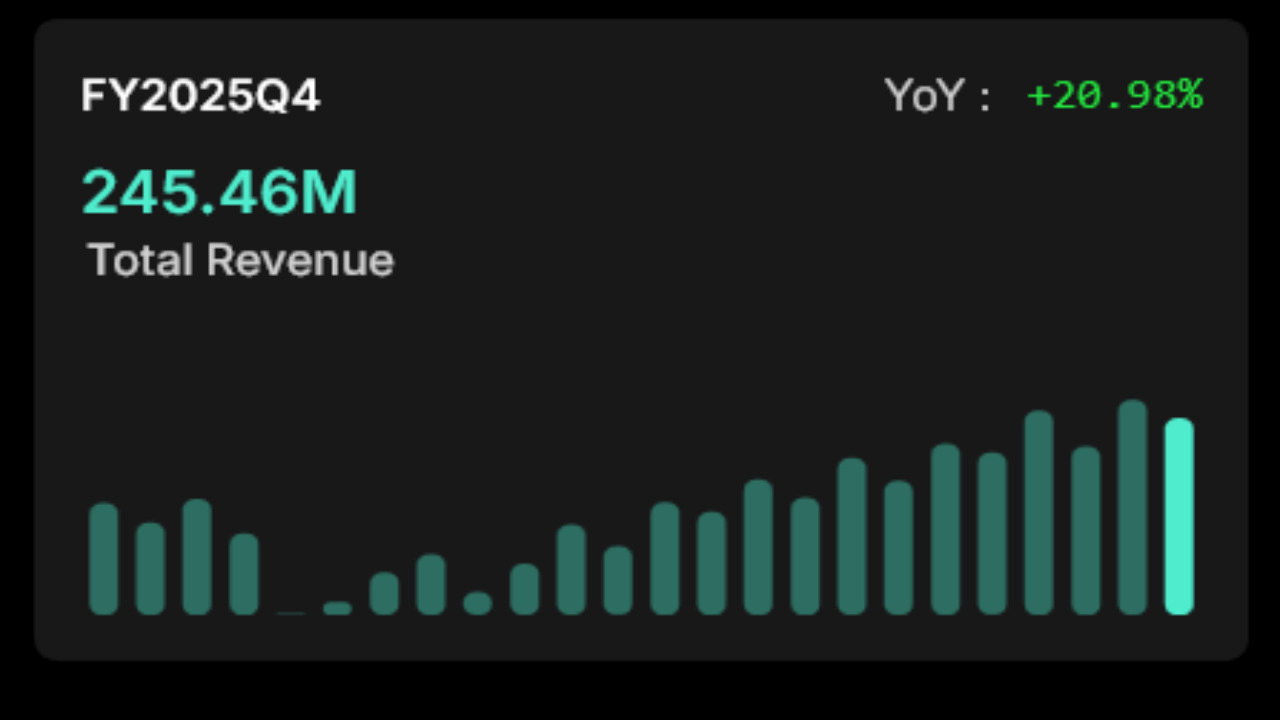

The Indian OTA, MakeMyTrip, is in an excellent position in a highly fast-growing travel marketplace. Intellectia emphasizes seasonal power with a 72% probability of generating profitable results in June and 80 percent in November. The analysts view the company as having a potential 34 Percent upside with an average price target of 122 dollars per share.

One of the reasons why MMYT is the standout is because of the extremely growth-worthy travel segment in India that is projected to grow at a gross booking in excess of 2.5x to ~$245.6 million by FY25Q4. Though its short-term technical fortunes are relatively weak, its long-term growth and discount potential can make it interesting to value investors who time entry on Intellectia signals.

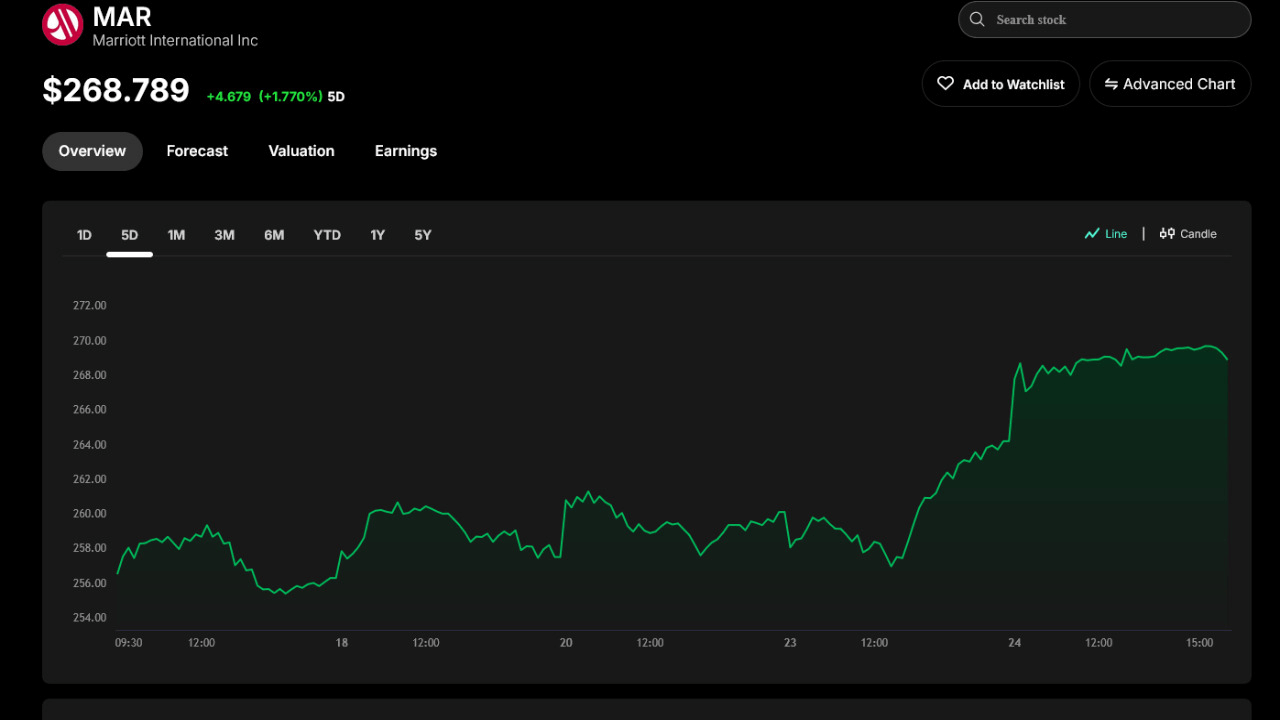

Marriott International (MAR)

Marriott is a five-star international hospitality brand with a strong following and loyal members. They have a 6-10 percent price upside in the next 12 months (at ~$280) and a consensus rating of Moderate Buy.

MAR provides modest earning opportunities with dividends and an international presence. Continued technical tracking of Intellectia Stock Monitor is picking up essential action moves that allow investors to maximize their entry moments on this steady blue-chip option.

Investment Strategies for Travel Stocks

Are you prepared to take action? Here are some clever strategies:

1. Increase Sub-Sector Diversification

Combine cruise lines, hotel chains, and internet agencies to balance risk and reward.

2. Make Use of AI-Powered Screening Instruments

Use Intellectia's AI Screener to find best travel stocks by analyzing analyst consensus, earnings growth, and price momentum.

3. Use AI Signals to Determine Timing

To take advantage of short-term and swing trading opportunities, particularly during earnings seasons or news events, use AI Trading Signals to get real-time buy/sell signals.

4. Long-Term versus Short-Term Planning

For medium-term gains, use the Swing Trading feature; for high-frequency opportunities, use the Day Trading tools.

Conclusion

Travel stocks are making a comeback - and they are rapidly changing. Whether they are focused on innovative technology-enabled businesses, such as Airbnb, or established brands, such as Marriott, any investor can find something in this sector. Whether you're here to play the long game or catch short-term waves, your edge lies in data and precision.

That is where Intellectia AI becomes your copilot. Register now to receive real-time alerts, daily AI stock picks, AI-generated signals, and performance monitoring to stay on track with the market.