Key Takeaways

- Learn the key criteria like revenue growth and innovation to pick the best AI companies to invest in.

- For Alphabet, AI enhancing Search via innovative features like AI Mode and Overviews, boosting YouTube and subscriptions, while Cloud expanded through comprehensive AI portfolios.

- NVIDIA delivered a record quarter in data centers via Blackwell's adoption and full-stack solutions for cloud and enterprises.

- Amazon is leveraging generative AI in AWS alongside robotics for efficiency, underscoring AI's early transformative potential in enterprise operations.

- Finally, balance risks like high valuations with diversification for smarter AI growth stocks in your portfolio.

Introduction

Have you ever felt overwhelmed trying to spot the next big winners in the stock market, especially with AI changing everything so fast? It's frustrating when you miss out on massive gains because the hype drowns out solid opportunities, leaving you second-guessing your choices. But imagine having expert insights drawn from real earnings data and market trends to guide you. That's where platforms like Intellectia.ai come in, offering AI stock analysis and predictions to cut through the noise. By using tools like the AI stock picker, you can identify top AI stocks 2025 with confidence, turning potential pitfalls into profitable moves—just like how savvy investors capitalized on early AI booms.

Why Invest in AI Stocks?

You might be wondering if now's the right time to jump into AI stocks, and the answer is a resounding yes. The AI market is on fire, projected to hit $1 trillion by 2031 with a 26.6% compound annual growth rate. This explosive growth stems from AI transforming industries like healthcare, finance, and entertainment, creating endless opportunities for investors like you.

Think about how AI is already boosting efficiency and innovation everywhere. For instance, companies are pouring billions into AI infrastructure, with global spend expected to reach $3-4 trillion by the decade's end, as highlighted in recent earnings calls. This isn't just buzz—it's real demand driving stock values higher.

By focusing on AI stock market leaders, you position your portfolio to ride this wave, potentially outpacing traditional investments. Plus, with Intellectia.ai's AI screener, you can filter for the most promising options based on real-time data.

Criteria for Selecting the Best AI Stock

Picking the best AI companies to invest in isn't about chasing trends—it's about smart evaluation. Start with revenue growth: Look for firms showing double-digit increases YoY, signaling strong market traction. Market share matters too; leaders dominating AI infrastructure or models often have a competitive edge.

Don't overlook the innovation pipeline—companies advancing in areas like generative AI or reasoning models are poised for long-term wins. Valuation is key: Aim for undervalued AI stocks where the price-to-earnings ratio suggests room to grow without overpaying. Finally, consider profitability and backlog, as these indicate sustainable performance.

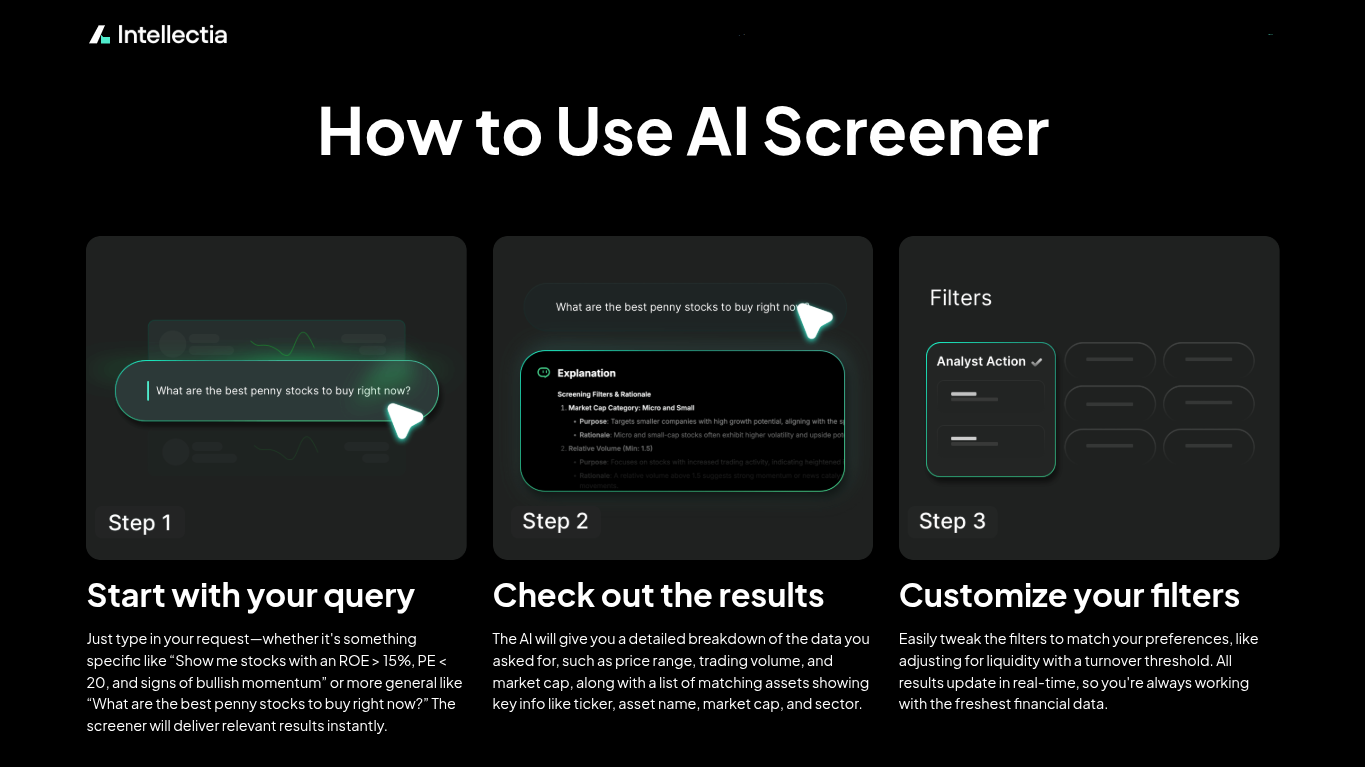

To make this easier, use metrics from tools like Intellectia.ai's stock technical analysis. This way, you avoid common pitfalls and zero in on AI growth stocks that fit your risk tolerance. For example, blending these criteria helped investors spot early gems in past tech surges.

Top AI Stocks to Consider in 2025

When it comes to AI stock picks for 2025, a few stand out based on their recent earnings and AI focus. Let's break down three leaders: NVIDIA, Alphabet, and Amazon to show why they're worth your attention. These companies are not just riding the AI wave—they're shaping it with massive investments in infrastructure, models, and applications.

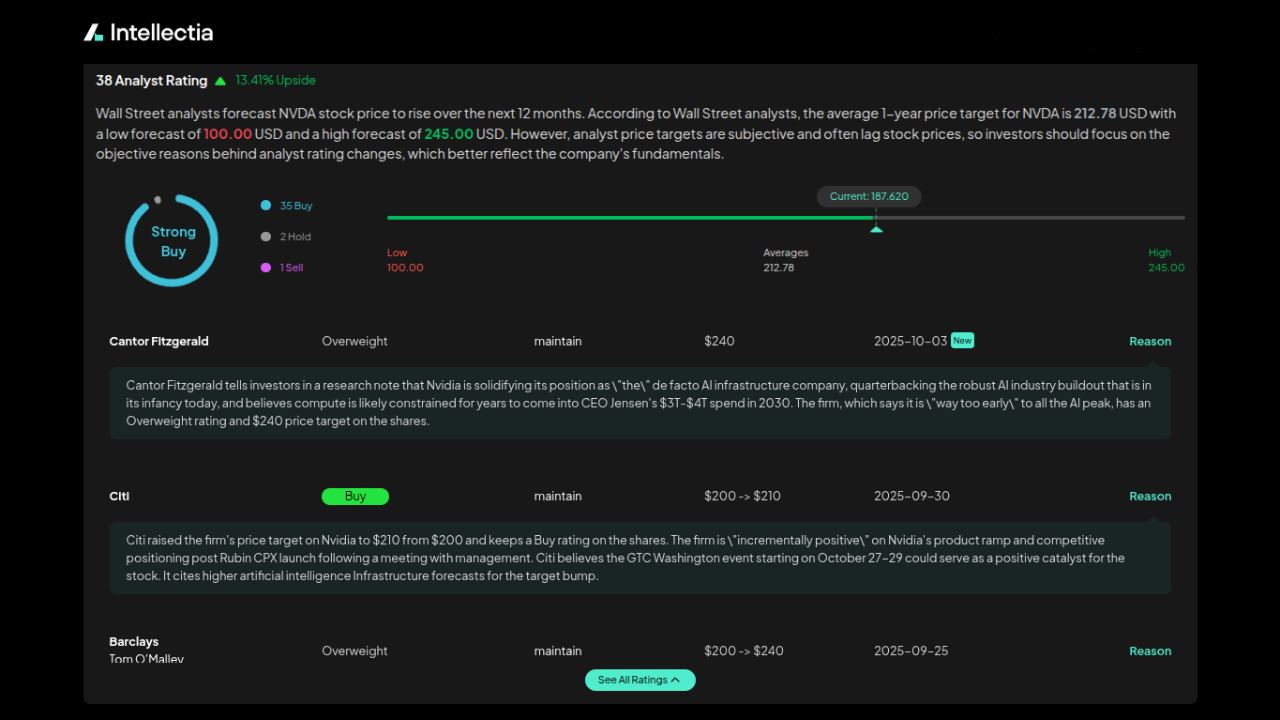

First up, NVIDIA (NVDA). Their Q2 2026 earnings were a blockbuster, with revenue hitting $46.74 billion, up 55.60% YoY, and EPS at $1.05 beating estimates by $0.04. Data center revenue surged 56% YoY, even after a $4 billion drop in H20 sales, thanks to the Blackwell platform's 17% sequential growth. You're looking at a company at the heart of the AI infrastructure boom, forecasting $3-4 trillion in global AI spend by the decade's end. Production shipments of GB300 started in Q2, and the transition from GB200 to GB300 has been seamless due to shared architecture, allowing major cloud providers to deploy racks easily. Factories are now producing 1,000 racks per week, ramping up further in Q3.

NVIDIA's full-stack AI solutions cater to cloud service providers, enterprises, and sovereign AI initiatives. The GB300 NVL72 promises 10x better energy efficiency per token than Hopper, crucial as data centers hit power limits. Sovereign AI is exploding, with NVIDIA leading in the UK and Europe—think the EU's €20 billion for 20 AI factories. Robotics is another frontier: Jetson Thor offers massive AI performance for edge applications, adopted by giants like Amazon Robotics and Boston Dynamics. Gaming revenue hit a record $4.3 billion, fueled by AI-enhanced RTX GPUs. Looking ahead, Rubin, their next platform, is in fab with six new chips, keeping the annual cadence. Challenges like geopolitical issues in China (potential $2-5 billion H20 revenue in Q3 if resolved) exist, but NVIDIA's perf per watt leadership drives margins.

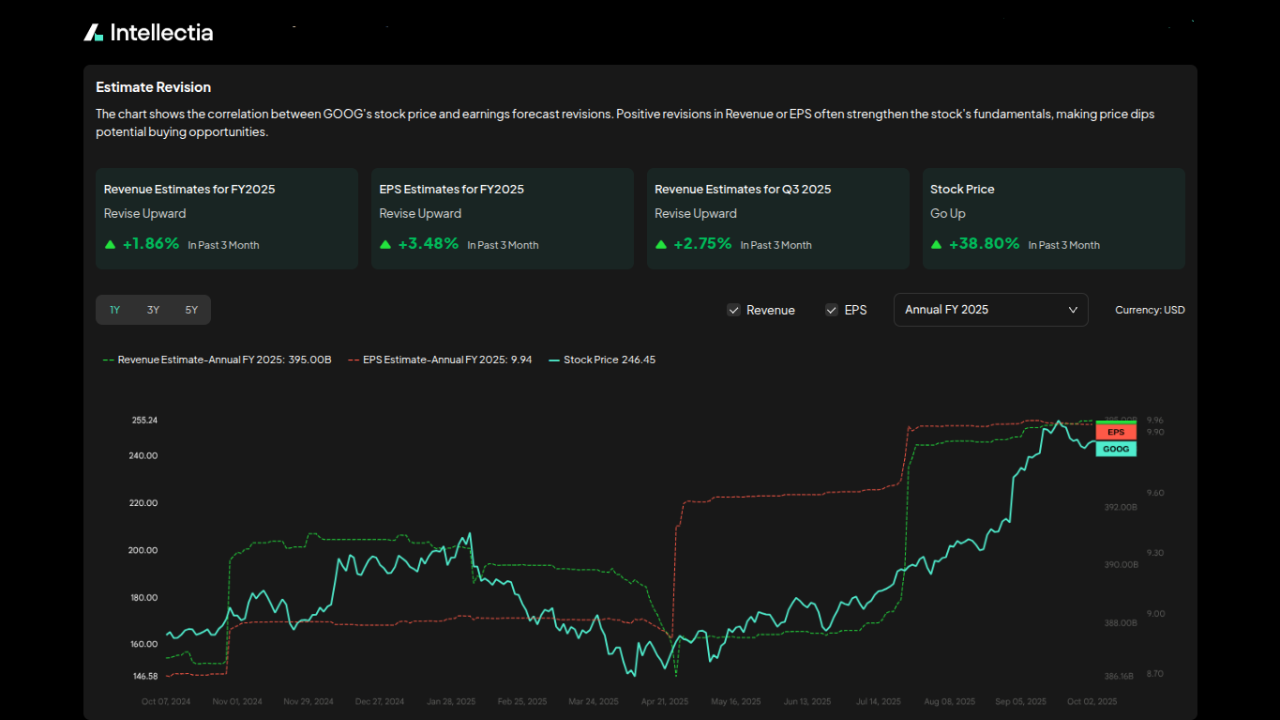

Next, Alphabet (GOOG). Q2 2025 delivered $96.43 billion in revenue, up 13.79%, with EPS of $2.31 beating by $0.11. AI permeates everything, from Search to Cloud, fueling robust growth. Sundar Pichai highlighted their full-stack approach: infrastructure, research, models, and platforms. AI infrastructure includes top TPUs and GPUs, powering nearly all GenAI unicorns like Safe Superintelligence. Cloud's annual run rate exceeds $50 billion, with deals over $1 billion matching all of 2024 in H1 alone. Gemini 2.5 models lead benchmarks, with 9 million developers building on them—up from innovations like Flash and Deepting for math Olympiad gold.

Search saw double-digit growth, with AI Overviews reaching 2 billion users in 200+ countries, driving 10% more queries globally. AI Mode, live in the US and India, handles complex questions with 100 million users, enhanced by Deep Search. Multimodal features like Lens (up 70% YoY) and Circle to Search (300 million devices) boost engagement, especially among Gen Z. YouTube's AI tools improve recommendations, with Shorts averaging 200 billion views daily and new creator features rolling out. Subscriptions grew via Google One AI plans. Ads revenue hit $83 billion, up 12%, with AI Max boosting conversions 14%. Partnerships like PayPal for AI recommendations underscore strength. Despite CapEx ramp for AI, margins expanded.

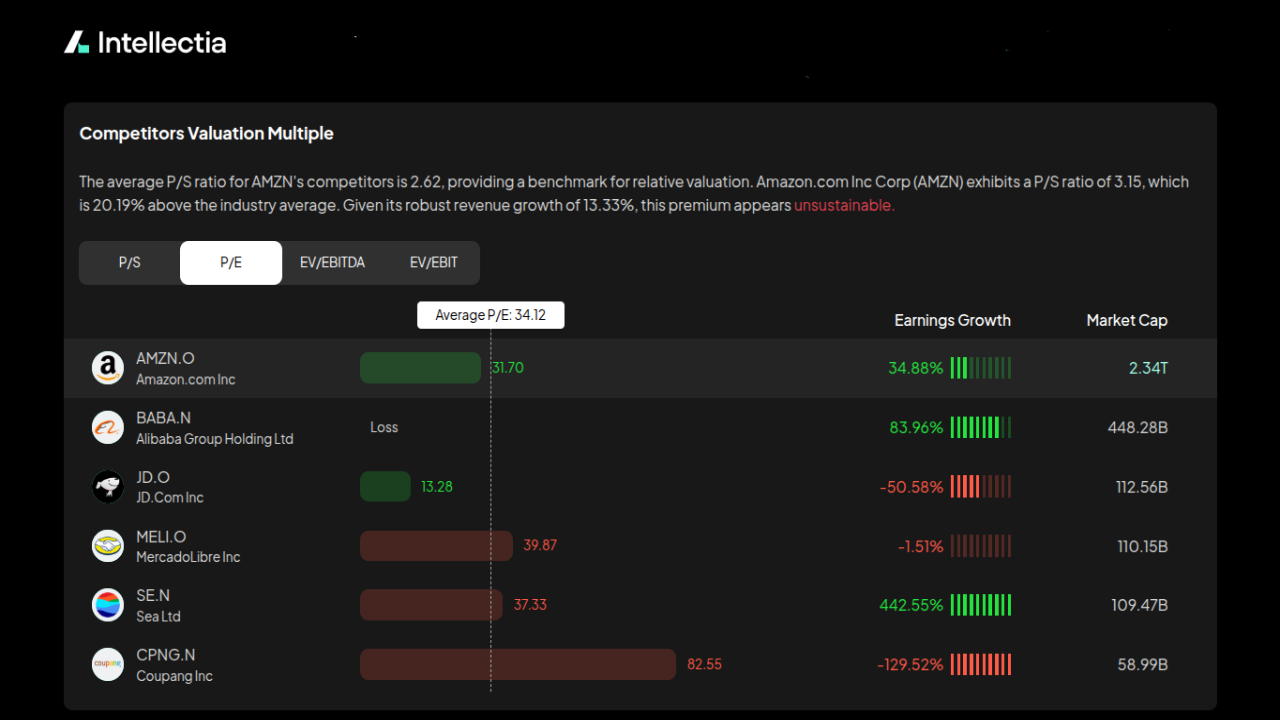

Finally, Amazon (AMZN). Revenue reached $167.70 billion in Q2 2025, up 13.33%, with EPS $1.68 surpassing by $0.36. AI shines in AWS, now at $123 billion run rate, growing 17.5% YoY amid supply constraints. Generative AI is a multibillion-dollar business, tripling YoY, with more demand than capacity. Custom chips like Trainium2 power Anthropic's Claude and Bedrock, offering 30-40% better price performance than rivals. Bedrock's Nova model is second most popular, with new agent tools like Strands (2,500 GitHub stars) and AgentCore easing deployment.

Enterprise adoption surges, with deals from PepsiCo to NatWest. Applications like AWS Transform cut mainframe modernization from years to months, and Kiro enables "vibe coding" for faster development—100,000 users in preview's first days. Robotics AI, like DeepFleet, boosts efficiency 10%, reducing costs at scale. Alexa+ rolls out to millions, promising engagement boosts. Ads grew 22% to $15.7 billion, leveraging AI for better targeting. While tariffs pose risks, no demand drop yet. Amazon's stack from hardware to apps makes it undervalued in AI.

Using AI Tools to Pick Stocks

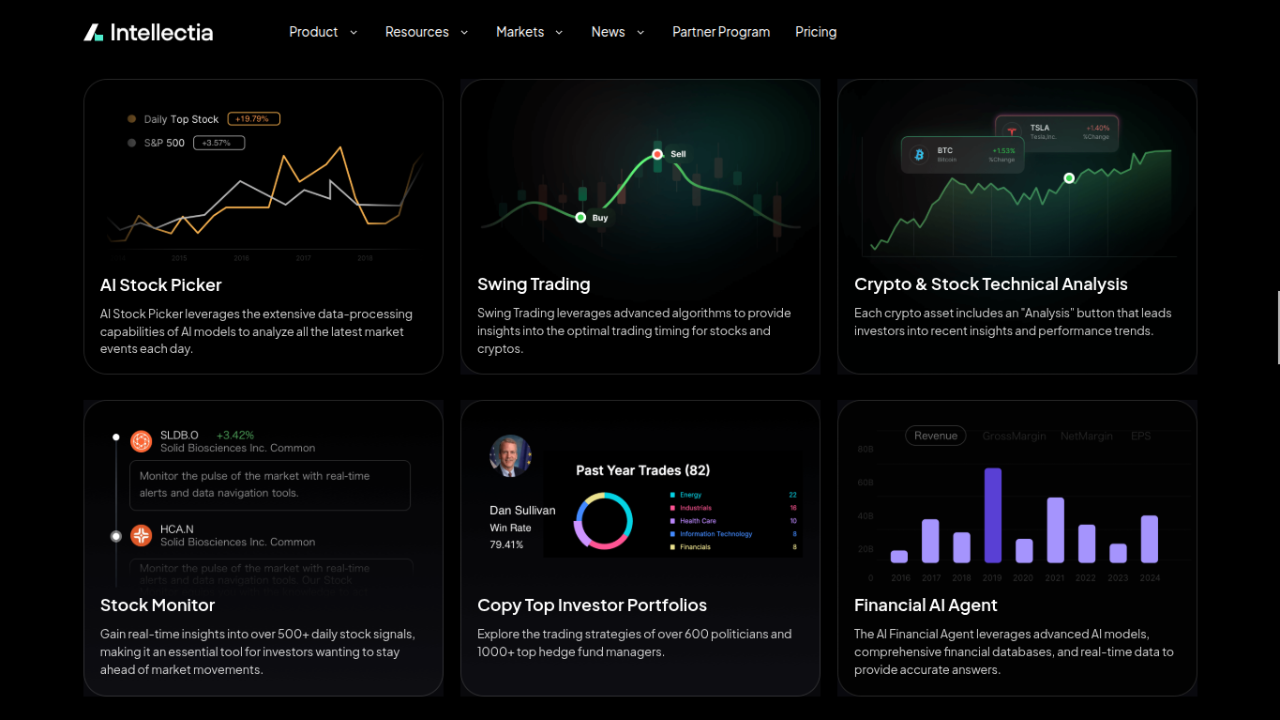

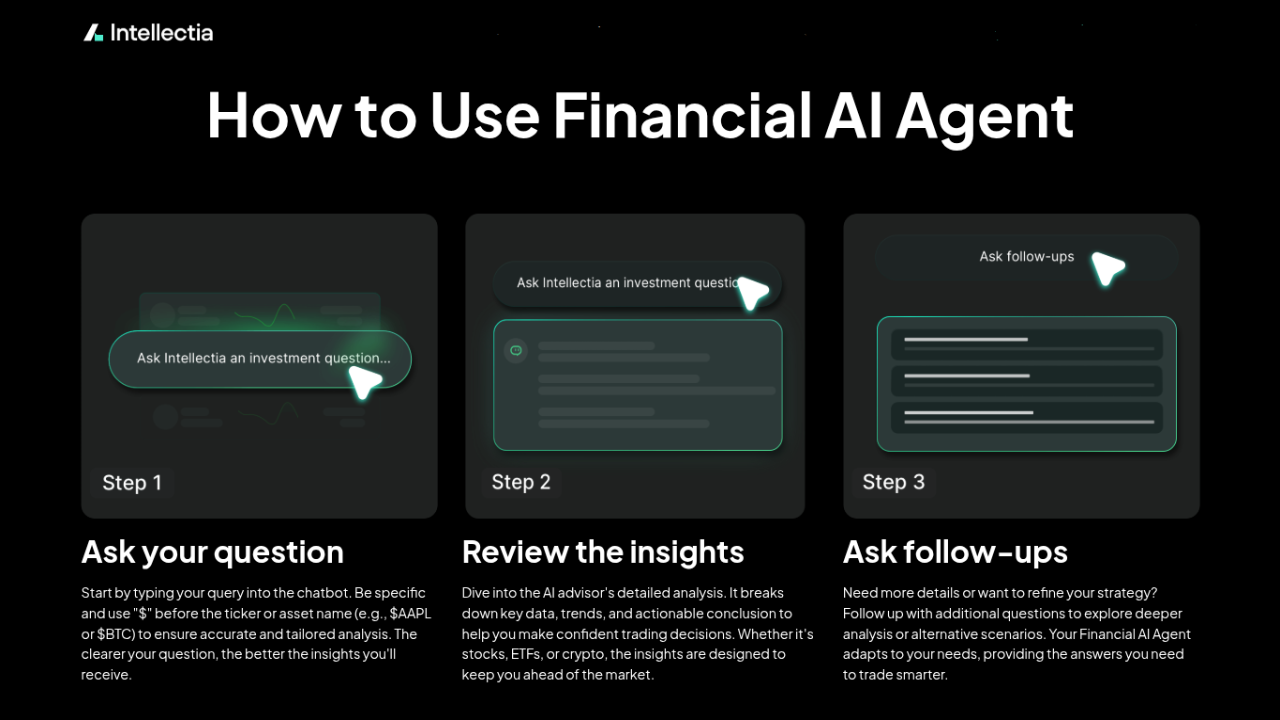

Why go it alone when AI tools can supercharge your decisions? Platforms like Intellectia.ai offer features tailored for AI stock investment, such as the AI stock picker that scans for high-potential picks based on earnings data and trends.

Imagine getting real-time AI stock price predictions or trading signals from daytrading center. Tools like the AI screener let you filter by criteria, spotting undervalued AI stocks effortlessly. For strategies, check swing trading or earnings trading pages.

Even monitor patterns with stock chart patterns or track big players via hedge fund tracker. These resources, plus stock monitor and AI agent, give you an edge. For crypto ties, see crypto technical analysis. Start exploring at Intellectia.ai/crypto or news for broader insights.

Finding the Best AI Stock for Your Portfolio

The AI sector brims with potential, but finding the right fit means weighing financial health, innovation, and market position. Companies like NVIDIA lead in infrastructure, Alphabet in models and search, and Amazon in cloud applications—each offering unique angles for growth.

High valuations pose risks, so diversify across AI stock picks to mitigate volatility. Regulatory hurdles could arise, but thorough research helps. Tools from Intellectia.ai simplify this, providing analytics to spot undervalued AI stocks and align with your goals.

Ultimately, the best AI companies to invest in match your strategy—whether aggressive growth or steady returns. Stay informed via blog updates to capitalize on AI's rise.

Conclusion

Wrapping up, the top AI stocks 2025 like NVIDIA, Alphabet, and Amazon stand out for their robust growth, innovative AI pushes, and strong earnings. By evaluating revenue, innovation, and using smart criteria, you can build a portfolio primed for success in this $738 billion market. Remember, diversification tempers risks while unlocking potential. Ready to dive in? Sign up at Intellectia.ai/sign-up and subscribe via pricing for daily AI stock picks, trading signals, strategies, and market analysis—your edge in the AI boom starts now.