Key Takeaways

- An AI stock picker app is a sophisticated platform that utilizes machine learning (ML) and artificial intelligence (AI) algorithms to analyze financial instruments.

- A good AI stock picker app must have an intuitive interface, a simplified dashboard, and a straightforward design.

- The AI stock pickers apps aren’t “set to forget” type solutions; instead, they can be a valuable tool to determine more accurate trade ideas when utilized efficiently.

Introduction

Many investors are facing challenges in analyzing vast amounts of stock market information, chart patterns, real-time data, and trend shifts. The problem is that there is too much data, insufficient time to investigate, missing key information, and elevated risk exposure. Stock picker apps can be the solution to all these issues, as they can analyze massive amounts of data for fundamental, technical, sentiment, and even alternative data using artificial intelligence and pattern recognition. These platforms can help investors determine the best stock by utilizing AI and a data-driven approach.

However, there are many stock-picking apps available; investors should select the best ones to generate top investing ideas with precision and at the best price. In this article, we introduce you to the best AI stock picker apps, how to choose them, list the best AI stock picker apps, and much more.

What Is an AI Stock Picker App and How Does It Work?

An AI stock picker app is a sophisticated platform that utilizes machine learning (ML) and artificial intelligence (AI) algorithms to analyze the stock market, identify investment opportunities, and provide potential investment suggestions for informed decision-making.

How an AI stock picker app works

These apps usually work through a five-step process:

- Data Collection and Processing: These apps typically collect a massive amount of data from various sources, as well as market sentiment, including geopolitical issues, institutional flow, and social media.

- Algorithmic models/machine learning: These apps typically employ various algorithms, such as classification, regression, deep learning, or ensemble models, to identify patterns in stocks that may correlate with future stock price movements.

- Ranking and scoring: The platform assigns a score or rank to a stock based on the analysis performed using AI.

- Recommendations and alerts: These apps translate scores or rankings to clear, actionable trading suggestions.

- Backtesting and continuous learning: These platforms typically utilize AI models that incorporate backtesting features, continuously comparing past predictions with actual outcomes.

How to Choose the Best AI Stock Picker App for Your Needs

Determine the best AI stock picker app that needs to pass some criteria or some basics, as follows:

- Ease of use: A good AI stock picker app must be easy to use and reduce complexity. The platform must have an intuitive interface, a simplified dashboard, and a straightforward design.

- Backtesting & transparency: Adequate performance is a core component of an AI stock picker app.

- Integration & broker support: An efficient signal is useless if you can’t act quickly. A good platform enables seamless integration via APIs with significant online brokerage firms.

- Risk controls & customization: Risk management is a significant portion when investing in the stock market.

- Pricing model: AI tools range from free to premium models, which can vary depending on the subscription period (weekly, monthly, yearly) and other accessibility options.

- Safety & Regulation: Verify the regulatory status of your platform and confirm that it utilizes secure APIs when connecting to the brokerage account.

Top AI Stock Picker Apps in 2026 (Reviewed & Compared)

In the following section, we list the best AI stock picker apps and review all recommended tools. Check the table below to help you compare key metrics at a glance:

| Bot/Platform | Key Features | Ideal User | Cost Range |

| Trade Ideas | Real-time AI scanner, backtesting, optimized strategies, and auto trade capability | Active day/swing traders, professional analysts | Free Basic: 89$/ Month Premium: 178$/ Month |

| Intellectia AI | AI stock picker and agent, conversational analysis through Financial AI agent, one-tap technical analysis for stocks, crypto, and ETFs. | Beginners to professionals who seek AI research assistance | Basic: 14.95$$/Month Pro: 29.95$/ Month Max: 49.95$/ Month Expert: 89.95$/ Month |

| Magnifi | Portfolio analysis, integrated commission-free trading, and a conversational AI assistant | Beginners/intermediate investors who seek simplified AI, and goal-oriented investors | Monthly: 14$ Annually: 132$ |

| StockHero | Automated trading bots, multi-broker support, easy bot setup, backtesting, and bot marketplace | Traders or investors focused on AI automation | Lite: 29.99$/ Month Premium: 49.99$/ Month Professional: 99.99$/ Month |

| Kavout | AI stock ranking (K Score 1-9), daily top AI stock pick, screening, AI-driven strategies, | Value/ growth/data-driven investors seek quality AI signals | Free Pro: 20$/ Month Premium: 49$/ Month |

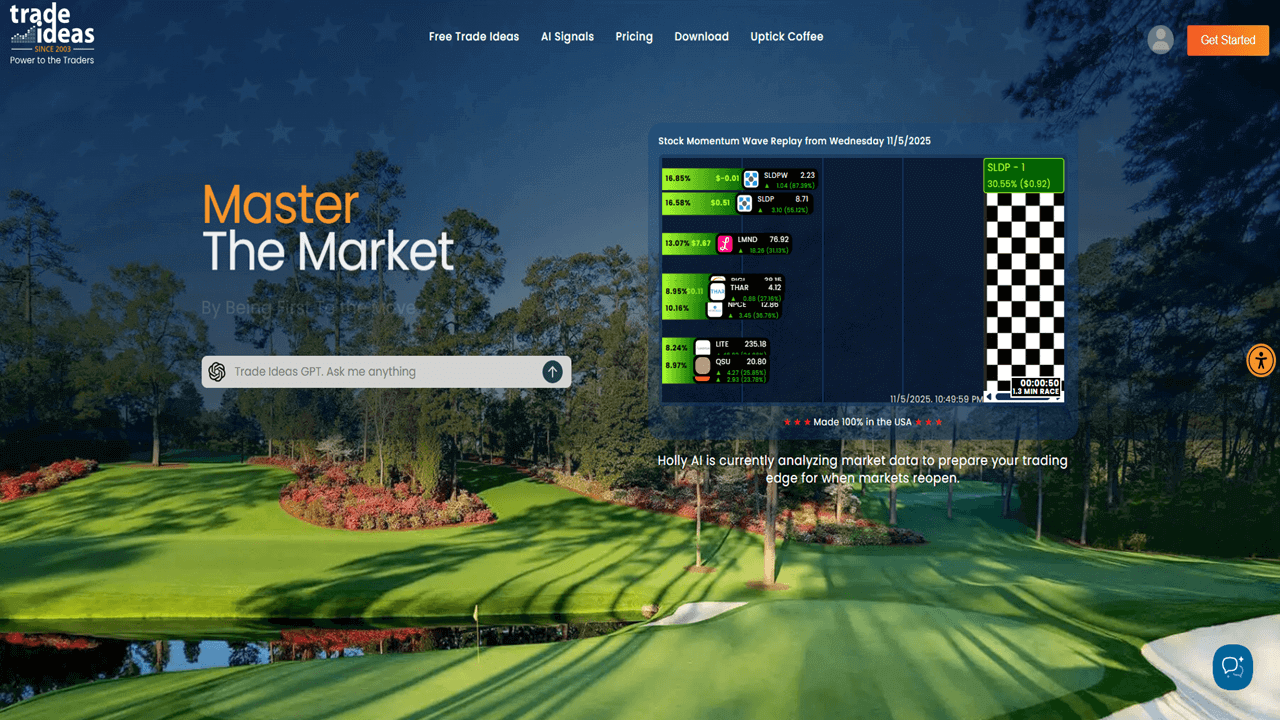

Trade Ideas

Trade Ideas is very popular among active traders for its professional-grade market scanning and AI trading signals. The AI-powered assistant “Holly AI” is a sophisticated engine that analyzes dozens of trading algorithms on assets, then selects and presents only the best performers, statistically suitable trading strategies for the next day. Besides finding stocks simultaneously, it executes completely optimized trading strategies, offering precise trading levels (entry, stop-loss, and profit-taking).

Key Features:

Holly AI (Artificial Intelligence)

Oddsmaker Backtesting

BrokeragePlus Module

Real-Time Scanner and Alerts

Pros and Cons

Pros: Notable speed, unique strength of optimising the entire strategy, autotrade capabilities, alerts, sophisticated trade suggestions

Cons: High cost, more suitable for the U.S. stock market but less supportive for the international market.

Intellectia AI

Intellectia AI focuses on delivering an all-in-one AI co-pilot platform for retail investors, generating highly optimised trading signals through a conversational, user-friendly financial AI agent. For many investors, the platform positions itself as more like a research/co-pilot tool rather than a brokerage. Intellectia AI has the “Financial AI agent” that is meticulously trained on real-time fundamentals, SEC filings, and other financial data.

Key Features:

Financial AI Agent (Conversational Analyst)

AI Stock Picker & Swing Trading Signals

AI Screener & One-Tap Technical Analysis

Proven AI Strategies

Pros and Cons

Pros: The exciting blending capacity of signals and technical/fundamental research via conversational AI strikes a crucial balance between simplicity and AI power, covering a diverse range of assets beyond stocks, including cryptocurrencies and ETFs. This AI-powered and data-driven stock picker provides alerts/notifications.

Cons: It's not a complete trade execution platform; you still need a brokerage to execute trades. The AI models in finance still have some limitations.

Magnifi

Magnifi is an AI-powered investment assistant, known as the AI Investing Copilot, focused on goal-based planning and holistic portfolio management, making it particularly suitable for growth-oriented, long-term, and passive income investors. The core component of the platform is its conversational AI, which connects multiple brokerage accounts to provide deeper and more unified AI-driven analysis for the investor's entire portfolio.

Key Features:

Conversational AI Search

Holistic Portfolio Analysis

Goal-Based Planning & Themed Investing

Integrated Commission-Free Trading

Pros and cons:

Pros: The low-cost offering makes it accessible to many investors, and the platform is excellent for those seeking long-term growth. Conversational analysis and portfolio management make it a market-leading platform for diversification and managing risks.

Cons: Not very suitable for active traders; some users may face app slowness and limited insights compared to others.

StockHero

StockHero is an AI-powered platform designed for automation and algorithmic trading, utilizing AI-powered bots. The platform is suitable for investors who seek to deploy automated strategies without needing to write a single line of code. StockHero focuses on enabling users to automate and manage their portfolios 24/7, with an easy setup process. The platform connects numerous stock brokers, allowing users to apply the same method across different accounts.

Key Features:

Easy Bot Setup

Multi-Broker Support

Aggregated Portfolio View

Backtest & Paper Trade

Bot Marketplace

Pros and Cons:

Pros: Easy setting of algorithmic bots, automation support, real-time data, and multibroker integration.

Cons: The focus is not entirely on “stock picking,” but on transformed algorithmic integration, which may not be attractive for casual investors. Performance heavily depends on strategy and automation, which doesn’t always guarantee profits.

Kavout

Kavout is an AI-powered stock picking service that leverages machine learning to determine the potential and quality of stocks. The core component of the platform is “Kai Score”, a comprehensive AI-driven ranking system that analyses over 9000+ U.S. stocks daily. The K score integrates three data types (technical, fundamental, and sentiment or alternative data), processes all these, and delivers a single score to predict potential outcomes.

Key Features:

Kai Score (AI-Driven Stock Ranking)

AI-Driven Strategies

Daily Top AI Stock Picks

Quantitative Multi-Factor Analysis

Pros and Cons:

Pros: The Kai score is a powerful tool that is easily understandable; the platform offers access at a competitive cost. The system focuses on multiple factors when blending trading signals.

Cons: The platform heavily focuses on ranking or scoring rather than trade executions or conversational research.

Conclusion

The AI stock pickers apps aren’t “set to forget” type solutions; instead, they can be a valuable tool to determine more accurate trade ideas when utilized efficiently. Whether you are an active trader, swing trader, or long-term investor, these apps can help you filter your ideas, reduce risks and noise, monitor, manage, and act more efficiently and effectively.

To explore the latest strategies, we recommend signing up for intellectia.ai today and subscribing to alerts and notifications on stock technical analysis, stock chart patterns, AI stock picker, stock monitor, and more.