Key Takeaways

Wall Street analysts are divided on Tesla's future, with 2026 price targets ranging from a bearish $150 to a bullish $510, reflecting uncertainty around its high valuation and ambitious growth plans.

Tesla's ability to successfully deploy its Full Self-Driving (FSD) technology and expand its Robotaxi service is the most significant catalyst for its long-term stock growth.

With a forward P/E ratio significantly above industry averages, Tesla's stock is priced for exceptional growth, leaving very little room for operational missteps or missed targets.

While Tesla remains the market leader, holding a 41% market share in Q3 2025, competition from legacy automakers and new EV brands is growing, which could pressure sales and margins.

Advanced AI models, like those from Intellectia AI, project a neutral price range of $440-$470 for Tesla in 2026, with a bullish scenario reaching as high as $550 if AI and Robotaxi initiatives succeed.

Introduction

Have you wondered where Tesla's stock is headed by 2026? With so much happening with artificial intelligence, new vehicle models, and intense market competition, getting a clear picture of its future value can feel overwhelming.

Many investors see conflicting analyst ratings and volatile news cycles, making it difficult to decide whether to buy, hold, or sell. To navigate this, you need to look beyond the headlines and analyze the core drivers of Tesla's valuation.

This article provides a detailed Tesla stock price prediction 2026, breaking down its current performance, future growth catalysts, and what you can expect in the years to come.

Current Overview of Tesla Stock Performance

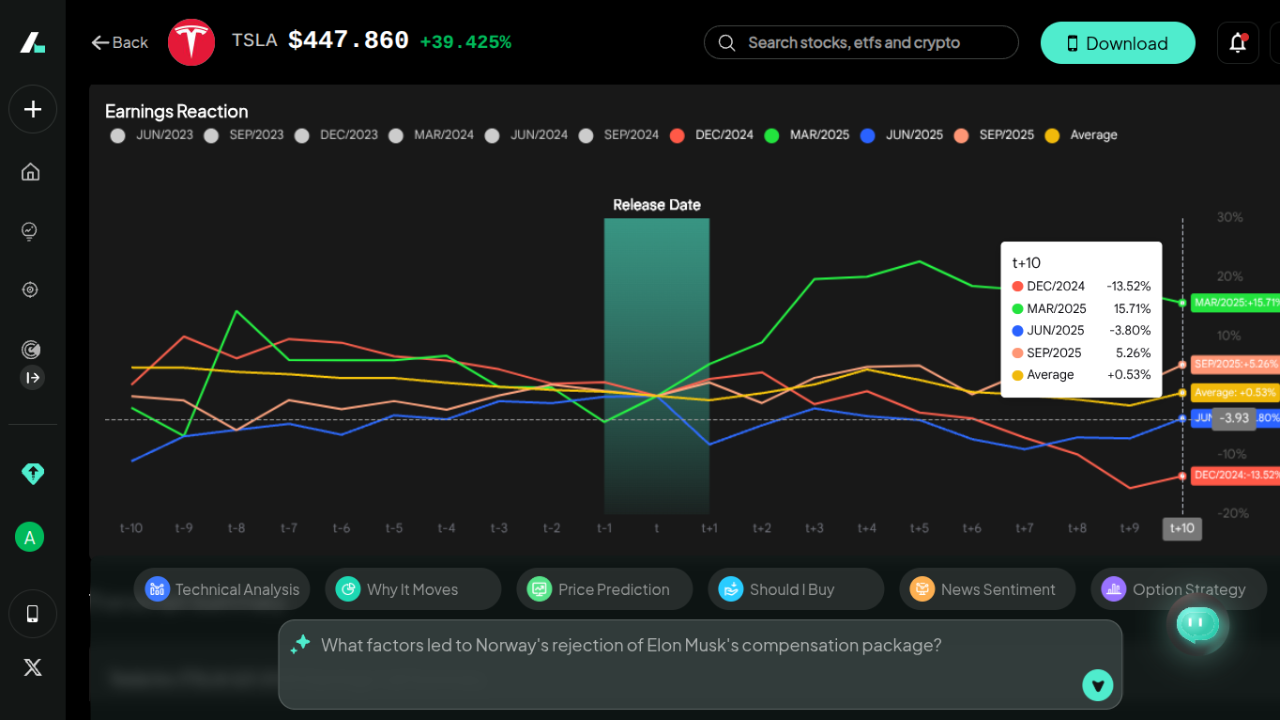

As of November 2025, Tesla (TSLA) continues to be one of the most talked-about stocks on the market. The stock has shown strong momentum, outperforming the S&P 500 over the past year with a 44.66% price return. However, its performance is closely tied to breaking news and ambitious future promises.

Recent events have kept investors on their toes. The company's Q3 2025 earnings report showed strong revenue that beat expectations, but it missed earnings per share (EPS) estimates due to rising operating expenses. This highlights a key challenge for you as an investor: balancing impressive top-line growth with profitability pressures.

A major recent event was the shareholder approval of CEO Elon Musk's record-breaking pay package, a move designed to keep him focused on Tesla for the long term. This vote of confidence is crucial as the company pushes forward with initiatives like the expansion of its Full Self-Driving (FSD) technology and the launch of its Robotaxi service in cities like Austin and the Bay Area.

At the same time, the electric vehicle (EV) market is becoming more crowded. While Tesla still dominates with a 41% market share in the US, brands like Ford, Hyundai, and Chevrolet are gaining ground. This increasing competition, combined with challenges like declining Cybertruck sales, adds another layer of complexity to any Tesla stock price forecast for 2026.

Factors Influencing Tesla’s 2026 Stock Price

To understand where Tesla might be headed, you need to look at the key factors that will influence its growth. These catalysts and challenges will shape the company's trajectory and its stock performance.

Growth of AI and Autonomous Driving

Tesla's future is deeply intertwined with its progress in artificial intelligence. The company has made significant strides with its FSD technology, accumulating over 6 billion miles of data from its fleet. The upcoming release of v14 promises even more advanced capabilities. The successful launch and expansion of its Robotaxi network, which is already operating in Austin, is a critical milestone that could unlock massive new revenue streams.

EV Market Competition and Demand Trends

The EV landscape is no longer a one-horse race. A flood of new models from established automakers and EV startups is creating more choices for consumers. According to a Q3 2025 Kelley Blue Book report, while total EV sales are up 29.6% year-over-year, Tesla's market share has slightly decreased from 43.2% to 41.0% YTD. Your investment's success will depend on Tesla's ability to maintain its edge through innovation and competitive pricing.

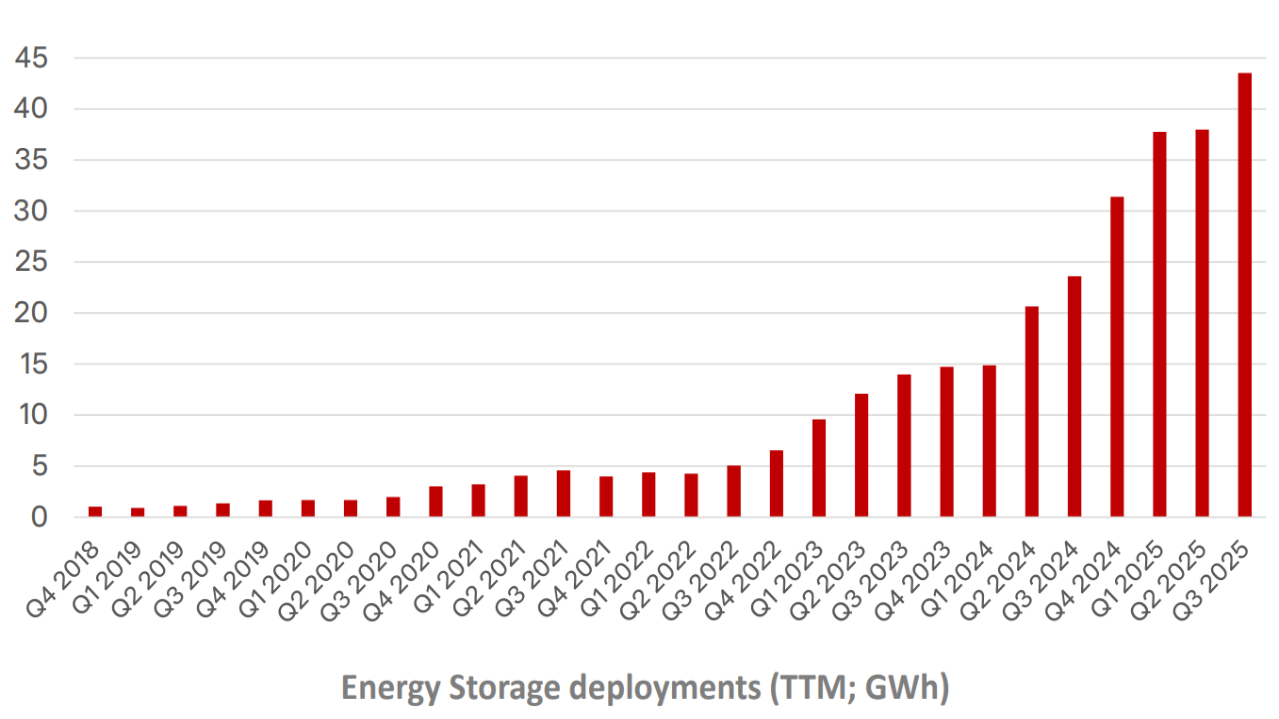

Energy Storage and Solar Expansion

Beyond cars, Tesla's energy division is a powerful, though often overlooked, growth engine. The company saw record energy storage deployments in Q3 2025, driven by its Megapack and Powerwall products. These technologies are crucial for stabilizing power grids and supporting the global transition to renewable energy. As this sector grows, it could become an increasingly significant part of Tesla's overall valuation.

Macroeconomic and Interest Rate Impacts

Global economic conditions will also play a role. Tesla itself has noted "near-term uncertainty from shifting trade, tariff and fiscal policy." Factors like interest rates, inflation, and government incentives for EVs can impact consumer demand and the company's manufacturing costs. A challenging economic environment could slow growth, while favorable conditions could accelerate it.

Tesla Stock Forecast And Valuation Outlook for 2026

Predicting Tesla's stock price for 2026 requires a close look at its valuation. Is the current price justified, and what does it tell you about future expectations?

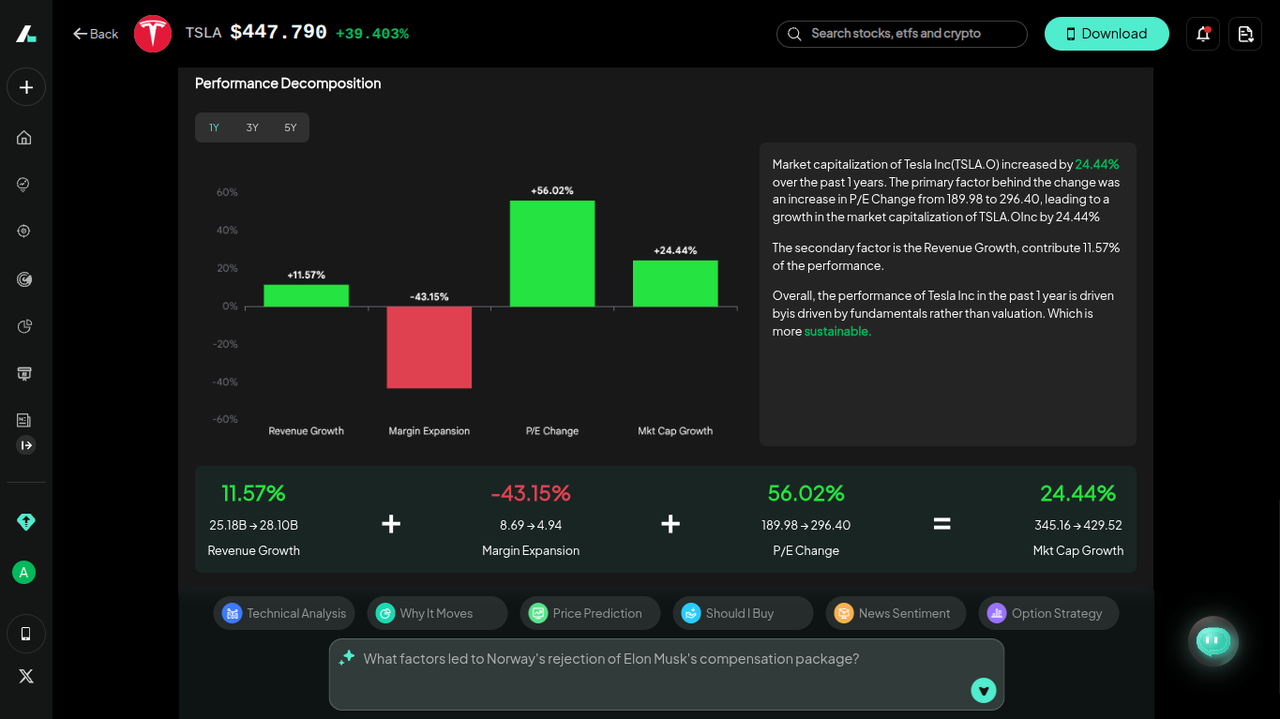

Fundamental Valuation Metrics

Tesla's valuation metrics are stretched by traditional standards. The company's forward Price-to-Earnings (P/E) ratio is 259.78, significantly higher than the tech sector average of around 20-30 and the EV sector average of 15-20. This premium indicates that the market is pricing in substantial future growth. For you, this means Tesla must deliver on its ambitious promises to justify its current stock price.

Free cash flow (FCF) tells a similar story. Tesla generated a record of nearly $4 billion in free cash flow in Q3 2025, a sign of strong operational health. However, its forward Price-to-Free Cash Flow ratio of 545.86 suggests that investors expect this growth to continue accelerating significantly. If cash flow growth slows, it could become a concern for the stock's valuation.

AI Model Forecast vs. Analyst Consensus

Wall Street analysts are deeply divided on Tesla's future, reflecting the high stakes and uncertainty. Price targets for 2026 are spread across a wide range:

JPMorgan holds an Underweight rating with a price target of $150, citing concerns over high operating expenses and rising capital expenditures.

BofA maintains a Neutral rating with a $471 target, acknowledging Tesla as a leader in AI but viewing its valuation as "stretched."

Cantor Fitzgerald is Overweight with a $510 target, remaining bullish on Tesla's long-term potential despite short-term headwinds.

The average analyst price target sits at ~$383. This mixed sentiment highlights the central debate around Tesla: are you investing in a car company or a revolutionary tech company? AI-based projections for Tesla in 2026 suggest a price range of $450-$500, assuming continued growth in EV deliveries, expansion into new markets, and advancements in AI-driven products like robotaxis and Optimus.

Tesla's valuation metrics highlight its premium pricing, driven by high growth expectations. While the company's innovation in AI and EV markets could support long-term growth, the current valuation leaves little room for error. For 2026, Tesla's stock performance will heavily depend on its ability to scale production, maintain margins, and deliver on its AI-driven initiatives.

What does Intellectia's AI say about Tesla stock in 2026?

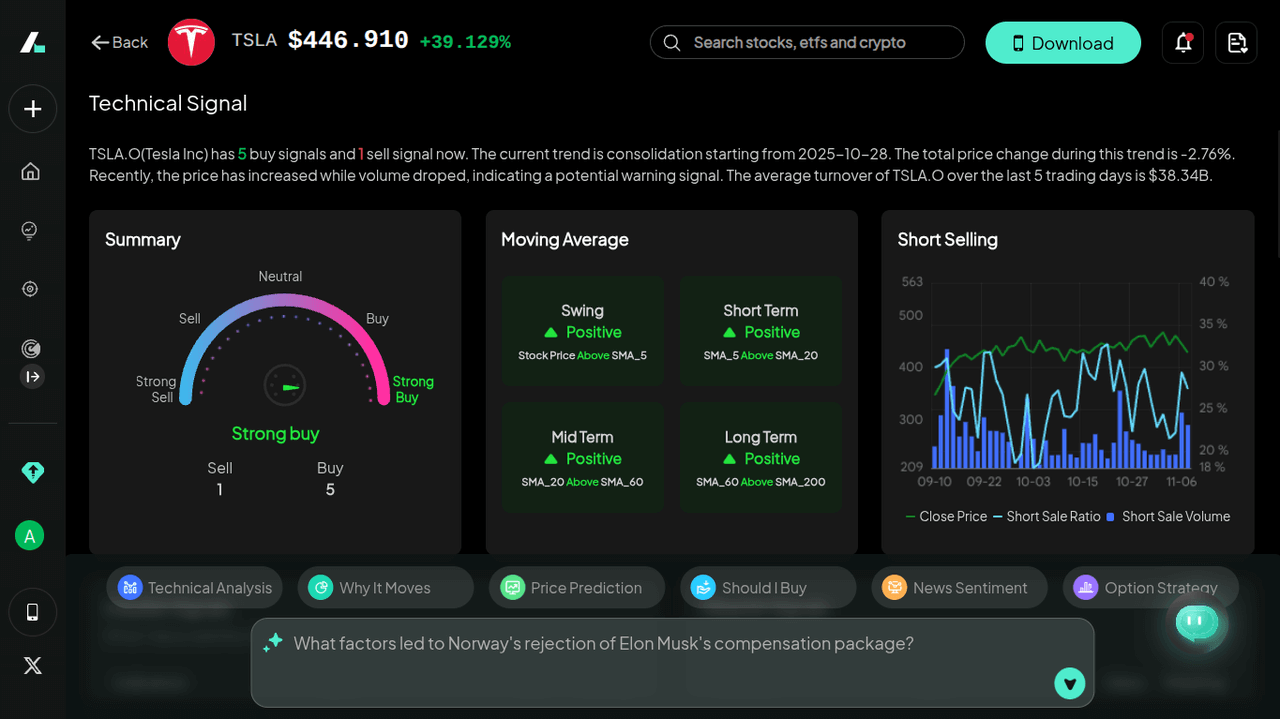

To get another perspective, you can turn to advanced AI platforms like Intellectia AI, which uses sophisticated machine learning algorithms to generate data-driven forecasts. Intellectia's model analyzes a vast array of inputs, including historical price trends, earnings performance (EPS), market sentiment, and technical indicators like RSI and MACD.

By integrating these factors, Intellectia provides a probabilistic forecast for Tesla's stock price movement. For 2026, its AI modeling suggests three potential scenarios:

Bullish Scenario: $520–$550. This outcome would be driven by the successful large-scale deployment of Robotaxis and breakthroughs in AI that solidify Tesla's tech leadership.

Neutral Scenario: $440–$470. This range reflects steady but limited upside, where Tesla continues to grow its EV deliveries but faces challenges in scaling its more ambitious AI-driven products.

Bearish Scenario: $350–$380. This scenario could materialize if EV demand slows significantly, operational costs rise, or the company faces major setbacks in its FSD and robotics development.

This AI-based forecast aligns closely with the neutral-to-bullish analyst consensus but provides a clearer picture of the potential risks and rewards you should consider:

Challenges: Declining Cybertruck sales and high-level management turnover could weigh on investor confidence.

Opportunities: Progress in AI chip development and robotaxi expansion could drive long-term growth.

Ready to harness the power of AI for your own investment research? Intellectia.ai's AI Screener can help you identify opportunities and analyze stocks with data-driven precision.

Conclusion

Tesla's stock price in 2026 hinges on its transformation from a car manufacturer to an AI and robotics powerhouse. While its valuation is demanding, the company's innovation in autonomous driving, energy storage, and AI presents a compelling long-term growth story. Your decision to invest should be based on your belief in Tesla's ability to execute on these ambitious goals while navigating an increasingly competitive market. The journey is likely to be volatile, but for those who believe in the vision, the potential rewards are substantial.

To stay ahead with daily AI-driven stock picks, trading signals, and in-depth market analysis, explore what Intellectia.ai has to offer. Sign up today to get the insights you need to navigate the markets with confidence.