Key Takeaways

- Combining fundamental and technical analysis helps you identify stocks with strong growth potential and optimal entry points for maximized returns.

- Target high-growth sectors like AI, semiconductors, and nuclear power to capitalize on emerging trends in 2025.

- AI stock picking tools, such as Intellectia.ai’s platform, deliver data-driven insights, simplifying stock selection with precise predictions.

- Risk management, including diversification and stop-loss orders, protects your portfolio from unexpected market volatility.

- Staying informed through continuous research and adapting to market shifts ensures your stock selection strategies remain effective.

Introduction

Ever found yourself scratching your head, wondering why some stocks skyrocket while others crash, even when the market feels like a rollercoaster? It’s frustrating, isn’t it? You’re not alone—countless investors face this challenge, pouring money into picks that seem promising but tank due to misjudged fundamentals or poor timing.

But here’s the thing: aggregating insights from multiple angles can transform your approach. With experience, I’ve learned that expertise comes from blending proven methods to make smarter decisions. The solution lies in combining fundamental analysis for stocks to assess a company’s financial health, technical analysis for stocks to pinpoint price trends, and AI stock picking tools to streamline the process with precision.

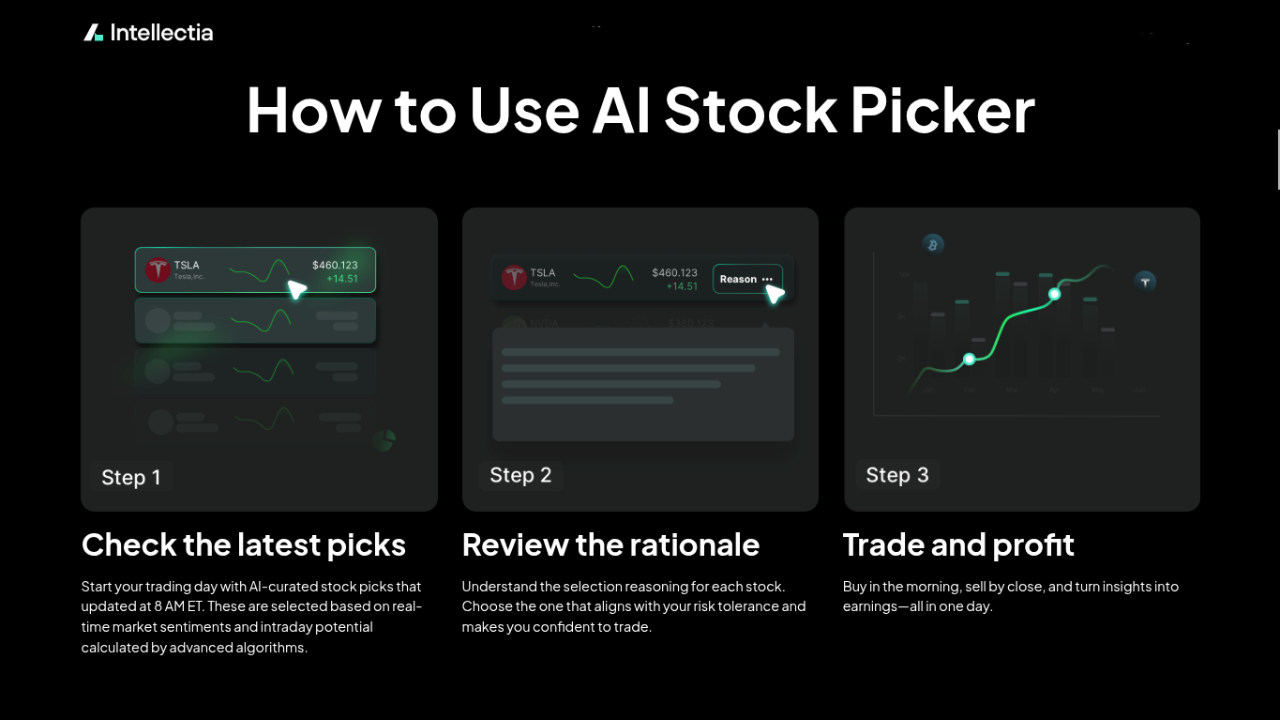

For example, platforms like Intellectia.ai’s AI Stock Picker deliver daily recommendations backed by data, helping you choose stocks confidently without second-guessing. Whether you’re a beginner or seasoned investor, this approach can guide you to better picks and stronger returns in 2025.

Source: intellectia.ai

Alt Text: An-image-showing-intellectia.ai-features-AI-stock-picker

Understanding Stock Selection Basics

Choosing the right stocks isn’t about rolling the dice—it’s about building a strategy that balances insight with opportunity. You need to combine fundamental and technical analysis to select stocks with both solid foundations and promising price movements. This dual approach ensures you’re not just chasing trends but investing in companies with real potential for growth.

Start by defining your investment goals. Are you looking for long-term wealth or quick profits through day trading? This clarity shapes your stock selection strategies. Fundamental analysis helps you evaluate a company’s health—think revenue, earnings, and debt. Technical analysis, on the other hand, uses charts to predict price movements, helping you time your trades. Together, they give you a 360-degree view of a stock’s potential.

In 2025, markets are shifting fast due to economic changes and technological advancements. Staying ahead means staying informed. Resources like Intellectia.ai’s blog can be used for market insights. By grounding your picks in data and aligning them with your goals, you’ll avoid overhyped stocks and focus on those with real value. This methodical approach sets you up for success in any market environment.

Fundamental Analysis Tips

When you’re figuring out how to choose stocks, fundamental analysis is like checking a company’s pulse. It’s about digging into financial metrics to ensure you’re investing in a business that’s strong and sustainable. Key indicators include revenue growth, earnings per share (EPS), and debt-to-equity ratio. A low debt-to-equity ratio, ideally below 1, signals a company isn’t drowning in loans, which is a sign of stability.

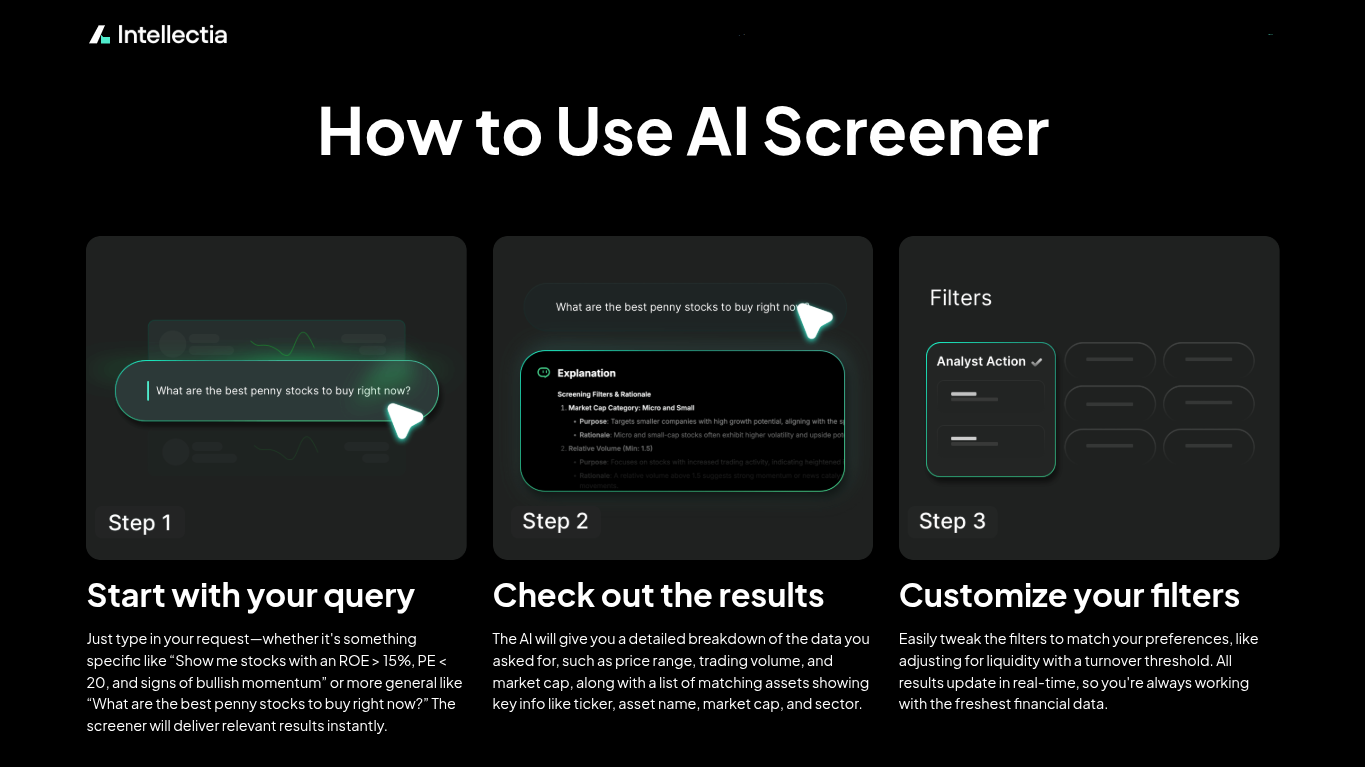

Look for companies with consistent revenue growth over the past three to five years. Expanding profit margins are another good sign— they show the company is managing costs well. You can use tools like Intellectia.ai’s AI Screener and stock monitors to screen these metrics efficiently. Also, check cash flow—positive free cash flow means the company has money to reinvest or weather downturns.

Focus on high-growth sectors like AI, semiconductors, and nuclear power. In AI, stocks like Nvidia (NVDA) and Microsoft (MSFT) are powerhouses driving innovation. For semiconductors, AMD and TSMC are leading the charge in chip production. In nuclear power, companies like Cameco (CCJ) or Constellation Energy (CEG) are poised for growth as clean energy demand rises.

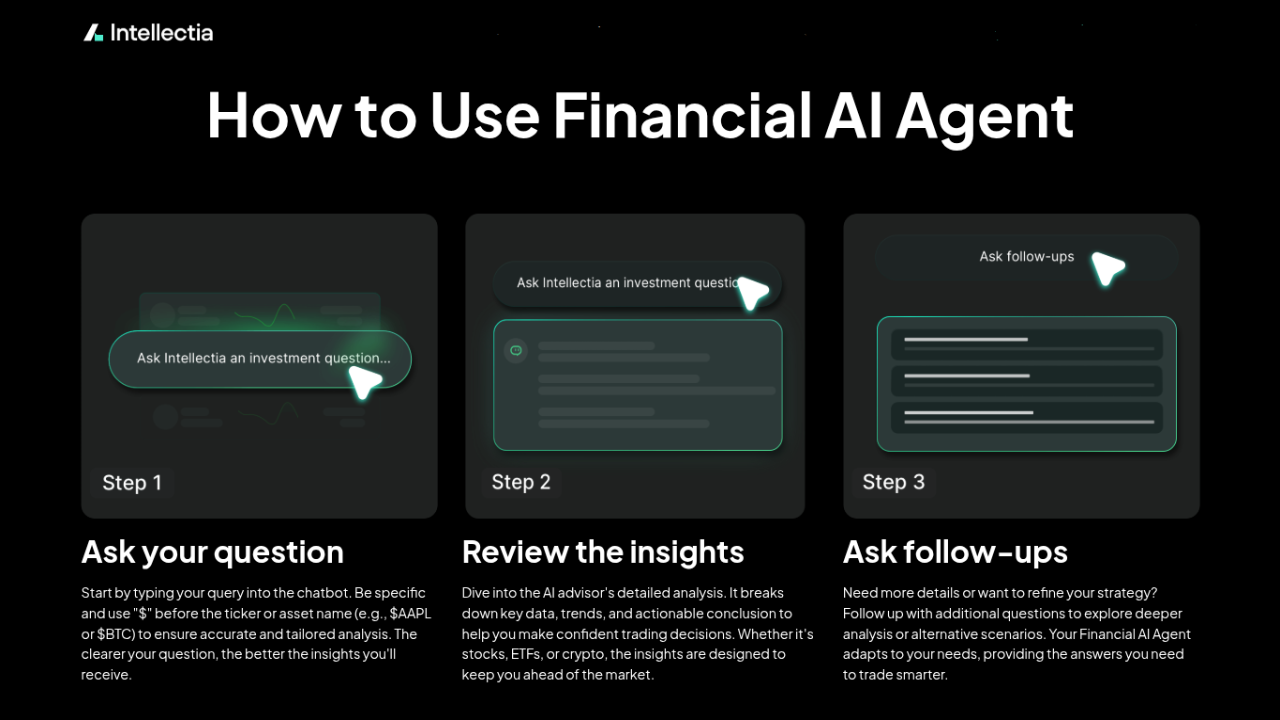

Compare stocks within the same industry. If a stock’s price-to-earnings (P/E) ratio is lower than its sector average, it could be undervalued—a hidden gem. Dive deeper with resources like Intellectia.ai’s AI Agent to sharpen your skills. Don’t just look at numbers—check the company’s competitive edge, like patents or market share. This ensures your picks are built on a rock-solid foundation, ready to grow in 2025’s dynamic market.

Technical Analysis Strategies

Once you’ve got the fundamentals down, technical analysis helps you time your trades like a pro. It’s all about reading charts to predict price movements and spot the best moments to buy or sell. Start with moving averages—when a stock’s price crosses above its 50-day or 200-day moving average, it often signals an uptrend, making it a potential buy.

Momentum indicators like the Relative Strength Index (RSI) are your friends. An RSI above 70 suggests a stock might be overbought, while below 30 indicates oversold conditions—perfect for spotting entry or exit points. Chart patterns, like head and shoulders or bullish flags, can also guide your decisions. Learning these through Intellectia.ai’s Stock Chart Patterns that can automate pattern detection and save time.

Volume analysis is critical too. A price jump on high trading volume confirms strength, while low volume might signal weakness. For stock selection, focus on breakouts. When a stock breaks through a resistance level with strong volume, it’s often a buy signal. Practice spotting these on trading platforms. You can also use Intellectia.ai’s Stock Technical Analysis to get real-time signals on over 10,000 assets. Test your strategies on a demo account first to build confidence. This way, you’re not just guessing—you’re trading with the market’s momentum on your side.

Leveraging AI for Stock Selection

AI is changing the game for stock picking, turning hours of research into minutes of actionable insights. With AI stock picking tools, you get predictive models that analyze vast datasets in real-time, spotting opportunities you might miss. These tools remove emotional bias, giving you clear, data-driven recommendations.

At Intellectia.ai AI Stock Picker uses advanced LLMs to deliver daily stock recommendations, complete with detailed rationales and backtested results boasting high win rates. It’s like having a pro analyst in your pocket. The AI Screener lets you filter stocks based on custom criteria—say, high ROE or strong momentum—by simply typing your query. Results are instant and tailored.

For technical traders, Stock Technical Analysis provides indicators and signals across thousands of assets, while Crypto Technical Analysis does the same for digital currencies. If you love chart patterns, the Stock Chart Patterns feature automatically detects formations like triangles or wedges, predicting price targets with 20% average returns.

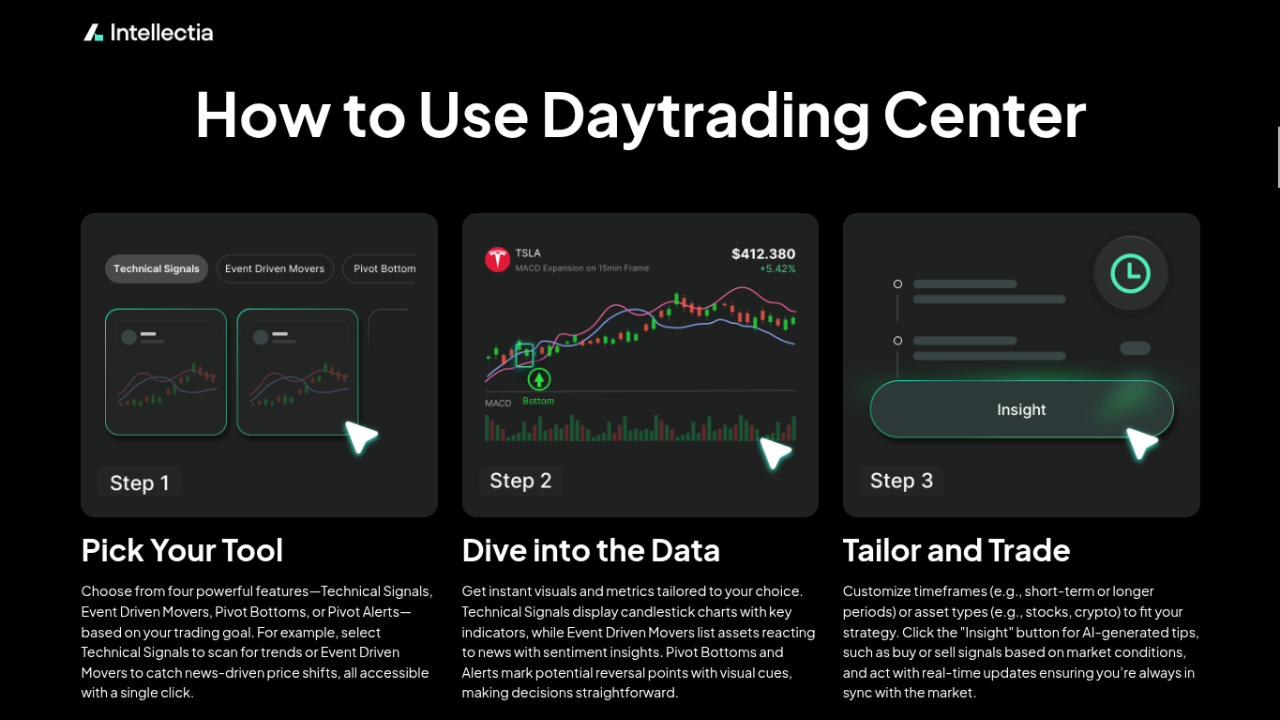

Day traders can rely on the Daytrading Center for event-driven movers and pivot alerts, while swing traders benefit from Swing Trading signals based on volume and price trends. For earnings season, Earnings Trading analyzes reports with a 75% win rate, helping you capitalize on post-earnings moves.

Stay updated with Stock Monitor for real-time alerts on your picks. Need advice? The AI Agent offers personalized guidance. Curious about what the pros are doing? Hedge Fund Tracker reveals their moves. Dive deeper into stocks, crypto, news, or blog for more insights. AI doesn’t just simplify stock selection—it makes it smarter, faster, and more precise.

Mastering Stock Selection for Better Returns

To truly excel at stock picking, you need to weave together all these threads—fundamentals, technicals, and AI tools. Effective stock selection starts with identifying high-potential companies in growth sectors like AI, semiconductors, or nuclear power. Use fundamental analysis to confirm their financial health, then apply technical analysis to time your trades for maximum profit. AI tools like Intellectia.ai’s platform streamline this process, offering data-driven stock rankings and predictive insights that cut through market noise. But don’t stop there—risk management is non-negotiable. Diversify across sectors to reduce exposure to single-market dips. Set stop-loss orders to cap losses, typically at 5-10% below your entry price.

Continuous learning keeps you sharp. Follow market trends via Intellectia.ai’s news and adapt your strategies. In volatile markets, lean toward value stocks with low P/E ratios for stability. Track your trades to analyze what works can help you refine this process. Stay disciplined. Avoid chasing hot tips without research, and don’t let emotions drive your decisions. With a balanced approach and tools like Intellectia.ai’s AI Stock Picker, you’ll build a portfolio that delivers consistent, long-term returns in 2025 and beyond.

Conclusion

Mastering stock picking isn’t about shortcuts—it’s about blending smart strategies with the right tools. Use fundamental analysis to find quality companies, technical analysis to time your trades, and AI stock picking tools to gain an edge. Focus on high-growth sectors like AI (think Nvidia), semiconductors (like AMD), and nuclear power (such as Cameco) to ride 2025’s biggest trends. Always manage risks with diversification and stop-losses, and stay updated through continuous research.

Ready to take your investing to the next level? Sign up at Intellectia.ai/sign-up and subscribe via pricing for daily AI stock picks, trading signals, strategies, and market analysis. These tools give you a competitive edge, delivering insights straight to your inbox. Don’t wait—start building your winning portfolio today!