Key Takeaways:

- Large-cap dividends offer a safety buffer against 2026 market volatility and inflation.

- Total Shareholder Yield (dividends + buybacks) is a superior metric to simple dividend yield.

- The "Safe Seven" stocks provide a mix of growth and income sustainability for your portfolio.

- Avoiding "yield traps" requires analyzing payout ratios against free cash flow, not just earnings.

- Sector diversification ensures you aren't overexposed to stagnant industries like utilities or tobacco.

The 2026 Dividend Landscape: Why 4% Isn't What It Used To Be

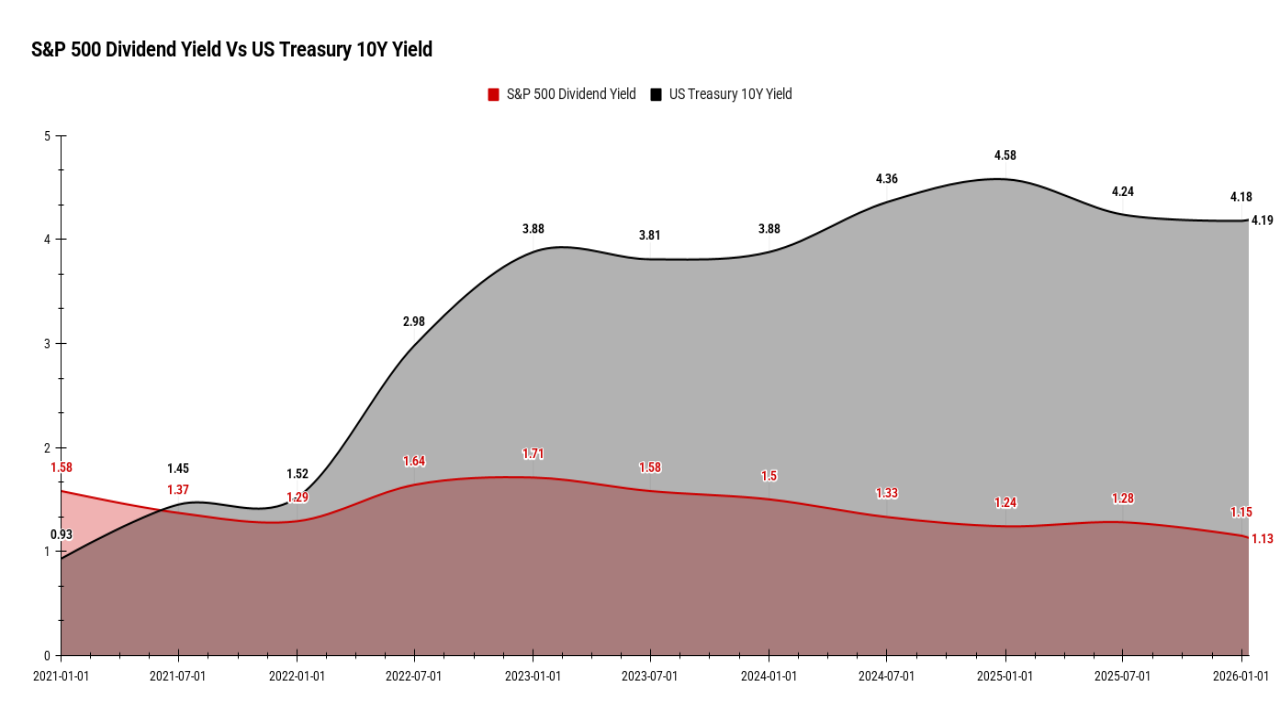

The investing environment has shifted significantly as you navigate the market in 2026. A few years ago, a 4% yield was the holy grail of income investing. Today, with the macro environment evolving, that number requires context. You have to look at the "Yield Gap"—the difference between the dividend yield of the S&P 500 and the risk-free rate offered by the 10-Year Treasury note.

When Treasuries offer competitive rates, equities must work harder to justify your capital. This is why high dividend large cap stocks are becoming the asset class of choice for smart money. They offer two things government bonds cannot: capital appreciation and dividend growth that outpaces inflation.

If you look at the 5-year trend, you will notice that while bond yields are fixed, the dividend payouts of top-tier large-caps have historically grown. In the current volatility, relying on speculative growth stocks is risky. Large-cap dividend payers act as an anchor. They provide cash flow while you wait for the market to find its footing.

To stay updated on these macro trends, checking the Intellectia News Monitor is a great habit. It helps you understand when the yield gap is widening or narrowing, signaling the right time to rotate into income stocks.

Source: Analyst’s compilation

The 'Total Shareholder Yield' Framework: Beyond The Dividend Check

Most investors make a critical mistake: they only look at the dividend yield. You need to look deeper. The real metric for wealth creation in 2026 is Total Shareholder Yield (TSY).

TSY is simple math: Dividend Yield + Buyback Yield = Total Shareholder Yield.

Why does this matter? Companies that aggressively buy back their own stock are essentially paying you a tax-deferred dividend. They reduce the share count, which increases the Earnings Per Share (EPS) and your ownership stake in the company. In many cases, a company with a 2% dividend and a 4% buyback yield (6% TSY) is a better investment than a company with a 5% dividend and zero buybacks.

You can use tools like Intellectia's Quant AI to dig into these numbers. Here is a comparison of how TSY changes the picture for famous large-caps:

| Ticker | Company | Dividend Yield | Buyback Yield | Total Shareholder Yield |

| CVX | Chevron Corp. | 4.3% | 4.3% | 8.6% |

| XOM | Exxon Mobil | 3.4% | 4.0% | 7.4% |

| MS | Morgan Stanley | 2.6% | 3.5% | 6.1% |

| JPM | JPMorgan Chase | 2.4% | 3.1% | 5.5% |

| ABBV | AbbVie | 3.5% | 1.0% | 4.5% |

| CSCO | Cisco Systems | 2.2% | 2.2% | 4.4% |

| KO | Coca-Cola | 3.1% | 0.8% | 3.9% |

| PEP | PepsiCo | 3.0% | 0.5% | 3.5% |

| AAPL | Apple | 0.5% | 2.5% | 3.0% |

| AVGO | Broadcom | 1.5% | 0.4% | 1.9% |

Note: Data represents estimated trailing 12-month trends as of early 2026.

Why Buybacks Matter In 2026

In 2026, corporate tax efficiency is paramount. Buybacks are a signal of management's confidence. When a CEO authorizes a massive repurchase program, they are telling you, “We believe our stock is undervalued, and we have the cash flow to prove it.”

For you, this means price support. During market downturns, companies with strong buyback programs often suffer less drawdown because there is a constant buyer in the market—the company itself. You can track these institutional moves using the Hedge Fund Tracker, seeing where the "smart money" is flowing before the retail crowd catches on.

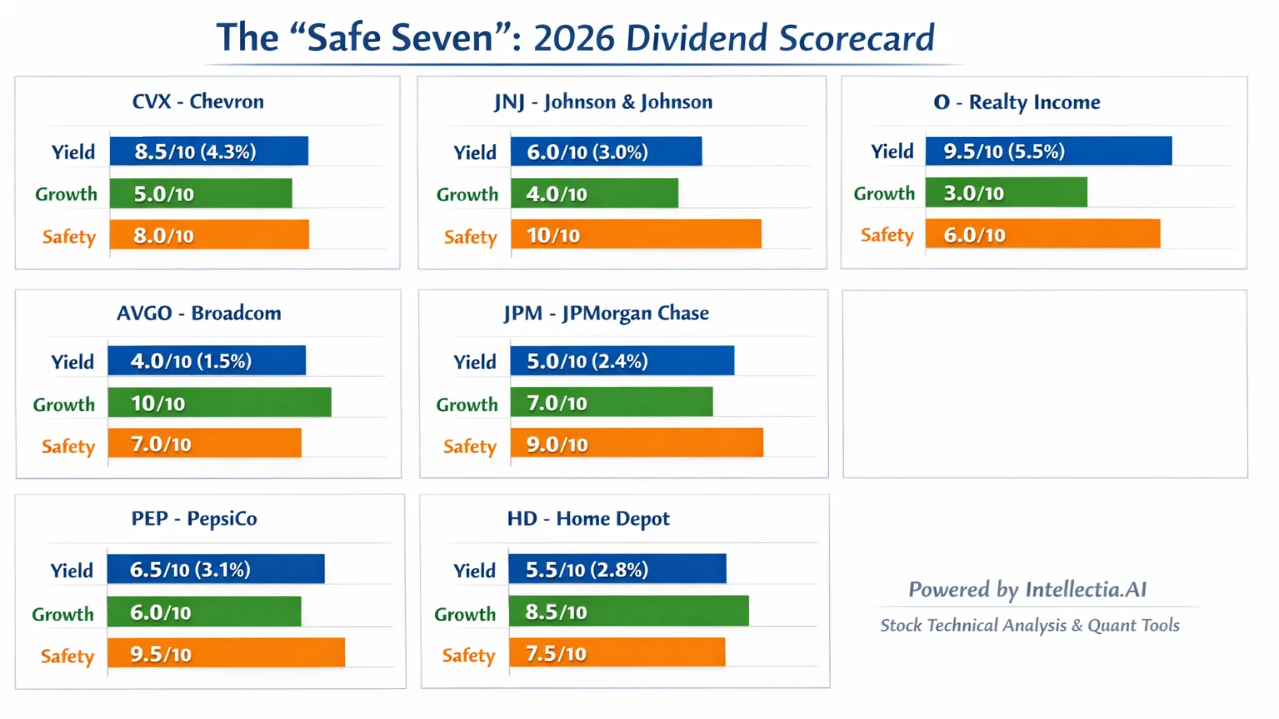

The 'Safe Seven': Top Large-Cap Dividend Picks For 2026

Finding the right stocks requires filtering through thousands of tickers. You want companies with "moats"—sustainable competitive advantages. Based on strong balance sheets, history of growth, and TSY potential, here are seven high dividend large cap stocks to consider for your watch list.

You can run these tickers through the AI Stock Picker to get real-time buy/sell signals.

1. Chevron Corp. (CVX)

Sector: Energy

The Pitch: Energy remains vital. Chevron has one of the strongest balance sheets in the sector and a history of maintaining dividends even when oil prices dip.

Rating: High Safety / Moderate Growth.

2. Johnson & Johnson (JNJ)

Sector: Healthcare

The Pitch: A "Dividend King." Regardless of the economy, people need medicine and medical devices. JNJ provides boring, beautiful stability.

Rating: High Safety / Low Growth.

3. Realty Income (O)

Sector: Real Estate (REIT)

The Pitch: The "Monthly Dividend Company." With thousands of properties and high occupancy rates, it is a pure income play.

Rating: Moderate Safety / Moderate Yield.

4. Broadcom (AVGO)

Sector: Technology

The Pitch: This is a dividend growth monster. While the starting yield is lower, the rate at which they raise the dividend is massive, driven by AI and chip demand.

Rating: Moderate Safety / High Growth.

5. JPMorgan Chase (JPM)

Sector: Financials

The Pitch: The fortress balance sheet. High interest rates benefit banks' net interest income, allowing JPM to return massive capital to you via dividends and buybacks.

Rating: Moderate Safety / Moderate Growth.

6. PepsiCo (PEP)

Sector: Consumer Defensive

The Pitch: Snacks and beverages are recession-resistant. PepsiCo has immense pricing power, meaning they can raise prices to match inflation without losing customers.

Rating: High Safety / Moderate Growth.

7. Home Depot (HD)

Sector: Consumer Cyclical

The Pitch: As the housing market stabilizes in 2026, home improvement spending returns. HD has a shareholder-friendly policy that targets a high payout ratio.

Rating: Moderate Safety / High Growth.

Source: Analyst’s compilation

Tip: Use the Stock Technical Analysis feature to find the best entry points for these stocks so you don't buy at a peak.

Spotting The Yield Trap: When High Dividends Signal Trouble

You see a stock yielding 9% and your eyes light up. Be careful. In the world of high dividend large cap stocks, an abnormally high yield is often a distress signal, not a bargain. This is called a “Yield Trap.”

A yield trap happens when a stock price collapses, mathematically pushing the yield up. If the company cuts the dividend next quarter, you lose your income and your capital.

Here is a checklist of 5 Red Flags to watch for:

1. Payout Ratio > 80%: If they are paying out more than they earn, the dividend is at risk (REITs and BDCs are exceptions).

2. Declining Free Cash Flow: Dividends are paid from cash, not "net income." If cash flow is dropping, the dividend is next.

3. High Debt Levels: In a high-rate environment, servicing debt takes priority over paying you.

4. Yield is 2x the Sector Average: If the sector yields 3% and this stock yields 8%, the market is pricing in a cut.

5. Declining Revenue: A shrinking business cannot support a growing dividend forever.

Source: Analyst’s compilation

You can automate this risk check using the AI Screener to filter out companies with dangerous debt-to-equity ratios.

The Payout Ratio Reality Check

Many investors look at the EPS Payout Ratio. You should look at the FCF Payout Ratio. Accounting gimmicks can manipulate Earnings Per Share (EPS). Free Cash Flow (FCF) is harder to fake. It is the cash left over after the company pays its bills and capital expenditures.

Always check if the dividend is covered by FCF. If a company has a dividend bill of $1 Billion but only generated $800 Million in FCF, they are borrowing money to pay you. That is unsustainable. For a deeper dive into financial health, utilize Intellectia's AI Earnings Prediction to see if future cash flows look healthy enough to sustain the payout.

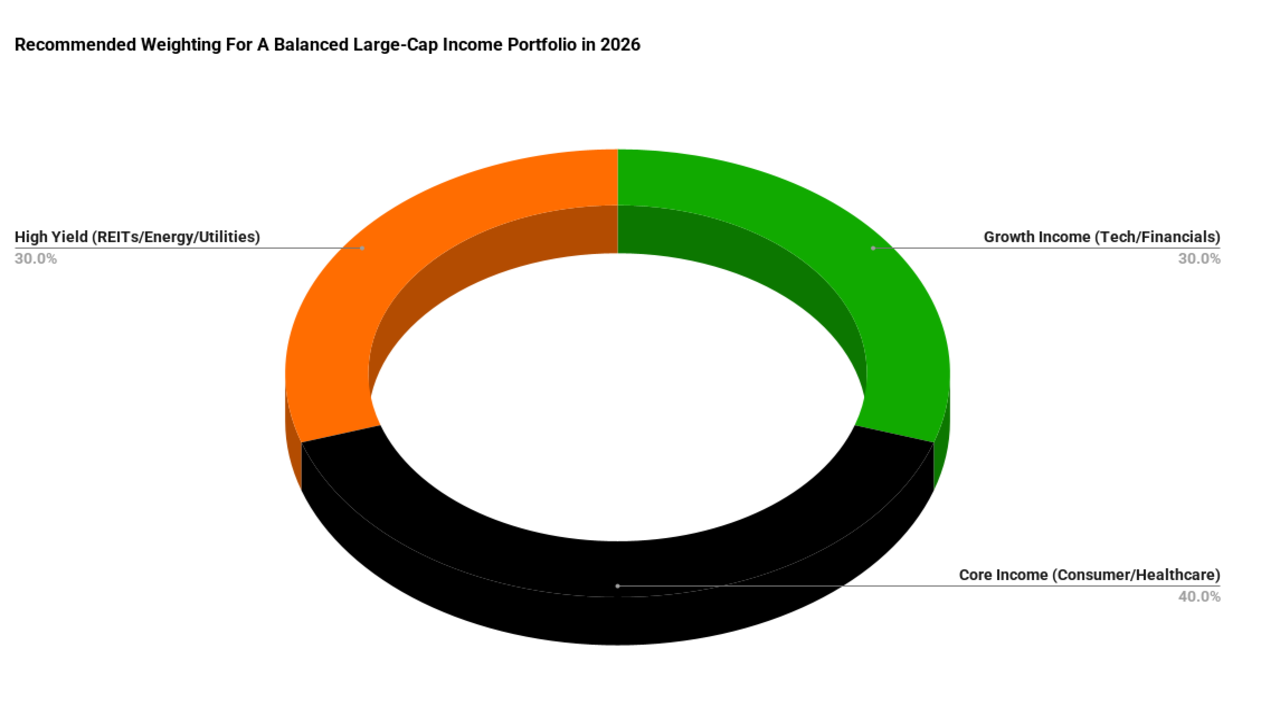

Sector Strategy: Avoiding Concentration In Stagnant Industries

A common mistake when building a dividend portfolio is ending up with 50% Utilities and 50% Consumer Staples. While these are safe, they often offer zero growth. If inflation hits 3%, and your stocks only grow 2%, you are losing purchasing power.

You need a diversified approach. Here is a recommended weighting for a balanced large-cap income portfolio in 2026:

- Growth Income (Tech/Financials): 30% - Look for lower yields but high dividend growth rates (e.g., Visa, Microsoft).

- Core Income (Consumer/Healthcare): 40% - The bedrock of your portfolio (e.g., Pepsi, Pfizer).

- High Yield (REITs/Energy/Utilities): 30% - Boosts the immediate cash flow (e.g., Realty Income, Duke Energy).

Source: Analyst’s compilation

To visualize your sector spread, you can use the Stock Monitor to track your portfolio's exposure and ensure you aren't over-concentrated.

Implementation Guide: How To Buy And Reinvest For Maximum Compounding

Once you have selected your high dividend large cap stocks, the execution matters as much as the selection. You have two powerful tools at your disposal: DRIPs and Tax-Advantaged Accounts.

The Power of DRIPs (Dividend Reinvestment Plans):

Don't take the cash. Reinvest it. When you turn on DRIP, your dividends automatically buy more shares of the stock, often without commission. This creates a “snowball effect.”

Tax-Advantaged Accounts:

Place your high-yield payers (like REITs) inside a Roth IRA or 401k. REIT dividends are usually taxed as ordinary income, which is a high rate. In a Roth IRA, that income is tax-free.

Here is the difference between taking the cash vs. reinvesting it over 20 years (assuming 7% growth and 3% yield):

| Strategy | Initial Investment | 20-Year Value |

| Cash Out Dividends | $10,000 | $38,696 |

| Reinvest Dividends (DRIP) | $10,000 | $67,275 |

The data is clear. Reinvesting nearly doubles your wealth over two decades.

For precise entry and exit signals to maximize your returns, consider using the Swing Trading features offered by Intellectia.

Conclusion

Navigating the market for high dividend large cap stocks in 2026 requires more than just chasing the highest number on a screen. By using the Total Shareholder Yield framework, focusing on cash flow coverage, and avoiding yield traps, you can build a portfolio that pays you to wait while offering solid upside potential.

Remember, the goal isn't just income; it's income safety and growth. Don't go it alone. Leverage the power of AI to validate your picks and time your trades.

Ready to build a smarter portfolio? Sign up and Subscribe to Intellectia.AI today. Get alerts on daily AI stock picks, advanced trading signals, and deep market analysis to secure your financial future.