Key Takeaways

- Energy storage stocks are growing so rapidly in many regions of the world as they support clean energy and help reduce the carbon emission impact.

- Research suggests that the projected size of the global energy storage market for 2030 is 114.01 billion, compared to 58.41 billion in 2023.

- When seeking the best energy storage stocks, it requires checking on different angles to determine the top ones.

- Direct investment, ETFs, Swing Trading, and research fundamentals would be good options to invest in energy storage stocks.

Introduction

The world is seeking zero carbon emissions or efficient and clean energy sources to deal with the global carbon impact. So, it's no wonder many companies are working with renewable energy sources like wind and solar. The energy storage system becomes valuable as the technique addresses the excess energy these systems produce and which remains unused. So, the world can use that energy when needed.

The system can deliver energy using the storage system from charging a mobile phone to powering a whole city. As the demand for clean, efficient, and reliable energy increases, stocks of companies involved with energy storage technologies or supplies become attractive and sustainable investments.

However, determining the best investment assets in any industry requires a certain understanding. The sector is emerging, and many energy storage stocks are available for investors. In the following section, we will discuss energy storage stocks, their definitions and types, why to invest in them, how to select the best, using the Intellectia.ai investment tools.

What Are Energy Storage Stocks?

Energy storage has become a notable part of the energy industry. The mechanism addresses storing energy during production and using it later; the process maintains imbalances between the supply and demand of energy. The energy storage system mostly incorporates renewable energy sources like solar and wind, which provide efficient, clean, and reliable energy. When the energy production decreases, for instance, at night if solar, these storage systems can provide energy and keep things going.

Usually, shares of publicly traded companies that are involved in the production, design, management or integration of energy storage technology can be considered energy storage stocks. The demand for clean energy is increasing rapidly, as are the uses of renewable energy sources. Energy storage stocks have become attractive investment assets as they play a significant role in the ecosystem. These companies usually enhance energy efficiency, sustainability, and reliability.

There are usually three types of energy storage stocks:

- Lithium-Ion Batteries: Lithium-ion batteries are rechargeable energy storage systems that depend on lithium-ion movements through the anode and cathode when charging or discharging. This energy storage system involves high energy density, and the technology is widely used in various applications, such as smartphones, electric vehicles (EVs), laptops, etc.

- Grid-Scale Storage: Grid-Scale Energy usually involves storing energy in a large volume, which in most cases has direct integration with the electrical grid and is capable of managing utility-scale energy. This system usually stores energy when supply exceeds demand and releases energy during an outage or when demand increases. This grid-scale energy storage plays a vital role in enhancing the efficiency, reliability, flexibility, and scalability of the power grid.

- Residential Storage: Residential energy storage usually involves storing energy in low scale compared to grid-scale and suitable to support homes or small businesses. In most cases, this system supports energy efficiency, reduces carbon footprint, cost effectiveness, dependency etc.

Why Invest in Energy Storage Stocks?

Energy storage technology is growing so rapidly in many regions of the world as it supports clean energy and helps reduce carbon emission impact.

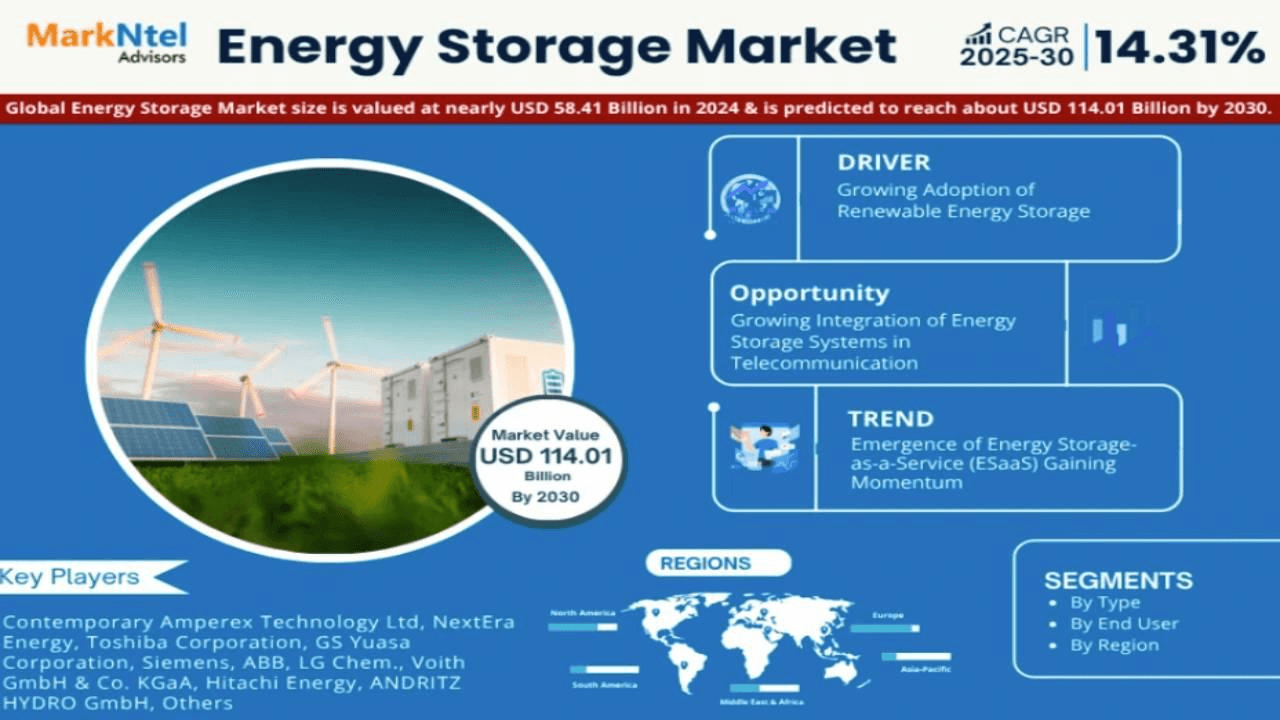

Research from MarkNtel Advisors shows that the projected size of the global energy storage market for 2030 is 114.01 billion, compared to 58.41 billion in 2023. Meanwhile, the estimated CAGR rate during the anticipation period is 14.31%.

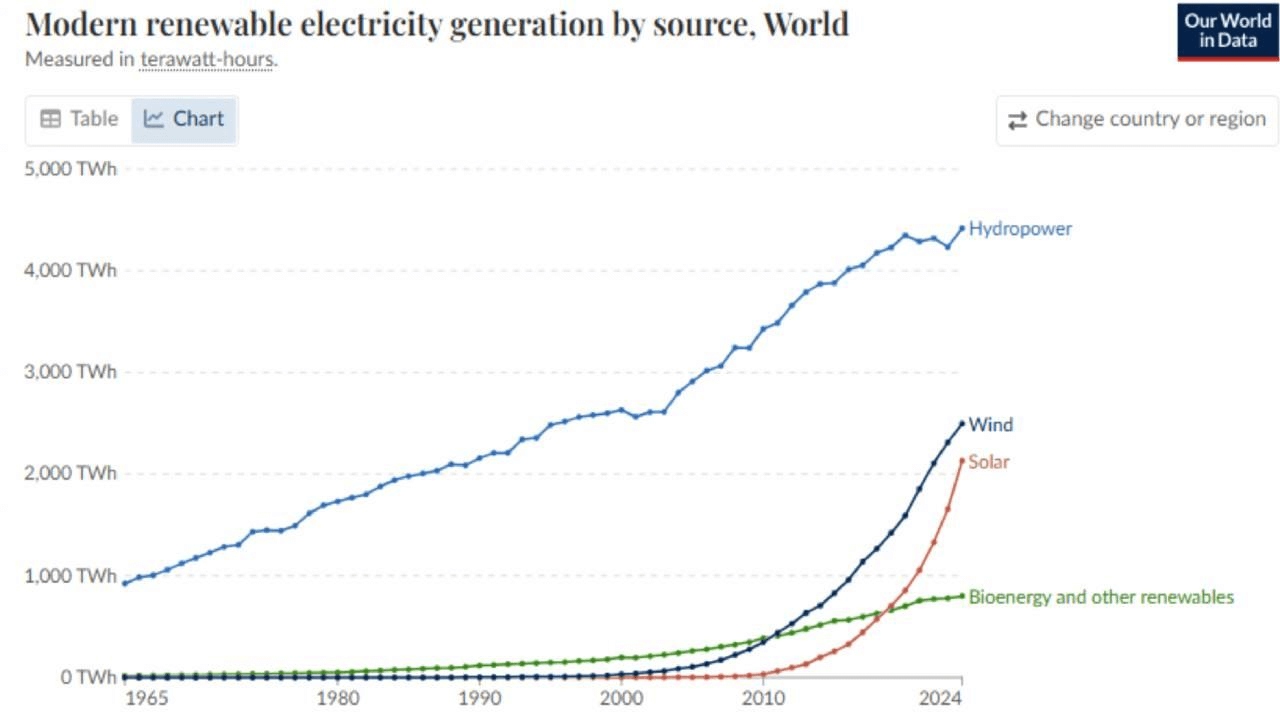

One of the key drivers of the global energy storage market is renewable energy, such as wind and solar power. Governments around the world shifting toward softer policies to adopt the technology drives the cost lower. As a result solar capacity increased by 417,800% and wind energy capacity surged by 63,380% since 2000.

In the meantime, fossil fuel consumption surged by only 68.9%. These figures suggest that the sector is expanding rapidly, and the adoption of energy storage technology is increasing rapidly.

These graphs above reveal that the deployment of solar, wind and EV is increasing, so the demand for energy storage technology is increasing. Meanwhile, the government provides policies in different regions to boost the adoption of renewable energy. Another positive factor driving the sector is technological innovation that supports cost reduction and enhances performance. These factors indicate the potential of the energy storage system or stocks related to this industry.

Criteria for Selecting the Best Energy Storage Stocks

Several criteria must be considered while selecting the best energy stocks. In the following section, we list the criteria that any investor must consider when selecting an asset to invest in.

- Battery Technology: It is mandatory to check the core of any company's business before investing in its shares. Battery technology is surging so rapidly, especially companies involved in manufacturing and distributing the latest lithium-ion, solid-state, or flow batteries, as these products drive long-term growth. These company stocks can be attractive as these organisations work on reducing costs and delivering more efficient technology.

- Diversified Business Model: Another key factor is to check on the target company's business model, as to which sector the company operates in. For example, a company with a diversified business model might be involved in various sectors, such as grid-scale storage, EV integration, etc. So, these companies can address commercial and individual demand for energy storage; it has more potential than any company that works with any single industry product.

- Revenue and Earnings Growth: Checking revenue growth and earnings growth data is another unavoidable factor when choosing the most promising energy storage stocks. A company with sustainable growth in both criteria indicates sustainable growth and makes the asset attractive to investors.

- Strategic Partnerships: Strategic partnerships are another crucial factor to consider when choosing potential energy storage stocks. Firms that have partnerships with big giants in the sector or government help the organisation expand accessibility and often trigger credibility. These companies may secure sustainable periods through these partnerships.

- Government Incentives And Regulatory Support: Government incentives help companies in the energy storage sector to reduce costs and regulatory support helps them to expand more. So checking these factors before investing might help investors to sort out the most potential energy storage stocks.

- Market Position and Global Expansion Strategy: The company's market position and global expansion strategy must be checked, as these factors are essential to understanding the company's vision and long-term growth perspective.

List of Energy Storage Stocks

In this part, we list the top five energy storage stocks which are potentially worth investing in 2025.

Company Name | Ticker Symbol | Market Cap (USD) | Strength |

|---|---|---|---|

Generac Holdings Inc | GNRC | 7.59 billion | The company has diversified product offerings, a notable market position and an established brand. |

Enersys | ENS | 3.46 billion | The company has attractive EPS growth, and has expertise to address different sectors. |

Eos Energy Enterprises Inc | EOSE | 1.04 billion | The company has a growing revenue figure and has significant innovation to support its growth. |

Fluence Energy Inc | FLNC | 867.36 million | The company has considerable position in the industry, and has recently secured contracts in different regions, reflecting growth potential. |

Enphase Energy Inc | ENPH | 5.68 billion | The company has notable market presence, and inverter technology innovation gives a boost to maintain solid financial performance. |

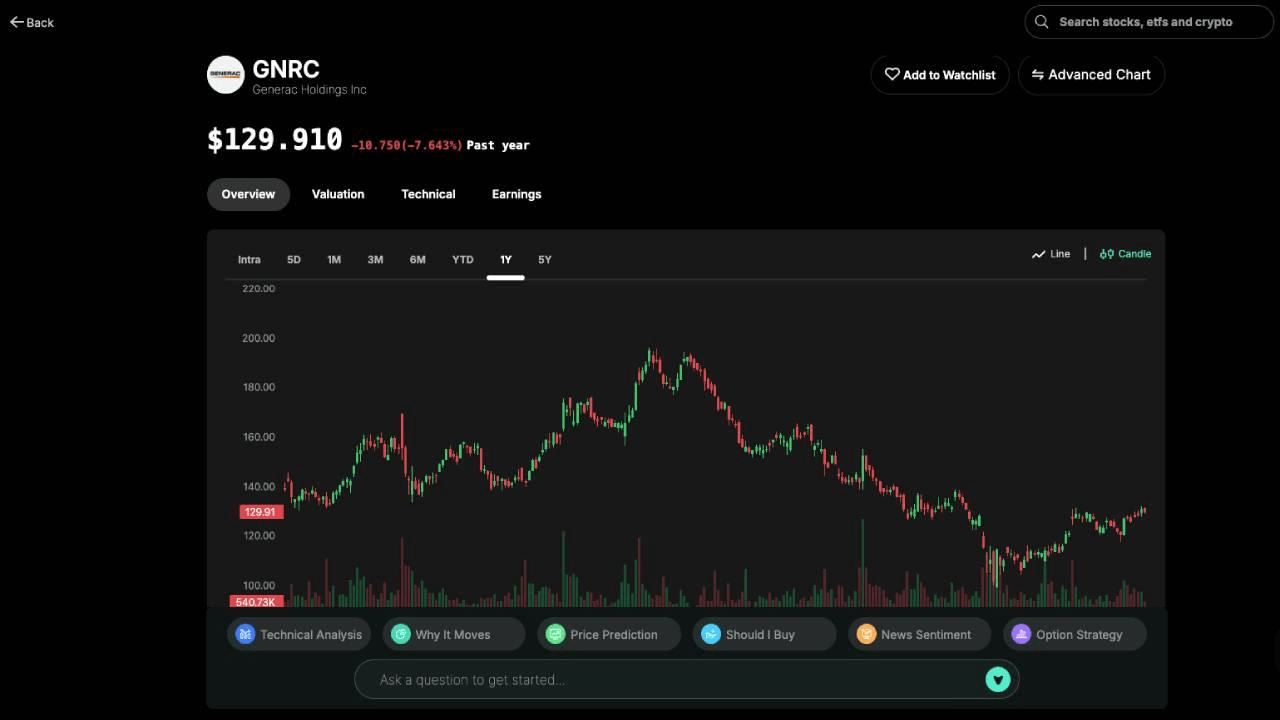

Generac Holdings Inc (GNRC)

Generac Holdings Inc is a top energy technology solution company, which is United States based. The company has diverse offerings for designing and manufacturing energy technology products and services. GNRC provides energy solutions for both commercial and residential clients.

The five-year chart shows that the price of the GNRC stock has remained near the support zone. With the industry's increasing demand, the price might hit near the peak of $500 in the upcoming years.

Buy and Hold would be one approach to jump into this stock but the ideal approach would be to find price swings using the Intellectia.ai swing trading tools to make the best out of the price movement.

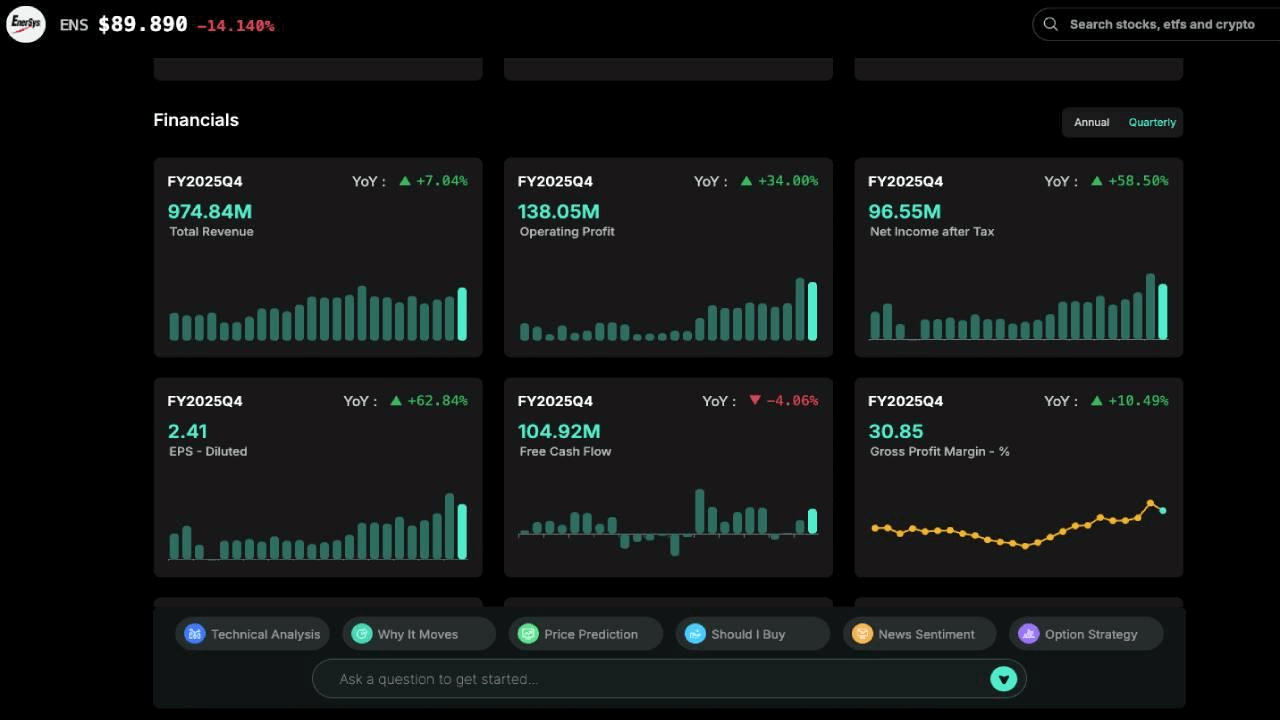

Enersys (ENS)

Enersys remains among the top energy storage stocks as the company provides energy solutions for industries. The company offers a wide range of applications in the energy sector, as it distributes and manufactures batteries, chargers, and energy storage solutions.

The figure above confirms the company shows notable financial performance, reflecting potentiality. ENS has considerable market presence and an established customer base helps the company to have sustainable growth.

It is clear that the company has been profitable for a considerable time, as shown by the stable Operating profit. Also, the net income after tax suggests that the company is even profitable after considering all non-cash costs.

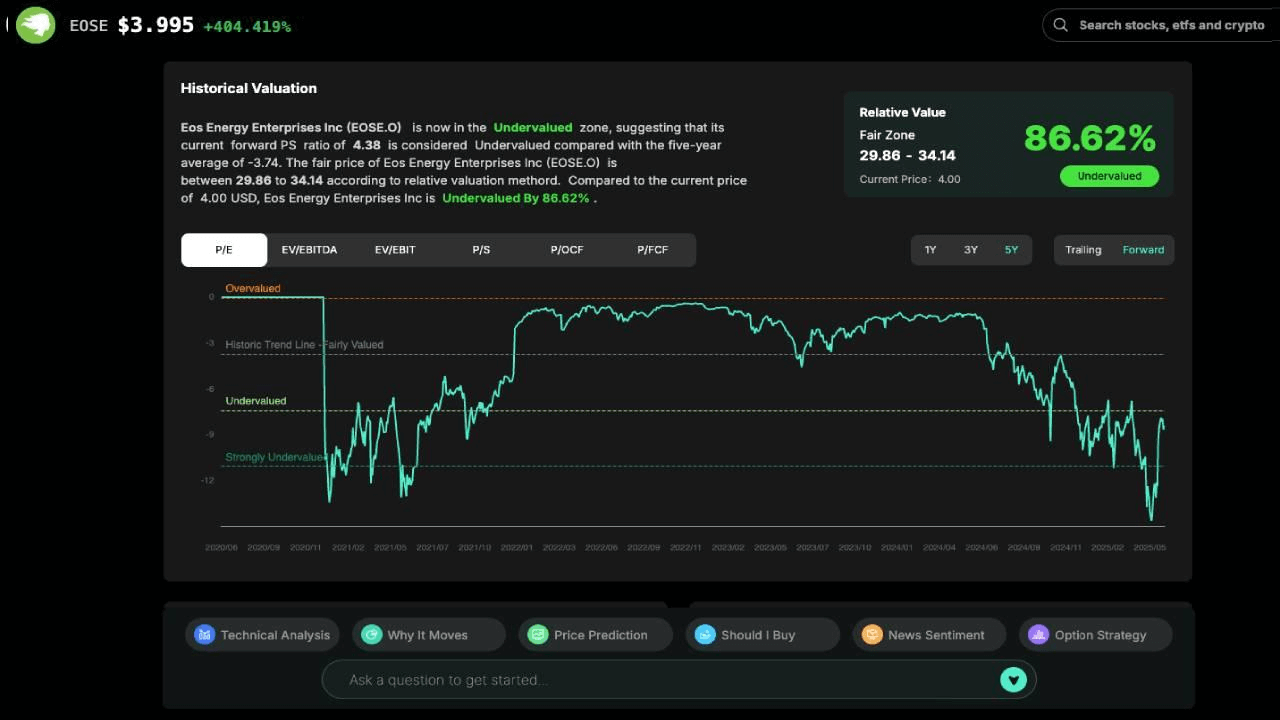

Eos Energy Enterprises Inc (EOSE)

Eos Energy Enterprises Inc is a company that provides energy-based solutions at utility scale for industries and commercials. The company usually provides zinc-based energy storage solutions, an alternative to lithium-ion based energy storage solutions. EOSE usually designs, manufactures and distributes zinc-based energy storage technology solutions.

The historic valuation data confirms the price of the EOSE stock remains significantly undervalued. So, there are significant possibilities that the price might hit an upside in the upcoming years to match the fair price with increasing demand of the product and services offerings by the company.

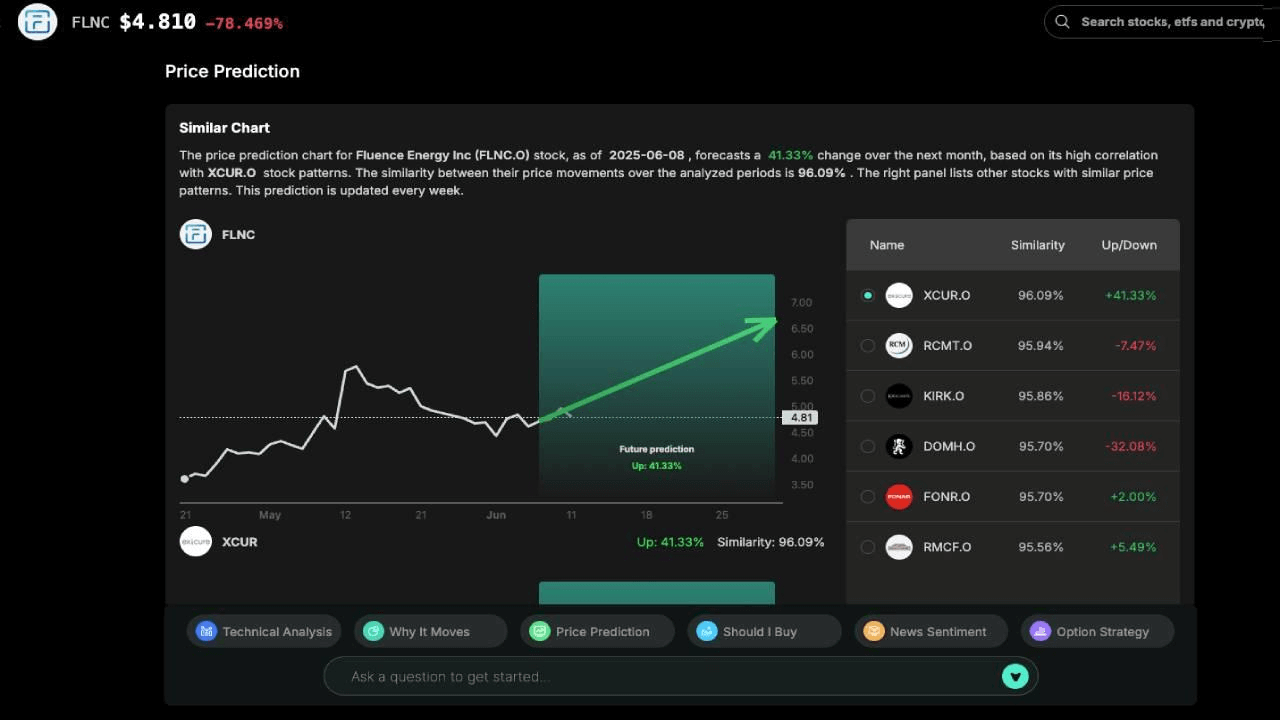

Fluence Energy Inc (FLNC)

Fluence Energy Inc is a global provider of services and products of energy storage solutions. They optimize AI based software solutions for renewable energy and storage solutions.

The chart above shows that the company has the potential to surge 41.33% in the next one-month period, making it an attractive investment asset for investors who want to generate significant profits. Meanwhile, the company is expanding its operations in different regions and securing different contracts, which reflects sustainability and long-term growth potential.

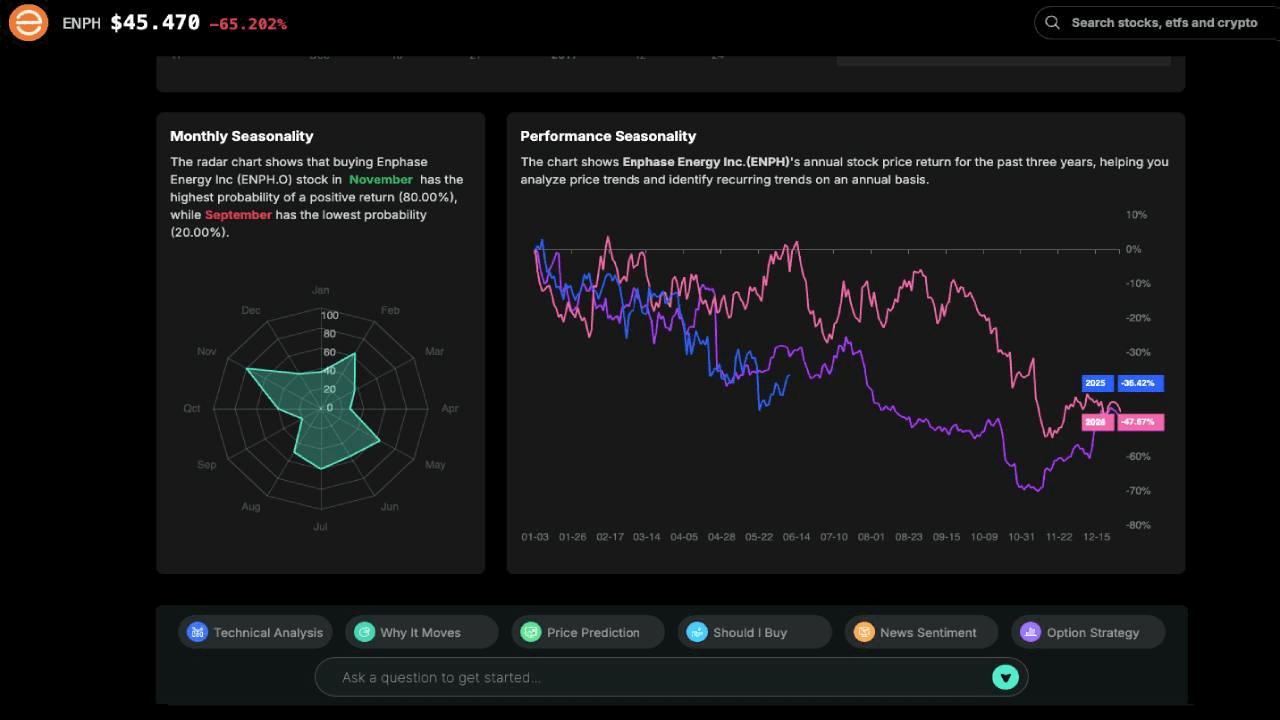

Enphase Energy Inc (ENPH)

Enphase Energy Inc. is another notable player in the energy solution industry. The company usually develops, designs, manufactures, and provides solutions for home energy. The primary focus of the company remains on generating, storing, and managing the system through an intelligent platform. ENPH has a microinverter system, battery solutions, and software solutions. The company provides services to homes and commercial areas through these products.

The chart above shows that the company has the potential to grow significantly in the upcoming years, as the recent demand surge and innovation support the company's maintenance of sustainable financial growth.

How to Invest in Energy Storage Stocks

When seeking the best energy storage stocks, it requires checking on different angles to determine the top ones. Platforms like Intellectia.ai have different features to enhance your analysis and select the best potential energy storage stocks.

- Direct Investment In Pure-Play Energy Storage Companies Vs. Diversified Energy Companies With Storage Divisions

You can choose companies that may be significantly involved in energy storage solutions, which can be risky. Again, you can also choose companies with diversified solutions addressing different industry sectors. These companies offer comparatively safe and sustainable products. Intellectia AI Stock Screener can filter the company by market capitalisation, financial health, volatility, etc.

- Consideration of energy storage ETFs and Mutual Funds Focused on Clean Energy and Storage Technologies

Some investors might look for diversified exposure on the sector; they can try investing in exchange-traded funds (ETFs) related to energy storage technology solutions. For example, an energy storage ETF might consist of stocks of companies involved in providing energy storage solutions, manufacturing equipment for renewable energy, providing softwares, etc. These are investment assets for investors who might seek long-term growth with low risk.

- Long-Term Growth Potential Balanced With Short-Term Market Volatility

Energy Investing in energy storage companies can be volatile and risky for short-term traders. To overcome and balance long-term vs short-term investment practices, you can use Day Trading Centre and Swing Trading features offered by intellectia.ai, as it will help you to determine the best potential investment assets based on technical analysis on different measurements like momentum, volume, price action, etc.

- Research Company Fundamentals and Market Positioning

Another mandatory factor to consider when selecting any energy storage stock is to check on company fundamentals such as market position, expansion, market presence, new contracts, strategic partnerships, etc. These factors influence the price of the stock. You can use Intellectia.ai Earnings Trading feature to get the news and fundamentals on your target asset to determine the best ones.

Conclusion

Investing in energy storage companies enables considerable profits to be made over a certain period. This article gives a basic idea of selecting the best potential energy storage stocks, besides listing the top five. When you have access to platforms like Intellectia AI, you can utilise the attractive features offered by the platform to determine the best ones, and it will also help you make trade decisions to maximise profits.

You can sign up today to explore the platform's AI tools and choose the one to enhance your investment experience.