Key Takeaways

- Bitcoin (BTC) serves as a digital currency and store of value, while Ethereum (ETH) powers a vibrant ecosystem of decentralized applications and smart contracts.

- They differ significantly in launch dates, market caps, supply limits, transaction speeds, energy consumption, block times, programming capabilities, and scalability.

- Bitcoin may appeal as a hedge against inflation with lower volatility, while Ethereum offers exposure to DeFi and dApps with higher risk and potential reward.

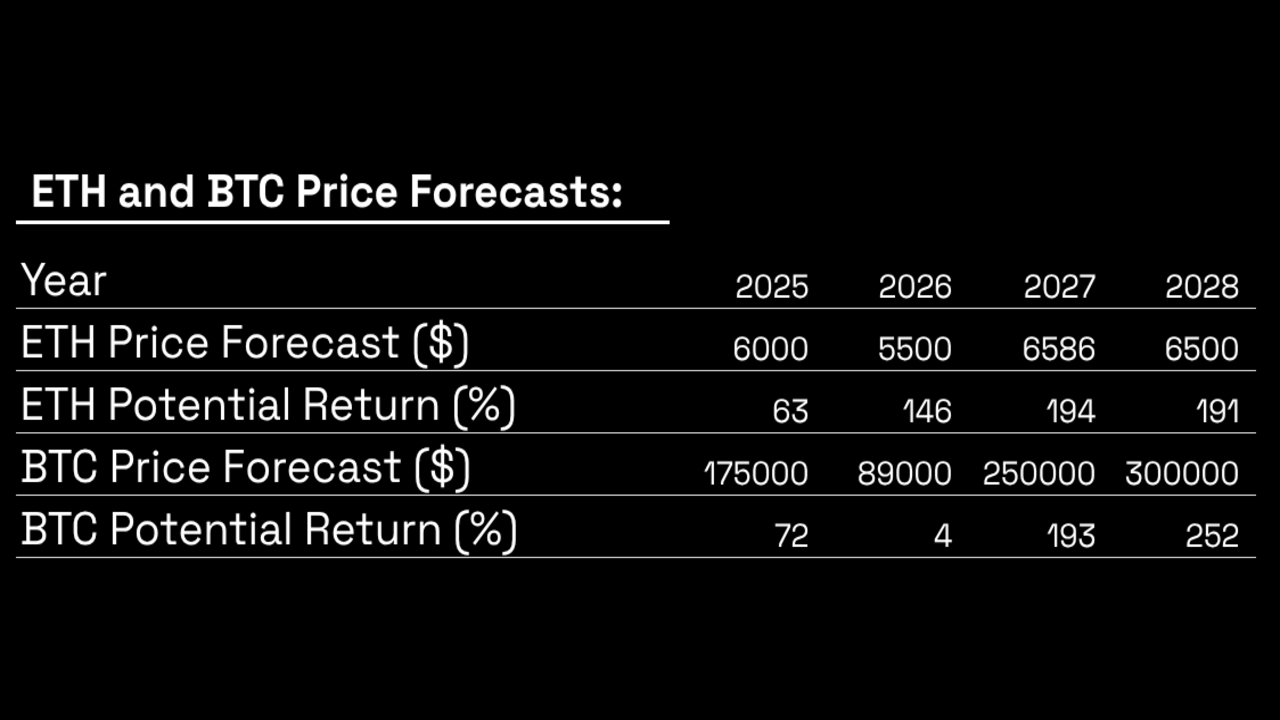

- Analysts predict Bitcoin could reach ~$175,000 and Ethereum $6,000 by 2025, driven by market trends and technological advancements.

- Platforms like Intellectia.ai provide AI-driven tools for price predictions, trading strategies, and market analysis to guide your crypto investments.

Introduction

Have you ever found yourself scratching your head over the differences between Bitcoin and Ethereum, wondering which one might be the better fit for your investment portfolio? As the top two cryptocurrencies by market capitalization, they dominate the digital finance landscape, each offering unique strengths that cater to different investor needs.

Bitcoin is often hailed as a stable store of value, akin to digital gold, while Ethereum fuels an expansive ecosystem of decentralized applications, from finance to digital collectibles. This article dives deep into the BTC vs. ETH debate, exploring their features, similarities, and investment potential for 2025.

What is Bitcoin?

Bitcoin, launched on January 3, 2009, by the enigmatic Satoshi Nakamoto, is the world’s pioneering cryptocurrency, setting the stage for the blockchain revolution. It operates on a decentralized blockchain, enabling secure, peer-to-peer transactions without the need for banks or governmental oversight.

With a capped supply of 21 million coins, Bitcoin is frequently compared to gold, serving as a store of value and a medium of exchange in an increasingly digital world. Its robust security, driven by a vast network of miners, and global recognition make it a cornerstone of the crypto market, particularly appealing to investors seeking stability and a hedge against economic uncertainty.

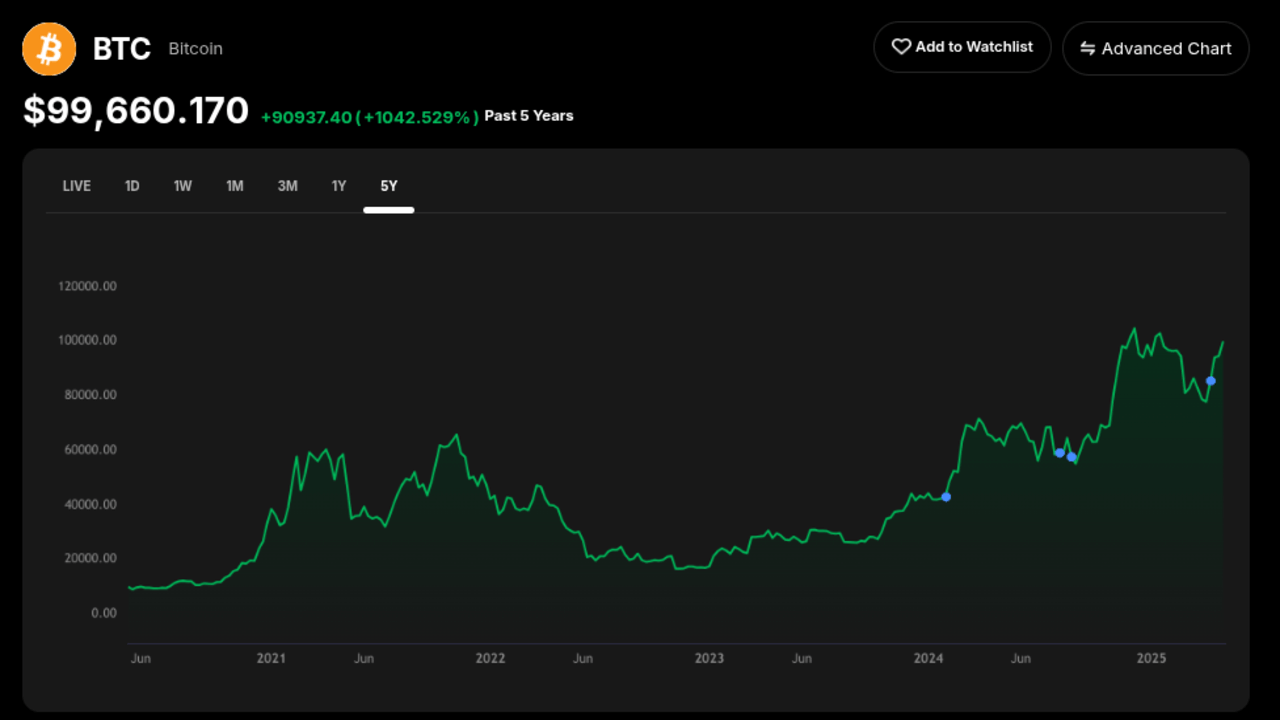

Source: Intellectia.AI

What is Ethereum?

Ethereum, introduced on July 30, 2015, by Vitalik Buterin and his team, is far more than a cryptocurrency—it’s a versatile blockchain platform that redefines how we interact with digital systems. Its native token, Ether (ETH), powers transactions and smart contracts, which are self-executing agreements that enable decentralized applications (dApps).

From decentralized finance (DeFi) platforms to non-fungible token (NFT) marketplaces, Ethereum’s flexibility makes it a hub for blockchain innovation, attracting developers and investors eager to capitalize on the future of decentralized technology. Unlike Bitcoin’s focus on currency, Ethereum’s vision is to create a decentralized internet, supporting a wide array of use cases that drive its growth.

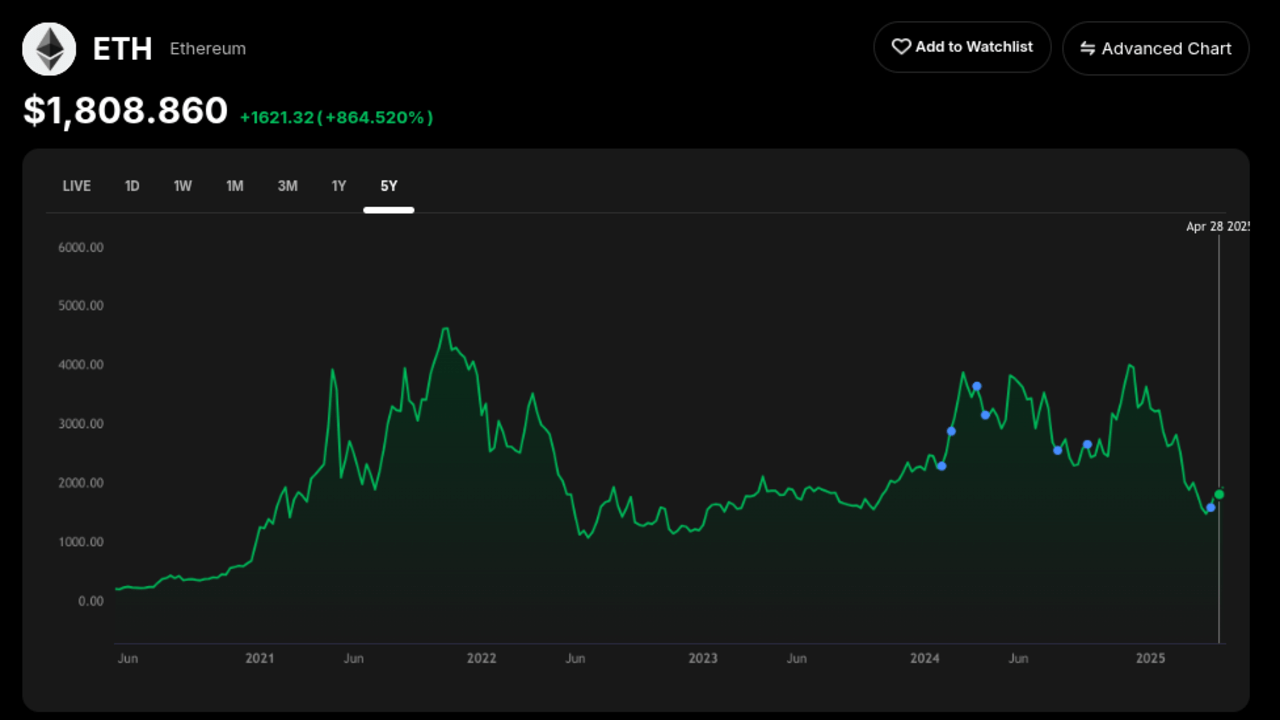

Source: Intellectia.AI

BTC vs ETH: Key Differences

To fully grasp how Bitcoin and Ethereum differ, let’s examine their core metrics in a detailed comparison table, which highlights their distinct approaches to blockchain technology:

| Aspect | Bitcoin (BTC) | Ethereum (ETH) |

|---|---|---|

| Launch Date | January 3, 2009 | July 30, 2015 |

| Market Cap | $1.92 trillion (May 2025) | $221.39 billion (May 2025) |

| Supply Limit | 21 million coins | No fixed limit |

| Transaction Speed | ~7 transactions per second | ~15 transactions per second |

| Energy Consumption | High (Proof of Work) | Low (Proof of Stake) |

| Block Time | 10 minutes | 12–15 seconds |

| Programming Capability | Limited scripting | Turing-complete smart contracts |

| Scalability | Lightning Network | Layer 2 solutions, sharding |

These metrics underscore Bitcoin’s focus on security and scarcity versus Ethereum’s emphasis on speed, programmability, and ecosystem growth.

BTC vs ETH: Comparison

Let’s explore the basics of Bitcoin and Ethereum across critical dimensions to help you understand their unique roles in the crypto landscape.

Use Cases

Bitcoin excels as a digital currency and store of value, often used to hedge against inflation or economic instability, much like a digital equivalent of gold. Its simplicity, security, and widespread adoption make it a preferred choice for investors looking to diversify their portfolios with a relatively stable asset.

Ethereum, on the other hand, is a platform for building decentralized applications, enabling services like decentralized exchanges, lending platforms, and NFT marketplaces. Ether fuels these applications, positioning Ethereum as a leader in blockchain innovation and a bet on the future of decentralized technology.

Consensus Mechanism

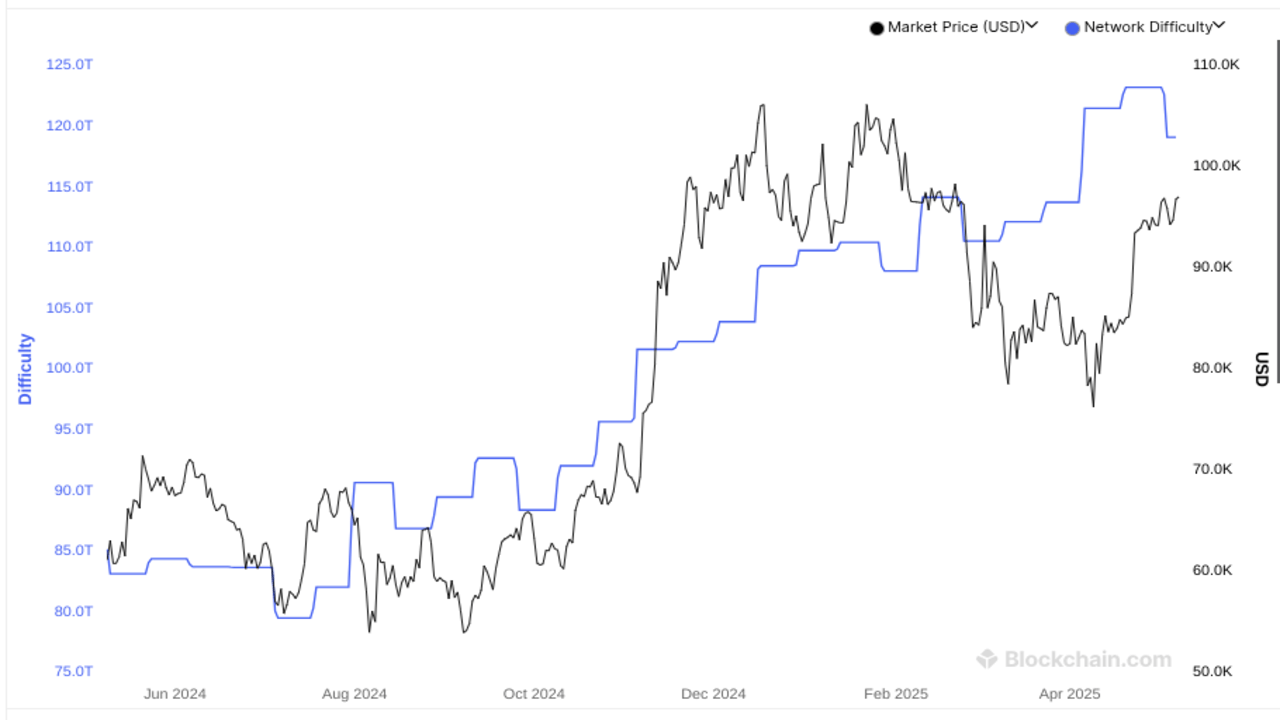

Bitcoin relies on Proof of Work (PoW), where miners solve complex mathematical puzzles to validate transactions, ensuring robust security but consuming significant energy. This energy-intensive process has drawn criticism but remains a hallmark of Bitcoin’s decentralized resilience.

Ethereum transitioned to Proof of Stake (PoS) in 2022, allowing users to stake ETH to secure the network, drastically reducing energy consumption and speeding up transactions. While PoS makes Ethereum more eco-friendly and efficient, some argue PoW offers a more battle-tested security model for long-term stability.

Source: blockchain.com

Smart Contracts and Decentralized Applications

Bitcoin supports basic scripting for transactions, such as multi-signature wallets, but its programmability is limited, focusing on secure value transfer. Ethereum’s Turing-complete smart contracts, however, enable complex dApps that automate processes without intermediaries, driving growth in sectors like DeFi and NFTs.

Platforms like Uniswap and OpenSea thrive on Ethereum, making it a hotbed for developers and investors seeking exposure to cutting-edge blockchain applications. This programmability sets Ethereum apart as a dynamic platform for innovation.

Price Volatility and Recent Price Levels

Both cryptocurrencies are volatile, but their price dynamics differ due to their market roles. As of May 2025, Bitcoin trades at approximately $96,737, reflecting a 41.5% increase from $68,372 in May 2024, driven by institutional adoption and ETF inflows.

Ethereum, at $1,834, has declined from $3,748 over the same period, likely due to market corrections and competition from rival blockchains. Bitcoin’s larger market cap often makes it less volatile, while Ethereum’s price can swing with trends in DeFi and NFTs.

ETH vs BTC: Similarities

Despite their differences, Bitcoin and Ethereum share several core traits that make them foundational to the crypto ecosystem. Both operate on decentralized networks, ensuring trustless transactions without central authorities, which appeals to those valuing financial sovereignty. They leverage blockchain technology for secure, transparent record-keeping, fostering trust in their systems.

Peer-to-peer transactions allow you to send funds directly, bypassing traditional intermediaries like banks. Additionally, both attract investors, with Bitcoin serving as a stable anchor and Ethereum offering growth opportunities tied to technological innovation. These shared features solidify their dominance in the crypto market.

BTC vs ETH: Future Outlook and Predictions

What lies ahead for Bitcoin and Ethereum? Let’s explore analyst forecasts and potential scenarios to help you plan your 2025 investments.

Bitcoin

Analysts predict Bitcoin could reach $175,000 by 2025, with some estimating an average price of $125,027 and bullish forecasts up to $181,064. This optimism stems from institutional investment, ETF inflows, and Bitcoin’s role as a deflationary asset in a world of fiat currency expansion.

However, regulatory scrutiny, energy consumption concerns, and competition from central bank digital currencies (CBDCs) could pose challenges. Stay informed with Intellectia.ai’s news to track these developments.

Source: Intellectia.AI Data

Ethereum

Ethereum’s price is projected to hit $6,000 by 2025, with some analysts predicting up to $5,925, driven by DeFi growth, NFT adoption, and the Pectra upgrade. The upgrade’s focus on staking efficiency and validator flexibility could increase ETH demand, particularly among institutional investors.

However, competition from rival blockchains, high gas fees, and regulatory uncertainties remain hurdles. You can use Intellectia.ai’s crypto technical analysis for detailed technical forecasts on crypto.

Source: Intellectia.AI

Potential Scenarios

Bitcoin could solidify its role as digital gold, attracting investors seeking stability amid economic uncertainty, particularly if inflation persists. Ethereum might dominate DeFi and Web3, with ETH’s value closely tied to the growth of dApps and smart contracts, especially in emerging sectors like decentralized identity and gaming.

Both face challenges, including regulatory pressures, technological risks, and competition from newer blockchains, requiring vigilant monitoring to stay ahead of market shifts.

Ethereum vs Bitcoin: Investment Considerations in 2025

Choosing between Bitcoin and Ethereum for 2025 hinges on your investment goals, risk tolerance, and market outlook. Here’s a detailed look to guide your decision-making process.

Bitcoin (BTC)

Bitcoin’s fixed supply of 21 million coins and global recognition make it a compelling hedge against inflation, particularly in uncertain economic times. Its larger market cap suggests lower volatility compared to altcoins, appealing to conservative investors seeking a stable, long-term store of value.

However, regulatory pressures, such as potential restrictions on crypto trading, and competition from newer digital assets could temper growth. Bitcoin is ideal if you prioritize stability and want a reliable anchor for your portfolio, especially during market turbulence.

Ethereum (ETH)

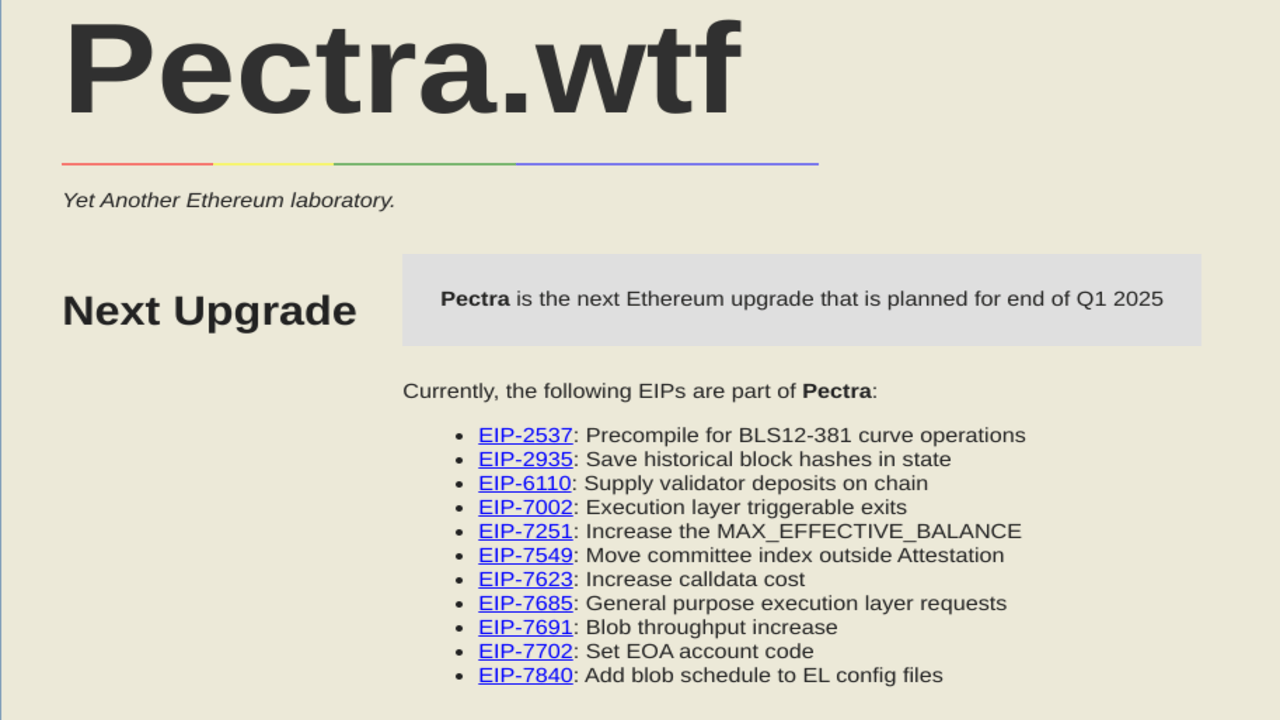

Ethereum’s leadership in DeFi, NFTs, and dApps offers high growth potential, driven by its vibrant developer ecosystem and upcoming network upgrades. The Pectra upgrade, set for 2025, will enhance staking efficiency and scalability, potentially boosting ETH’s value.

However, Ethereum faces higher volatility, competition from blockchains like Solana and Cardano, and technical risks from network changes. It suits investors comfortable with risk and excited by blockchain’s evolving applications, offering a chance for significant returns.

Recent developments could significantly influence Bitcoin and Ethereum’s performance in 2025. For Bitcoin, growing institutional adoption, including the proliferation of Bitcoin ETFs, continues to drive demand and mainstream acceptance. The Lightning Network, a layer-2 solution, enhances transaction speed and scalability, potentially expanding Bitcoin’s use cases beyond a store of value.

For Ethereum, the Pectra upgrade, scheduled for May 7, 2025, introduces 11 Ethereum Improvement Proposals (EIPs), including staking optimizations and an increased validator limit (from 32 ETH to 2048 ETH). These changes could attract more stakers and developers, strengthening Ethereum’s ecosystem and potentially driving ETH’s price higher.

Source: pectra.wtf

Conclusion

Bitcoin and Ethereum remain the pillars of the cryptocurrency world, each offering distinct opportunities for 2025 investors. Bitcoin’s stability and global recognition make it a safe haven, ideal for those seeking to preserve value in turbulent times. Ethereum’s innovation in DeFi, NFTs, and dApps promises higher rewards, albeit with greater risk, appealing to those excited by blockchain’s potential.

As you plan your investments, consider your financial goals, risk tolerance, and the evolving crypto landscape. With Intellectia.AI, you can access AI tools for price predictions, trading strategies, and market analysis.