Key Takeaways

- Treasury ETFs offer a secure way to generate yield and hedge against stock market volatility in 2026.

- Short-term funds like BIL provide cash-like safety, while long-term funds like TLT offer capital appreciation potential during rate cuts.

- Intermediate funds such as VGIT and IEF serve as the "sweet spot" for balanced portfolios.

- Utilizing AI tools from Intellectia.ai can help you time your entry points and optimize your asset allocation.

Introduction

Have you ever looked at your portfolio during a market downturn and wished for a safe haven that still generates cash? You aren't alone. I have spoken to countless investors who chase high-growth stocks, only to panic when volatility strikes, realizing too late that they lacked a defensive anchor. It is a painful lesson, but one that is easily avoidable by understanding the mechanics of the bond market.

By analyzing market sentiment and interest rate trends, you can identify stability without sacrificing income. The solution often lies in US government debt. However, buying individual bonds can be cumbersome and complex. This is where Treasury ETFs come into play. They offer liquidity, diversity, and ease of access, making them a vital tool for any serious investor. In this article, you will explore the best US treasury bond etfs 2026 has to offer, helping you build a fortress around your wealth.

What Are Treasury ETFs?

Before diving into specific tickers, you need to understand exactly what you are buying. Treasury ETFs (Exchange-Traded Funds) are investment funds that hold baskets of U.S. Treasury securities—debt issued by the United States government. Because they are backed by the "full faith and credit" of the U.S. government, they are considered virtually risk-free regarding default.

Source: investor.gov

Definition and Types of Treasury ETFs

Unlike buying a single bond where your money is locked up until maturity, a Treasury ETF trades on the stock exchange just like shares of Apple or Tesla. This gives you high liquidity, meaning you can buy or sell instantly during market hours.

There are varying types of Treasury bond ETFs based on the "maturity" or "duration" of the bonds they hold:

1. Short-Term Treasury ETFs (Bills): These funds hold Treasury Bills (T-Bills) with maturities of one year or less. They are essentially cash equivalents, offering stability and protection of principal with very low volatility.

2. Intermediate-Term Treasury ETFs (Notes): These funds typically hold Treasury Notes with maturities between 2 and 10 years. They offer a balance between yield and interest rate risk. This category includes 10 year treasury etfs, which are often used as a benchmark for the broader bond market.

Source: treasurydirect.gov

3. Long-Term Treasury ETFs (Bonds): These funds hold Treasury Bonds with maturities of 10 to 30 years. They pay higher yields but are highly sensitive to interest rate changes. If rates fall, these prices soar; if rates rise, these prices drop.

4. TIPS ETFs: Treasury Inflation-Protected Securities (TIPS) are designed to protect your purchasing power. The principal value of these bonds adjusts with inflation.

Understanding these distinctions is crucial because the best treasury etfs for you depend entirely on your timeline and risk tolerance.

Why Investors Choose Treasury ETFs in 2026

As the market looks toward 2026, the economic landscape continues to shift. Following a period of aggressive rate hikes, the market is settling into a "new normal." Here is why savvy investors are allocating capital to this sector right now.

Stability in a Volatile Market

Equity markets are prone to sharp corrections driven by earnings misses, geopolitical tension, or sector rotations. Treasury bond ETFs generally have a negative correlation to stocks. When fear grips the stock market, investors flock to the safety of Treasuries, often pushing their prices up. Holding these ETFs acts as a shock absorber for your portfolio, smoothing out the ride and preventing panic selling.

Predictable Income & Strong Liquidity

In an environment where stock dividends can be cut, Treasury yields are contractually guaranteed by the government. Most Treasury ETFs pay dividends monthly, providing you with a predictable stream of income. This is excellent for retirees or anyone looking to compound their wealth through reinvestment. Furthermore, the liquidity is unmatched. Unlike real estate or physical bonds, you can liquidate your position in a Treasury ETF in seconds to raise cash for other opportunities.

How Treasury ETFs Fit Conservative or Balanced Portfolios

Whether you are a conservative investor seeking capital preservation or an aggressive trader looking for a hedge, these funds have a place.

Conservative: You might lean heavily into short-term ETFs to act as a high-yield savings account substitute.

- Balanced: You might use intermediate ETFs to stabilize your core holdings.

- Aggressive: You might trade long-duration ETFs to speculate on interest rate cuts.

In 2026, the ability to tailor your duration exposure will be a key differentiator in performance.

Top Treasury ETFs to Buy in 2026

To help you navigate the market, five of the best treasury etfs available. These picks cover the spectrum from cash-like safety to long-term growth potential.

| Ticker | ETF Name | Sector | Expense Ratio | Yield (TTM) | AUM | Focus |

| VGIT | Vanguard Intermediate-Term Treasury ETF | Gov. Bond | 0.03% | 3.74% | $42.8B | Intermediate Stability |

| IEF | iShares 7-10 Year Treasury Bond ETF | Gov. Bond | 0.15% | 3.71% | $45.4B | 10-Year Benchmark |

| SCHP | Schwab U.S. TIPS ETF | Inflation-Protected | 0.03% | 3.64% | $14.8B | Inflation Hedge |

| BIL | SPDR® Bloomberg 1-3 Month T-Bill ETF | Cash Equivalent | 0.14% | 4.19% | $43.6B | Ultra-Short Safety |

| TLT | iShares 20+ Year Treasury Bond ETF | Long-Term Bond | 0.15% | 4.27% | $49.7B | Rate Cut Play |

1. Vanguard Intermediate-Term Treasury ETF (VGIT)

The Vanguard Intermediate-Term Treasury ETF (VGIT) tracks a market-weighted index of the U.S. Treasury bonds with maturities between 3 and 10 years. With an incredibly low expense ratio of 0.03%, it is one of the most cost-effective ways to gain exposure to the "belly" of the yield curve.

We consider VGIT the "sweet spot" for most investors in 2026. It offers higher yields than short-term cash funds but carries significantly less interest rate risk than long-term bonds.

- Performance: It has shown steady returns, with a 1-year total return of roughly 7.16% as of late 2025.

- Risk Profile: Rated "A" for Risk by quantitative metrics, holding a standard deviation of only 3.41, which is significantly lower than the median for all ETFs.

- Dividends: It has a solid track record of 15 consecutive years of dividend payments.

If you want a "set it and forget it" anchor for your portfolio, VGIT is a prime candidate.

Source: intellectia.ai

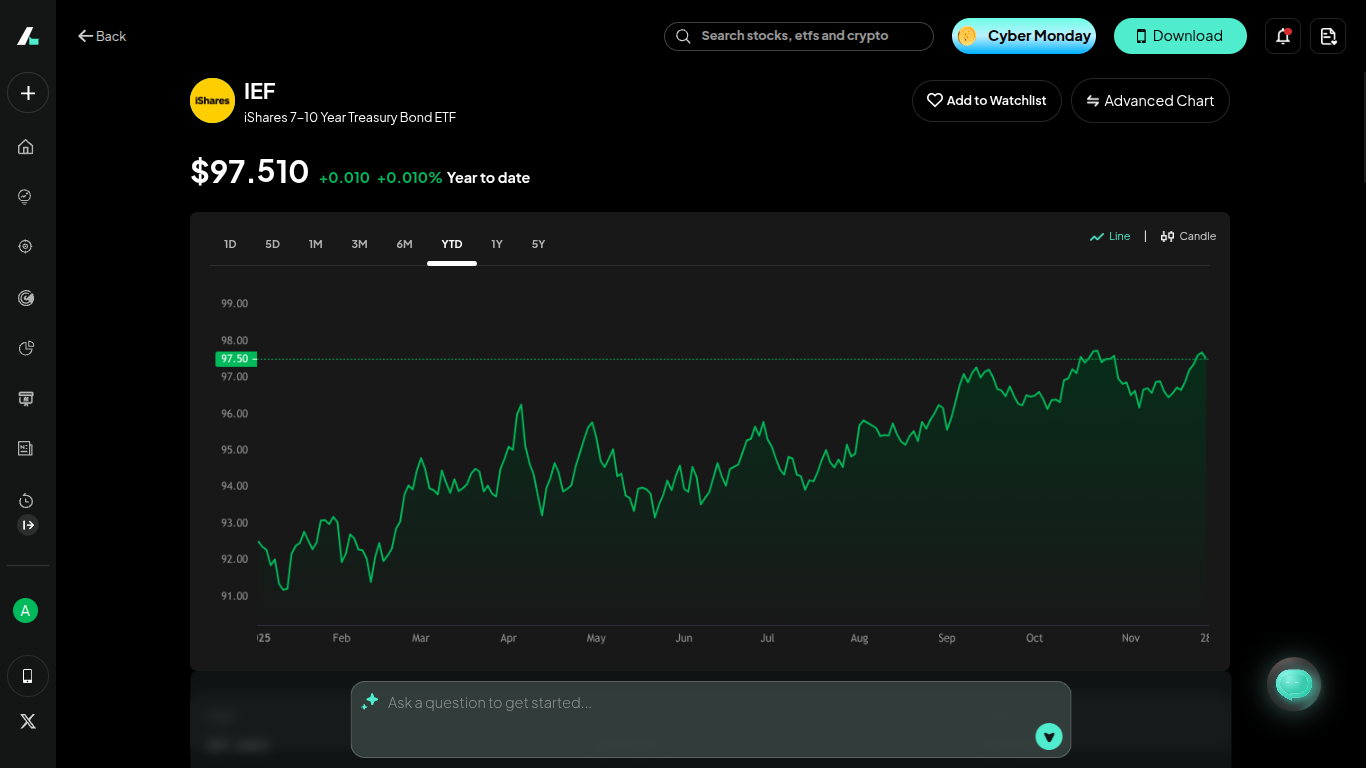

2. iShares 7-10 Year Treasury Bond ETF (IEF)

The iShares 7-10 Year Treasury Bond ETF (IEF) is highly popular among traders and institutional investors. It specifically targets the 7-to-10-year maturity range, making it the standard proxy for the 10-year Treasury note.

When financial news anchors talk about "rates moving," they are usually referencing the 10-year note. IEF gives you direct exposure to this benchmark.

- Liquidity: With an average daily volume of over 7 million shares, spreads are tight, making it easy to enter and exit.

- Yield: A TTM yield of 3.71% provides competitive income.

- Strategy: IEF is often used to hedge against equity corrections. Historically, when the S&P 500 drops, IEF tends to rise.

If you are looking for one of the premier 10 year treasury etfs to balance out a heavy stock portfolio, IEF is the go-to choice.

Source: intellectia.ai

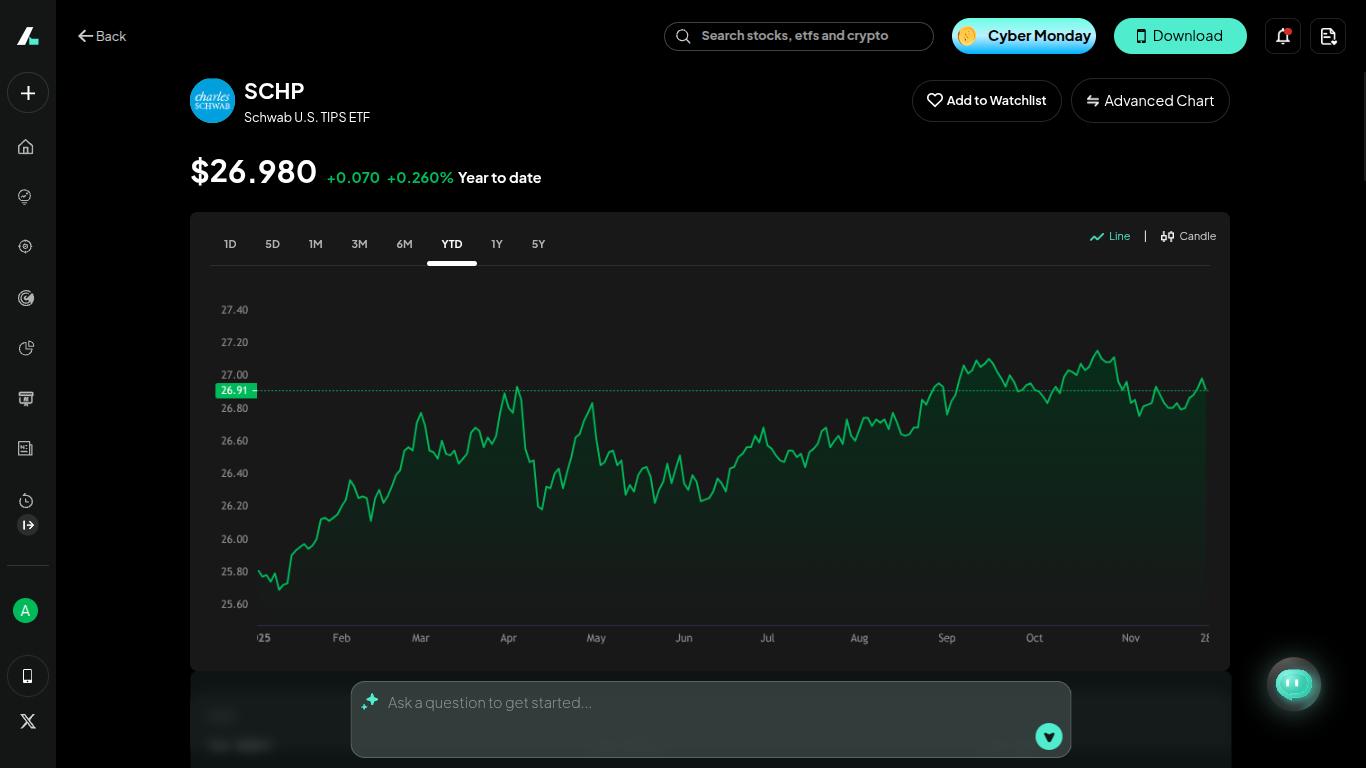

3. Schwab U.S. TIPS ETF (SCHP)

The Schwab U.S. TIPS ETF (SCHP) invests in Treasury Inflation-Protected Securities. These are bonds where the principal value increases with the Consumer Price Index (CPI).

Inflation remains a lingering concern for many investors heading into 2026. SCHP acts as insurance against rising prices.

- Cost: Matches Vanguard with a rock-bottom 0.03% expense ratio.

- Portfolio Fit: This is not necessarily for capital appreciation, but for purchasing power protection.

- Holdings: It holds diverse maturities, but the weighted average keeps it in the intermediate range.

If you believe the economy will run hot and inflation will persist, swapping some nominal treasuries for SCHP is a smart defensive move.

Source: intellectia.ai

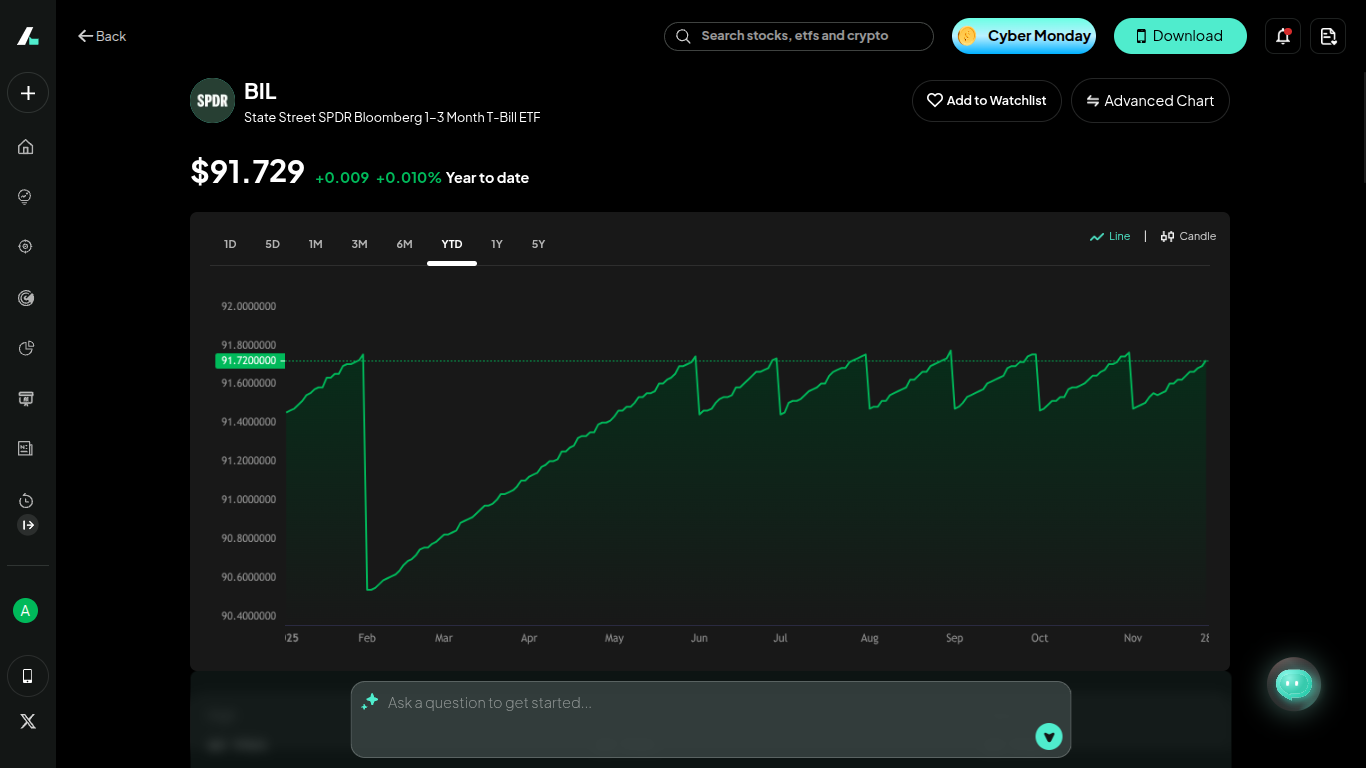

4. SPDR® Bloomberg 1-3 Month T-Bill ETF (BIL)

BIL invests in ultra-short-term Treasury Bills with remaining maturities between 1 and 3 months. Ideally, think of this as a high-yield savings account that trades on the stock market.

In uncertain times, cash is king. BIL offers capital preservation with zero duration risk.

- Stability: The price of BIL barely fluctuates (52-week range of roughly $91.29 - $91.80). The return comes almost entirely from the monthly dividend.

- Yield: It currently boasts a strong dividend yield (TTM ~4.19%), which is competitive with CDs without the lock-up period.

- Safety: Rated "A+" for Risk due to its remarkably low volatility (Standard Deviation of 0.54).

For funds you might need in the next 6 to 12 months, BIL is safer than intermediate or long-term bonds.

Source: intellectia.ai

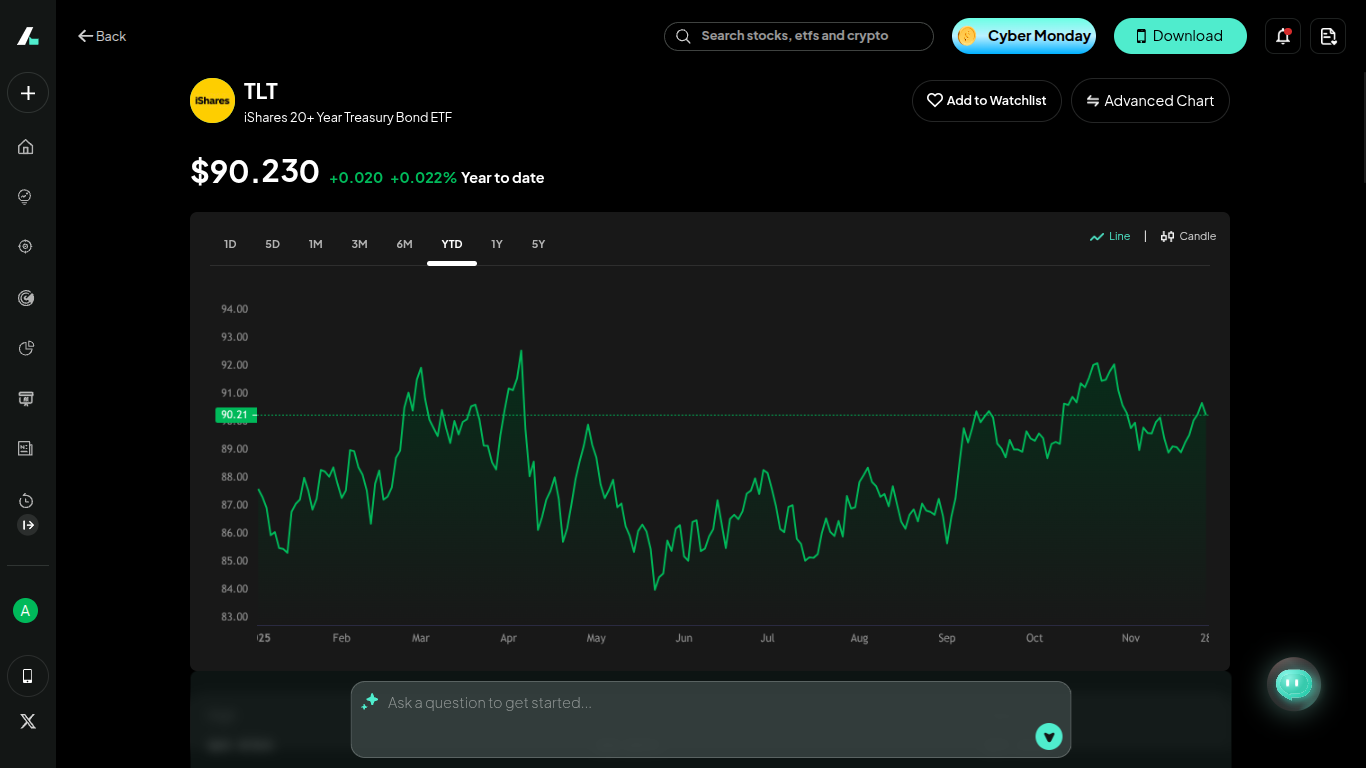

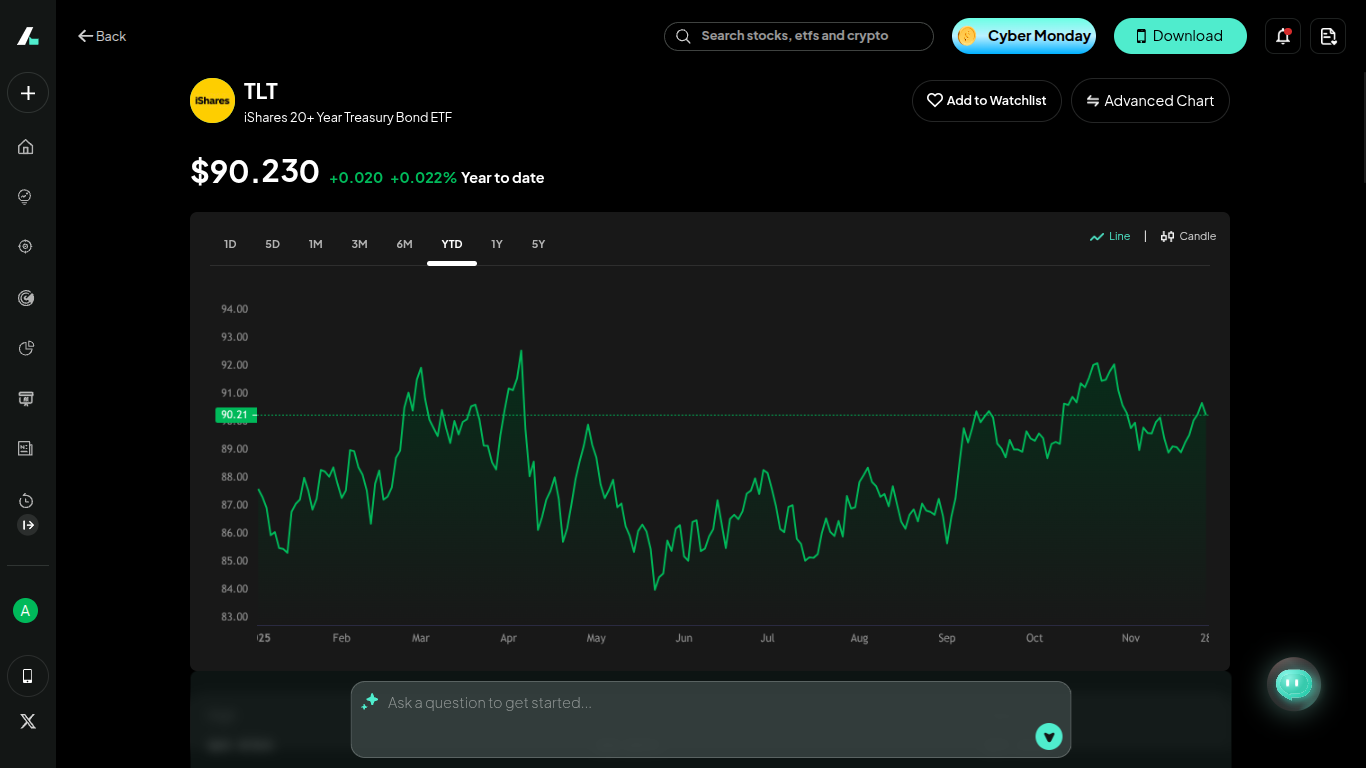

5. iShares 20+ Year Treasury Bond ETF (TLT)

TLT is the heavyweight champion of long-duration bonds. It invests in Treasuries with maturities of 20 years or more.

TLT is the most aggressive play on this list. It has high "duration," meaning it is very sensitive to interest rate changes.

- The Bull Case: If the Federal Reserve cuts rates aggressively in 2026 due to a slowing economy, TLT prices could surge, offering equity-like returns (capital appreciation) on top of its ~4.27% yield.

- The Bear Case: If inflation spikes and rates rise, TLT will drop faster than other bond funds.

- Liquidity: Massive AUM ($50B+) and volume make it a favorite for tactical traders.

Buy TLT if you are betting on a recession or falling interest rates.

Source: intellectia.ai

Investment Strategies for Treasury ETFs

Merely picking a ticker isn't enough; you need a strategy. Here is how you can deploy these ETFs effectively in 2026.

Mixing Short- and Long-Duration Treasuries (Barbell Strategy)

A popular approach used by professional wealth managers is the "Barbell Strategy." This involves holding ultra-short ETFs (like BIL) to generate safe income and preserve cash, while simultaneously holding long-term ETFs (like TLT) to capture high yields and potential capital appreciation.

By avoiding the middle maturities, you balance safety with high-reward potential. If rates stay high, BIL pays you. If rates crash, TLT appreciates. It creates a robust defense for your portfolio.

Using Treasury Bond ETFs for Diversification

The correlation between asset classes is vital. If your portfolio is 100% in tech stocks, a market correction could wipe out years of gains. By allocating 20% to 40% of your portfolio to intermediate treasury bond ETFs like VGIT or IEF, you create a buffer.

When stocks sell off, investors typically "fly to quality," buying Treasuries. This inverse relationship helps smooth out your equity curve, ensuring you stay in the game long enough for the market to recover.

Tax Considerations for Treasury ETFs

One of the most overlooked benefits of Treasury ETFs is their tax treatment. While you still have to pay federal income tax on the interest earned, income from U.S. Treasury securities is generally exempt from state and local income taxes.

If you live in a high-tax state like California or New York, this can significantly boost your "after-tax" yield compared to a corporate bond ETF or a standard savings account. Always consult your tax advisor, but for many, this exemption makes Treasury ETFs the superior choice for cash management.

Leverage Intellectia.ai for Timing

Knowing what to buy is half the battle; knowing when is the other half. Using Intellectia.ai’s Stock Technical Analysis and AI Agent, you can analyze the momentum of funds like TLT or IEF.

Our platforms track hedge fund flows and institutional sentiment. For example, if its Hedge Fund Tracker shows smart money accumulating long-duration Treasuries, it might be a signal that a rate cut is imminent. Using these AI-driven insights allows you to move from passive holding to active, profitable investing.

Source: intellectia.ai

Conclusion

Navigating the financial markets in 2026 requires a blend of offense and defense. While stocks drive growth, Treasury ETFs provide the income, stability, and liquidity necessary to sleep well at night. Whether you choose the ultra-safe BIL for your cash reserves, the balanced VGIT for your core holding, or the aggressive TLT to capitalize on rate cuts, you are taking a crucial step toward financial resilience.

Don't leave your financial future to guesswork. To stay ahead of market trends, interest rate changes, and institutional moves, you need the best tools available.

Sign up for Intellectia.ai today to get alerts on daily AI stock picks, advanced crypto analysis, and institutional trading signals. Let Intellectia AI help you build a smarter, stronger portfolio for 2026 and beyond.