Key Takeaways

- Stocks under $50 offer an affordable entry point for investors seeking growth and diversification.

- Promising sectors like technology, industrials, and communication services feature strong candidates.

- Companies like AT&T, Tetra Tech, IonQ, ExlService Holdings, and Serve Robotics show solid potential.

- Using AI-driven tools, such as those from Intellectia AI, can help identify top picks.

- Always research fundamentals and market trends before investing, as stock performance varies.

Introduction

Have you ever felt that the stock market is out of reach because many stocks cost hundreds or even thousands of dollars? You’re not alone. Many investors seek affordable stocks that still offer great growth potential. Stocks under $50 are a fantastic option—they’re accessible and can deliver significant returns if chosen wisely. The challenge is sorting through countless options to find the best ones.

That’s where Intellectia AI comes in. With advanced AI-driven tools, Intellectia analyzes thousands of stocks to uncover hidden gems trading under $50. In this article, you’ll discover five top picks for 2026, each vetted for their potential to grow your portfolio.

What Are Best Stocks Under $50?

Stocks under $50 are shares of companies trading at a price below $50 per share, offering affordability and growth potential. Unlike penny stocks (typically under $5), which can be highly speculative and risky, stocks under $50 often belong to established or emerging companies with solid fundamentals. These stocks span promising sectors like technology, industrials, and communication services, where innovation and demand drive growth.

For example, technology companies focusing on AI or quantum computing, like IonQ, or industrials like Tetra Tech, are gaining traction. The best stocks under 50 dollars combine strong financials, analyst support, and market opportunities, making them ideal for investors seeking value and growth.

How Do Stocks Under $50 Differ from Penny Stocks?

Penny stocks, priced under $5, are often tied to smaller, less stable companies with higher volatility and risk. Stocks under $50, however, typically have larger market capitalizations and more established operations, reducing risk while maintaining growth potential. For instance, a company like AT&T, with a share price around $27, offers stability and dividends, unlike most penny stocks.

Why Invest in Best Stocks Under $50?

Investing in stocks under $50 has several advantages:

- Affordability and Accessibility: With less capital, you can buy more shares, increasing your exposure to potential gains.

- Significant Growth Potential: Many of these stocks are mid-cap or small-cap companies with room to grow, especially in high-demand sectors like technology and robotics.

- Portfolio Diversification: You can invest in multiple stocks across different sectors without needing a large budget, spreading your risk.

These factors make stocks under 50 dollars appealing for both new and seasoned investors looking to maximize returns.

Criteria for Selecting Best Stocks Under $50

To pick the best stocks under $50, consider these key factors:

- Market Capitalization and Financial Health: Focus on companies with stable or growing market caps, strong revenue, and manageable debt. Mid-cap or large-cap stocks are often safer bets.

- Affordability and Share Count: Stocks under $50 allow you to purchase more shares, amplifying potential returns.

- Valuation Metrics: Look at price-to-earnings (P/E), price-to-sales (P/S), and enterprise value-to-EBITDA (EV/EBITDA) ratios to assess if a stock is undervalued.

- Dividend Yield and Income: For income-focused investors, stocks with dividends, like AT&T, provide steady returns.

- Analyst and Hedge Fund Interest: Positive analyst ratings and institutional ownership signal confidence in a stock’s future.

Using tools like Intellectia AI’s AI Stock Picker can streamline this process by analyzing these metrics for you.

5 Best Stocks Under $50

Here are five top stocks under $50 for 2026, each with unique strengths and growth potential. The table below provides a comparative overview:

| Company Name | Ticker | Sector | Current Price | Market Cap | Analyst Rating |

|---|---|---|---|---|---|

| AT&T Inc. | T | Communication Services | $27.72 | $199.46B | Buy |

| Tetra Tech, Inc. | TTEK | Industrials | $35.27 | $9.29B | Moderate Buy |

| IonQ, Inc. | IONQ | Technology | $35.09 | $8.69B | Strong Buy |

| ExlService Holdings, Inc. | EXLS | Technology | $45.49 | $7.32B | Buy |

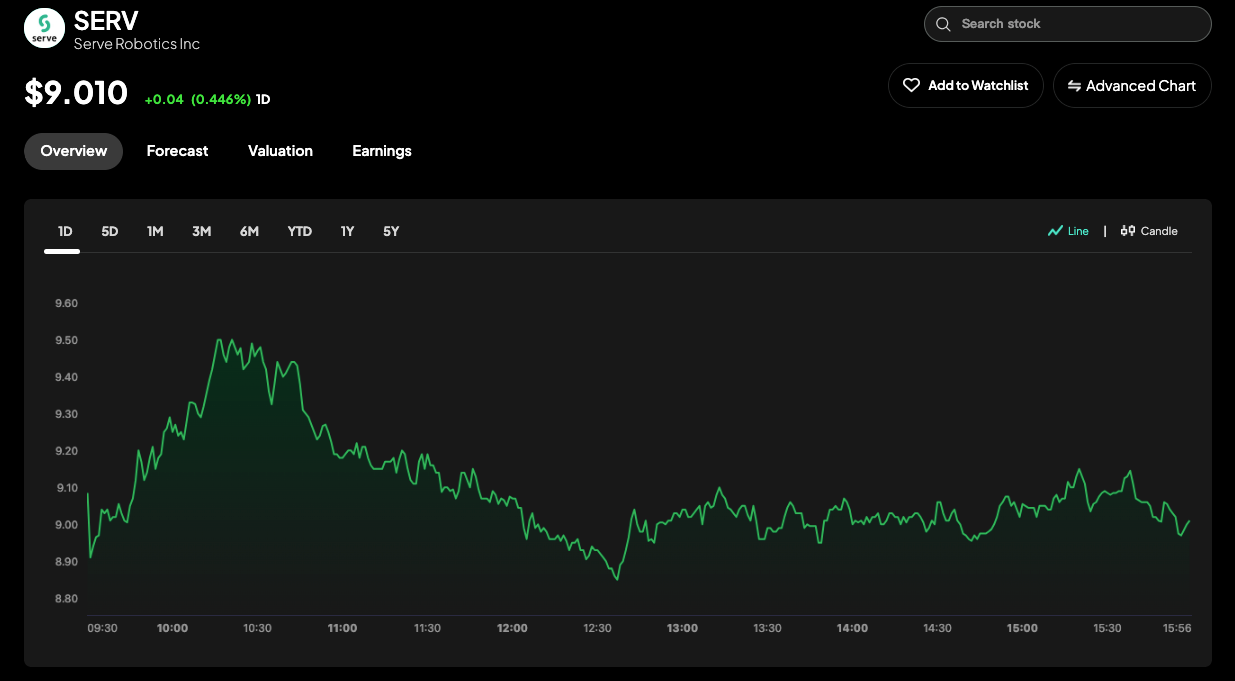

| Serve Robotics Inc. | SERV | Technology | $10.50 | $0.60B | Moderate Buy |

AT&T Inc. (T)

AT&T is a global leader in communication services, offering wireless, broadband, and media solutions, including 5G networks and HBO Max. Its recent focus on reducing debt and expanding 5G infrastructure has strengthened its financial position. In Q2 FY2025, AT&T reported robust free cash flow, supporting its 4.00% dividend yield, which is ideal for income-focused investors.

The company’s push into streaming and fiber networks positions it to compete in digital media and high-speed internet markets. With a $199.46 billion market cap and a Buy rating, AT&T offers stability and moderate growth. Compared to smaller firms, it’s less volatile, making it perfect if you prioritize dividends and reliability over rapid price gains.

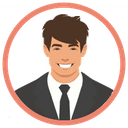

Tetra Tech, Inc. (TTEK)

Tetra Tech excels in the industrials sector, providing consulting and engineering services for water, environmental, and infrastructure projects. Its Q2 FY2025 revenue reached $1.10 billion, up 4.85% year-over-year, driven by a strong order backlog and demand for sustainable solutions.

With a 0.75% dividend yield and a Moderate Buy rating, Tetra Tech is a reliable choice for investors eyeing infrastructure growth. Its $9.29 billion market cap and P/E ratio of 32.61 reflect its solid financials. If you’re interested in sustainability trends, Tetra Tech’s expertise in environmental projects makes it a standout among the best stocks under 50 dollars.

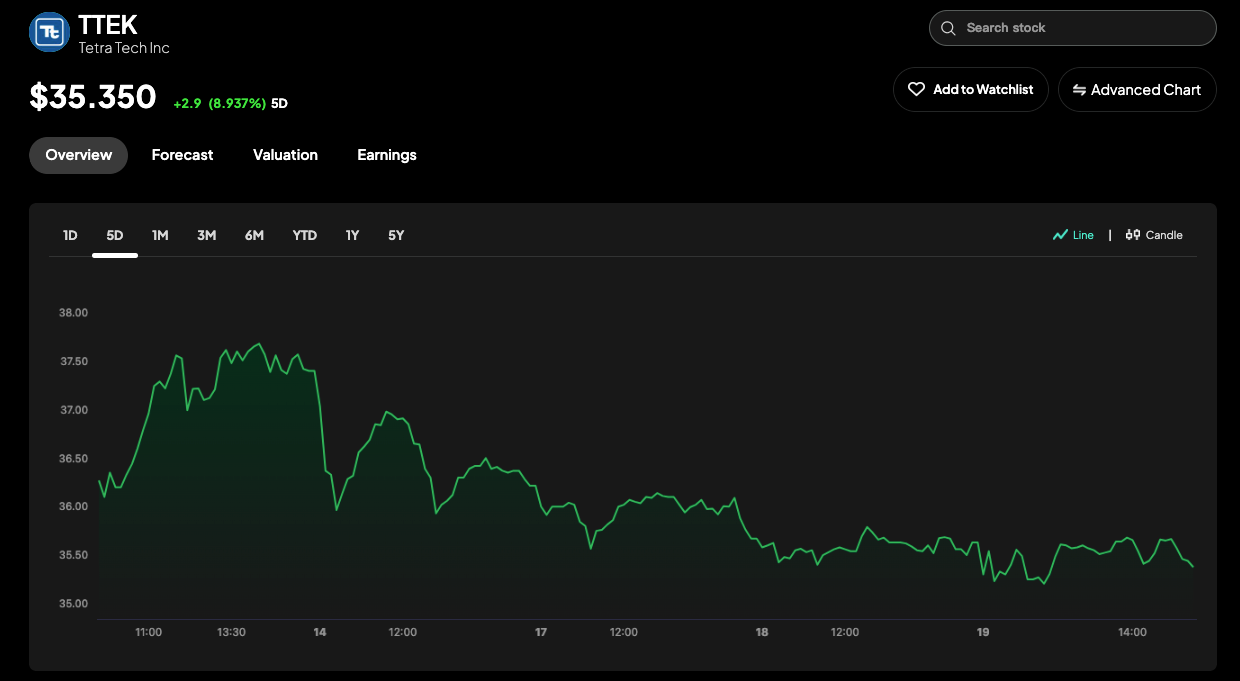

IonQ, Inc. (IONQ)

IonQ is a trailblazer in quantum computing, developing cloud-based quantum computers accessible via platforms like AWS and Azure. Its Q2 FY2025 revenue is projected at $17.23 million, up 51.36% year-over-year, reflecting its rapid growth. Analysts give it a Strong Buy rating with a $40.00 price target, signaling significant upside potential.

With an $8.69 billion market cap, IonQ is a high-risk, high-reward pick for tech enthusiasts. Unlike AT&T’s stability, IonQ’s focus on a transformative industry makes it ideal if you’re willing to embrace volatility for the chance at exponential returns.

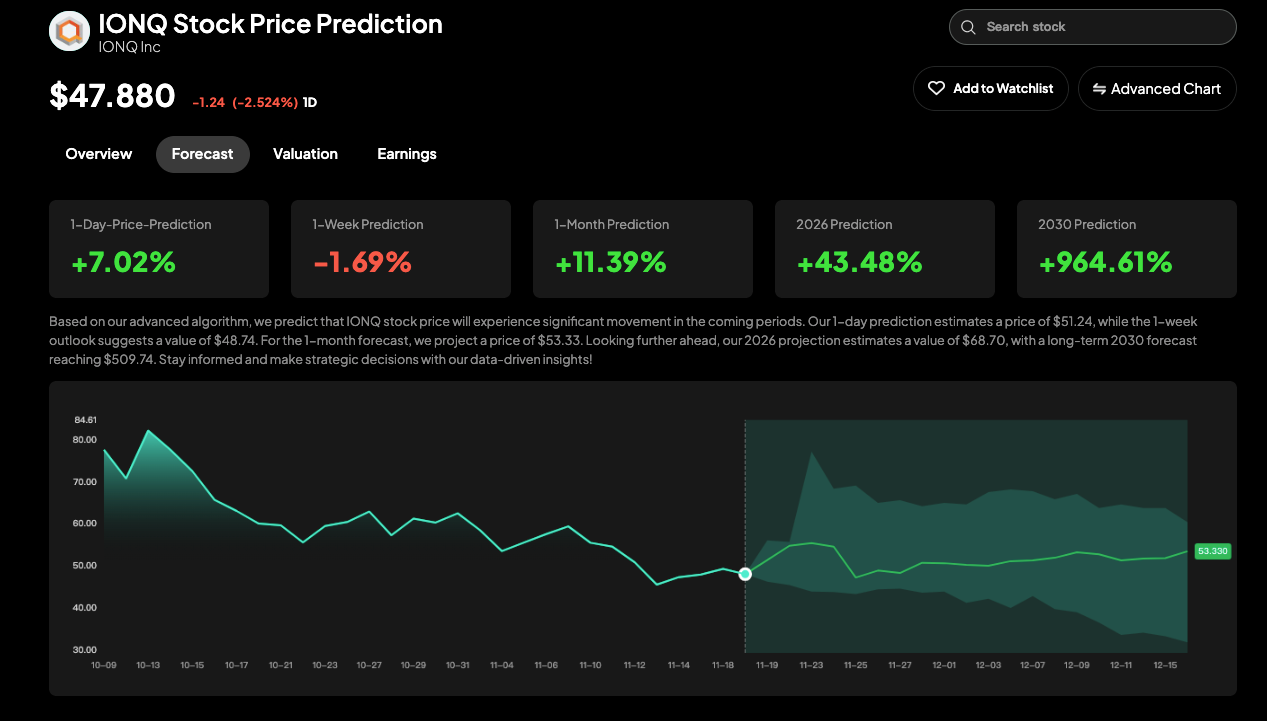

ExlService Holdings, Inc. (EXLS)

ExlService Holdings leverages AI and data analytics to serve industries like insurance, healthcare, and finance. Its consistent revenue growth and profitability, combined with a Buy rating and $51.00 price target, make it a compelling choice.

The company’s $7.32 billion market cap and P/E ratio of 24 reflect its strong market position. ExlService benefits from the growing demand for digital transformation, making it a balanced pick for growth investors. If you’re excited about AI-driven solutions, this stock aligns perfectly with long-term industry trends.

Serve Robotics Inc. (SERV)

Serve Robotics develops autonomous delivery robots for last-mile delivery, partnering with Uber Eats and expanding into markets like Dallas-Fort Worth. Its Q3 FY2025 revenue is projected at $1.73 million, up 682.63% year-over-year, with a Moderate Buy rating and a $17 price target, suggesting 61.90% upside.

With a $0.60 billion market cap, Serve is a high-growth, high-risk option. If you’re betting on the rise of e-commerce and autonomous technology, this stock offers tremendous potential among stocks under 50 dollars.

How to Research and Evaluate Stocks Under 50 Dollars

Finding the best stocks under 50 dollars requires diligent research. Start by analyzing company fundamentals—check revenue growth, profitability, and debt levels using metrics like P/E or P/S ratios. Stay updated on sector trends, like AI advancements or infrastructure spending, to spot opportunities. Review earnings reports and news for insights into partnerships or product launches.

Tools like Intellectia AI’s Stock Monitor and AI Screener provide real-time data and technical analysis. Finally, consider analyst ratings and hedge fund moves via Intellectia’s Hedge Fund Tracker. Combining these steps ensures you make informed investment decisions.

Conclusion

Investing in the best stocks under $50 is a smart way to build a diversified portfolio with limited capital. AT&T, Tetra Tech, IonQ, ExlService Holdings, and Serve Robotics each offer unique opportunities, from stable dividends to cutting-edge technology. Whether you’re seeking income or growth, these stocks have the potential to deliver.

To make informed decisions, use Intellectia AI’s advanced tools for stock analysis, price predictions, and trading signals. You can use Intellectia AI to stay ahead with the latest market insights and find the best stocks under 50 dollars for your portfolio.