Key Takeaway

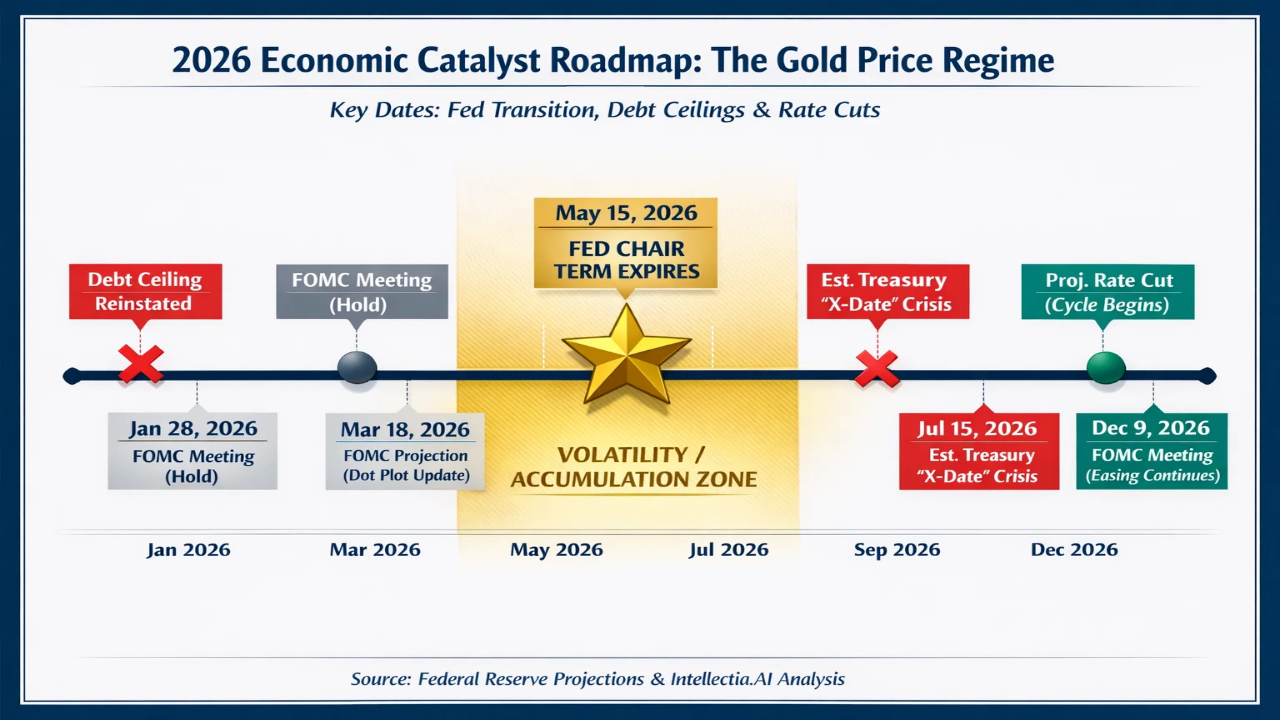

- The expiration of the Fed Chair’s term in May 2026 creates a unique volatility catalyst, favoring gold as a safe-haven asset.

- Low-cost "Mini" ETFs like GLDM and IAUM are superior for core holdings due to significantly lower expense ratios compared to legacy funds.

- Gold miners (GDX) and junior miners (GDXJ) offer leveraged upside potential if energy costs stabilize while spot prices rise.

- Tax efficiency is crucial, investors must account for the 28% collectibles tax on physical gold ETFs when calculating net returns.

If you are looking for the best gold ETF to buy 2026, you are likely anticipating a major shift in the financial landscape. The year 2026 is shaping up to be a historic period for precious metals, driven by a convergence of monetary policy shifts and global debt maturity walls. With many analysts projecting a potential $5,000 per ounce price regime, selecting the right vehicle for your portfolio is no longer just about buying gold; it is about buying it efficiently.

This guide will move beyond general macro-projections. You will find a direct cost-benefit comparison of specific tickers, an analysis of mining stocks for leveraged returns, and a tactical roadmap centered around the critical Federal Reserve transition in May 2026. Whether you are a conservative investor or a tactical trader, understanding these nuances is key to maximizing your returns.

Why 2026 Is The 'Year Of Reallocation' For Gold Investors

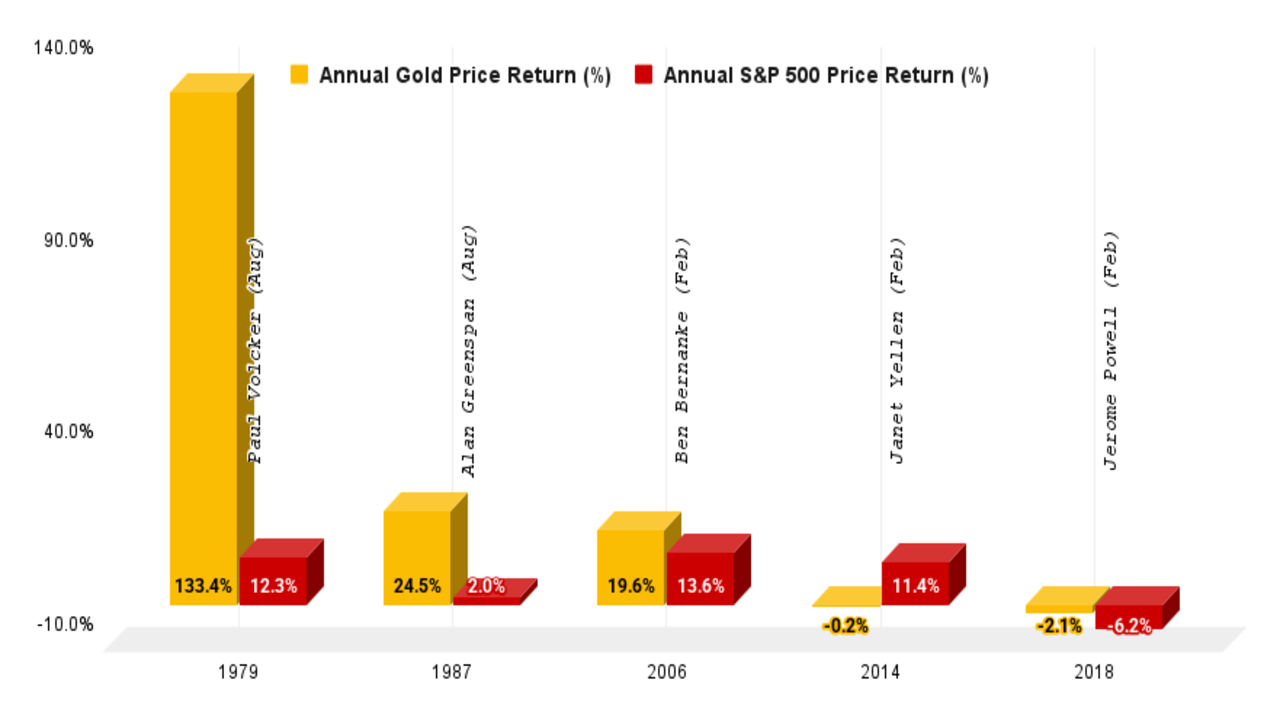

The argument for holding gold often centers on inflation, but 2026 presents a specific, time-bound catalyst: the transition of the Federal Reserve Chair. Markets abhor uncertainty. With the current Fed Chair's term set to expire in May 2026, the first half of the year will likely be dominated by speculation regarding future monetary policy.

Historically, transition years for the central bank coincide with increased volatility in the S&P 500. This drives institutional capital toward non-correlated assets. When you combine this institutional anxiety with the peak of the global debt debasement trade, the floor for gold prices rises significantly.

This is not just about fear; it is about liquidity. As central banks worldwide potentially pivot to lower rates to service mounting debts, real yields (interest rates minus inflation) could turn negative. This is the "rocket fuel" scenario for precious metals. To stay ahead of these macro shifts, you can utilize tools like the Intellectia News Monitor to track real-time sentiment shifts regarding central bank policies.

Source: Analyst’s compilation

The Core Holdings: Best Low-Cost Physical Gold Etfs

For the majority of your portfolio—specifically the "buy and hold" portion—your primary enemy is the expense ratio. Over a holding period extending through 2026, a high fee structure eats directly into your compounding returns.

Legacy funds like the SPDR Gold Shares (GLD) are highly liquid but come with higher fees (around 0.40%). For 2026, you should look toward the newer generation of "Mini" ETFs. These funds hold physical gold bars in secure vaults, just like their larger counterparts, but are structured to be more cost-effective for retail investors.

| Ticker | ETF Name | Expense Ratio | Assets Under Management | 2026 Liquidity Forecast | Ideal For |

| GLD | SPDR Gold Shares | 0.4% | $148.2B+ | Ultra-High (Deepest Options Market) | Institutions & Day Traders |

| IAU | iShares Gold Trust | 0.25% | $69.1B+ | High (Tight Spreads) | Active Retail Traders |

| GLDM | SPDR Gold MiniShares | 0.1% | $25.3B+ | High (Rapidly Growing) | Core Buy & Hold (Best Value) |

| IAUM | iShares Gold Trust Micro | 0.09% | $6.1B+ | Medium (Potential for wider spreads) | Small Account Accumulation |

| BAR | GraniteShares Gold Trust | 0.17% | $1.5B+ | Medium (Stable) | Alternative Custody Diversification |

Here are the top contenders for the best gold ETF to buy 2026 regarding cost efficiency:

1. SPDR Gold MiniShares (GLDM): This is the lower-cost version of GLD. It tracks the same spot price but with a significantly lower expense ratio.

2. iShares Gold Trust Micro (IAUM): The lowest cost option in the iShares family, designed specifically for buy-and-hold investors.

3. GraniteShares Gold Trust (BAR): Known for being one of the cheapest on the market, BAR consistently offers one of the lowest expense ratios available.

Using a Stock Screener can help you compare the daily volume of these ETFs to ensure they meet your liquidity requirements before buying.

GLDM Vs. IAU: Which Mini-ETF Wins On Total Cost?

When deciding between SPDR Gold MiniShares (GLDM) and the iShares Gold Trust (IAU), you need to look at the spread and the management fee.

IAU has been a favorite for years, but its expense ratio is generally higher than GLDM. For a $10,000 investment held throughout 2026, the difference in fees might seem small—perhaps the cost of a nice dinner—but on larger portfolios, this drags down performance.

GLDM typically boasts an expense ratio of around 0.10% to 0.18% (always check the current prospectus), whereas legacy funds hover near 0.40% or higher. For the best gold ETF to buy 2026, GLDM often wins the mathematical debate for investors who do not need to trade in and out on an hourly basis.

However, if you are day trading, the typically higher liquidity of IAU might result in tighter bid-ask spreads, potentially offsetting the higher annual fee.

Leveraged Upside: Should You Buy Miners (GDX) Or Spot Gold in 2026?

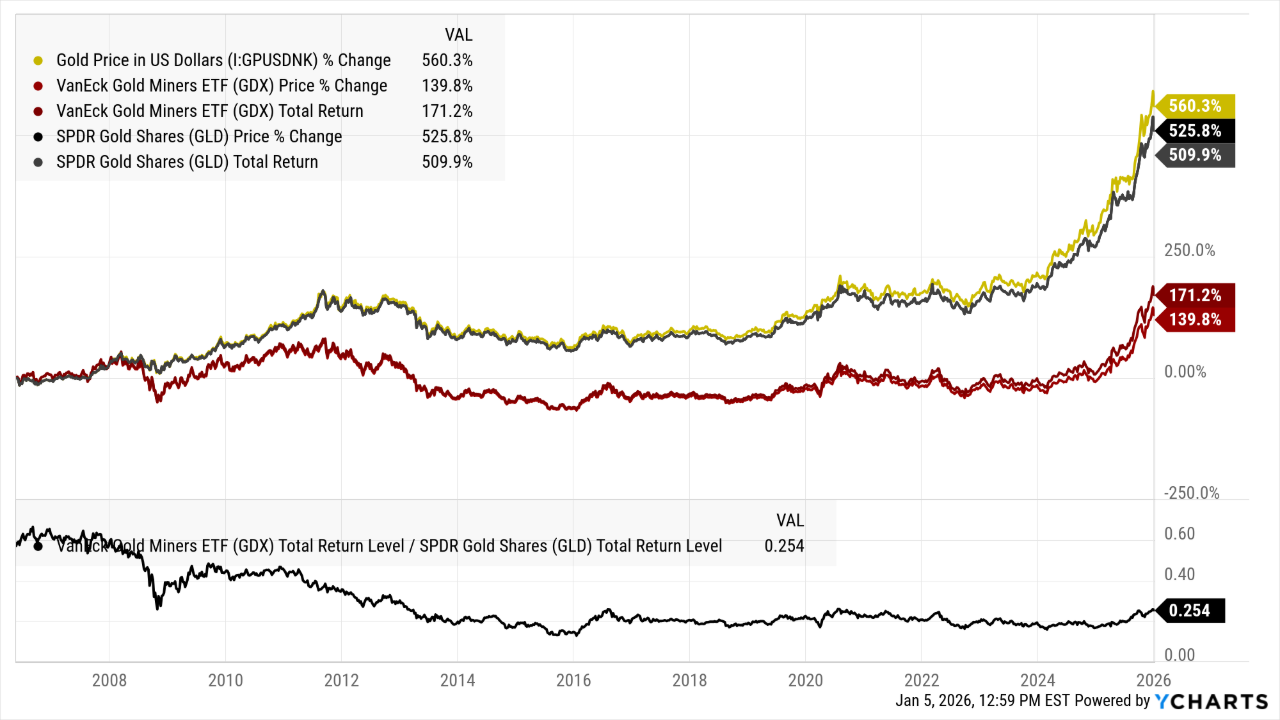

Buying physical gold ETFs protects your wealth. Buying miners offers the potential to multiply it. This is due to a concept called “operational leverage.”

Imagine a mining company has a production cost (All-In Sustaining Cost, or AISC) of $1,800 per ounce. If gold is at $2,000, they make $200 profit. If gold jumps 25% to $2,500 in 2026, their profit does not just go up 25%; it jumps from $200 to $700—a 250% increase in profitability.

The VanEck Gold Miners ETF (GDX) is the standard vehicle for this strategy. It holds a basket of the world's largest mining companies. If you believe the $5,000 price regime is real, miners could vastly outperform spot gold ETFs. However, they also carry equity risk (bad management, jurisdictional issues, energy costs).

Source: Ycharts

You can analyze the technical setups for GDX using Stock Technical Analysis tools to time your entry perfectly.

GDXJ: The Junior Miner Play For High-Risk Alpha

If you have a higher risk tolerance, the VanEck Junior Gold Miners ETF (GDXJ) targets smaller, exploration-stage companies. These stocks are volatile. In a bear market, they can drop 50% or more. But in a raging bull market—like the one predicted for 2026—they often provide 2x to 3x the returns of the spot price.

This ETF acts almost like a call option on the gold price. It is not a "safe haven" investment; it is a speculative growth play. Ensure this portion of your allocation is smaller than your core holdings.

The May 2026 'Fed pivot' strategy

Timing is everything. As mentioned, May 2026 marks the expiration of the current Federal Reserve Chair's term. Markets will begin pricing in the successor's likely policy stance months in advance—typically starting in Q4 2025 and peaking in Q1 2026.

If the incoming Chair is perceived as dovish (willing to print money to support the economy), the dollar may weaken rapidly, sending gold soaring. Conversely, a hawkish appointee could cause a temporary pullback.

The Strategy:

1. Accumulation Phase: Use the Stock Monitor to accumulate positions in GLDM or BAR during dips in late 2025.

2. The Run-Up: Hold through early 2026 as uncertainty builds.

3. The Event: Watch for the announcement. If the market spikes on the news, consider taking partial profits on your leveraged positions (GDX/GDXJ) while keeping your core physical allocation intact.

This tactical approach allows you to capture the volatility premium surrounding the event.

Source: Analyst’s compilation

Hidden Costs: Tax Efficiency and ESG Standards in 2026

Before you execute your trade, you must understand the tax implications. In the United States, the IRS treats gold ETFs as "collectibles." This means if you hold them for more than a year, your capital gains are taxed at a maximum rate of 28%, rather than the standard 15% or 20% long-term capital gains rate applied to stocks.

This tax drag is substantial. While you cannot avoid it with standard physical gold ETFs, being aware of it helps you calculate your true net return.

Additionally, institutional money in 2026 is heavily focused on ESG (Environmental, Social, and Governance) compliance. ETFs like the Aberdeen Standard Physical Gold Shares ETF (SGOL) emphasize responsible sourcing.

If you are tracking Hedge Fund activity, you might notice whales moving toward these ESG-compliant funds to meet their internal mandates. Following the "smart money" into these specific funds can be a wise move.

Checklist: What to Look For in a 2026 Gold ETF Prospectus:

| Checklist Item | The "Green Flag" (What you want to see) | Why it Matters in 2026 |

| 1. Legal Structure | "Grantor Trust" | You want to own the physical metal. Avoid "Exchange Traded Notes (ETNs)" which are unsecured debt obligations. In a financial crisis, ETNs carry credit risk; Trusts do not. |

| 2. Allocation Method | "Fully Allocated" | This means specific bars are identified as belonging to the Trust. Avoid "Unallocated" accounts where you are essentially an unsecured creditor of the bank. |

| 3. Expense Ratio Cap | Total Expenses < 0.20% | In a high-inflation environment, every basis point counts. Ensure there are no "Fee Waivers" that expire halfway through 2026, causing your costs to jump. |

| 4. Audit Transparency | "Daily/Weekly Bar List" | The best funds (like GLDM or BAR) publish a list of the actual serial numbers of the gold bars they hold. This transparency is vital if institutional trust erodes. |

| 5. Sourcing Standards | "LBMA Responsible Sourcing" | As ESG mandates tighten in 2026, "dirty gold" (unverified origins) may trade at a discount. Ensure your ETF holds bars that meet the London Bullion Market Association's ethical standards. |

| 6. Tax Treatment | "Collectibles Tax" Disclaimer | Verify the tax status. Most physical ETFs are taxed as collectibles (max 28%). If the prospectus mentions "K-1 Forms" (common in futures ETFs), you are buying a different, more complex tax headache. |

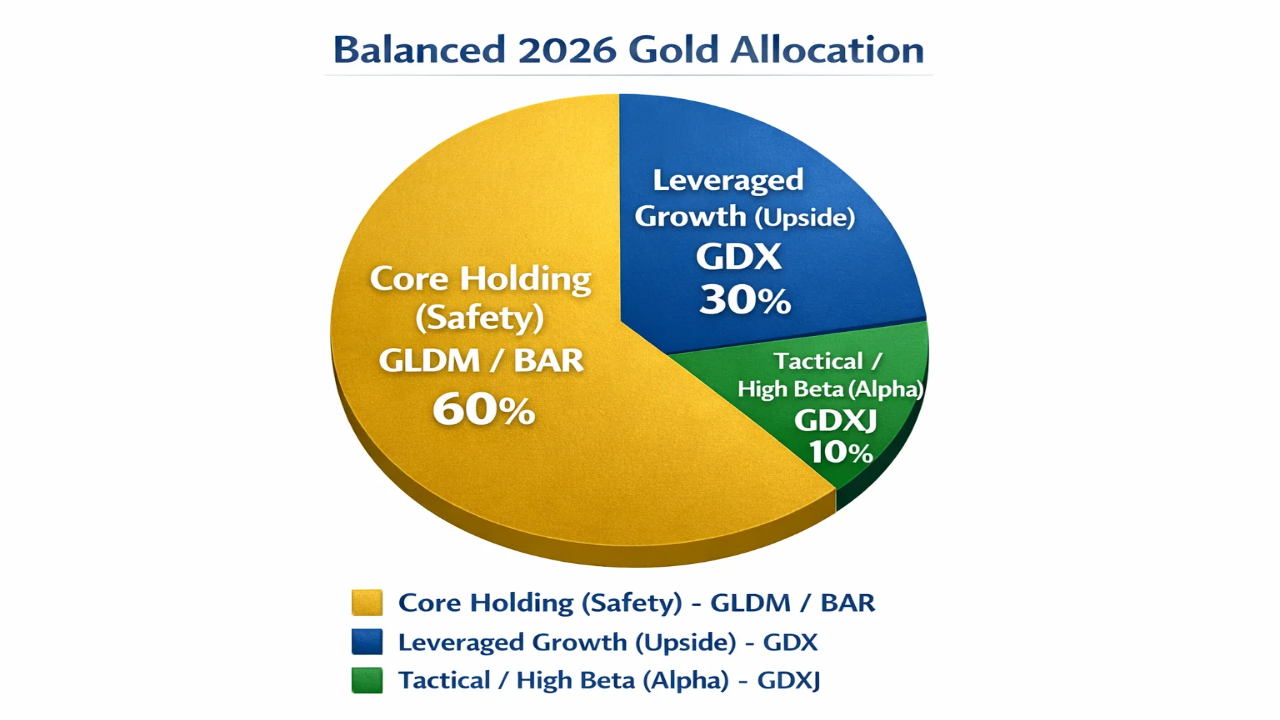

Summary: The Recommended 2026 Gold ETF Portfolio

To build a robust portfolio for the $5,000 price regime, you should not rely on a single ticker. Instead, construct a balanced allocation that captures safety, growth, and tactical advantages.

Here is a model portfolio structure for 2026:

- 60% Core Holding (Safety): Allocate the majority to GLDM or BAR. These offer the lowest fees and secure physical backing. This is your insurance policy.

- 30% Leveraged Growth (Upside): Allocate this portion to GDX. This gives you exposure to the operational leverage of major miners without the extreme volatility of individual stocks.

- 10% Tactical/High Beta (Alpha): Use GDXJ or specific tactical trades around the Fed transition. This is "risk capital" aiming for outsized returns.

Source: Analyst’s compilation

By using AI stock selection tools, you can further refine this list, perhaps swapping GDX for a basket of high-performing individual miners if the data supports it.

Conclusion

The year 2026 offers a rare convergence of macro-events that heavily favor precious metals. By choosing the right vehicle—balancing low-cost physical ETFs like GLDM with the explosive potential of miners like GDX—you can position your portfolio to thrive during the transition to a new economic regime. Do not just buy gold blindly; buy it with a strategy.

To stay ahead of the market in 2026, you need real-time data and predictive insights. Sign up for Intellectia.AI today to access advanced AI stock picks, trading signals, and comprehensive market analysis. Subscribe now to ensure you never miss a critical alert when the gold market moves.