Key Takeaways

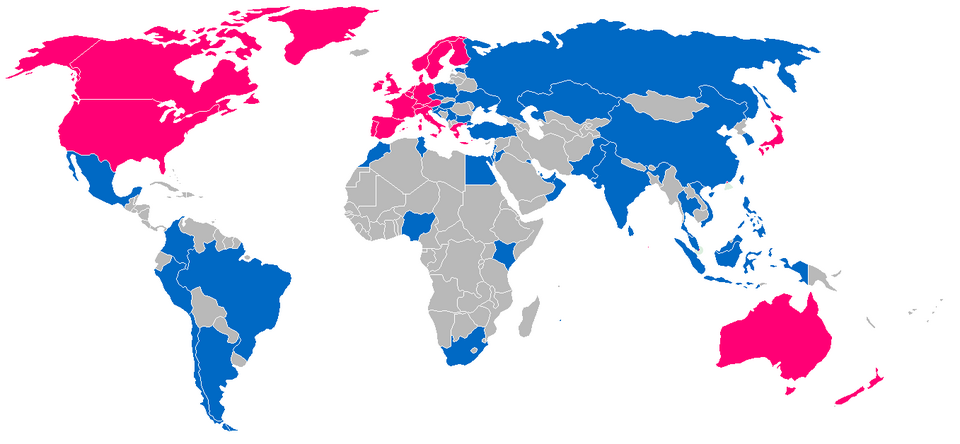

- You can tap into rapid economic growth by investing in emerging markets ETFs that focus on developing countries like China, India, and Brazil.

- Top ETFs for emerging markets offer low costs and diversification to help balance your portfolio.

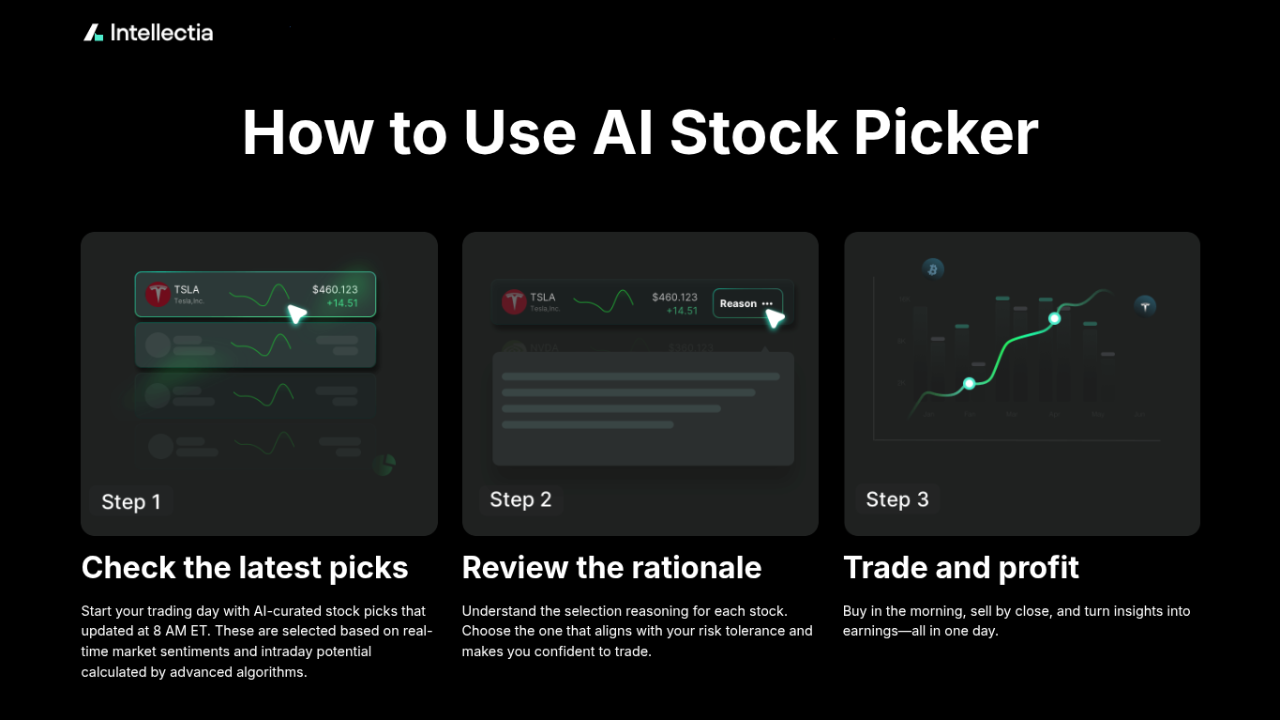

- Using tools like Intellectia.ai's AI screener makes selecting the best emerging markets ETFs 2025 easier and more informed.

- Risks such as currency fluctuations exist, but strategies like dollar-cost averaging can mitigate them effectively.

- Overall, emerging markets ETF performance has shown solid returns, making them a smart addition for long-term growth.

Introduction

Have you ever felt like your investments are stuck in the same old markets, missing out on the explosive growth happening elsewhere? You're not alone—many investors overlook emerging markets, where economies are booming but access feels complicated and risky. The problem is that sticking to developed markets like the US can limit your potential returns, especially when valuations there are sky-high and growth is slowing.

Aggregating data from global indices shows that emerging markets have outperformed in periods of economic expansion, driven by factors like rising consumer demand and technological adoption. As an AI-powered platform, Intellectia.ai brings expertise through advanced analysis, helping you navigate these opportunities with AI stock and crypto selection, price predictions, and trading strategies.

The solution? Dive into the best emerging markets ETFs for 2025—they provide easy, diversified entry points to these high-potential areas. For example, imagine boosting your portfolio with funds tracking powerhouse economies, all while keeping costs low and risks managed through Intellectia.ai's insights.

What Are Emerging Markets ETFs?

You might be wondering what exactly emerging markets ETFs are all about. These are exchange-traded funds that invest in stocks from developing economies, such as China, India, Brazil, and others on the rise. They pool your money with others to buy shares in companies across these regions, giving you broad exposure without picking individual stocks.

Think of them as a basket of opportunities from countries with rapid industrialization and growing middle classes. Unlike developed market ETFs, these focus on areas with higher growth potential but also more volatility.

By choosing the top ETFs for emerging markets, you get diversification across sectors like technology, finance, and consumer goods. This makes investing in emerging markets simpler and more accessible for you.

Why Invest in Emerging Markets ETFs?

You're probably asking yourself why you should consider emerging markets ETFs right now. The answer lies in their incredible growth potential—these economies are expanding faster than developed ones, thanks to younger populations, increasing urbanization, and rising consumer demand.

For instance, countries like India and China are seeing massive tech and infrastructure booms, which can translate to higher returns for your portfolio. Emerging markets ETF performance often outpaces traditional investments during global recoveries.

Plus, they offer diversification, helping you spread risk beyond US stocks. With inflation cooling and interest rates potentially dropping in 2025, investing in emerging markets could be a timely move to capture upside.

Don't forget, tools like Intellectia.ai's AI stock picker can help you identify the best fits for your strategy.

Criteria for Choosing the Best Emerging Markets ETFs

Selecting the right ETF isn't just about picking the most popular one—you need to look at key metrics to ensure it aligns with your goals. Start with the expense ratio; lower fees mean more of your money stays invested and compounds over time.

Liquidity is crucial too, so you can buy and sell shares easily without big price swings. Check country exposure to avoid over-reliance on one economy, like too much China if you're worried about geopolitical risks.

Performance history, including 5-year returns, gives insight into how the fund has handled ups and downs. Use Intellectia.ai's AI screener to filter these criteria effortlessly.

Other factors include the underlying index and diversification across sectors. By evaluating these, you'll find the best emerging markets ETFs 2025 that suit your risk tolerance and investment horizon.

5 Best Emerging Markets ETFs for 2025

You're ready to explore specific options, so let's dive into the top picks. These ETFs stand out for their low costs, strong performance, and broad exposure, making them ideal for investing in emerging markets.

| ETF Name | Ticker | Expense Ratio | Top Countries | 5-Year Annualized Total Return |

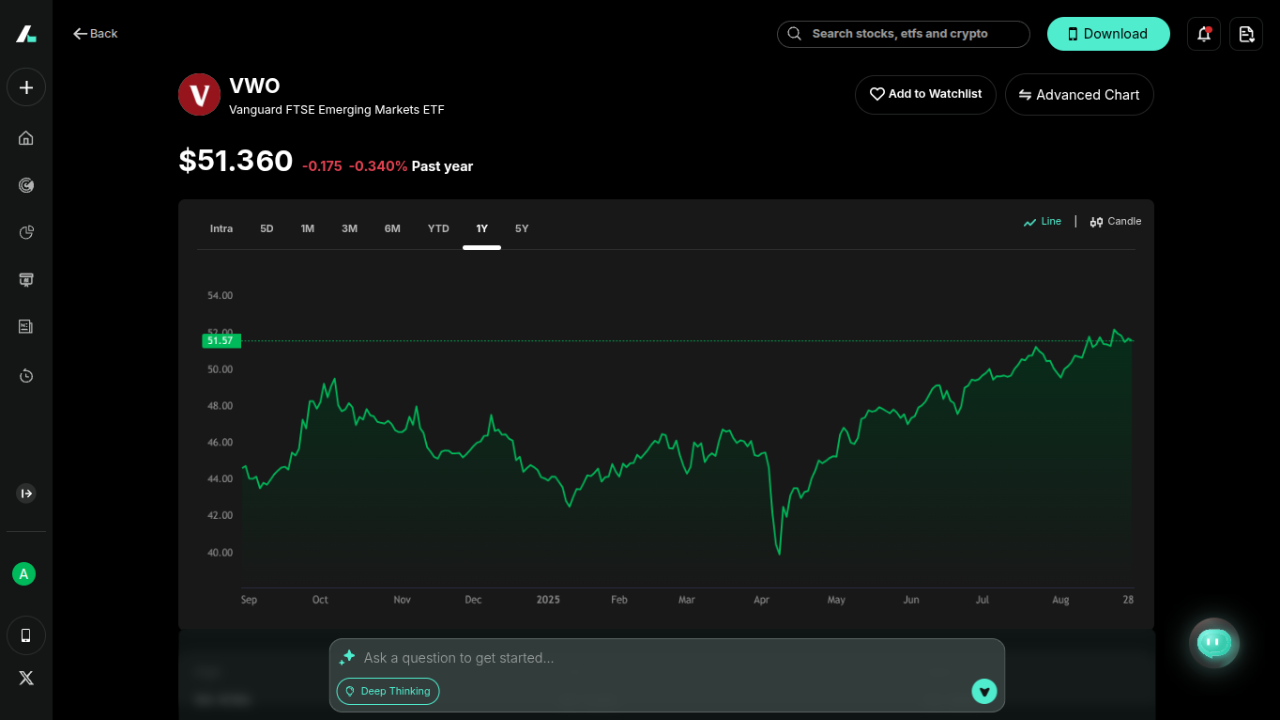

| Vanguard FTSE Emerging Markets ETF | VWO | 0.08% | China (31%), Taiwan (20%), India (19%), Brazil (4%), Saudi Arabia (4%) | 7.21% |

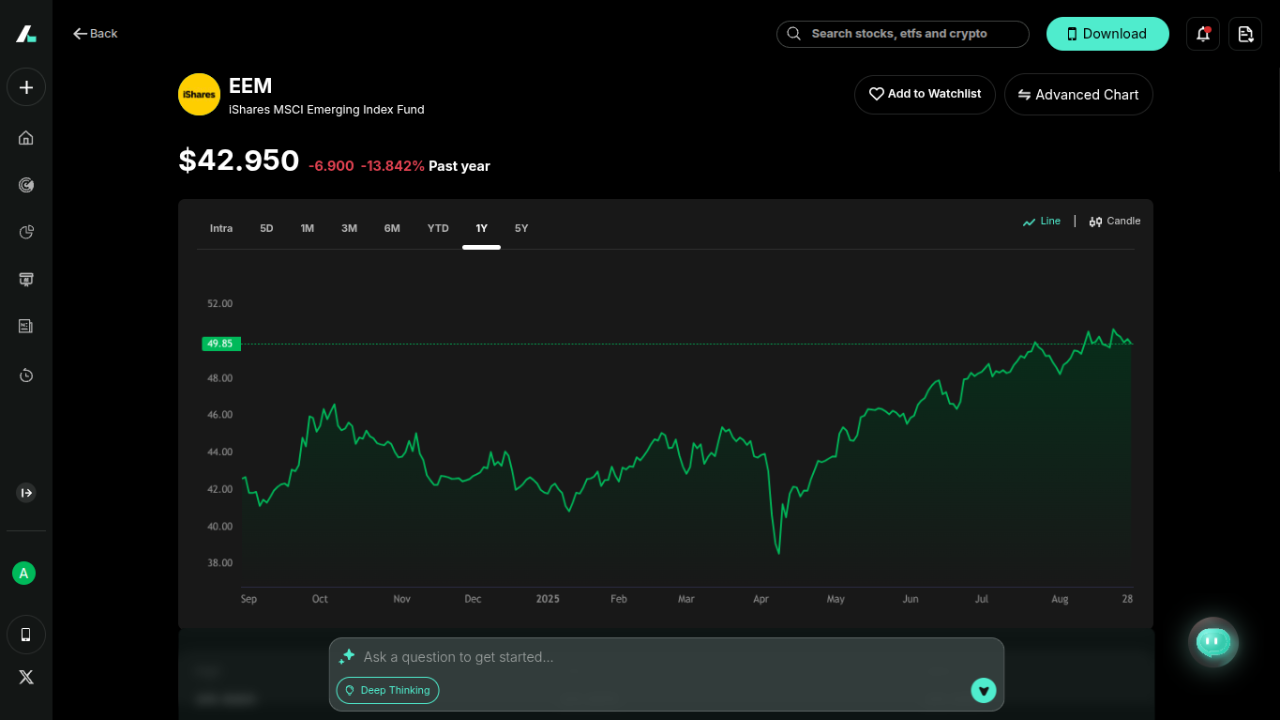

| iShares MSCI Emerging Markets ETF | EEM | 0.72% | China (27%), Taiwan (19%), India (16%), South Korea (10%), Brazil (4%) | 6.11% |

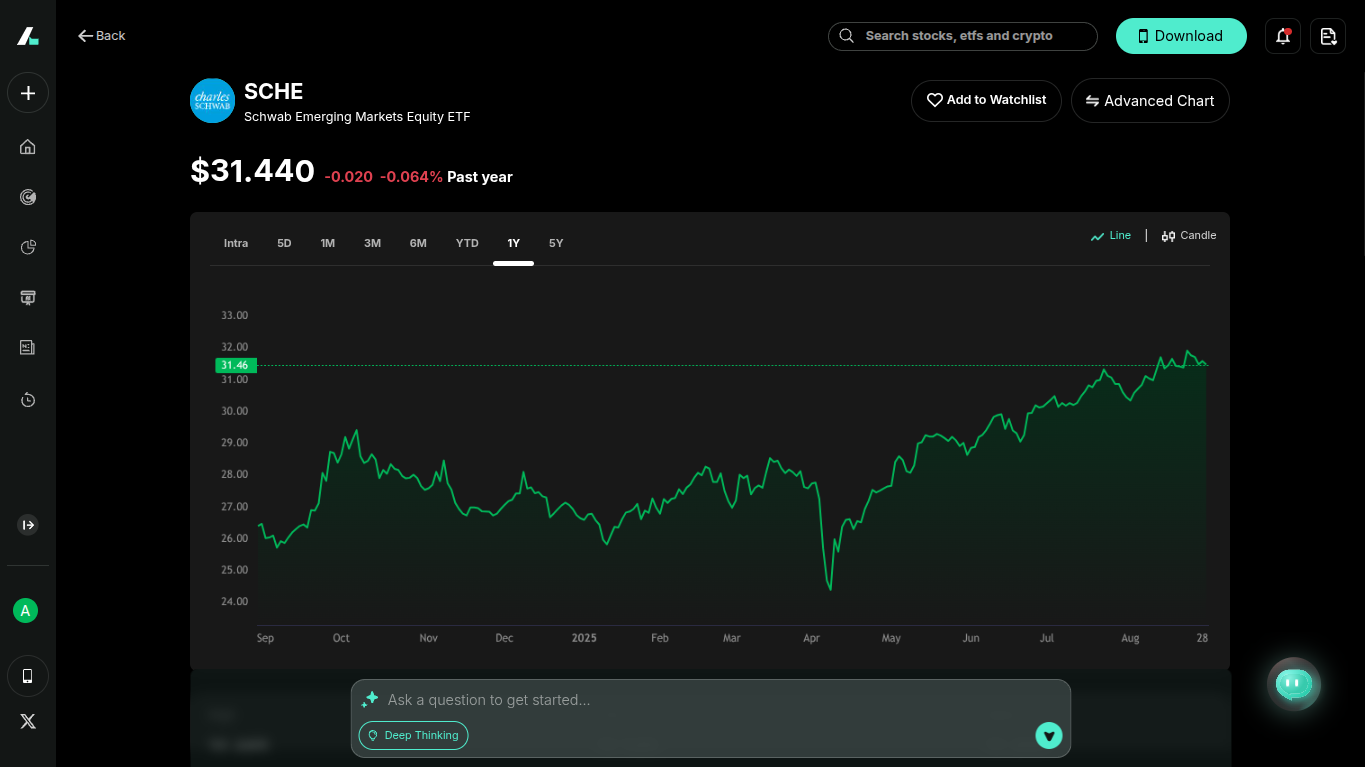

| Schwab Emerging Markets Equity ETF | SCHE | 0.11% | China (31%), Taiwan (20%), India (19%), Brazil (4%), Saudi Arabia (4%) | 7.21% |

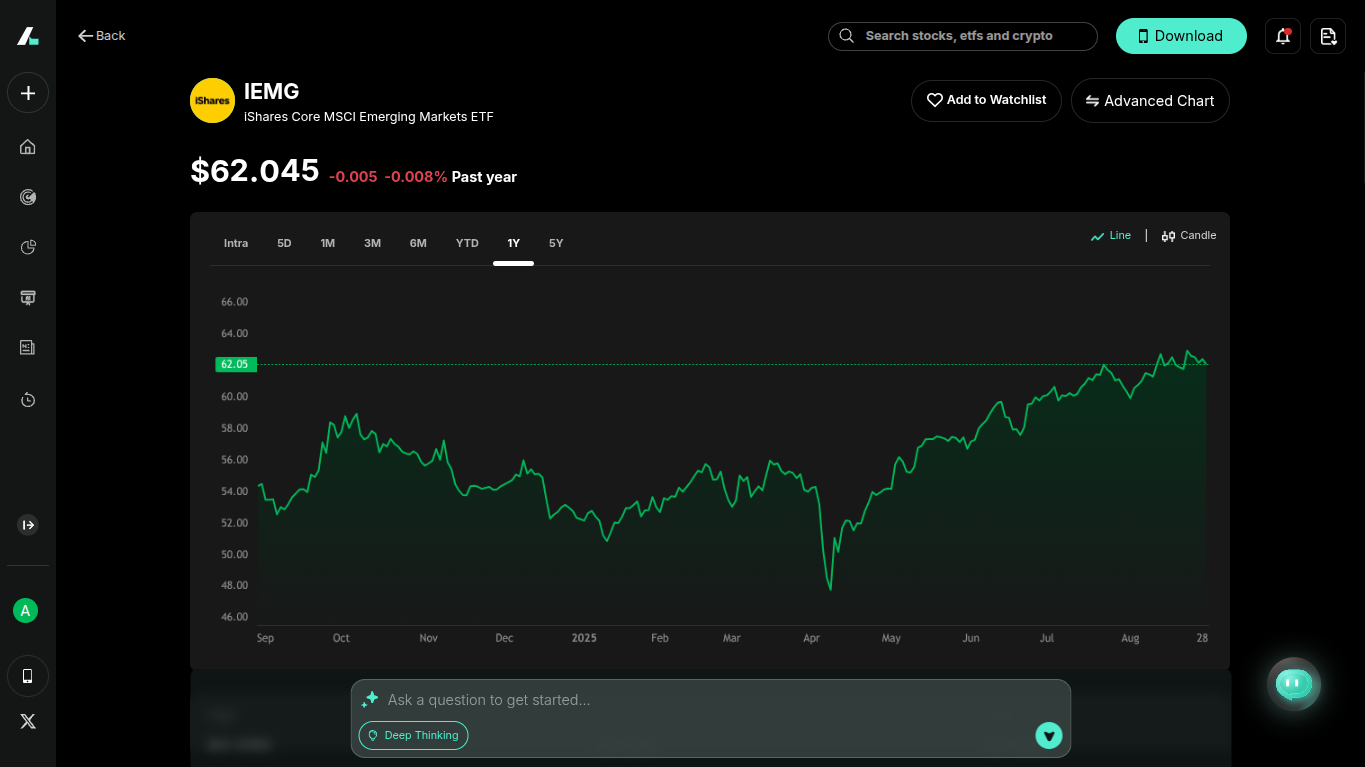

| iShares Core MSCI Emerging Markets ETF | IEMG | 0.09% | China (27%), Taiwan (19%), India (16%), South Korea (10%), Brazil (4%) | 7.53% |

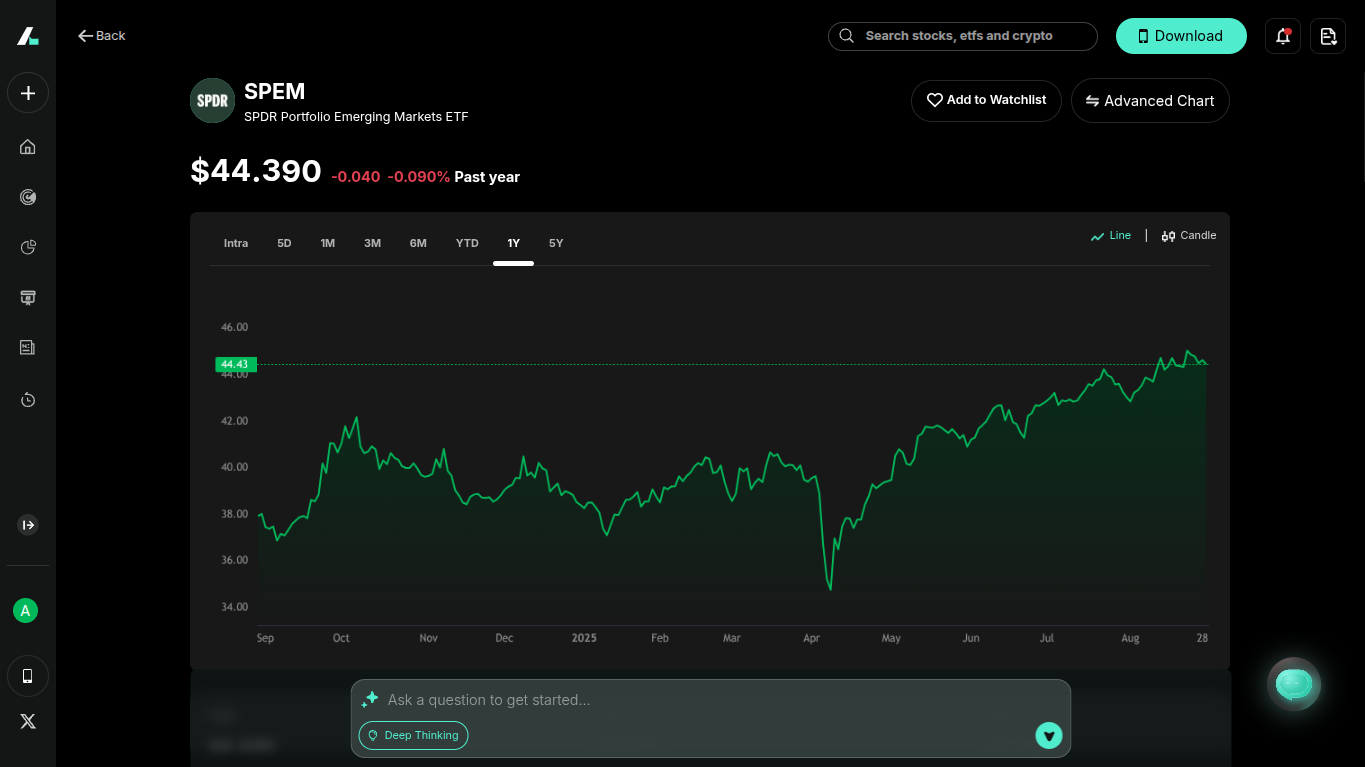

| SPDR Portfolio Emerging Markets ETF | SPEM | 0.07% | China (31%), Taiwan (21%), India (20%), Brazil (4%), Saudi Arabia (4%) | 6.60% |

Vanguard FTSE Emerging Markets ETF (VWO)

Starting with the Vanguard FTSE Emerging Markets ETF (VWO), its unique theme revolves around providing broad, all-cap exposure to emerging markets through the FTSE Emerging Markets All Cap China A Inclusion Index. This means you get a mix of large, mid, and small-cap stocks, with a special inclusion of China A-shares that many other funds might underweight. It's designed for investors seeking comprehensive diversification without the hassle of picking individual stocks.

Top holdings as of August 2025 include Taiwan Semiconductor Manufacturing (TSMC) at about 9.51%, Tencent Holdings at 4.40%, Alibaba Group at 2.73%, HDFC Bank at 1.3%, and Xiaomi Corp at around 1.1%, followed by others like Reliance Industries, Hon Hai Precision, Infosys, MediaTek, and Vale. These are heavy hitters in tech and finance. Sector-wise, you'll see strong allocations to Information Technology (around 21-22%, driven by semiconductors and software), Financials (22%, with growing banks in India and China), Consumer Discretionary (13%, tapping into rising middle-class spending), and Communication Services (10%, fueled by social media and telecom giants). The potentials here are huge—IT sectors benefit from global chip demand and the AI boom, while financials grow with economic expansion and digital banking in places like India.

You should invest in VWO if you're after rock-bottom fees (just 0.08%) and long-term growth from diverse emerging economies. It's perfect for buy-and-hold strategies, offering stability through over 5,000 holdings. With a 5-year return of 7.21%, it's shown resilience.

iShares MSCI Emerging Markets ETF (EEM)

Next up is the iShares MSCI Emerging Markets ETF (EEM), which focuses on large- and mid-cap companies via the MSCI Emerging Markets Index. Its unique theme is high liquidity and accessibility, making it a go-to for active traders who need to move in and out quickly without big price impacts. This ETF emphasizes established players in dynamic economies, excluding smaller caps for a more stable ride. Top holdings include TSMC at 10.23%, Tencent at 5.38%, Alibaba at 2.80%, Samsung Electronics at about 2.3%, HDFC Bank at 1.2%, Reliance Industries at 0.9%, Xiaomi at 1.1%, Hon Hai at 0.9%, MediaTek at 0.8%, and Infosys at 0.7%.

Sectors lean toward Information Technology (21%, with semiconductors leading the charge), Financials (22%, boosted by banking reforms), Consumer Discretionary (13%, from e-commerce growth), and Communication Services (10%, via platforms like Tencent). The sector potentials shine in tech, where emerging markets are becoming innovation hubs, and financials, as fintech adoption surges in Asia.

Invest in EEM if you value liquidity—it's one of the most traded ETFs—and want exposure to blue-chip emerging stocks. Despite a higher expense ratio of 0.72%, its 6.11% 5-year return reflects solid performance in recoveries.

Schwab Emerging Markets Equity ETF (SCHE)

The Schwab Emerging Markets Equity ETF (SCHE) shares a similar theme to VWO, tracking the FTSE Emerging Index for large- and mid-cap exposure, but its uniqueness lies in ultra-low costs and tax efficiency, appealing to cost-conscious investors building core portfolios. It avoids South Korea (classified as developed by FTSE), putting more weight on China, India, and Taiwan.

Top holdings mirror VWO closely: TSMC at 10.58%, Tencent at 5.20%, Alibaba at 3.00%, HDFC Bank at 1.3%, Xiaomi at 1.1%, Reliance at 1.1%, Hon Hai at 0.9%, China Construction Bank at 0.9%, MediaTek at 0.8%, and ICICI Bank at 0.9%. Sector allocations include Financials (22%), IT (21%), Consumer Discretionary (13%), and Industrials (8%), with potentials in IT for semiconductor supply chains and financials for inclusive banking growth.

You should consider SCHE if you're focused on minimizing fees (0.11%) while getting broad diversification—it's great for retirement accounts. Its 7.21% 5-year return highlights consistent gains.

iShares Core MSCI Emerging Markets ETF (IEMG)

Moving to the iShares Core MSCI Emerging Markets ETF (IEMG), its unique theme is "core" exposure, including small caps alongside large and mid, via the MSCI Emerging Markets Investable Market Index. This adds a layer of growth potential from up-and-coming companies, making it ideal for those wanting fuller market representation.

Top holdings: TSMC at 9.18%, Tencent at 4.33%, Alibaba at (around 2.5%, based on similar), Samsung at 2.3%, HDFC Bank at 1.2%, Xiaomi at 1.1%, Reliance at 0.9%, Hon Hai at 0.9%, Infosys at 0.7%, and MediaTek at 0.7%. Sectors: IT (21%), Financials (22%), Consumer Discretionary (13%), Communication (10%), with high potential in health care (4%) from biotech in Asia and energy (4%) amid green transitions.

Invest in IEMG for its low 0.09% expense ratio and balanced approach— the inclusion of small caps has contributed to its strong 7.53% 5-year return. It's a smart choice for diversification beyond big names.

SPDR Portfolio Emerging Markets ETF (SPEM)

Finally, the SPDR Portfolio Emerging Markets ETF (SPEM) stands out with its theme of cost-effective, broad diversification across large, mid, and small caps via the S&P Emerging BMI Index. It's part of a suite aimed at core holdings, emphasizing value and minimizing country-specific risks.

Top holdings: TSMC at 9.06%, Tencent at 4.69%, Alibaba at 2.35%, HDFC Bank at 1.25%, Reliance at 1.11%, Xiaomi at 1.11%, China Construction Bank at 0.93%, Hon Hai at 0.92%, ICICI Bank at 0.90%, and MediaTek at 0.86%. Sector breakdowns: Financials 22.37%, IT 21.35%, Consumer Discretionary 12.89%, Communication Services 9.70%, Industrials 7.83%, Materials 7.28%, Consumer Staples 4.88%, Health Care 4.28%, Energy 4.19%, Utilities 3.00%, Real Estate 2.23%.

Potentials are strong in materials (commodity booms in Brazil/SA) and health care (pharma growth in India). You should invest in SPEM for its rock-bottom 0.07% expense and wide coverage—over 2,000 holdings for true diversification. With a 6.60% 5-year return, it's reliable for growth.

Risks and Strategies for Emerging Markets ETFs

You can't ignore the risks when investing in emerging markets—currency fluctuations can eat into your returns if the US dollar strengthens. Political instability in some countries might cause short-term dips too.

Market volatility is higher here compared to developed regions, so expect bigger swings. Economic slowdowns in major players like China could impact overall performance. But you can manage these with smart strategies. Dollar-cost averaging lets you invest fixed amounts regularly, smoothing out volatility over time. Check Intellectia.ai's AI agent for customized strategies.

Diversify across ETFs and use hedging tools if needed. Leverage Intellectia.ai's AI trading strategies like daytrading-center to stay ahead with real-time signals and analytics. Remember, long-term holding often rewards patience in these markets.

Capitalizing on Emerging Markets ETFs for Growth

Emerging markets ETFs like VWO and EEM offer access to high-growth economies with affordable diversification. Investors face risks like currency volatility but can mitigate them with disciplined strategies and low-cost funds. Use Intellectia.ai’s AI screener to identify top-performing emerging markets ETFs and optimize your portfolio for long-term gains.

Conclusion

Wrapping this up, the best emerging markets ETFs for 2025—like VWO, EEM, SCHE, IEMG, and SPEM—give you a straightforward way to tap into global growth while keeping things diversified and cost-effective.

You've seen how their performance, low fees, and exposure to booming economies can supercharge your portfolio. Investing in emerging markets isn't without risks, but with the right strategies, you can navigate them successfully. For final recommendations, start with low-cost options like SPEM or VWO if you're focused on long-term holds.

Ready to take action? Sign up and subscribe for daily AI stock picks, AI trading signals & strategies, and market analysis from Intellectia.ai to keep your investments on track.