Key Takeaways

- Charles Schwab, Fidelity, Robinhood, Interactive Brokers, and Intellectia AI are among the best day trading platforms for 2025, each catering to different trader needs.

- Intellectia AI excels in providing AI-driven trading signals, making it a strong choice for traders seeking data-driven insights.

- These platforms offer diverse features like real-time data, advanced charting, and low fees, but choosing the right one depends on your trading style and experience level.

- Day trading carries significant risks, and no platform guarantees profits, so careful strategy and risk management are essential.

- Intellectia AI appears particularly accessible and advantageous due to their user-friendly interfaces and innovative tools.

Introduction

Have you ever felt overwhelmed by the sheer number of day trading platforms, each claiming to be the best day trading platform? As a day trader, you need a platform that offers real-time data, lightning-fast execution, and tools to make quick, informed decisions. The wrong choice can cost you time, money, and opportunities. Here, we’ll navigate the crowded landscape of day trading platforms in 2025 to help you find the one that suits your needs.

Day trading is a fast-paced, high-risk endeavor that demands precision and access to cutting-edge tools. Whether you’re a beginner seeking a user-friendly interface or an experienced trader looking for advanced charting and analytics, choosing the right platform is critical. We’ll explore the top five day trading platforms, with a special focus on Intellectia AI, which leverages artificial intelligence to deliver real-time, data-driven insights.

By the end, you’ll have a clear understanding of the best platforms for day trading and how to use them effectively.

What is a Day Trading Platform

A day trading platform is an online brokerage service designed to help traders buy and sell financial instruments—such as stocks, options, futures, and cryptocurrencies—within the same trading day. These platforms are built for speed and efficiency, providing tools to capitalize on short-term market movements. According to Investopedia, day trading involves exploiting rapid price fluctuations, requiring platforms with robust features to support quick decision-making.

Key Features of a Day Trading Platform

- Real-time Data: Access to live market prices, volume, and trends ensures you’re never behind the curve.

- Lightning-Fast Order Execution: Speedy trade processing lets you seize fleeting opportunities in volatile markets.

- Advanced Charting Tools: Customizable charts with technical indicators like RSI, MACD, and Bollinger Bands empower in-depth analysis.

- Margin Accounts: Leverage increases your buying power, though it comes with heightened risk, as noted by FINRA.

- Research and Educational Resources: Comprehensive market analysis, news feeds, and tutorials help you refine your strategies and stay informed.

Source: Intellectia.ai

Criteria for Choosing Best Day Trading Platform

Selecting the best platform for day trading requires careful consideration of several factors. Here’s what you should look for:

- Low Fees and Commissions: Platforms with minimal or no commissions help you keep more of your profits.

- Execution Speed: Fast and reliable trade execution is critical in volatile markets.

- Asset Access: Ensure the platform supports the assets you want to trade, like stocks, options, or cryptocurrencies.

- Advanced Trading Tools: Look for features like technical indicators, algorithmic trading, and customizable dashboards.

- Mobile Accessibility: A robust mobile app lets you trade on the go.

- Research and Educational Resources: Access to market insights and learning tools can improve your strategy.

- User-Friendly Interface: An intuitive design ensures efficient trading, especially for beginners.

- Regulation and Security: Choose a platform regulated by authorities like FINRA or the SEC, with strong security measures.

5 Best Day Trading Platforms

Here’s a comparison of the top five day trading platforms for 2025, based on their features, fees, and suitability for different traders.

| Platform | Minimum Deposit | Fees & Commissions | Best for |

|---|---|---|---|

| Charles Schwab | $0 | $0 for stocks/ETFs, $0.65 per options contract | Advanced traders with thinkorswim |

| Fidelity | $0 | $0 for stocks/ETFs, $0.65 per options contract | Active traders with Active Trader Pro |

| Robinhood | $0 | $0 for stocks/ETFs, $0 for options (with regulatory fees) | Beginners and commission-free trading |

| Interactive Brokers | $0 for IBKR Lite | $0.005 per share for stocks (min. $1) | Experienced traders needing advanced tools |

| Intellectia AI | No Deposit | Subscription-based | AI-driven insights and signals for day trading |

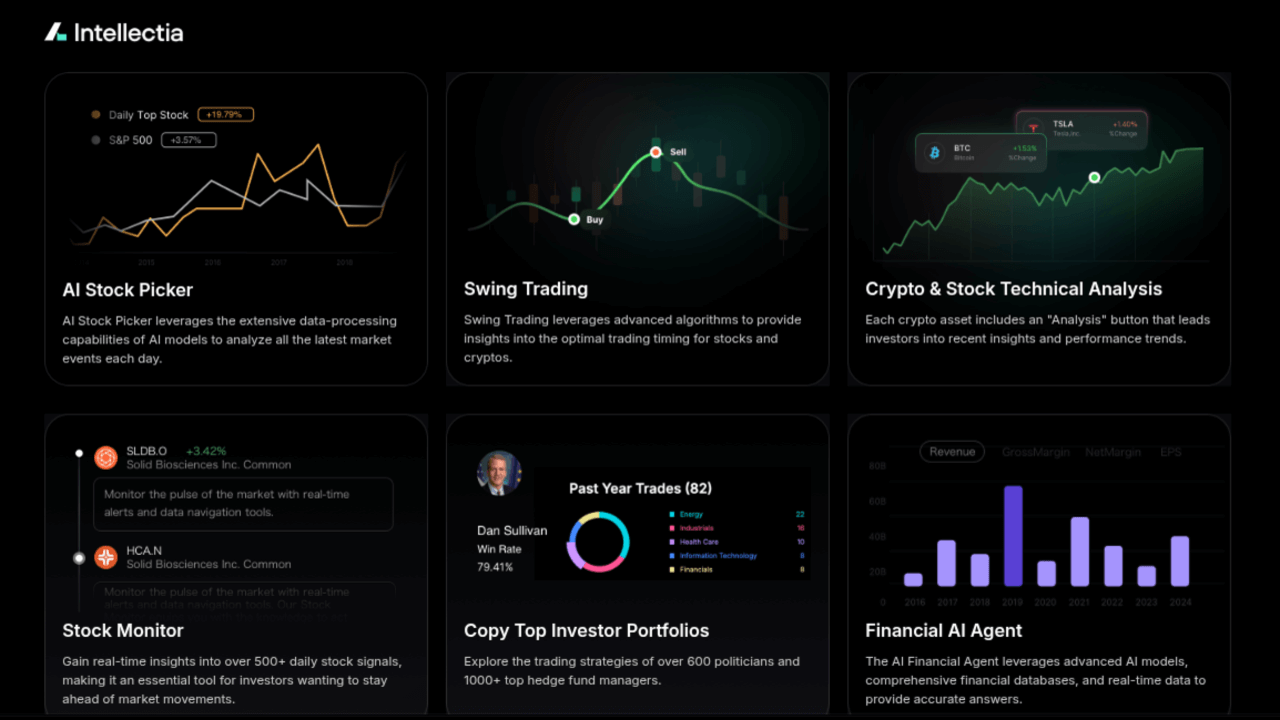

Charles Schwab

Charles Schwab is a trusted name in brokerage services, offering a wide range of investment products. Its thinkorswim platform is a favorite among day traders for its advanced charting and analysis tools.

- Key Features: Commission-free trading for stocks and ETFs, access to options, futures, forex, and bonds, robust research tools, and extensive educational resources like webinars and market commentary.

- Pros: No minimum deposit, advanced thinkorswim platform, strong customer support, and a wide range of investment options.

- Cons: The platform’s complexity can overwhelm beginners, and options trading fees may add up for high-volume traders.

- Best for: Advanced traders who value sophisticated tools and are willing to navigate a steeper learning curve.

Source: schwab.com

Fidelity

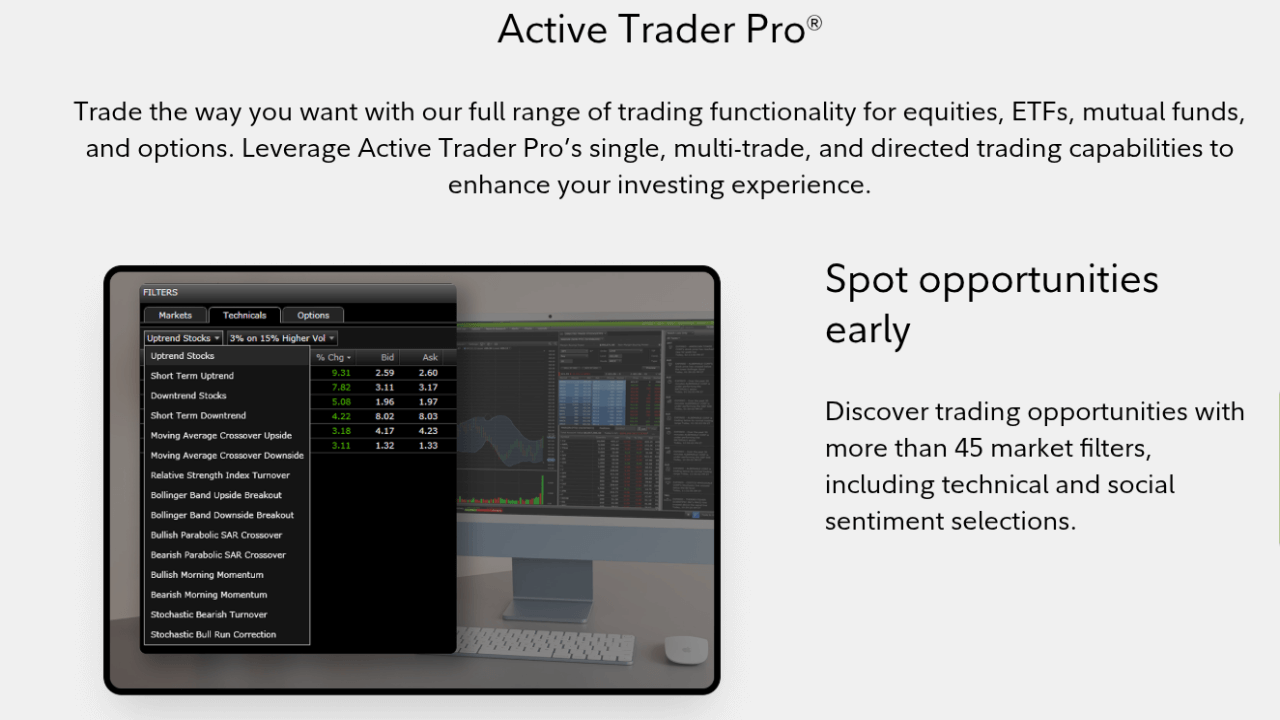

Fidelity is renowned for its comprehensive offerings and excellent customer service. Its Active Trader Pro platform is tailored for active traders, providing real-time data and advanced tools.

- Key Features: Zero commissions on stocks and ETFs, options trading, mutual funds, and limited cryptocurrency trading (Bitcoin, Ethereum, Litecoin). The platform also includes research reports and educational content.

- Pros: No minimum deposit, excellent customer support, and a broad selection of investment products.

- Cons: Active Trader Pro may feel complex for new traders, and some advanced features require a learning curve.

- Best for: Active traders seeking a balance of advanced tools, research, and reliable support.

Source: fidelity.com

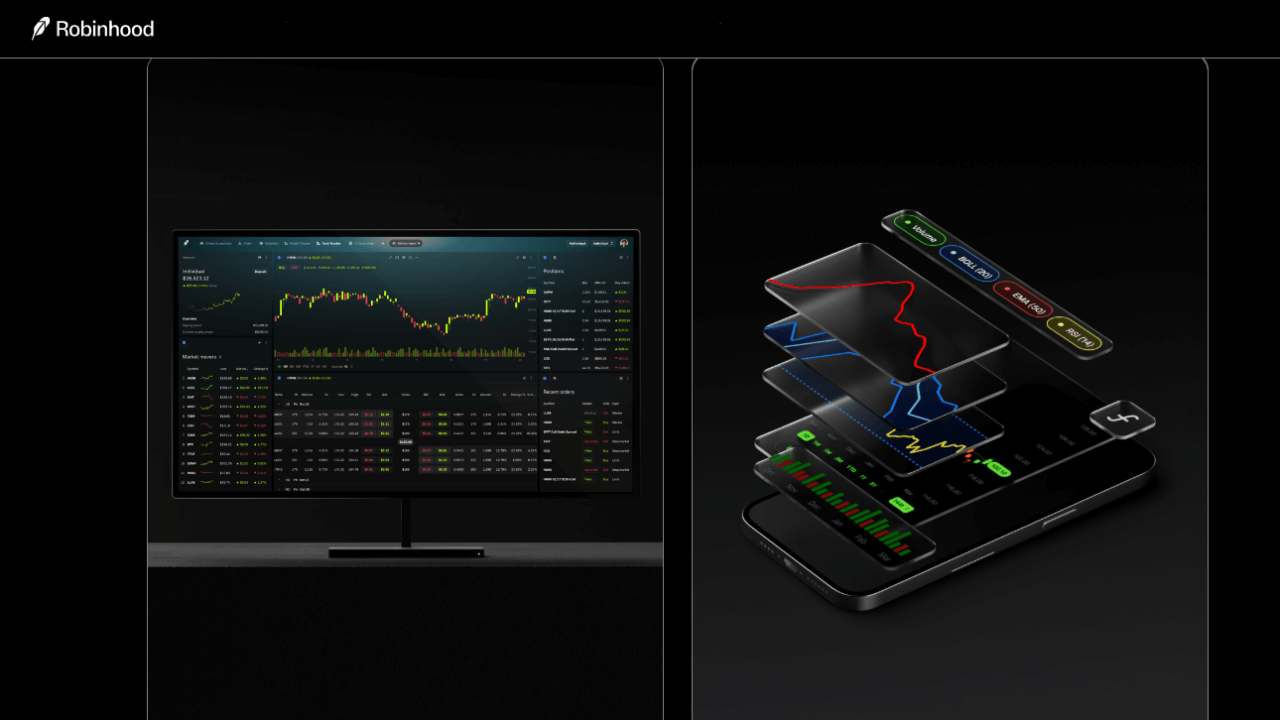

Robinhood

Robinhood disrupted the industry with its commission-free trading model, making it a go-to for retail investors. Its simple interface is ideal for beginners, though it has limitations.

- Key Features: Commission-free trading for stocks, ETFs, options, and cryptocurrencies, with an intuitive mobile app and basic charting tools.

- Pros: No minimum deposit, user-friendly interface, and zero commission fees make it accessible.

- Cons: Limited research tools, basic platform functionality, and occasional execution delays during high market volatility.

- Best for: Beginners and budget-conscious traders prioritizing simplicity and commission-free trading.

Source: robinhood.com

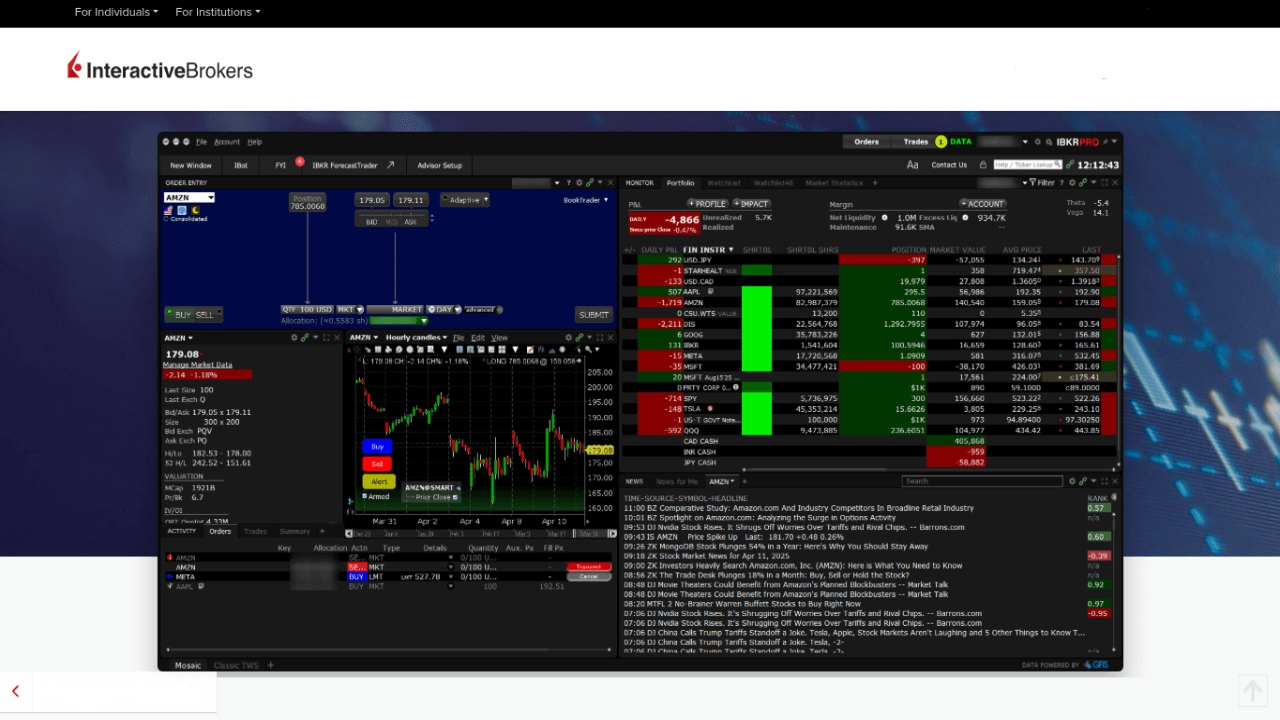

Interactive Brokers

Interactive Brokers is a top choice for professional traders due to its low costs and advanced trading capabilities. Its Trader Workstation (TWS) platform offers extensive customization.

- Key Features: Low per-share commissions, direct market access, over 90 order types, and coverage of global markets, including stocks, options, futures, and forex.

- Pros: Highly customizable platform, competitive fees, and access to international markets.

- Cons: The platform’s complexity can be daunting for beginners, and customer support may not be as responsive as competitors.

- Best for: Experienced traders who need advanced tools, low costs, and global market access.

Source: interactivebrokers.com

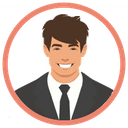

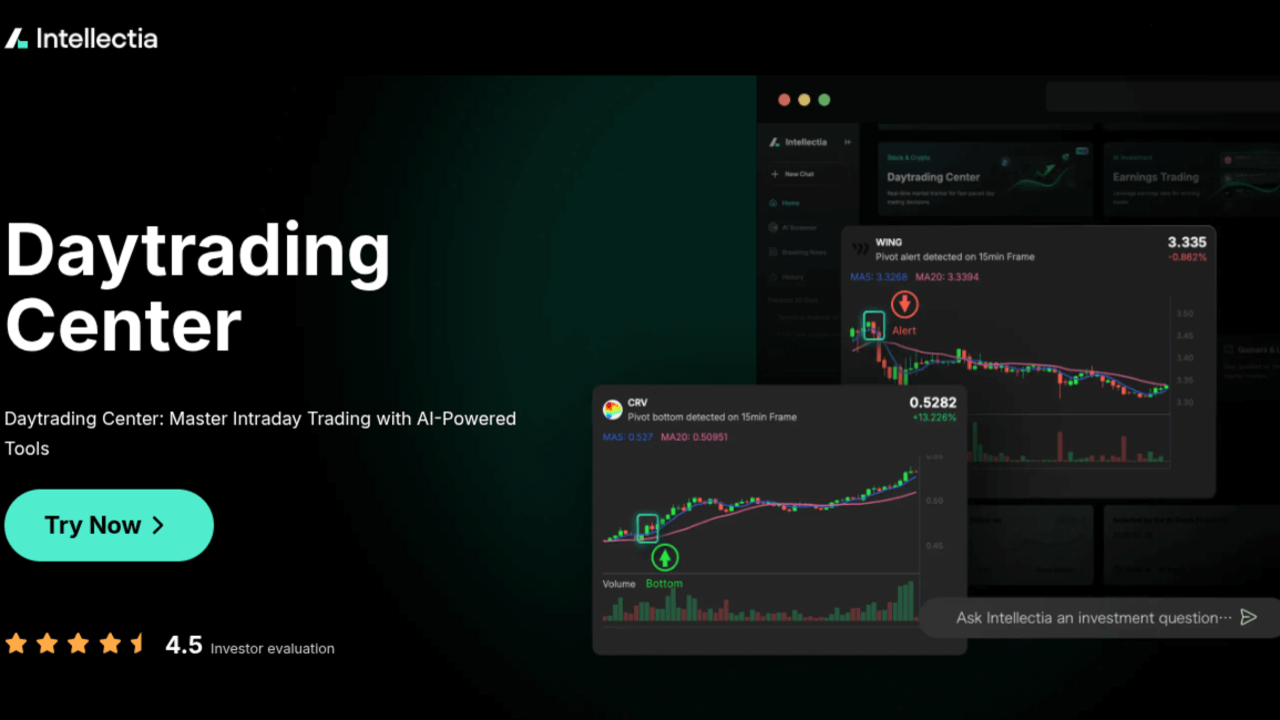

Intellectia AI - Best Platform for Day Trading Signals

Intellectia AI is a game-changer in day trading, using artificial intelligence to deliver real-time insights and trading signals for stocks, ETFs, and cryptocurrencies. Its subscription-based model provides Wall Street-level analysis, making it a standout for data-driven traders.

- Key Features of Day trading Center: Includes technical signals, event-driven movers, pivot bottoms, and pivot alerts. The platform supports multiple timeframes and asset types, with email alerts for timely trading decisions.

- Why Intellectia AI Stands Out

Its AI analyzes market trends, news, and technical indicators to generate precise buy and sell signals. Traders report catching reversals using Pivot Alerts, enhancing profitability.

Other cutting-edge AI tools besides Daytrading center like AI stock picker and Swing trading signals, real-time insights, and versatility for stocks, crypto, and ETFs analysis.

- Best for: Traders seeking AI-powered signals to make informed, data-driven decisions in stocks, cryptocurrencies, and ETFs.

Source: Intellectia.ai

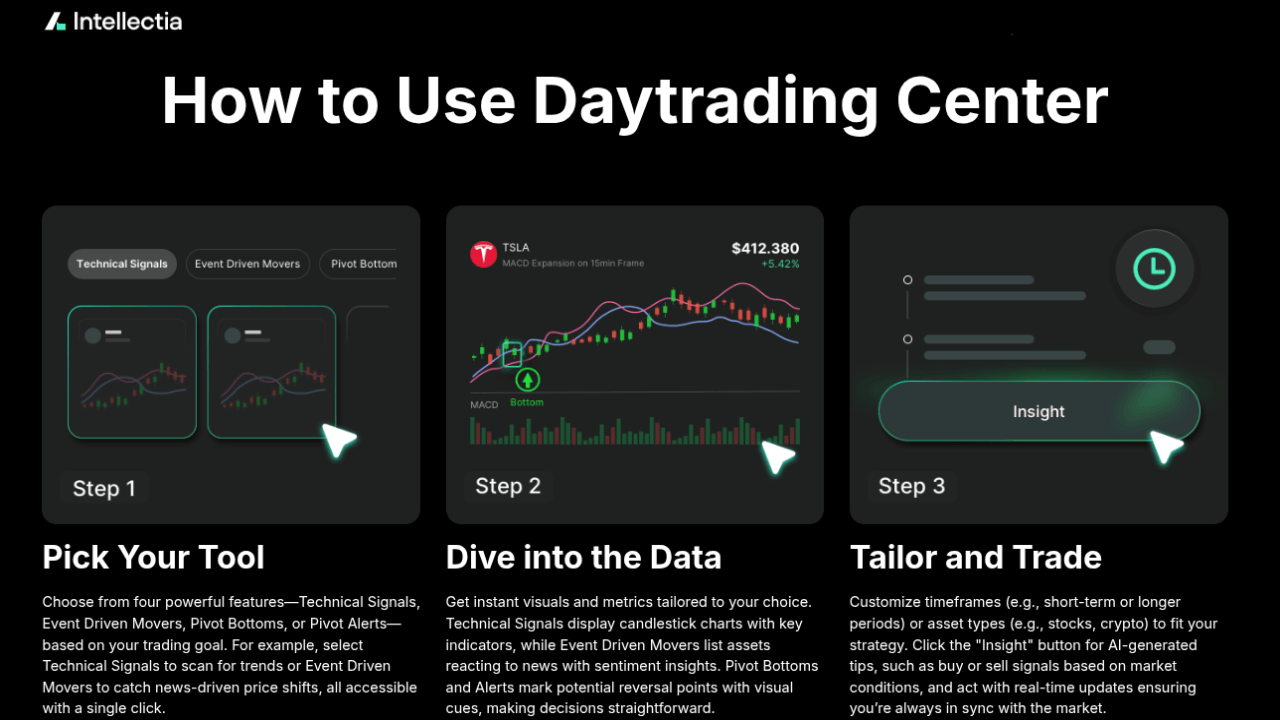

How to Use Intellectia AI Day Trading Tools: Step-By-Step Guide

Intellectia AI’s Day Trading Center is a treasure trove of AI-powered tools designed to simplify and enhance your trading. Here’s a detailed guide to using these tools effectively:

1.Sign Up and Subscribe

Start by visiting Intellectia AI’s sign-up page to create an account. Choose a subscription plan that fits your trading frequency and goals, as detailed on the pricing page.

2. Access the Day Trading Center

After logging in, navigate to the Day Trading Center, your hub for all day trading features, including stock and crypto analysis tools.

Source: Intellectia.ai

3. Analyze Technical Signals

- In the Day Trading Center, Intellectia's AI automatically gives traders overbought/oversold signals on stocks across the market.

- Select your asset (stocks, crypto, or ETFs) and timeframe (15min, 30min, 1H, 2H, 4H). Monitor signals like RSI (overbought/oversold), MACD (bullish/bearish cross), and MACD expansion/contraction to identify trading opportunities.

- Unlike other day trading platforms, Intellectia AI’s day trading signals allow traders to avoid monitoring over 7,000 stocks across the market and recognizing signals themselves.

4. Track Event-Driven Movers

- Use the Event-Driven Movers feature to monitor assets impacted by breaking news or market events.

- Click “Insight” for AI-generated buy or sell recommendations based on real-time sentiment analysis.

Source: Intellectia.ai

5. Time Your Trades with Precision

- Leverage Pivot Bottoms to identify potential buy signals at price lows, ideal for entering trades.

- Use Pivot Alerts for sell signals to exit at optimal points.

- Email alerts for real-time notifications on these signals, ensuring you never miss a trade.

For a deeper dive, explore Intellectia AI’s step-by-step tutorial.

Tips for Maximizing Your Day Trading Success

Success in day trading requires more than a great platform—it demands strategy, discipline, and adaptability. Here are expanded tips to help you thrive:

- Assess Your Trading Style: Are you a beginner, active, or advanced trader? Beginners may prefer Intellectia AI’s user-friendly interface, while pros might opt for Interactive Brokers’ advanced customization.

- Choose Your Assets Wisely: Ensure the platform supports your preferred assets, like stocks, options, or cryptocurrencies. Intellectia AI excels in both stock and crypto analysis.

- Practice with Demo Accounts: Many platforms offer demo accounts to test strategies risk-free. Use these to build confidence before risking real capital.

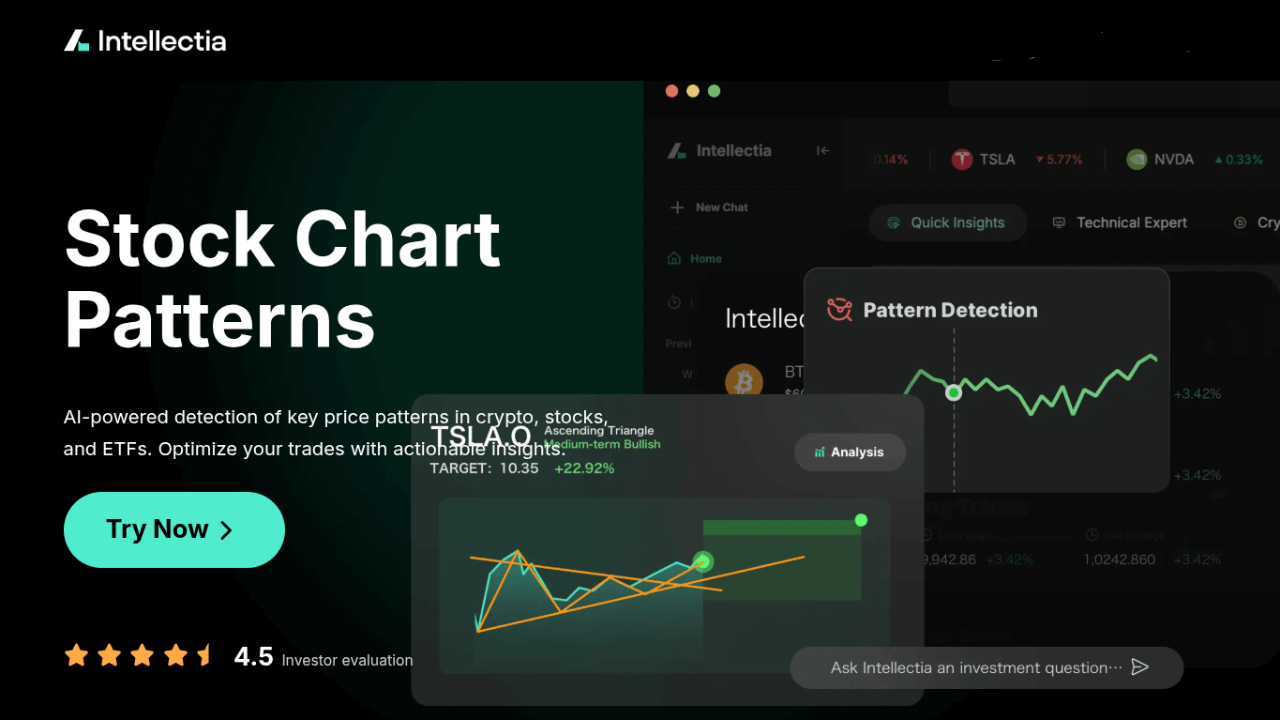

- Leverage Research Tools: Dive into resources like Intellectia AI’s technical analysis, pattern detection, price prediction, and earnings trading to stay ahead of market trends.

- Monitor Execution Speeds: Test your platform’s speed during volatile periods to ensure reliable trade execution, especially for high-frequency trading.

- Manage Risk Effectively: Use stop-loss and limit orders to protect your capital. Intellectia AI’s trading signals can guide your risk management strategy.

- Keep Fees in Check: High commissions can erode profits. Opt for low-cost platforms like Robinhood or understand Intellectia AI’s subscription model via its pricing page.

Source: Intellectia.ai

Conclusion

Choosing the best day trading platform for 2025 depends on your trading style, experience level, and goals. Established platforms like Charles Schwab, Fidelity, Robinhood, and Interactive Brokers offer robust tools and features, catering to a range of traders from beginners to professionals.

However, Intellectia AI stands out with its innovative AI-driven tools, providing real-time insights and trading signals for stocks and cryptocurrencies. Whether you’re looking to capitalize on market trends or manage risk effectively, Intellectia AI empowers you to make smarter, data-driven decisions.

Ready to take your day trading to the next level? Sign up for Intellectia AI and subscribe to access daily AI stock picks, trading signals, and market analysis tailored to your needs.