Key Takeaways

- Each company exceeded expectations in key areas, reflecting strong market confidence and operational strength despite minor setbacks.

- From Microsoft's innovative cloud solutions to Marvell's data center advancements, and AMD's cutting-edge processors, AI is fueling significant demand and reshaping industry landscapes.

- Strategic initiatives, like AMD's international partnerships and Broadcom's advanced platforms, demonstrate adaptability and a forward-looking approach to overcome these challenges.

- Wall Street optimism points to a thriving AI investment landscape, encouraging a positive outlook for future opportunities and market expansion.

Introduction

Have you ever felt overwhelmed by the hype around AI, wondering how to turn it into real profits without getting burned? Many investors chase trends but end up losing money due to poor choices or market volatility.

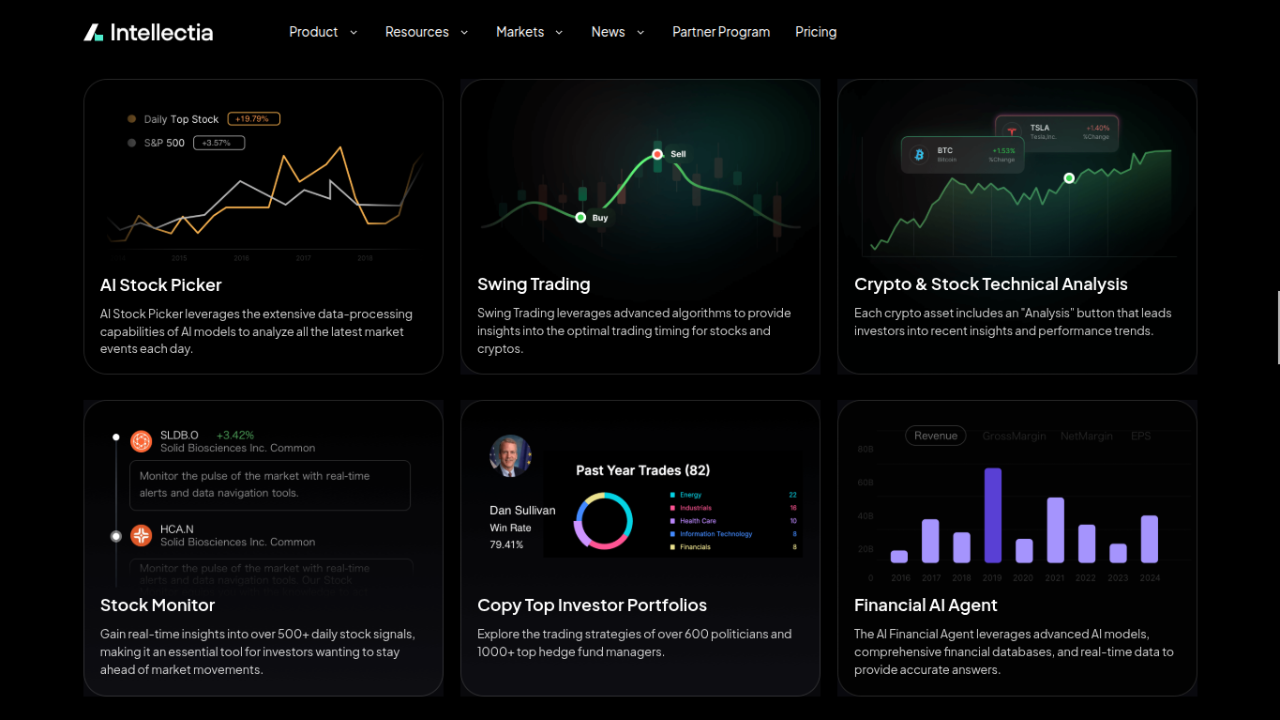

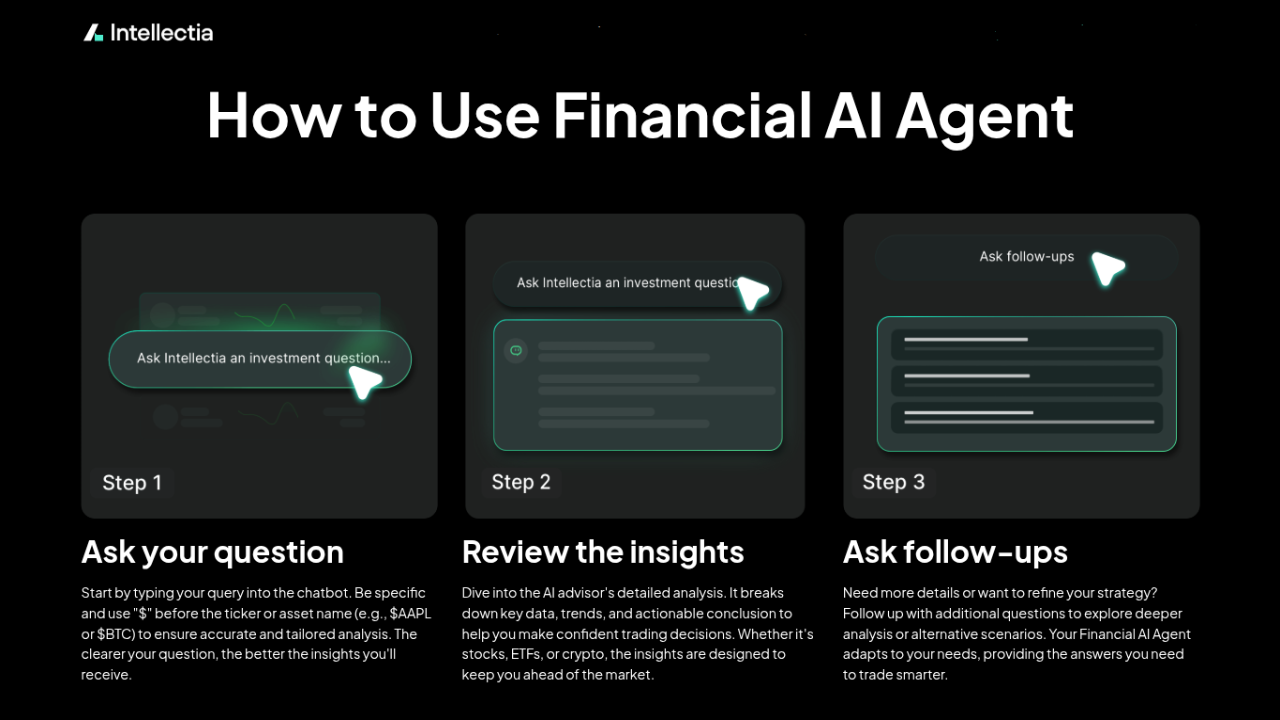

You can see how AI can help in aggregating insights and expert-level analyses to spotlight winners. The solution? Use platforms like Intellectia.ai for AI stock selection and predictions.

For example, analyzing recent transcripts from companies like AMD shows how AI hardware demand is driving massive revenue jumps, helping you build a portfolio that grows steadily.

What is AI Investing?

AI investing means putting your money into companies that develop or use artificial intelligence to drive innovation. This includes hardware like chips from firms such as AMD, software platforms from Microsoft, and services that integrate AI across industries.

Think of AI as split into key sectors: hardware for processing power, software for algorithms, and services for applications in healthcare or finance. It's revolutionizing everything from autonomous cars to personalized medicine. By investing here, you're betting on tech that's already transforming daily life.

Why Invest in AI?

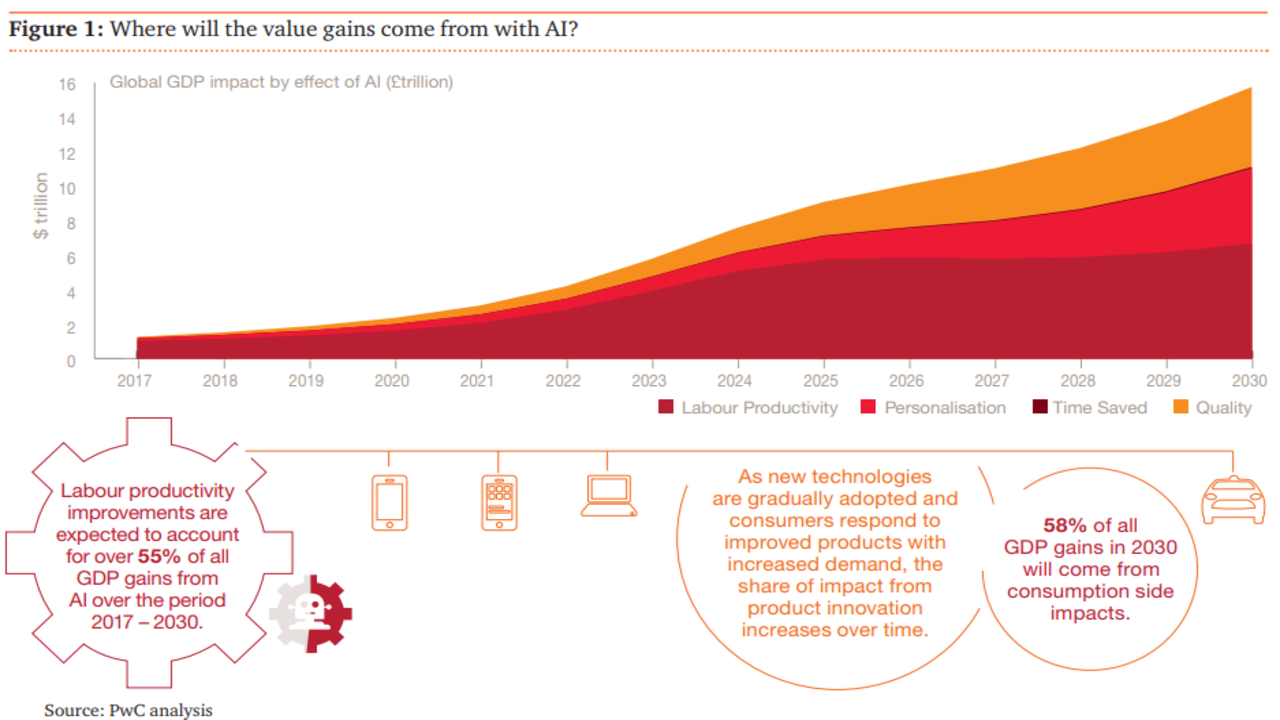

You're probably wondering if AI is worth the buzz. Market growth projections are staggering—the global AI market could reach $15.7 trillion by 2030. Technological advancements like machine learning are boosting efficiency in sectors like manufacturing and retail. Imagine AI optimizing supply chains, cutting costs by up to 20%.

The transformative impact is clear: companies adopting AI see higher profits. That's why top AI companies to invest in are leading the charge. For real-time insights, use Intellectia.ai's AI stock picker to spot opportunities. Plus, with governments pushing AI research, the future of AI investing looks bright. Don't miss out on this wave—it's like investing in the internet boom of the '90s.

How to Invest in AI

Getting started in AI doesn't have to be complicated. First, consider buying individual stocks from leaders in the space, which lets you target specific growth areas. If you prefer less hands-on, AI-themed ETFs spread your risk across multiple companies. Options like the Global X Robotics & Artificial Intelligence ETF (BOTZ) cover hardware and software.

Another smart way is using AI-powered investment tools. Platforms like Intellectia.ai offer AI stock and crypto analysis, price predictions, and trading strategies to guide your decisions. You can also explore swing trading features or day trading centers for short-term plays. For beginners, start small and learn through stock monitors.

Remember, how to invest in artificial intelligence depends on your goals—long-term growth or quick gains? Tools like AI agents can automate much of this for you.

Top AI Stocks to Consider

You're eyeing the best AI stocks to buy, right? With the AI boom showing no signs of slowing—think trillions in projected market value by 2030—picking the right ones can supercharge your portfolio.

| Company | Ticker | Market Cap | Main Strength | 5-Year Total Return |

| Microsoft Corporation | MSFT | $3.80 Trillion | Strong network effects from Office and Azure, economies of scale, and brand loyalty in cloud and productivity software | 157% |

| Marvell Technology, Inc. | MRVL | $71.70 Billion | Intangible assets in networking chip design, high R&D investment for custom ASICs, and focus on AI/data center interconnects | 123% |

| Taiwan Semiconductor Manufacturing Company Limited | TSM | $1.42 Trillion | Process technology leadership (e.g., 3nm/2nm nodes), economies of scale in foundry services, and reputation for high yields serving major chip designers | 277% |

| Broadcom Inc. | AVGO | $1.58 Trillion | Expertise in custom AI accelerators and networking (e.g., Jericho platforms), high switching costs for hyperscalers, and strategic partnerships | 949% |

| Advanced Micro Devices, Inc. | AMD | $262 Billion | Innovation in high-performance CPUs/GPUs (e.g., EPYC, MI300X), integrated ecosystem (Infinity Fabric), and cost-effective alternatives in AI/data centers | 104% |

Microsoft (MSFT)

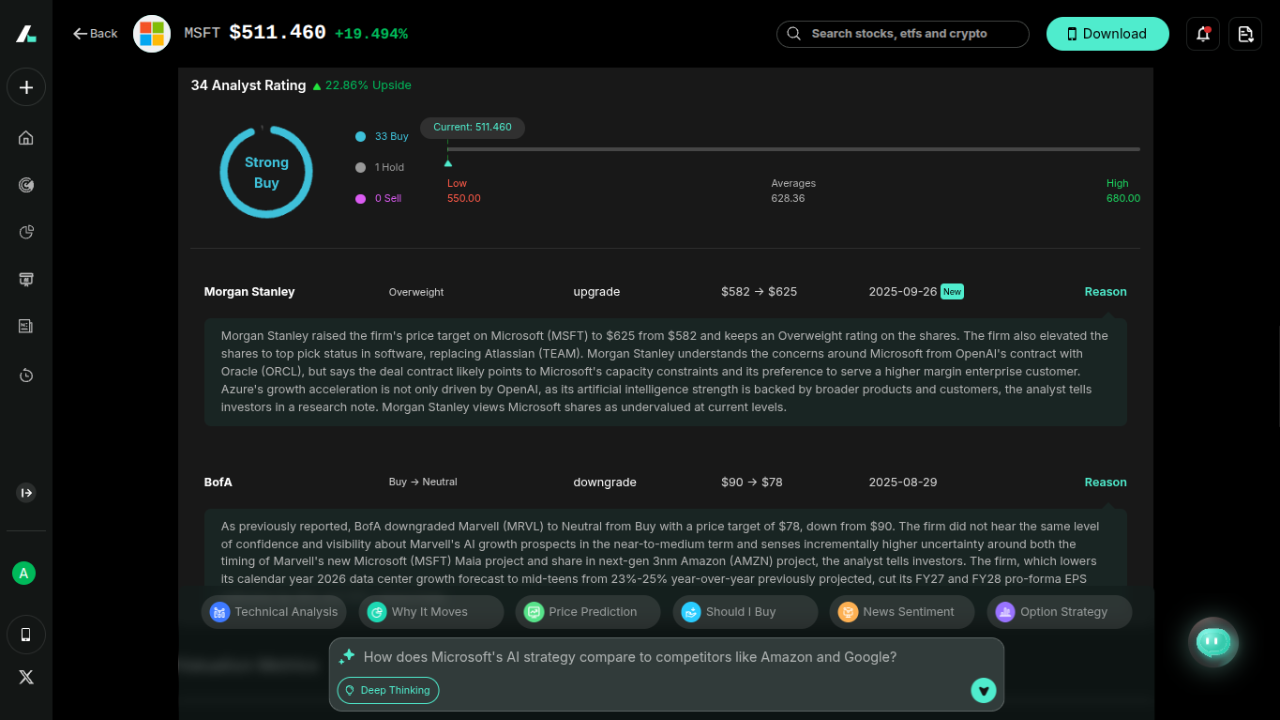

Start with Microsoft (MSFT), the software giant that's woven AI into every corner of its empire. You know them for Azure cloud and Office, but their AI play is massive. Market position? They're the undisputed leader in commercial cloud AI, with Azure holding about 25% global share and leading in AI infrastructure.

Recent performance shines in Q4 2025: Revenue hit $76.44 billion, up 18.1% year-over-year, beating estimates by $2.60 billion. EPS was $3.65, smashing expectations by $0.27. Azure AI services alone contributed to $5 billion in annual revenue, up 34%, driven by explosive growth in AI workloads across six continents. They opened new data centers everywhere, making every Azure region "AI-first" with liquid cooling for massive scalability. Copilot, their AI assistant, now has over 800 million monthly active users across products, and GitHub Copilot usage has doubled AI projects on the platform.

Gross margins dipped slightly to 68% due to AI infrastructure scaling, but operating margins held strong at 42%, thanks to efficiency gains. Growth prospects? Huge. Satya Nadella emphasized blending consumption models with AI agents, predicting teams will throttle usage as models evolve. They're investing $30 billion+ in Q1 capex for AI, with backlog surging from big customers.

Advanced Micro Devices (AMD)

Next up, Advanced Micro Devices (AMD), the chip challenger that's clawing market share from Nvidia in AI accelerators. Their position? A powerhouse in CPUs and GPUs for data centers, with EPYC and Instinct lines powering AI training and inference. They trail Nvidia but lead in open ecosystems like ROCm software. Q2 2025 was a mixed bag but strong overall: Revenue reached $7.69 billion, up 31.71% year-over-year, beating by $255.65 million, though EPS of $0.48 just missed.

Excluding $800 million in export-related write-downs on Instinct GPUs, gross margins hit 54%—six straight quarters of improvement. Data Center revenue soared on EPYC records, up thanks to agentic AI demand for general-purpose compute. Instinct faced headwinds from U.S. export controls to China, but MI325 wins expanded with top AI firms, and sovereign AI deals like the multibillion-dollar HUMAIN collab for secure infrastructure kicked off. They acquired teams from Brium, Lamini, Nod.ai, and others to boost AI software, and launched Radeon AI Pro R9700 for desktop inferencing.

Embedded dipped, but overall, free cash flow was $1.1 billion. Prospects look electric: MI350 series and ROCm 7 are winning hyperscalers, with sovereign AI additive. They're scaling to tens of billions in annual AI revenue by 2026, fueled by MI400 ramps. Lisa Su's bullish on the "industry-wide AI transformation" driving compute demand.

Marvell Technology (MRVL)

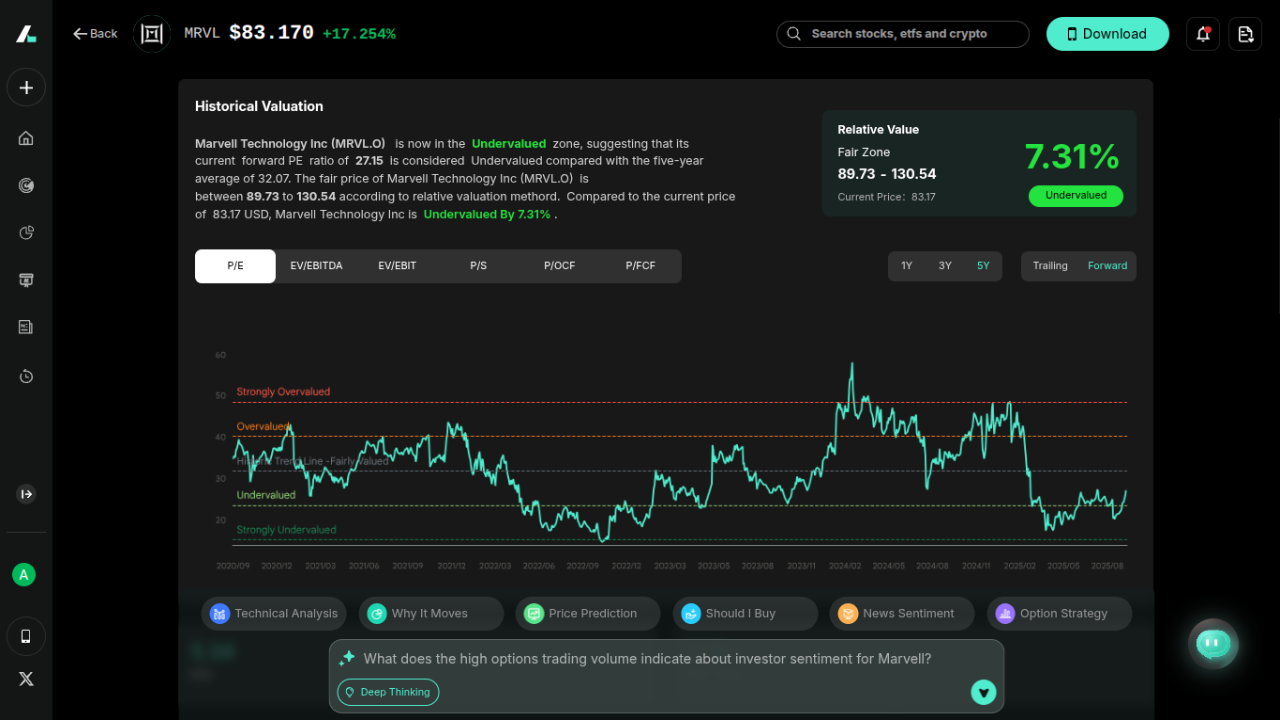

Don't sleep on Marvell Technology (MRVL), the leader of AI networking and custom chips. They dominate data center interconnects, with custom XPUs and electro-optics holding 90%+ of AI revenue. Positioned perfectly for the "scale-up" era where AI clusters need ultra-fast links. Q2 2026 delivered records: $2.006 billion revenue, up 58% year-over-year and 6% sequentially, though missing by $3.99 million. EPS was $0.67, up 123%, with non-GAAP margins expanding to 34.8%.

Data center end-market exploded 69% on AI demand, with custom XPUs and PAM DSPs leading; AI/cloud now over 90% of that segment. Enterprise networking and carrier recovered 43%, and they repurchased $540 million in stock, with $2 billion left. Design wins hit all-time highs—18 major AI deals ramping now through next year. Their 12.8T switches and Jericho4 for Ethernet/UALink fabrics are essential for massive AI clusters.

Optics like 800-gig PAMs have long lifecycles. Matt Murphy highlighted redirecting investments to AI, with R&D over 80% data center-focused. Outlook? AI revenue crossing half the company soon, with scale-up networking a tailwind. They're pivoting hard from consumer to AI-first.

Taiwan Semiconductor Manufacturing (TSM)

Taiwan Semiconductor Manufacturing (TSM), the foundry leader, fabs chips for everyone from Apple to Nvidia—essential for AI hardware. They command 60%+ advanced node market share, especially 3nm/5nm for AI/HPC. Q2 2025 crushed it: $31.73 billion revenue, up 54.18% year-over-year, beating by $438.46 million; EPS $2.47 topped estimates by $0.16.

NT revenue rose 11.3% sequentially on 3nm/5nm demand, with USD terms up 17.8%. Gross margins at 58.6%, operating at 49.6%, ROE 34.8%. AI/HPC drove the surge, with token volume growth signaling more compute needs. CoWoS capacity tightens as chips get bigger/power-hungrier. They're building giga-fab clusters in Arizona (30% of 2nm+ capacity overseas) and two advanced packaging sites for AI supply chain.

Sovereign AI and humanoid robots emerge as frontiers. C.C. Wei raised 2025 guidance, expecting mid-40s% CAGR for AI accelerators, potentially higher with H20 shipments to China resuming. N3/N5 supply-demand stays tight for two years as AI migrates nodes. On-device AI developments accelerate. Capex holds at $38-42 billion but could rise with demand. Margins benefit from AI efficiencies in fabs.

Broadcom (AVGO)

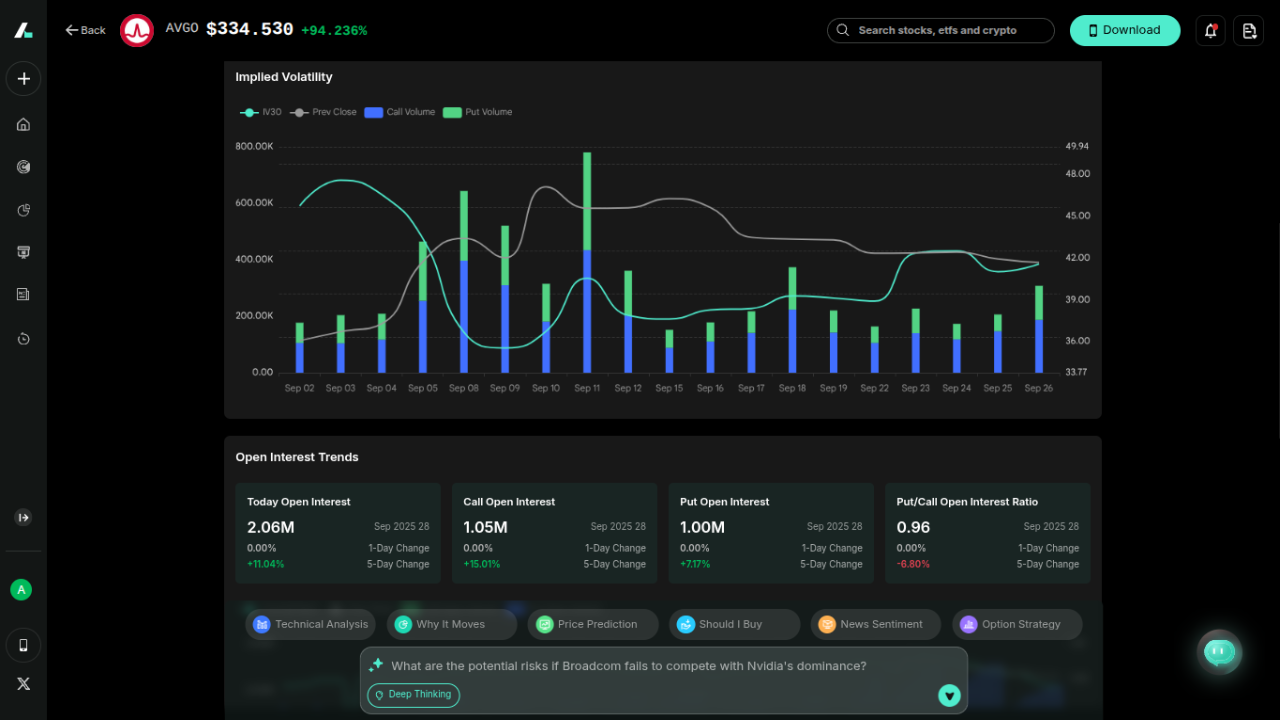

Finally, Broadcom (AVGO), the semiconductor Swiss Army knife for AI networking and XPUs. They lead in Ethernet for hyperscale data centers, with Jericho/Bailly chips handling AI's bandwidth crunch. Q3 2025 was stellar: $15.95 billion revenue, up 22.03% year-over-year, beating by $129.31 million; EPS $1.69 topped by $0.03. AI semiconductors hit $5.2 billion, up 63%, driving 26% segment growth to $9.2 billion. Total backlog record-high on AI/VMware strength; EBITDA $10.1 billion. Q4 guides $17.4 billion total, with AI semis at $6.2 billion (66% up). Non-AI semis recover slowly (low-single digits up), but bookings +23%. Jericho4 at 51Tbps tackles scale-out for generative AI. Hock Tan forecasts FY26 AI growth >60%, with $110 billion backlog (mostly AI-driven). Enterprise AI workloads on-prem/cloud add layers. They're disaggregated from accelerators, making Ethernet a logical pick for hyperscalers. R&D ramps for leading-edge AI. With Tan extending his tenure, momentum's strong.

Risks and Strategies for AI Investing

AI investing isn't without pitfalls. Rapid technological changes can make today's leaders obsolete tomorrow—think how new algorithms disrupt old ones. Regulatory uncertainties, like data privacy laws, add volatility. Market swings from hype cycles can tank prices overnight.

To manage risks of AI investing, diversify across sectors. Don't put all eggs in hardware; mix with software and ETFs. Use strategies like stop-loss orders and regular portfolio reviews. Intellectia.ai's technical analysis helps spot trends early.

AI investment strategies also include hedging with crypto tools or tracking hedge fund moves. Stay ahead with earnings trading insights. For patterns, leverage stock chart tools to predict shifts. Remember, education is your best defense—read up on news and blogs.

Key Steps to Invest in AI

First, educate yourself on the AI landscape. Read about sectors and opportunities via Intellectia.ai's resources. Choose your approach: individual stocks for high rewards, ETFs for stability, or platforms for automated picks based on your risk tolerance.

Leverage Intellectia.ai to screen investments with AI tools, analyzing data for predictions and signals. Stay informed on trends—subscribe to alerts on pricing plans. Adapt as AI evolves, perhaps shifting to emerging areas like quantum AI. Track performance with stock monitors and adjust quarterly.

Conclusion

In summary, the best AI stocks to buy like MSFT, AMD, MRVL, TSM, and AVGO offer huge potential amid explosive market growth. Balance risks with smart strategies, diversification, and tools for success in the future of AI investing. Whether picking stocks or ETFs, knowledge is key. Ready to dive in? Sign up at Intellectia.ai/sign-up and subscribe for daily AI stock picks, trading signals, strategies, and market analysis to stay ahead.