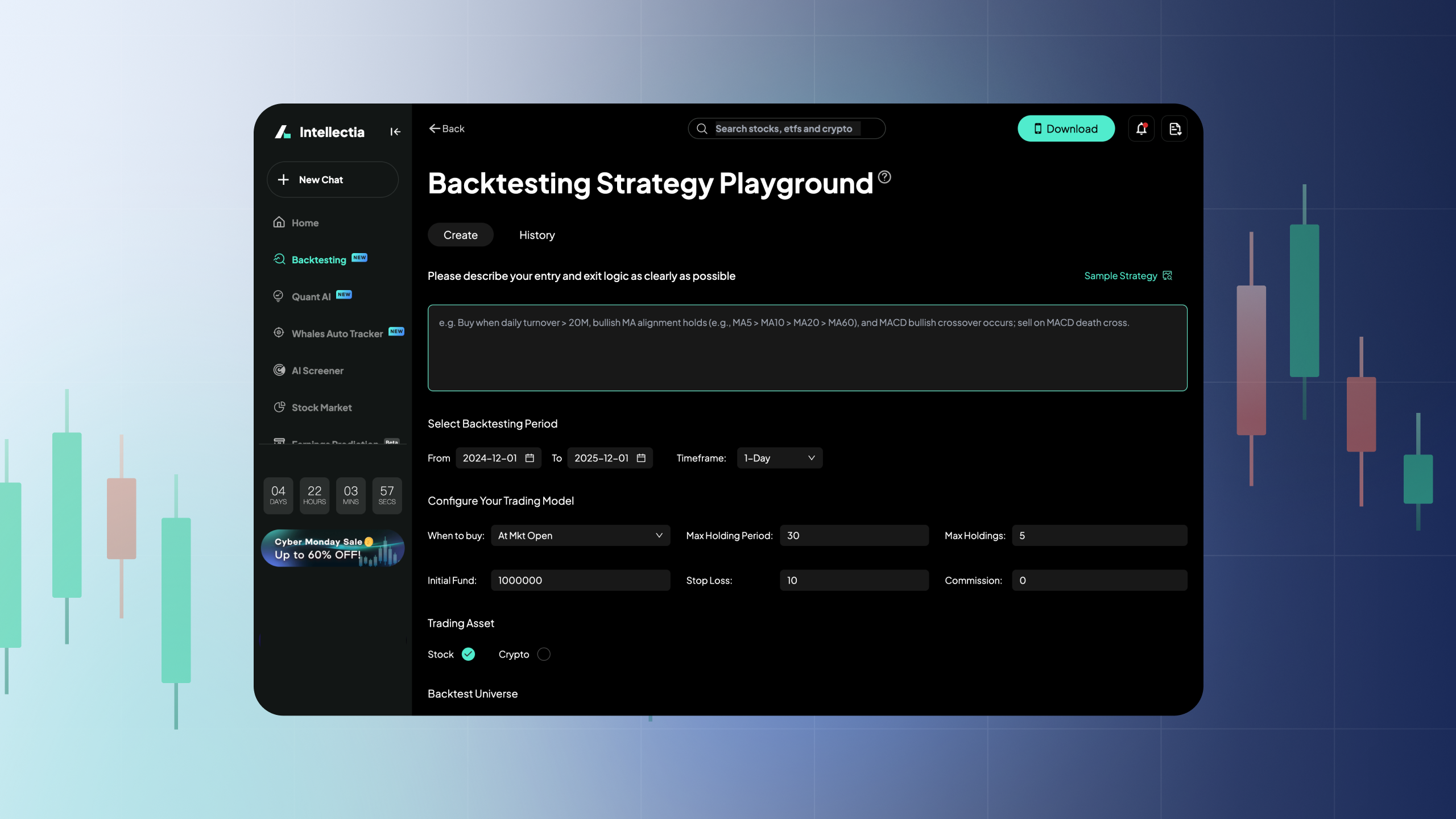

Welcome to QuantAI Alpha Pick, a revolutionary AI-driven feature designed to optimize your mid-term investment strategy with precision and ease. This tutorial will guide you through its functionality, helping you follow the strategy for buying, selling, and managing your portfolio effectively.

Understanding QuantAI Alpha Pick

QuantAI Alpha Pick curates a dynamic portfolio of ~40 stocks, each weighted at 2-3%, optimized for a one-month horizon. Using advanced AI, it selects stocks based on price momentum, fundamental strength, and market sentiment, while incorporating a 15% fixed stop-loss to protect your capital. The strategy adapts to market conditions, shifting to a risk-off state with diversified assets during volatile periods.

Key Features

Daily Portfolio Updates: Check the latest trades and holdings in the app under "Latest Trades" and "Current Positions" to stay informed.

Automated Notifications: Receive push notifications and emails for real-time actions.

Risk Management: A 15% stop-loss and dynamic cash allocation safeguards your investments.

How to Follow the Strategy

Monitor Daily Picks:

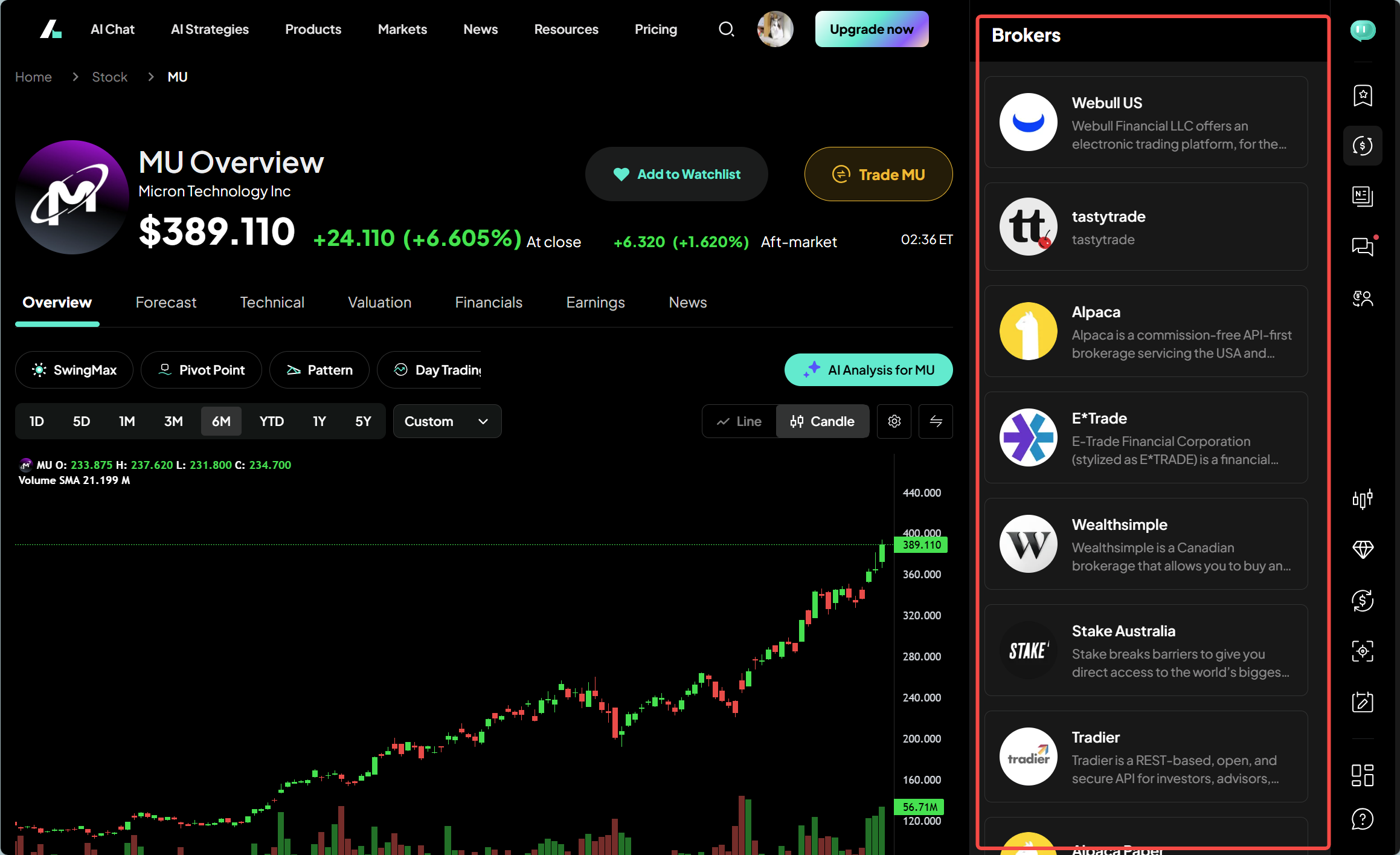

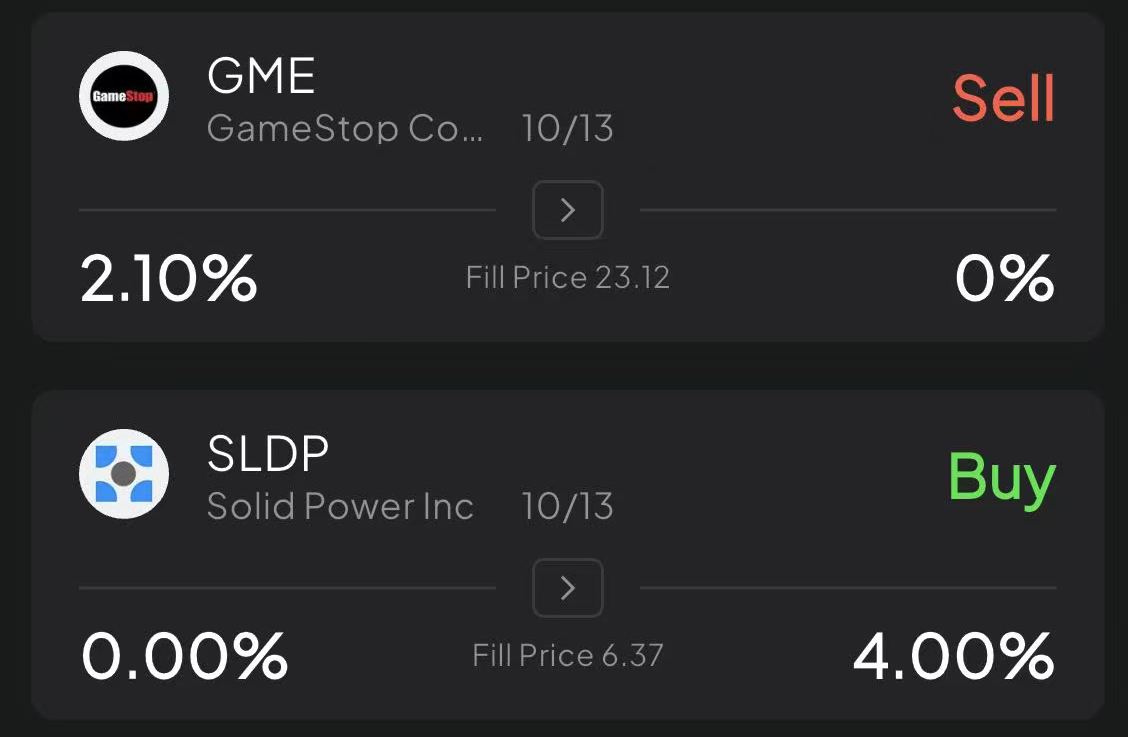

- Open the QuantAI Alpha Pick feature and navigate to the "Portfolio" tab (as shown in the image).

- Review stocks like GME (Sell), SLDP(Buy) with their Position size (e.g.4.00% for SLDP, means buying SLDP with 4.00% of your portfolio size. If you have $10k, then $400 is the amount of this trade).

- A sell trade means sell the holding stock, which was bought earlier. This strategy doesn't involve short selling.

Act on Notifications:

- Buy (Tune-In): Around 9:30 AM (market open), you’ll receive a push notification (e.g., "[QuantAI] RIVN has been selected... awaiting steady gains"). Buy the stock at the specified Fill Price.

- Sell (Tune-Out): Around 3:50 PM (market close), if a stock like TDOC is marked "Sell", sell it based on the notification (e.g., "[QuantAI] TDOC has been removed... ").

- Stop-Loss: If a stock triggers a 15% loss, you’ll get a notification (e.g., "[QuantAI] TDOC removed due to stop-loss"). Sell immediately to limit losses.

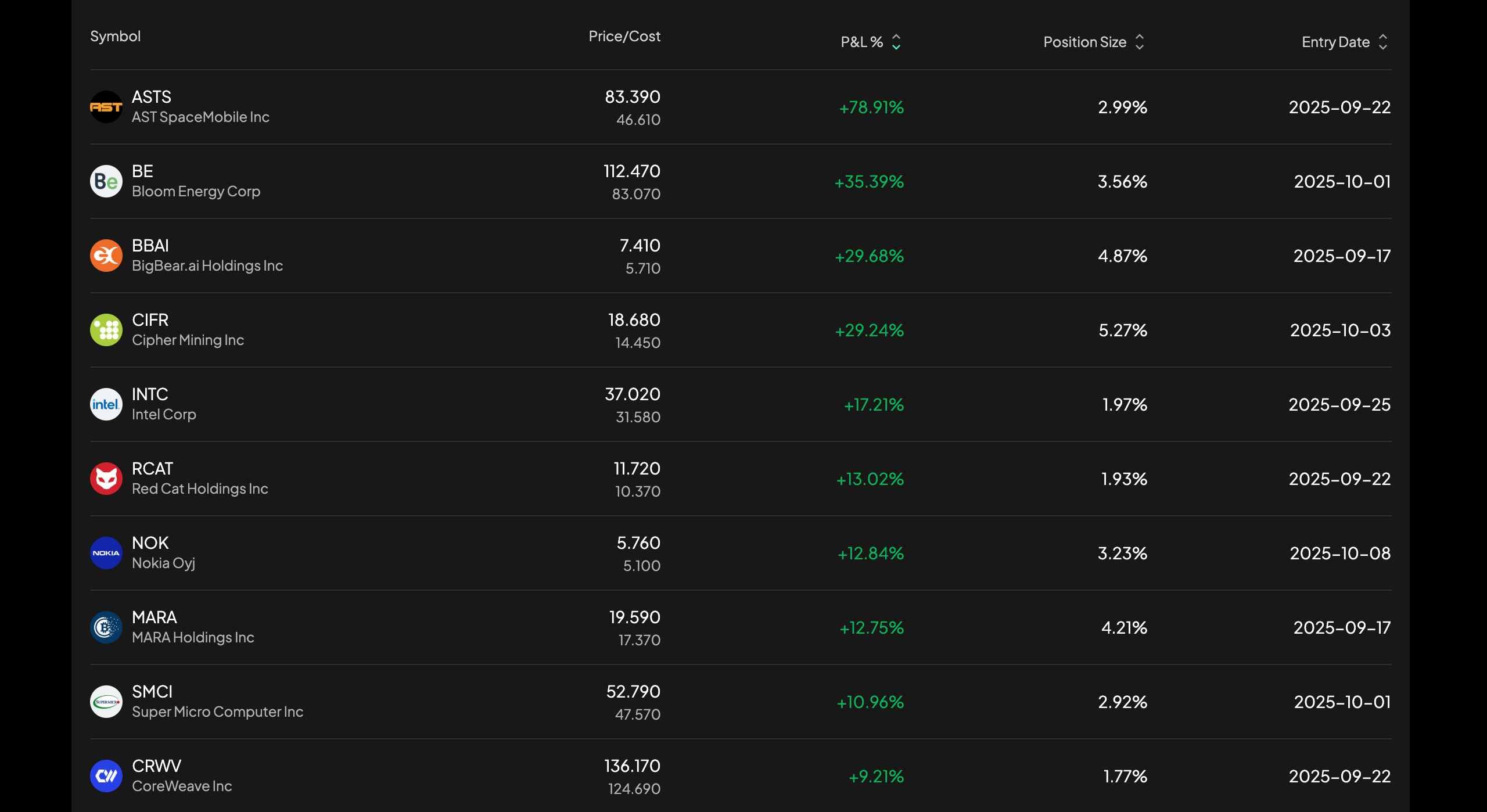

Watch the Current Positions:

- Current Positions: You can see all the current holdings in the Current Position. Each holding has the cost, current price, P&L and entry date.

Risk-Off State:

During volatile markets, the strategy may shift to a risk-off state. Allocate your portfolio as follows:

20% Gold ETF (GLD)

20% Investment-Grade Bonds (LQD)

20% Mid-Term Bonds (BIV)

10% High-Yield Bonds (HYG)

10% Silver ETF (SLV)

10% VIX Hedge ETF (VXX)

10% Cash

Hold this allocation until the strategy returns to normal trading.

Step-by-Step Action Plan

Start of Day: Check the app at 9:30 AM for buy signals and execute trades.

Mid-Day: Monitor for stop-loss triggers and act promptly.

End of Day: Review sell notifications at 3:50 PM and adjust your portfolio.

Risk-Off: Switch to the predefined asset allocation during market downturns as advised.

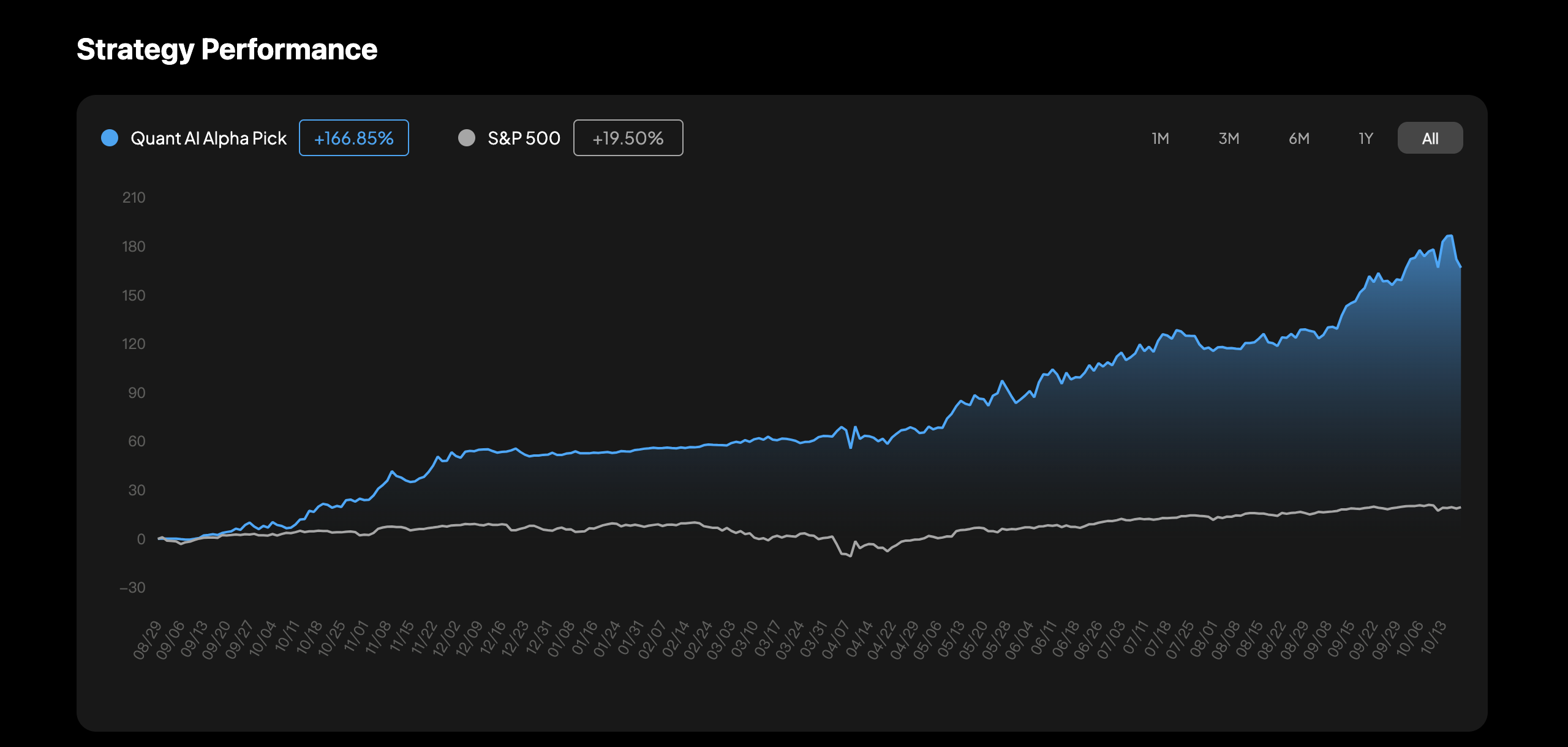

Why It Works

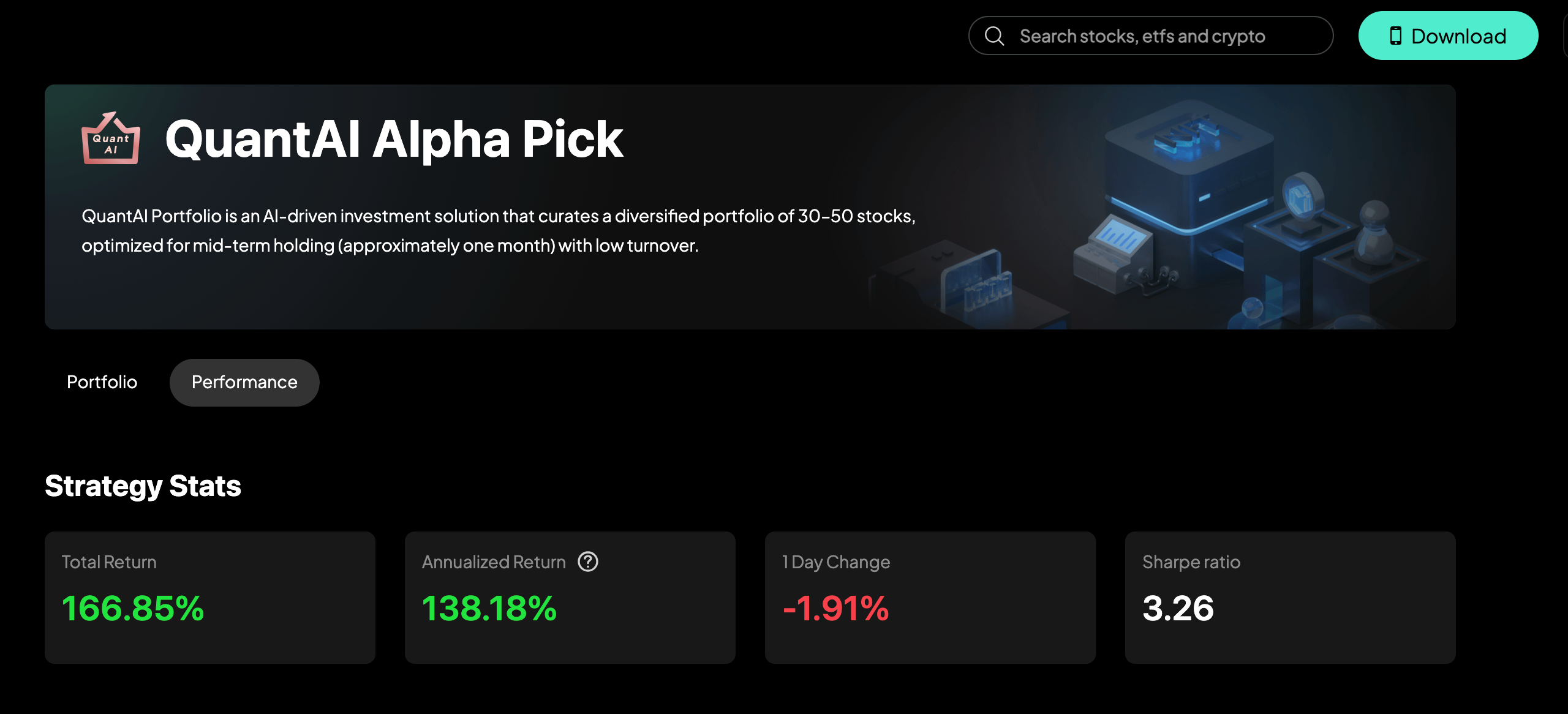

The strategy’s low-turnover approach and diversified holdings (e.g., 23.94% Software & IT, 21.97% Financial Tech) ensure stability. The 15% stop-loss and cash-shift mechanism protects against downturns, making it ideal for investors with $10,000+. And the performance is incredible with over 100% annualized return and very low drawback.

Next Steps

Download the Intellectia app, log in, and subscript QuantAI Alpha Pick. For detailed insights, check the "Performance" tab or email support@intelllectia.ai with questions. Happy investing!

Past performance is not indicative of future results. Invest responsibly.