Nvidia Q3 Earnings Highlight AI Boom

Updated: 20 Nov 25

0mins

Nvidia reported record-breaking Q3 revenue of $57 billion, marking a 62% year-over-year growth and exceeding Wall Street expectations. CEO Jensen Huang emphasized surging demand for AI-driven technologies, with Blackwell chips leading the way. The company projected Q4 revenue between $63.7 billion and $66.3 billion, reflecting the growing adoption of AI solutions across industries. Nvidia's strong performance has bolstered confidence in the AI sector, influencing related stocks like AMD and Micron.

Nvidia's Record-Breaking Q3 Performance

Nvidia reported a staggering $57 billion in revenue for Q3, marking a 62% increase compared to the same period last year. This revenue not only broke records but also outperformed Wall Street’s expectations of $54.88 billion. The company’s earnings per share (EPS) stood at $1.30, exceeding analysts' predictions of $1.25. This marks Nvidia's 12th consecutive quarter of surpassing both revenue and EPS forecasts, solidifying its position as a leader in the tech industry. The results highlight Nvidia's exceptional ability to capitalize on the burgeoning demand for AI and data-driven technologies.

AI-Driven Growth and Blackwell Chip Demand

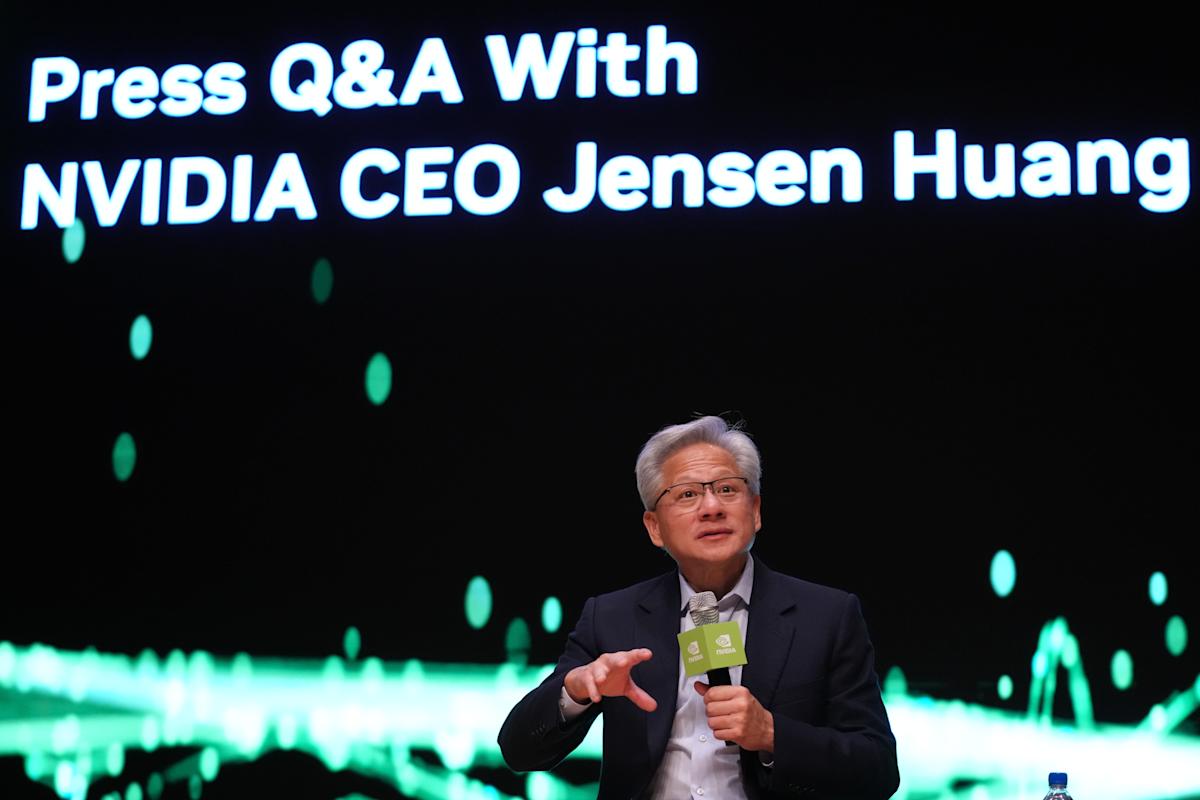

The quarter's performance was largely driven by the overwhelming demand for Nvidia's Blackwell GPUs, which have reportedly sold out. These GPUs are crucial for powering AI workloads, and their adoption is accelerating across industries. CEO Jensen Huang emphasized that AI is no longer confined to niche applications but is transforming industries, startups, and even national economies. He stated that Nvidia has entered a "virtuous cycle of AI," where the ecosystem's rapid scaling is further boosting demand for their cutting-edge technologies. This underscores Nvidia’s pivotal role in driving the AI revolution and meeting the surging computational requirements of AI development.

Future Outlook and Market Impact

Looking ahead, Nvidia has provided optimistic guidance for Q4, projecting revenue between $63.7 billion and $66.3 billion, significantly higher than analysts’ average forecast of $61.48 billion. This outlook has instilled confidence in the broader market, with AI-related stocks such as AMD and Micron experiencing notable gains following Nvidia’s report. The company's continued success is expected to have a positive ripple effect across the tech sector, further cementing Nvidia's influence as a bellwether for AI-driven market growth.

Sources

Sources- Nvidia stock soars results, forecasts estimates sales AI chips 'off charts'

yahoo

yahoo - Nvidia Q3: Record Revenue Blackwell Demand Surges — Huang Says 'AI Going Everywhere' - NVIDIA (NASDA

benzinga

benzinga - Nvidia's earnings attest leadership AI race. numbers

yahoo

yahoo - Chip giant Nvidia beats revenue expectations 62% growth, rebuking warnings AI bubble

abc

abc

- Nvidia stock soars results, forecasts estimates sales AI chips 'off charts'

yahoo

yahoo - Nvidia Q3: Record Revenue Blackwell Demand Surges — Huang Says 'AI Going Everywhere' - NVIDIA (NASDA

benzinga

benzinga - Nvidia's earnings attest leadership AI race. numbers

yahoo

yahoo - Chip giant Nvidia beats revenue expectations 62% growth, rebuking warnings AI bubble

abc

abc

About the author

Preview

John R. Smitmithson

With over 15 years of experience in global financial markets, John R. Smitmithson holds a Master’s degree in Finance from the London School of Economics. A former investment strategist at Goldman Sachs, he specializes in macroeconomic trends and equity analysis, contributing authoritative insights to Intellectia’s market overviews.