Three Options to Explore Beyond the Traditional 60/40 Portfolio at This Time

60/40 Portfolio Strategy: The traditional 60% stocks and 40% bonds portfolio has historically provided solid returns, averaging 6.89% annually over the past two decades.

Rebalancing Considerations: Financial experts suggest that investors looking to rebalance by year-end should explore alternative strategies to enhance returns and diversify against market volatility.

Trade with 70% Backtested Accuracy

Analyst Views on ALLW

About the author

Market Performance: The U.S. stock market has shown broad gains recently, indicating a positive outlook as we approach 2026.

Tech Sector Importance: The S&P 500's ability to continue rallying may be hindered without significant contributions from the technology sector, especially in light of the ongoing artificial intelligence boom.

Sector Analysis: Bespoke Investment Group conducted an analysis of the S&P 500 and its 11 sectors, highlighting the critical role of technology in the index's performance.

Future Outlook: The reliance on the tech sector suggests that its performance will be a key factor in the overall market trajectory moving forward.

60/40 Portfolio Strategy: The traditional 60% stocks and 40% bonds portfolio has historically provided solid returns, averaging 6.89% annually over the past two decades.

Rebalancing Considerations: Financial experts suggest that investors looking to rebalance by year-end should explore alternative strategies to enhance returns and diversify against market volatility.

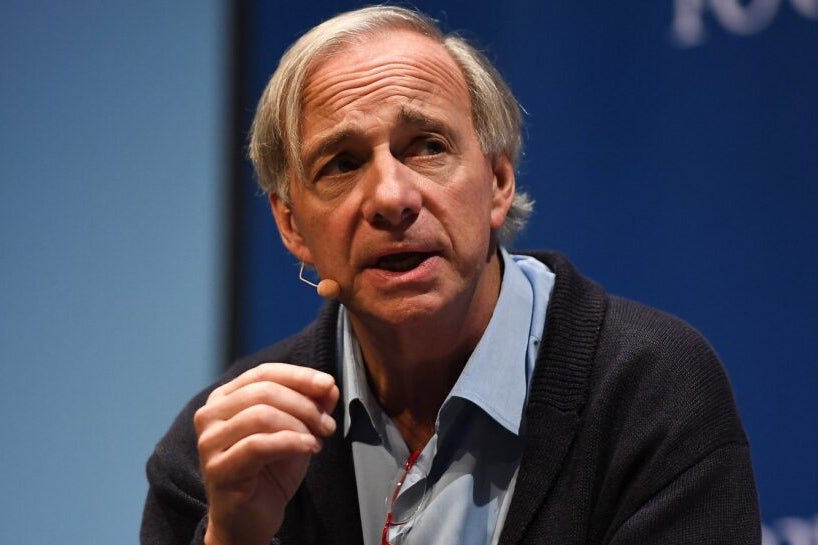

Market Strategy Advice: Ray Dalio emphasizes the importance of maintaining a broader perspective and having a strategic game plan in today's volatile markets, advising against reacting to daily headlines and focusing instead on economic cycles and geopolitical factors.

All-Weather Portfolio Performance: Dalio's 'All-Weather' portfolio strategy, which includes a diversified mix of assets, has shown resilience during past market downturns, outperforming traditional stock-bond portfolios during crises while recently being made accessible to retail investors through the SPDR Bridgewater All Weather ETF.

Launch of ETF: Ray Dalio's Bridgewater Associates has introduced the SPDR Bridgewater All Weather ETF, based on its well-known 'All-Weather' investment strategy, allowing retail investors to access it for a low price of $22.

Investment Strategy Details: The ETF employs a risk parity approach with asset allocations designed to provide consistent returns across various economic conditions, featuring a diversified mix including equities, US Treasury bonds, gold, and commodities.

Impact of Tariffs on the Economy: President Trump's new tariffs, ranging from 10% to as high as 54%, are raising concerns among investors about their potential negative effects on U.S. companies, consumer spending, and overall economic health, with some economists predicting a recession.

Ray Dalio's All Weather ETF: Billionaire investor Ray Dalio has launched the SPDR Bridgewater All Weather ETF, based on his strategy that diversifies investments across stocks, bonds, gold, and commodities, aiming to provide resilience in various market conditions, making it appealing for both aggressive and cautious investors.

State Street's All-Weather Fund Launch: Investment firm State Street has launched an all-weather fund aimed at ordinary investors during a time of significant stock-market volatility.

Luck vs. Skill in Investing: The launch is seen as fortunate, suggesting that sometimes luck can play a crucial role in investment success amidst challenging market conditions.