Three Leading ETFs I'm Eager to Invest in Heavily in 2026, Even with Numerous Affordable Stocks on My Watchlist

Investment Strategy for 2026: The author plans to allocate half of their retirement contributions to ETFs in 2026, focusing on the Vanguard Russell 2000 ETF, Vanguard Real Estate ETF, and Ark Autonomous Technology & Robotics ETF as key investments.

Small Cap Stocks Outlook: Small cap stocks, particularly those in the Russell 2000 index, are currently undervalued compared to large caps, and lower interest rates in 2026 could help close this valuation gap.

Real Estate Investment Potential: The Vanguard Real Estate ETF is highlighted as a promising investment due to its exposure to REITs and a 4% dividend yield, especially as the real estate sector is expected to recover.

AI Investment via ETFs: The Ark Autonomous Technology & Robotics ETF is favored for its focus on smaller AI stocks, providing a way to invest in the AI revolution without extensive research on individual companies.

Trade with 70% Backtested Accuracy

Analyst Views on AMD

About AMD

About the author

- Capacity Expansion Plan: TSMC's new 15.46-hectare facility in the Southern Taiwan Science Park has passed environmental impact assessment, with completion targeted for 2028, focusing on industrial efficiency with 8 hectares dedicated to production equipment to enhance overall capacity to meet global AI hardware demand.

- Job Creation: The new fab is expected to generate 1,400 direct jobs and 500 supply-chain roles, further solidifying TSMC's leadership in semiconductor manufacturing while injecting vitality into the local economy.

- Strong Market Performance: Driven by AI hardware demand, Taiwan's January exports surged 70%, the fastest pace in 16 years, while TSMC reported a 37% revenue increase for the same period, indicating robust market demand and economic momentum.

- GDP Growth Forecast Upgraded: The Taiwanese government has revised its annual GDP growth forecast upward to 8.68% due to strong export performance and TSMC's impressive results, reflecting the positive impact of the semiconductor industry on the economy.

- Iran Withdrawal Resolution Fails: The U.S. Senate's failure to pass a resolution demanding President Trump withdraw from military actions in Iran highlights significant congressional divisions over current military policy, despite the resolution's largely symbolic nature.

- Major Update to French Nuclear Policy: French President Macron's announcement to increase the number of nuclear warheads and enhance cooperation with European allies is viewed as the most significant update to France's nuclear deterrence policy in 30 years, potentially reshaping the European security landscape.

- Impact on Indian Remittance Flows: A Citi report indicates that the Indian diaspora in Gulf countries contributes nearly 38% of total remittance inflows, with a total of $135.4 billion in FY 2025, of which $51.4 billion comes from Gulf nations, suggesting that prolonged Middle Eastern conflict could negatively impact India's economy.

- China Sets Record Low GDP Growth Target: The Chinese government has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, reflecting the challenges Beijing faces amid persistent deflationary pressures and trade tensions with the U.S.

- Strong Earnings Report: Broadcom's fiscal Q1 2026 revenue reached $19.31 billion, surpassing the $19.18 billion consensus forecast with a 29% year-over-year increase, indicating robust growth potential in the AI chip sector.

- Improved Profitability: Adjusted earnings per share (EPS) rose 28% to $2.05, exceeding expectations of $2.03, while adjusted EBITDA grew 30% to $13.13 billion, further boosting investor confidence.

- Optimistic Future Outlook: Broadcom projects AI chip revenue to exceed $100 billion by 2027, having secured the necessary supply chain, reflecting strong confidence in future demand, particularly with a positive relationship with OpenAI.

- Shareholder Return Plan: The company announced a newly authorized $10 billion share repurchase program, which, combined with strong financial performance and an optimistic outlook, enhances market confidence in Broadcom's stock.

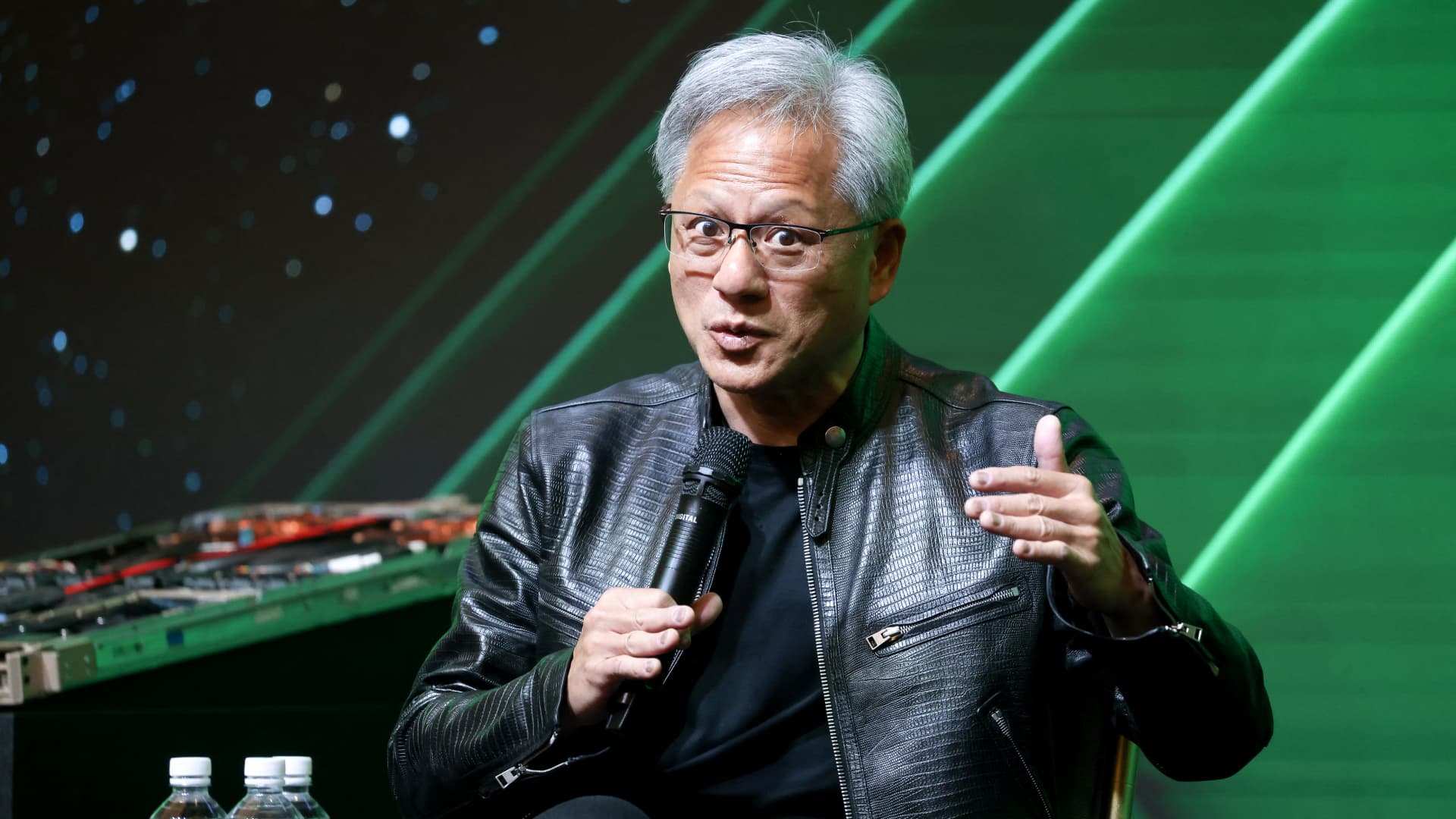

- Market Share Comparison: Nvidia commands an impressive 86% market share in AI data center revenue, compared to AMD's mere 7%, highlighting Nvidia's dominant position in the data center processor market, which is likely to attract more customers in the future.

- Major Deal Impact: AMD's agreement with Meta to supply up to 6 gigawatts of AI data center processing, valued at over $100 billion, represents a significant win for AMD; however, its high stock valuation raises concerns among investors.

- Financial Performance Divergence: Nvidia's recent Q4 fiscal 2026 results revealed a 65% increase in sales to nearly $216 billion, with adjusted earnings rising 60% to $4.77 per share, indicating strong growth momentum in the AI sector.

- Valuation Comparison: Nvidia's P/E ratio stands at 53, which, while above the tech sector average, is significantly lower than AMD's 101, making Nvidia a more attractive investment in the AI stock landscape given its robust financial performance.

- GDP Growth Target: China has set its GDP growth target for 2026 at 4.5% to 5%, marking the lowest target on record since the early 1990s, indicating significant challenges for economic recovery amid persistent deflationary pressures and trade tensions with the U.S.

- Defense Spending Increase: Defense spending is projected to rise by 7%, the slowest increase since 2021, although analysts believe the official figures may be understated, which could impact national security and military modernization efforts.

- Data Center Attack: Amazon's data center in Bahrain was targeted by Iran for supporting the U.S. military, with damage reported from a drone strike, potentially affecting Amazon's cloud computing operations in the Middle East in the short term.

- Global Tariff Increase: U.S. Treasury Secretary announced that global tariffs will rise from 10% to 15%, with expectations that tariff rates will return to pre-Supreme Court ruling levels by August, which will have profound implications for international trade and the cost structures of U.S. businesses.

- Strong Economic Data: The February ADP employment report revealed an addition of 63,000 jobs, surpassing expectations of 50,000, indicating continued growth in the labor market and boosting investor confidence in economic recovery.

- Service Sector Expansion: The US ISM services index unexpectedly rose to 56.1 in February, significantly better than the anticipated 53.5, reflecting the fastest pace of expansion in 3.5 years and further supporting the stock market rally.

- Oil Price Volatility: Crude oil prices surged over 1% due to the closure of the Strait of Hormuz, despite reports suggesting Iran's willingness to discuss terms for ending the conflict, intensifying market concerns over energy supply.

- Market Performance: The S&P 500 index rose by 0.78%, the Dow Jones Industrial Average increased by 0.49%, and the Nasdaq 100 index climbed by 1.51%, reflecting optimistic expectations regarding economic resilience and corporate earnings.